U.S. 25% Tariff for Cars, Pharma and Semiconductors?

· Tariff reality in the spring and summer will likely be both tariff threats to negotiate trade deals and permanently higher tariffs in certain products and reciprocally to raise revenue for the U.S. government – along Peter Navarro guidance to Trump. The macro effects of this could be inflationary in a small to modest or moderate way, which will be a function of the scale of product and reciprocal tariffs and also whether they are implemented against some countries (e.g. China/EU) or globally. We will likely only be clear on this by the summer rather than in April. The economic effects will likely be small to modest adverse impact on U.S. domestic demand as higher prices suppress U.S. domestic demand/trade policy uncertainty more than offset extra military and LNG sales by the U.S.

President Trump signaled that he is looking to add cars, pharma and semiconductors in the spring as well as reciprocal/steel and aluminum tariffs.

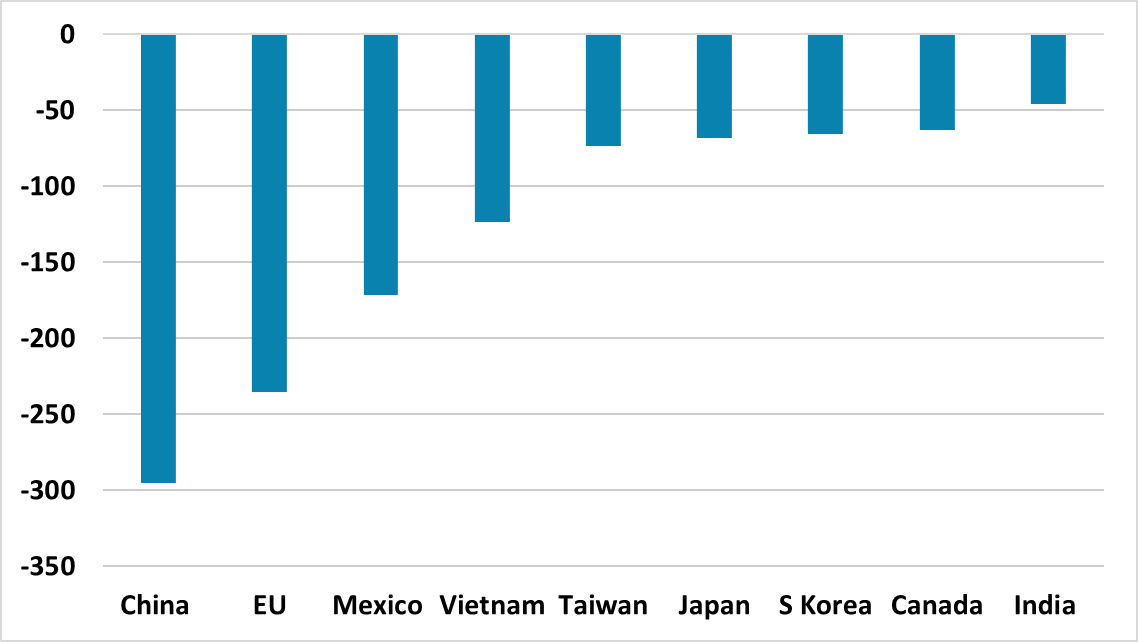

Figure 1: U.S. 2024 Bilateral Trade Position (USD Blns)

Source: BEA/Continuum Economics

President Trump on Tuesday signaled that he is likely to announce on April 2, 25% tariffs on imported cars, pharmaceutical and semiconductors into the U.S. No clarity exists on an implementation date (though Trump hinted it could be months to allow manufacturers to switch production into the U.S.); whether certain countries would be hit first or whether they would be subject to a wider trade negotiation on a bilateral basis. While Trump has hinted that his array of tariffs could stack upon each other (steel and aluminum; reciprocal and country specific), this is likely to be a Trump maximist negotiating tactic. For example, if the U.S. imposes across the board 25% of Canada and Mexico and then 25% on top for cars, then the impact on U.S. inflation would start to become a concern. 25% on cars, pharma and semi plus worst-case global reciprocal tariffs implementation would have a bigger adverse inflation impact.

If we take the view that Trump will deliver maximum tariff threats in April but in some cases will look to implement less after trade negotiations, then the issue is not the bilateral trade deficit in cars but rather the overall bilateral trade deficit for the U.S. (Figure 1). Trump will be looking forward to announce tariffs on the EU, but could delay and allow negotiations with more friendly countries such as Japan/India. However, Trump also believes that tariffs can raise revenue for the U.S. and allow lower taxes, as championed by Peter Navarro senior counselor for trade and manufacturing who is working closely with Trump on tariffs. This means that tariff reality will be both trade deals and higher tariffs in certain products and reciprocally. The macro effects of this could be inflationary in a modest or moderate way, which will be a function of the scale of product and reciprocal tariffs and also whether they are implemented against some countries (e.g. China/EU) or globally. We will likely only be clear on this by the summer rather than in April.

Meanwhile, trade deals with certain countries can have some effect in reducing bilateral deficits, with Taiwan/Japan/S Korea/EU/India all keen to buy more U.S. military hardware and EU/Japan to buy more LNG. This could boost some exports from the U.S., but the increase in tariffs and prices will likely outweigh this and suppress U.S. demand and this will hurt the economy – though also help to curb the overall U.S. trade deficit. The U.S. economy domestic demand can also be hit by tariff policy uncertainty. Do all businesses want to track the drama in Washington, with uncertainty over what products/countries tariffs will be imposed on and when? At a minimum this could lead U.S. businesses to delay purchases that hurt imports, but also domestic purchases. Fourthly, U.S. exports are at risk of a backlash and a boycott U.S. goods, which has already occurred in Germany for new Tesla sales after Elon Musk support for the AFD. Finally, some tariffs would be permanent for revenue raising purposes and this would hurt the U.S. economy. In GDP terms, the impact could be small to modest, as import growth will slow and this could partially counterbalance any slowing in U.S. export growth – we are particularly concerned if Canada and Mexico are hit by either a 25% overall tariff or 25% on cars.

A wider point on the economy is that the expected boost to growth from fiscal stimulus; higher oil production and deregulation are likely to be on a smaller scale and come after tariff implementation. Though the House of representatives has passed the first stage of the 10yr budget bill, the expectation is that the Senate two bill strategy could become the front runner and this would delay fiscal stimulus. Opposition from fiscal hawks in the House also means that the net fiscal stimulus into 2026 will now likely be small to modest. Secondly, the desire for higher U.S. oil and gas production is counterbalanced by the focus of individual U.S. producers on profit margins. Trump desire to see oil prices down to USD50 again is a headwind against extra U.S. production. Finally, deregulation is coming, but domestically the administration focus is on restructuring the Federal government first and this cause pain before any gain.