SNB: 25bps Cut and Next Cut in September

The SNB cut by 25bps to try and stop inflation undershooting. We look for a further 25bps cut in September, as the new inflation forecasts remains too far below target for SNB comfort. CHF strength will also not ebb quickly given the prospect of prolonged French political uncertainty.

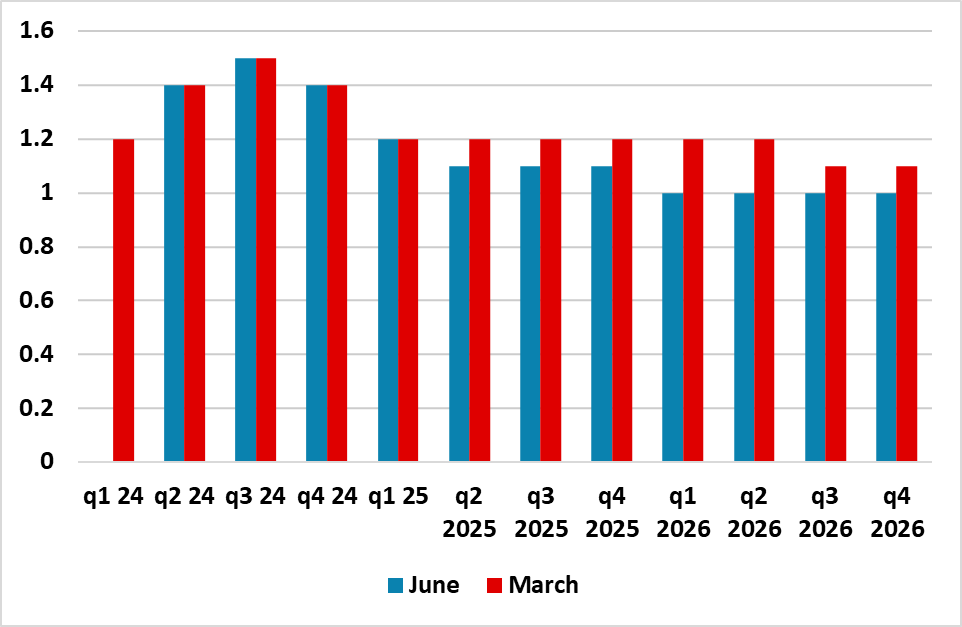

Figure 1: SNB CPI Inflation Projections Back Below Target

Source: SNB

SNB Still Sees Marked Inflation Undershoot

The SNB cut by 25bps to 1.50% as we projected, despite some in the market not expecting a cut. The rationale for the cut is clear in the even clearer undershoot of the inflation target with the new inflation projections (Figure 1). Indeed, the 2024-26 annual projections were all cut by 0.1 ppt, even after taking account of the new policy rate. Recent actual inflation dynamics certainly suggest disinflation continues. Headline CPI look set to match the 1.4% existing projection of the SNB for the current quarter. The continued strength of the Swiss Franc is only compounding domestic disinflation, but where even the latter is slowing. GDP growth continues to be projected at 1.0% in 2024 and the SNB forecast of 1.5% in 2025 is healthy but not inflationary.

The SNB policy reaction function suggests that they will likely cut the policy rate still further, as the new inflation forecasts are consistent with a 25bps in September and this is our forecast. Though the SNB statement suggests that the new inflation projection is consistent with the SNB inflation goal, the reality is that these type of inflation forecasts are enough to keep the SNB cutting, especially if the SNB’s repeated worries about property market vulnerabilities materialise. Indeed, a further 25bps cut down to 0.75% in December is now feasible, both given the forecast inflation undershoot and if CHF strength does not ebb – we forecast that the ECB will cut in September and December and the French political uncertainty will be ongoing (here).

It is noteworthy that the SNB continues to threaten further CHF sales, with the opposition to balance sheet increase now being removed by the persistent CHF strength.