Markets: ECB/BOE/SNB Before the Fed?

Bottom Line: We do see 25bps cuts arriving from the ECB/BOE and SNB and most likely these will all be in June. Whether this is before the Fed will likely be a function of the Fed, as we see these interest rate moves as being driven by domestic fundamentals rather than the Fed being an influence. We will learn a lot in March on European central bank thinking, though the weak forward guidance will likely mean that a Q2 rate cut from the ECB and BOE are not signaled.

Figure 1: 2 and 10yr Government Bond Yield Changes Since Dec 31

Source: Continuum Economics

Source: Continuum Economics

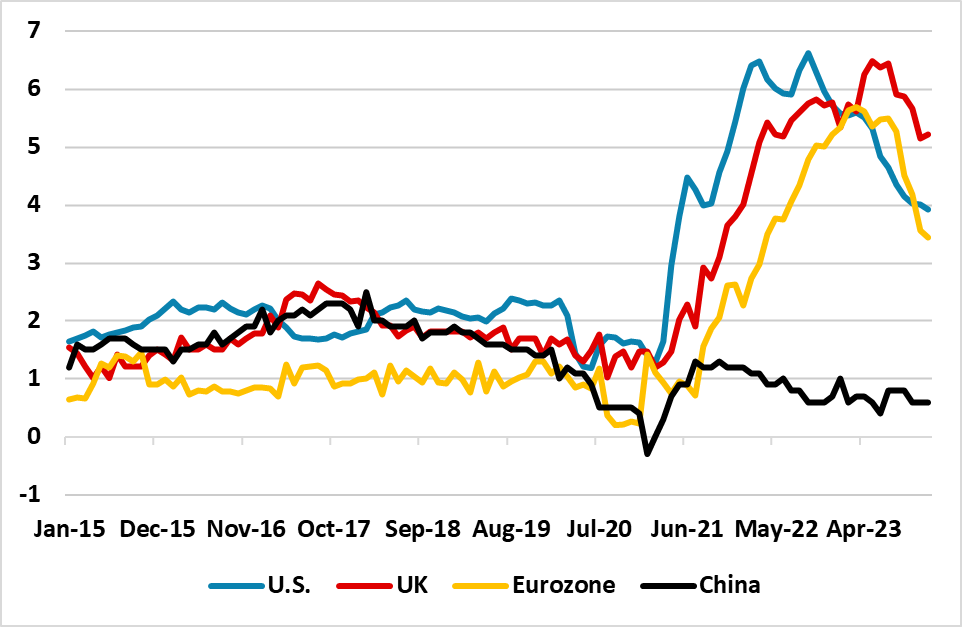

The major theme in global markets remains the timing and scale of interest rate reductions from DM central banks. We have previously argued that markets had become too aggressive by end 2023 and the first seven weeks of 2024 has seen markets trimming the scale of easing and also to a degree pushing back the timing of the first rate cut. This has not diverged much across DM major government bond markets at the 2 or 10yr area where the yield back up has largely been in tandem (ex Japan) – 10yr U.S. versus Germany and UK have actually consolidated since November despite the absolute yield moves (Figure 1).

However, the economic fundamentals have changed somewhat in the U.S., where the economy has proved more resilient than expected in the face of lagged monetary policy tightening. Though the latest core CPI figure also shows a degree of resilience, this is partially counterbalanced by the run of low core PCE inflation numbers in recent months. The market is still discounting three 25bps rate cuts from the Fed starting June 12, but could the ECB/BOE or SNB ease before the Fed?

The fundamental case for ECB easing is strong, with a near recession in contrast to the trend type growth in the U.S. Meanwhile, core and headline EZ inflation have come down smartly (Figure 2) and we project that headline inflation will fall below 2% in Q2 – monthly inflation trends are consistent with this disinflation (here). Combined with poor money supply and lending growth, the ECB are likely to cut inflation forecasts at the March ECB meeting – NB existing projections already envisage sustained below-target inflation after next year. The first realistic date for an ECB rate cut is the June 5 meeting, as the April 11 meeting is unlikely to have seen enough ECB officials convinced that the rate cutting cycle should have started. However, the April 11 meeting cannot be ruled out, as some of the doves will likely be keen to push for a rate cut as early as this meeting.

Figure 2: Core CPI Coming Down Yr/Yr and More to Come (%)

Source: Continuum Economics

Source: Continuum Economics

This slow moving ECB consensus is a consideration for the start of easing, but once the ECB starts we still see a cumulative 75bps of cuts arriving in 2024.

What about the BOE where they release the next monetary policy report and forecasts on May 9? Looking at the Yr/Yr UK CPI and wage inflation data is misleading (here), as the monthly trends have slowed sharply and large base effects/gas and electricity price cuts in April means that Yr/Yr inflation will also fall below 2% in Q2. May is possible for a cut from the BOE, but what is crucial is the opinion of the core four insiders in the BOE (Bailey/Broadbent/Ramsden and Pill) that shaped the end of the tightening cycle. They may want to see the April CPI data on May 22. This means that June 20 could be a more important meeting and the likely start of the BOE easing cycle – we still see a cumulative 100bps from the BOE in 2024 (here).

Finally, the SNB will have been surprised by the January CPI numbers (here) due to currency strength depressing import prices and prompt some to ask whether the SNB could cut in March to combat CHF strength? We would see the SNB as being more cautious on interest rate setting, despite the prospect that they will lower the CPI trajectory in March. The SNB do not want to stand out from the ECB and would prefer to wait until June and cut in line with the ECB. The SNB could use CHF sales as a temporary tool to calm CHF strength against other European currencies.

The bottom line is that we will learn a lot in March on central bank thinking, though the weak forward guidance will likely mean that a Q2 rate cut from the ECB and BOE are not signaled. We do see 25bps cuts arriving from the ECB/BOE and SNB and most likely these will all be in June. Whether this is before the Fed will likely be a function of the Fed, as we see these interest rate moves as being driven by domestic fundamentals rather than the Fed being an influence.

For financial markets, the Fed remains the most important and whether a 25bps cut arrives in June or Q3. This will be uncertain until at least the March 20 FOMC meeting, given that the Fed will want to see more data in the next five weeks. Cuts from the BOE or SNB would be important for financial markets, as it would start the DM easing cycle. However, in market terms the ECB is more important and the first easing from them would be a watershed moment in 2024.