SNB Preview (Sep 26): Another Cut All But Certain But How Large an Inflation Target Undershoot

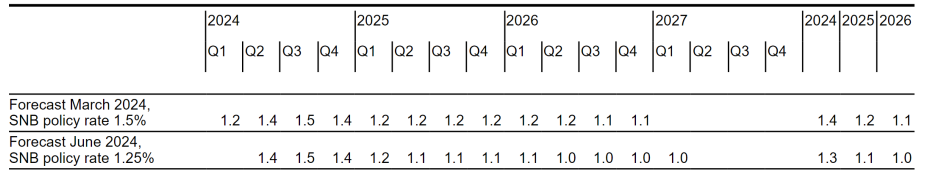

Along with market thinking, we see the SNB next Thursday repeating the 25 bp policy rate cut that it has now made twice since March. This would take the policy rate to 1.0% and where the very clear below-target inflation picture in both recent actual numbers and the outlook flagged by the SNB in June warrant further easing (Figure 1). Admittedly, better signs in terms of property prices and the apparent resilience in the economy do not suggest any urgency. But the likely below-target inflation rationale that the updated September statement will point to also implies another same sized move in December with the risk that the then ensuing policy rate of 0.75% may not prove to be trough, this possibly depending on whoever takes over as SNB President Jordan retires at the end of this month.

Figure 1: SNB CPI Inflation Projections Continue Below Target

Source: SNB

SNB to See Further and Marked Inflation Undershoot

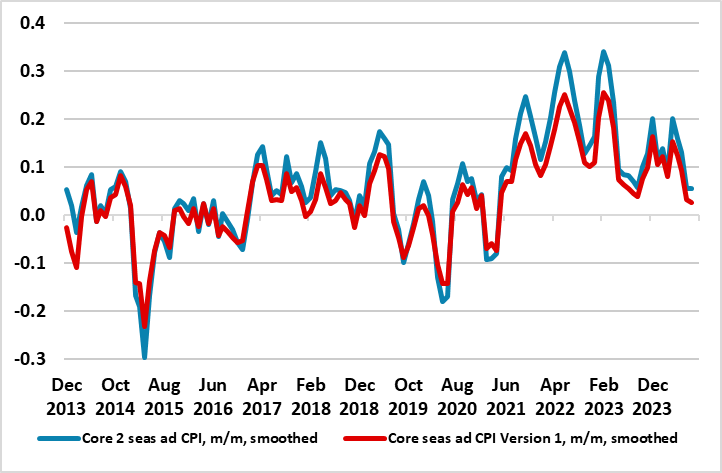

Perhaps over and beyond the surprise timing of the SNB’s cut six months came the further downward revision in the inflation outlook three months ago. Indeed, the 2024-26 annual projections were each cut by 0.1 ppt, even after taking account of the new policy rate. Recent actual inflation dynamics certainly suggest disinflation continues if not even more intensely so, both domestically and from abroad (Figure 2) and back down to pre-pandemic levels. Headline CPI looks set to undershoot the 1.5% existing projection of the SNB for the current quarter and where core measures tell a similar disinflationary story. The continued strength of the Swiss Franc is only compounding more limited domestic disinflation.

The SNB GDP growth projection is likely upgraded from 1.0% in 2024 but where the existing SNB 2025 forecast of 1.5% may go in the opposite direction – NB the GDP strength this year is due special factors such as sporting events and gold sales. The SNB may backtrack on its June assessment where it implied downside risks from the global economy may be softer than expected but reiterate that concern about second round effects from the previous pick-up in inflation have diminished.

It is noteworthy that the SNB will continues to threaten further CHF sales, with the implied opposition to balance sheet increases now being tempered by the persistent CHF strength. But its balance sheet has nevertheless resumed contracting of late suggesting little actual such FX intervention. Otherwise, the SNB may continue warnings about the property sector, even though house and apartment prices do seem to have settled after the clear recent slowing.

Figure 2: Domestic CPI Inflation Dynamics Still Softening

Source: SNB, CE, smoothed is 3 mth mov avg