SNB: 25 bp Cut Likely To Last

Bottom Line: With inflation forecasts stable, and given a reasonable economic outlook, it would be a good time to pause or stop the SNB easing cycle. However, if the U.S. trade tariffs have a bigger adverse effect than expected or the CHF surges, then the SNB may want the option to ease again later in the year. Thus SNB communications will likely leave the door open to further easing, but in reality we see this as probably the end to the easing cycle.

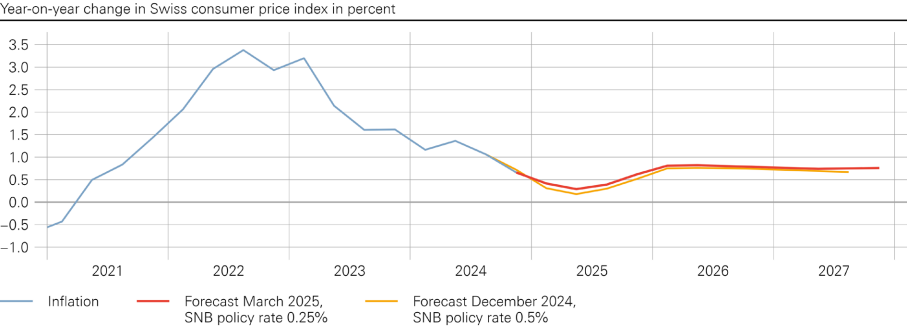

Figure 1: SNB CPI Inflation Projections

Source: SNB

The SNB cut the policy rate by 25 bp to 0.25% as widely expected. In the policy assessment, the forecasts for inflation hardly changed, in contrast to the downward revisions in previous quarters. Additionally, the SNB noted that the forecast (i.e. for CPI) is within the range of price stability (the SNB inflation target is purely for the rate to be below 2%) over the entire forecast horizon - no hurry then for more easing but not ruling them out!

On the real sector side, the SNB sticks with 1.0-1.5% for 2025 and is now forecasting 1.5% for 2026. Though U.S. tariffs could have an adverse effect on Switzerland, the SNB note that increased defence spending in Europe could provide a medium to long-term boost. Domestically the lagged effect of monetary easing, plus positive real wage growth should support domestic demand. Though the SNB notes higher uncertainty over the global growth picture, it’s baseline of reasonable growth has some supportive arguments.

This leaves the SNB with a dilemma going forward. With inflation forecasts stable, and given the economic outlook, it would be a good time to pause or stop the easing cycle. However, if the U.S. trade tariffs have a bigger adverse effect than expected, then the SNB may want the option to ease again later in the year. Additionally, the SNB will leave open the option of cutting to negative rates, just in case the Swiss Franc surges. The option of negative rates in itself meanwhile acts as a restraint from the FX market getting too bullish on the CHF. Thus SNB communications will likely leave the door open to further easing, but in reality we see this as probably the end to the easing cycle.