SNB Review: More Cuts on the Way

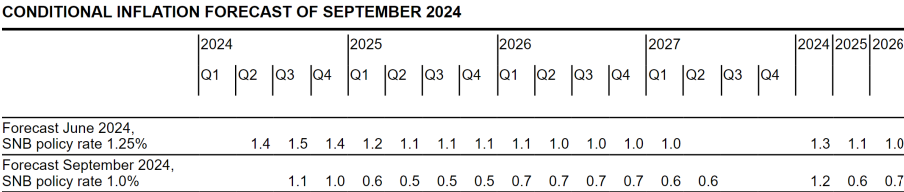

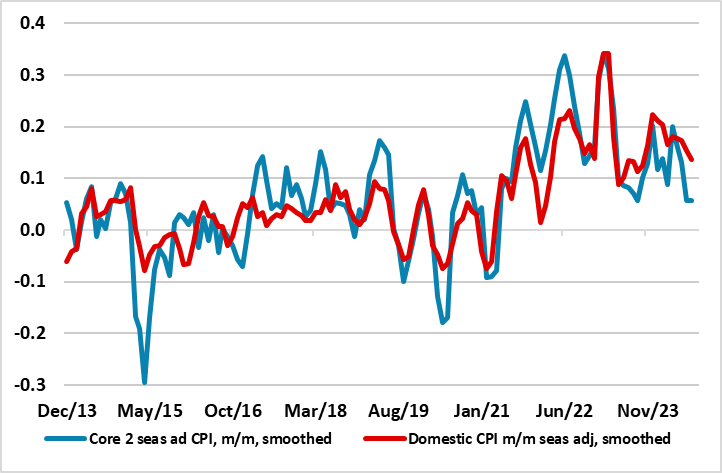

Very much as expected, the SNB today repeated the 25 bp policy rate cut that it had made twice since March. This took the policy rate to 1.0% and reflected an even clearer below-target inflation picture in both recent actual numbers and the updated outlook (Figure 1). This flagged further easing. Indeed, the SNB was quite open about this suggesting that ‘Further cuts in the SNB policy rate may become necessary in the coming quarters’. Perhaps somewhat excessively, much of this inflation weakness is attributed to the strong Swiss Franc, but we stress that domestic inflation is also softening too, especially in regard to seasonally adjusted m/m numbers which show that such price pressures are falling in line with core inflation albeit not to a degree that warrant the inflation undershoot seen by the SNB (Figure 2). Notably, this much weaker inflation outlook comes even with solid and near-trend GDP growth of around 1% this year and 1.5% expected next year. Even though we think the SNB inflation picture is probably too low, another same sized move in December looms and now with it likely that a policy rate trough of 0.5% will arrive in Q1.

Figure 1: SNB CPI Inflation Projections Even Further Below Target

Source: SNB

SNB Sees Further and Much More Marked Inflation Undershoot

SNB Chair Thomas Jordan is going out with a bang. This was his last policy assessment before retiring at the end of the month and he leaves his successor - Martin Schlegel (current Vice Chair) - with a clear precedent in the form of a marked and even softer inflation outlook. We think that the clear sub-1% rates projected for 2025 and 2026 are probably too low, not least as domestic inflation - while falling – is still running at a much higher pace, while the strong currency is unlikely to deliver persistent additional bouts if disinflation. Moreover, there are better signs in terms of property prices and the apparent resilience in the economy does not suggest such marked disinflation. Indeed, The SNB GDP growth projection was unchanged at 1.0% in 2024 as was the 2025 forecast but at 1.5% the GDP strength this year is due special factors such as sporting events and gold sales. But such rates of growth are near potential and do not suggest such marked disinflation ahead, even with special factors unique to Switzerland in the form a marked looming fall in electricity prices as of early next year.

This revised inflation outlook actually saw further downward revision in the inflation outlook compared to three months ago. Indeed, the 2025-26 annual projections were each cut by between 0.3-0.5 ppt, even after taking account of the new policy rate. It is noteworthy that the SNB will continues to threaten further CHF sales, with the implied opposition to balance sheet increases now being tempered by the persistent CHF strength. But its balance sheet has nevertheless resumed contracting of late suggesting little actual such FX intervention. Otherwise, the SNB continued warnings about the property sector, even though house and apartment prices do seem to have settled after the clear recent slowing.

Figure 2: Domestic CPI Inflation Dynamics Still Softening

Source: SNB, CE, smoothed is 3 mth mov avg