SNB Preview (Dec 12): How Much Further Easing?

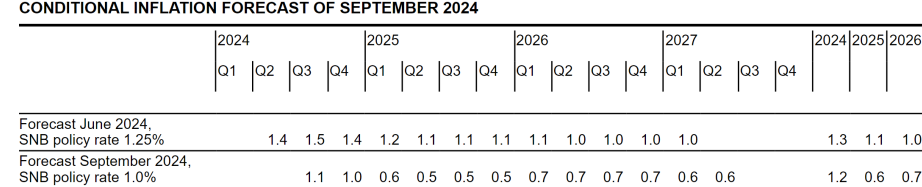

Whatever the SNB does this month is likely to be merely a further staging post in an easing cycle that has to date delivered three 25 bp moves since March, ie taking the policy rate to 1.0%. More likely the SNB will again cut by 25 bp this month, but amid downside real economy risks and inflation both below target and below SNB recent projections, a bigger move is possible. Indeed, back in September, the updated outlook (Figure 1) suggested an even larger undershoot in the medium-term. This flagged further easing not least as the SNB was explicit in suggesting that ‘Further cuts in the SNB policy rate may become necessary in the coming quarters’, rhetoric repeated more recently (end Oct) by SNB President Schlegel who has also refused to rule out a return to negative policy rates. At this juncture, such a policy shift is a risk than a likelihood but we have nevertheless shaved our terminal rate by 25 bp, now seeing the policy rate down to 0.25% by Q2 next year and then staying there.

Figure 1: SNB CPI Inflation Projections Even Further Below Target

Source: SNB

Inflation Fall Broadening Out?

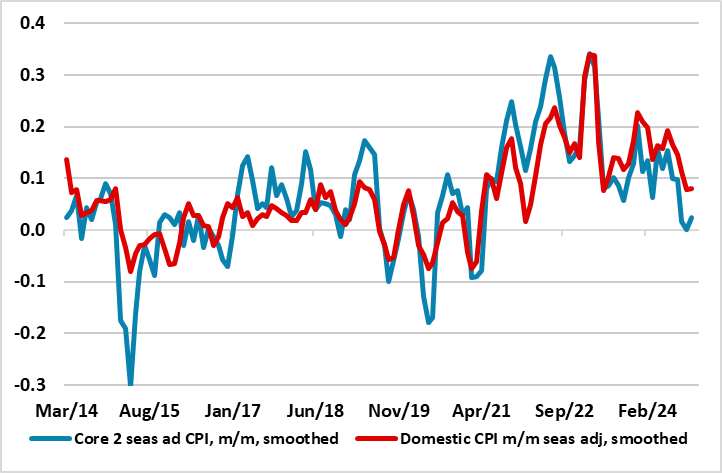

Perhaps somewhat excessively, much of this inflation weakness is attributed (at least by the SNB) to the strong Swiss Franc, but where we suggest weaker global demand is also playing a part. Notably, back in September, actually saw a further downward revision in the inflation outlook compared to three months previously, where the 2025-26 annual projections were each cut by between 0.3-0.5 ppt, even after taking account of the new policy rate. While this scale of disinflation may be somewhat excessive, we continue to stress that domestic inflation is also softening too, especially in regard to seasonally adjusted m/m numbers which show that such price pressures are falling in line with core inflation and now maybe even to a degree that warrant at least a good portion of the inflation undershoot risks seen by the SNB (Figure 2).

Persistent and Marked Inflation Undershoot

New President Martin Schlegel (previous Vice Chair) takes over the SNB helm for this meeting - with a clear precedent in the form of a marked and even softer inflation outlook. But there are other considerations; there are better signs in terms of property prices and an apparent resilience in the economy. Indeed, the SNB GDP growth projection was unchanged in September at 1.0% in 2024 but may be raised to around 1.25% this time around, this offset by a paring back of the 2025 forecast of 1.5%. Notably, the GDP ‘strength’ this year is due to sporting events and gold sales. While it could be argued that while such rates of growth are near potential and do not suggest such marked disinflation ahead, the underlying pace is much softer. This is evident in just-released Q3 GDP data, where GDP adjusted for sporting events halved to 0.2% q/q, following 0.4% in the previous quarter, the pertinent question being whether hitherto solid services can continue to make up for the flagging factory sector - the chemical and pharmaceutical industry barely grew after a strong previous quarter; the other manufacturing sectors recorded significant declines.

Figure 2: Domestic CPI Inflation Dynamics Still Softening

Source: SNB, CE, smoothed is 3 mth mov avg

Finally, it is noteworthy that the SNB will continue to threaten further CHF sales, with the implied opposition to balance sheet increases now being tempered by the persistent CHF strength. In fact, its balance sheet has nevertheless resumed expanding of late suggesting actual such FX intervention. Otherwise, the SNB may have further warnings about the property sector, even though house and apartment prices do seem to have settled after the clear recent slowing.