SNB Preview (Jun 20): Another Cut Likely but How Large an Inflation Target Undershoot

Along with market thinking, we see the SNB on June 20 repeating the 25 bp policy rate cut that it surprised many with three months ago. This would take the policy rate to 1.25% and where the very clear below-target inflation picture in both recent actual numbers and the outlook flagged by the SNB in March warrant further easing (Figure 1). Admittedly currency considerations and the resilience in the economy do not suggest any urgency. But the likely below-target inflation rationale that the updated June statement will point to also implies another same sized move in September with the risk that the then ensuing policy rate of 1% may not prove to be trough, this possibly depending on whoever takes over as SNB President Jordan retires after the summer.

Figure 1: SNB CPI Inflation Projections Back Below Target

Source: SNB

SNB Sees Marked Inflation Undershoot

Perhaps over and beyond the surprise timing of the SNB’s cut three months came the marked downward revision in the inflation outlook, with a clear 0.5 ppt downgrade at the end of the forecast horizon (Figure 1). This seemingly reflected lower than expected CPI, amid a little-changed growth projection of 1% this year (which looks credible, even after a higher-than-expected Q1 outcome boasted by sporting even effects again. The SNB also suggested downside risks from the global economy turning out to be softer than expected as well as paring back its concern about second round effects from the previous pick-up in inflation.

Additionally, the SNB statement made clear that the easing was also partially to counterbalance the tightening of financial conditions from the real appreciation of the CHF. The SNB also appears to remain keen to intervene and sell CHF to restrain the CHF, but want the FX market to understand that it can move quicker than other central banks on interest rate reductions as well. This message seems to have been understood given the fall back in the currency of late.

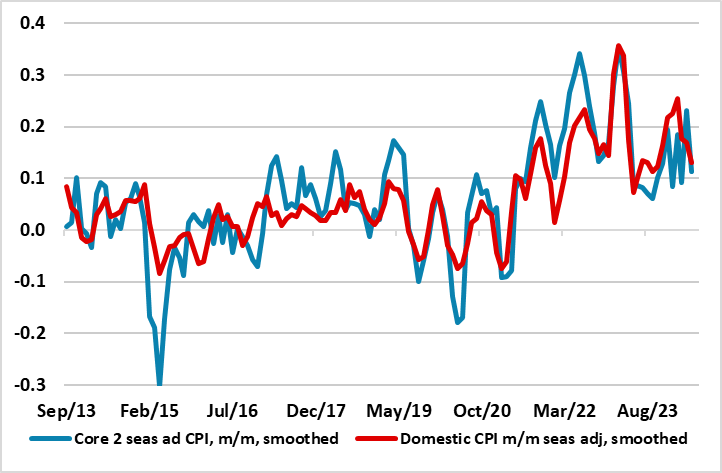

A further 25bps cut in June and September is now our forecast, as the new inflation forecast is far too low below target. Recent actual inflation dynamics certainly suggest disinflation continues. Headline CPI look set to match the 1.4% existing projection of the SNB for the current quarter. This below-target current backdrop largely reflects the impact of the hitherto strong currency, but we also discern clear(er) signs that domestic price pressures have continued to fall, with the latter helping moderate core inflation, both to rates also well below those consistent with target (Figure 2). As a result, we see the SNB’s updated inflation forecast continuing to point to a below-target picture in the latter part of its forecast horizon.

Figure 2: Domestic CPI Inflation Dynamics Still Softening

Source: SNB, CE, smoothed is 3 mth mov avg

It is noteworthy that the SNB not only became the first DM central bank to cut conventionally in March but having dropped formally in December plans of further FX sales, it is now seemingly doing something of the opposite to a degree that is seeing its balance sheet re-expand partly as it intervenes to curb CHF strength, albeit where the latter has clearly eased of late.