United States

View:

January 06, 2026

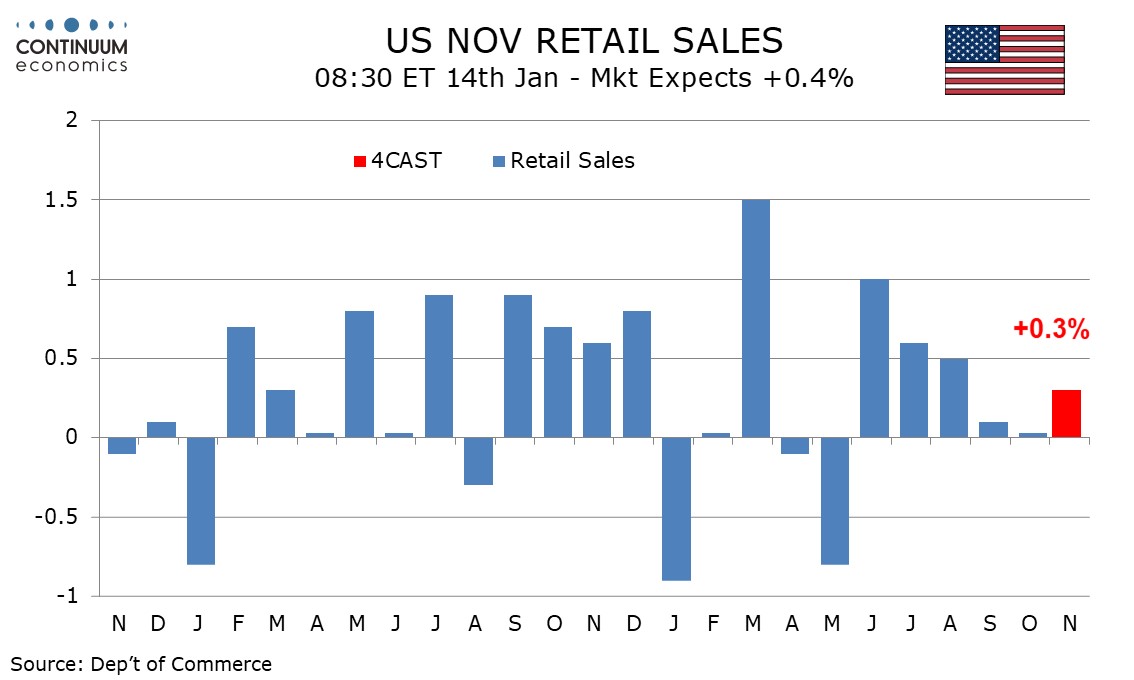

Preview: Due January 14 - U.S. November Retail Sales - A mostly subdued month, but December may be stronger

January 6, 2026 7:53 PM UTC

We expect a modest 0.3% increase in November retail sales, with positive contributions from autos and gasoline, Ex autos we expect a rise of 0.2% with ex auto and gasoline sales rising by only 0.1%.

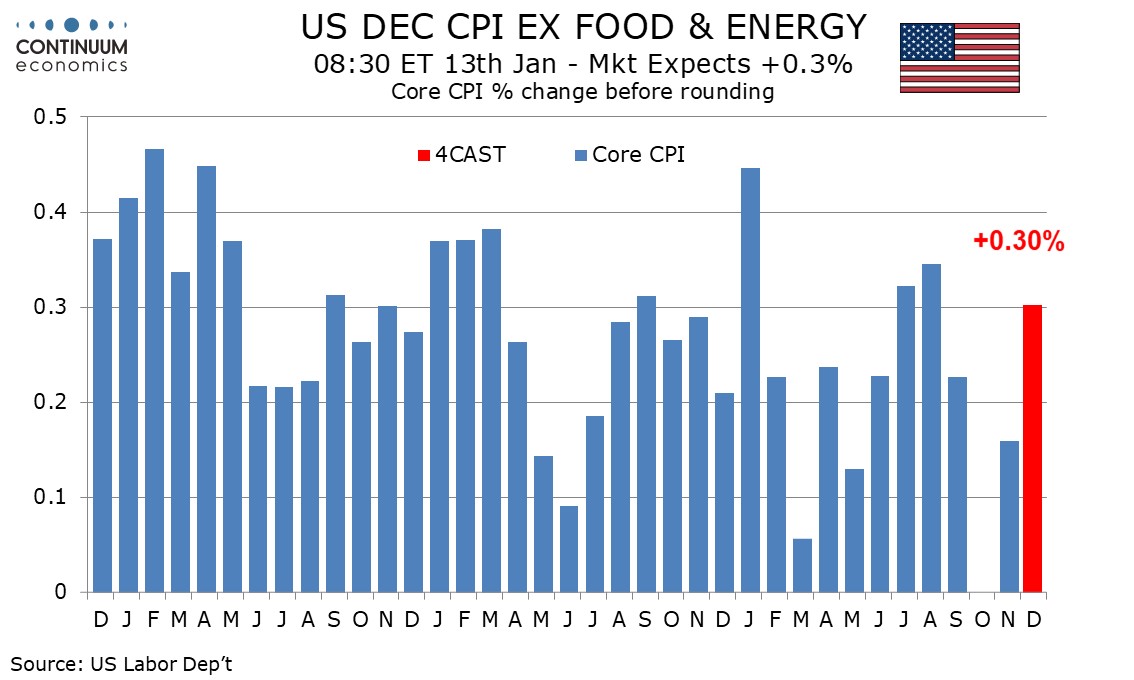

Preview: Due January 13 - U.S. December CPI - Soft November probably understates true picture

January 6, 2026 2:17 PM UTC

We expect gains of 0.3% in both December overall and ex food and energy CPI, with the gains being close to 0.3% even before rounding. There is extra uncertainty over this release as it is unclear whether the surprisingly soft data for November, after a missing October, represented a slowing in trend

Markets 2026

January 6, 2026 9:58 AM UTC

• For financial markets, the muddle through for global economics and policy provides support for risk assets, combined with solid earnings prospects from some of the magnificent 7. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, b

January 05, 2026

Venezuela: Oil and Geopolitics

January 5, 2026 12:02 PM UTC

· Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot

AI and U.S. Productivity

January 5, 2026 8:04 AM UTC

· Structural labor and overall productivity will be boosted if current AI adoption is sustained at a pace quicker than the adoption of the internet. However, not all areas of the U.S. economy are exposed to AI benefits, as manual work can only be replaced by humanoid robots with maj

January 02, 2026

Preview: Due January 8 - U.S. October Trade Balance - Exports to correct from stronger September

January 2, 2026 3:40 PM UTC

We expect an October trade deficit of $60.5bn, up from September’s $52.8bn which was the narrowest since June 2020. The deficit would be marginally above August’s $59.3bn, while remaining well below July’s $77.2bn and March’s record $136.4bn when imports surged ahead of the tariff announceme

Bessent: New Fed Inflation Range and Dropping Dots?

January 2, 2026 11:30 AM UTC

U.S. Treasury Secretary Bessent over the Christmas period suggested that the Fed should shift to targeting an inflation range and drop the quarterly dots. What impact would this have? Such a change would give the Fed more flexibility on the margin, but not significant. This could make communicat

December 30, 2025

U.S. Consumption Vulnerable to Asset Market Hit

December 30, 2025 8:42 AM UTC

Overall, we see consumption growth prospects as being modest for 2026, as low to middle income households still struggle with the cost of living crisis. Additionally, the slowdown in immigration is causing less overall employment gains and in turn less absolute increase in real income and consumptio

December 23, 2025

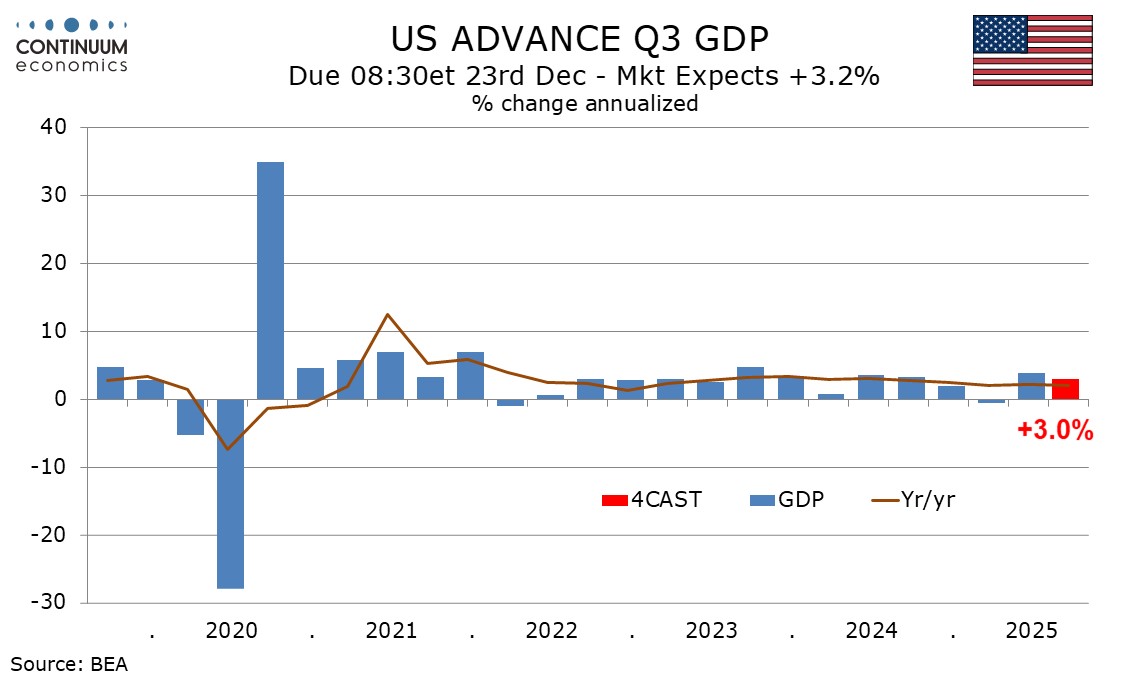

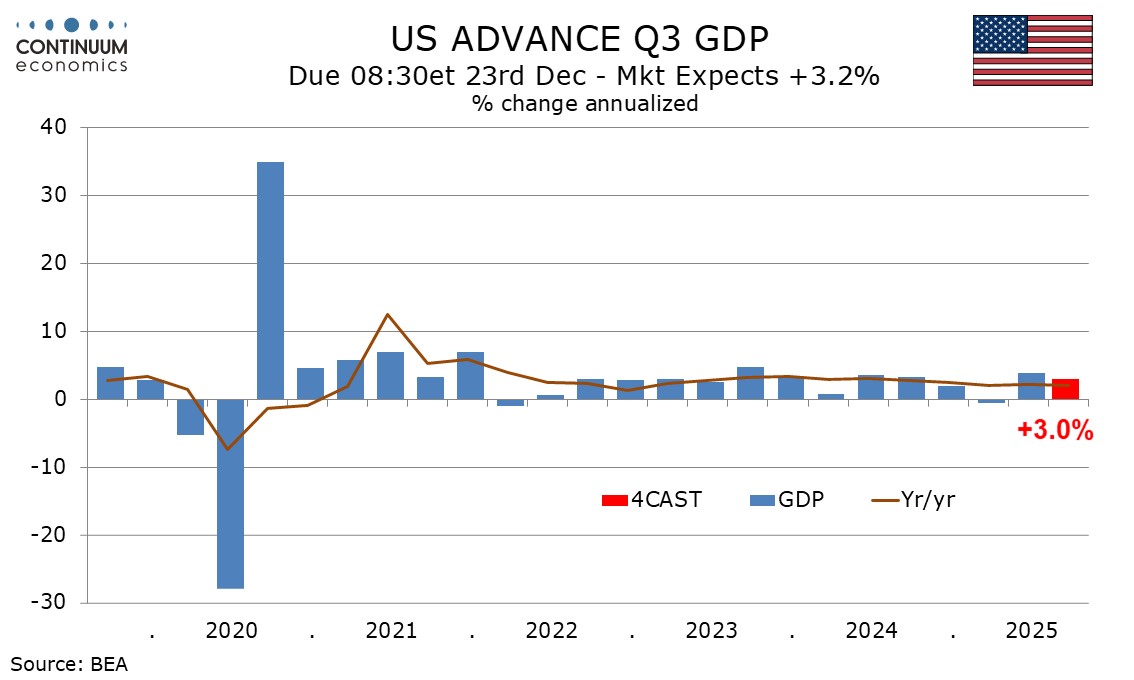

U.S. Q3 GDP: Better Than Expected, But

December 23, 2025 1:54 PM UTC

Q3 GDP came in better than expected due to a big net export contribution to growth. Gross domestic purchases at 2.7% were more in line with expectations, with mixed performance in key expenditure sectors. We see growth slowing in Q4, with net exports unlikely to repeat the Q3 outcome and consume

December 22, 2025

Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

December 22, 2025 2:42 PM UTC

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

December 19, 2025

December 18, 2025

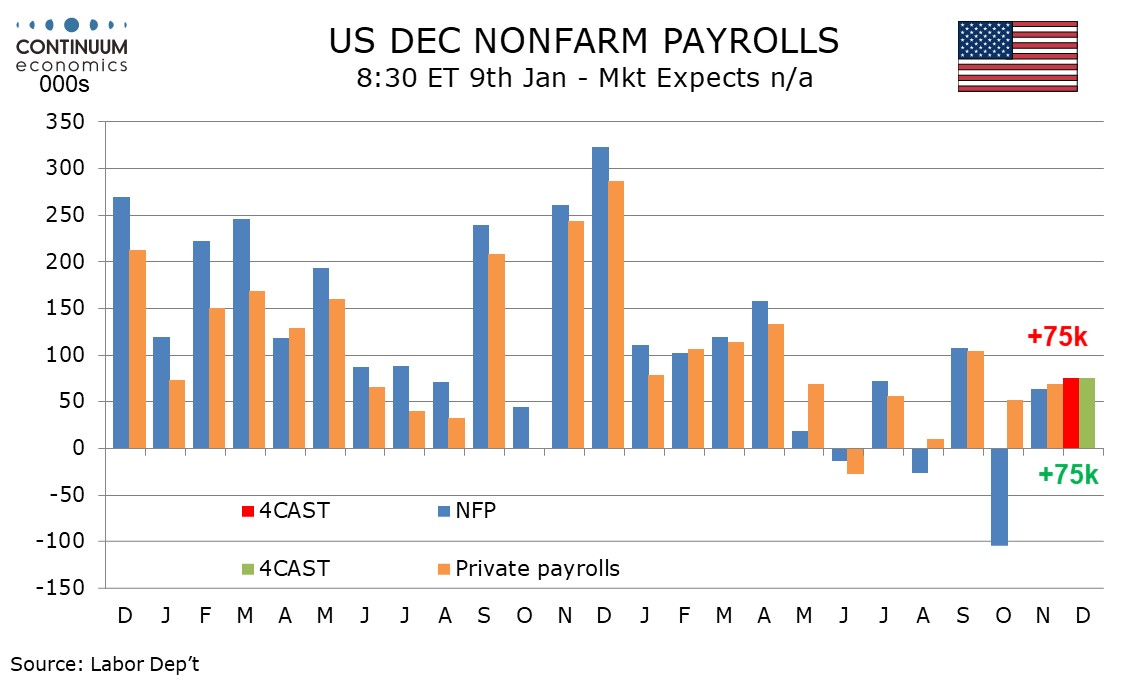

Preview: Due January 9 - U.S. December Employment (Non-Farm Payrolls) - Slightly firmer with unchanged unemployment

December 18, 2025 8:46 PM UTC

We expect December’s non-farm payroll to rise by 75k both overall and in the private sector, up from 64k and 69k respectively in November. We expect unemployment to be unchanged at 4.6% and a modest 0.3% increase in average hourly earnings.

DM FX Outlook: Scope for USD decline against JPY, AUD and NOK

December 18, 2025 2:31 PM UTC

· Bottom Line: We expect some modest USD losses across the board over the next couple of years, but there is much more scope for losses against the JPY, AUD and NOK than the other G10 currencies, as yield spreads have moved dramatically in favour of these currencies, and the currencies

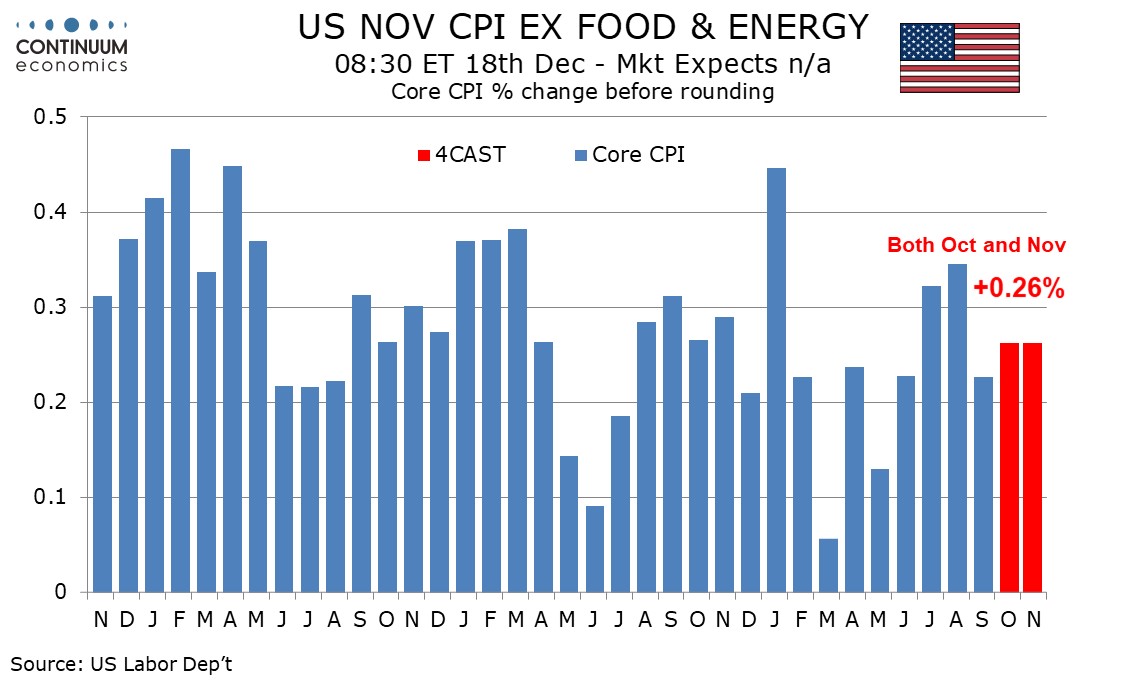

U.S. November CPI - Is the tariff impact fading?

December 18, 2025 2:10 PM UTC

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month ov

December 17, 2025

Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

December 17, 2025 1:41 PM UTC

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October b

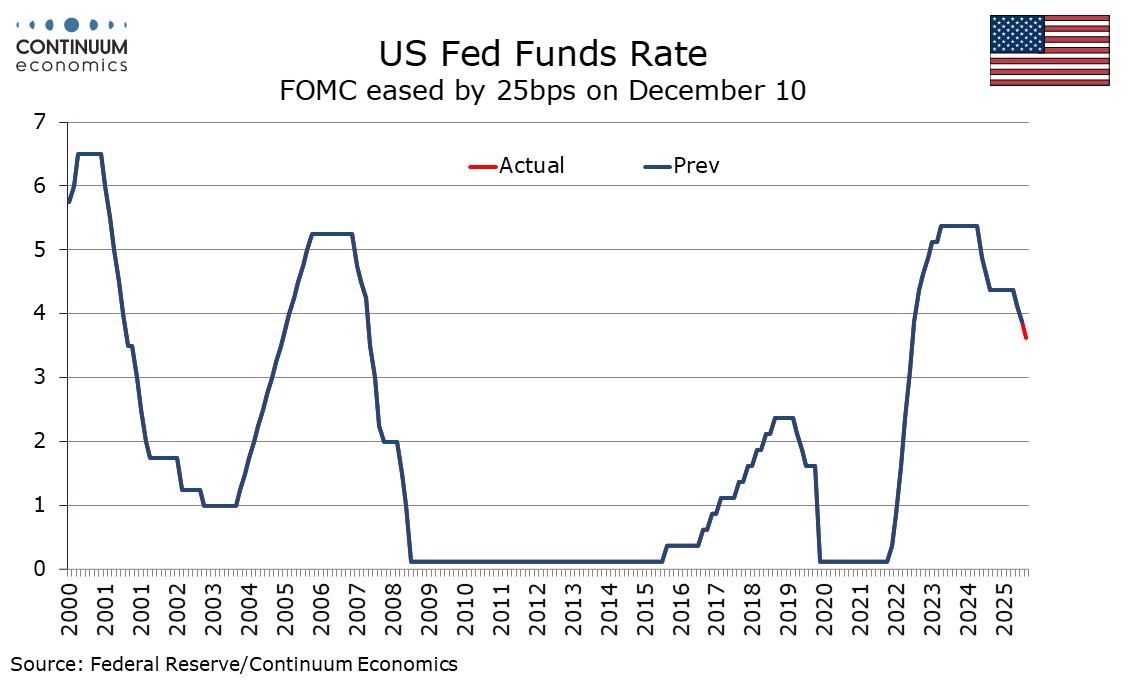

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 16, 2025

Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

December 16, 2025 4:25 PM UTC

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

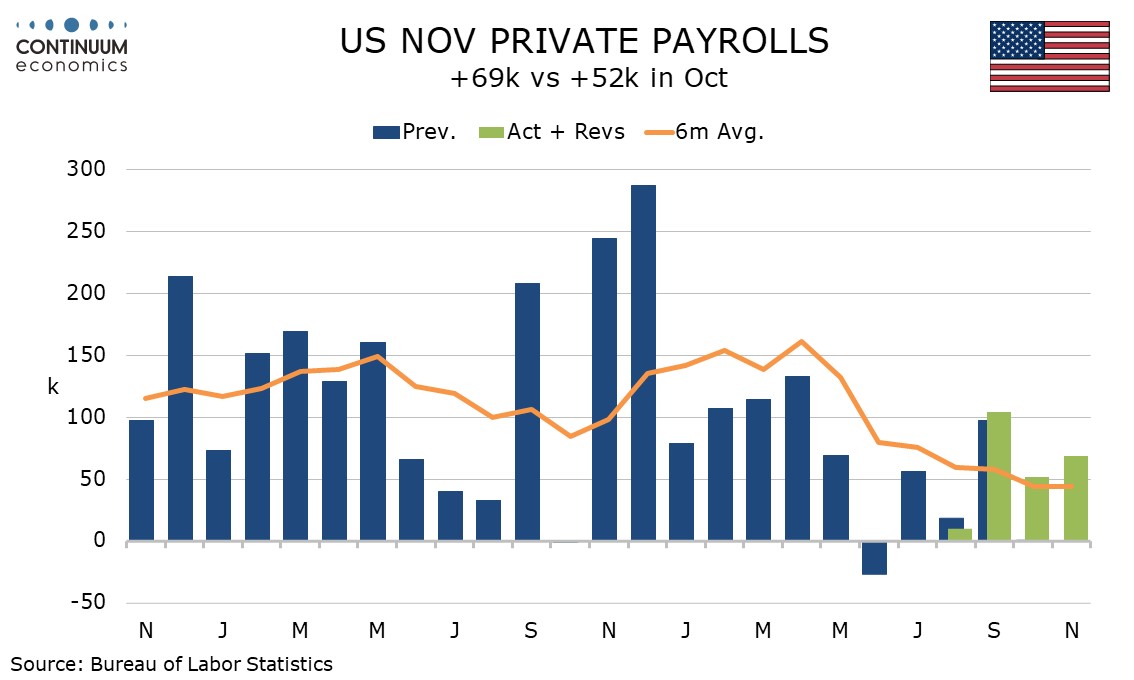

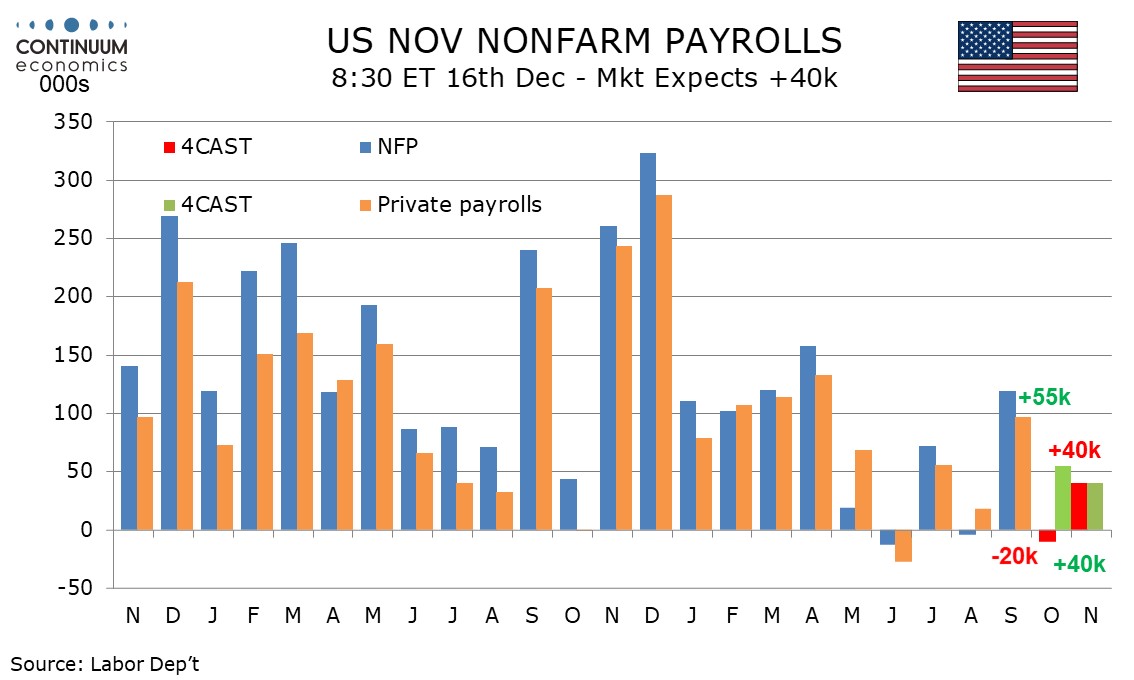

U.S. October and November Employment - Unemployment rising but economy maintains some momentum

December 16, 2025 2:22 PM UTC

November’s non-non-farm payroll at 64k does not fully erase a 105k decline in October but private payrolls at 69k in November and 52k in October maintain moderate growth, though unemployment at 4.6% in November is the highest since September 2021, and average hourly earnings growth is slowing. Oct

December 15, 2025

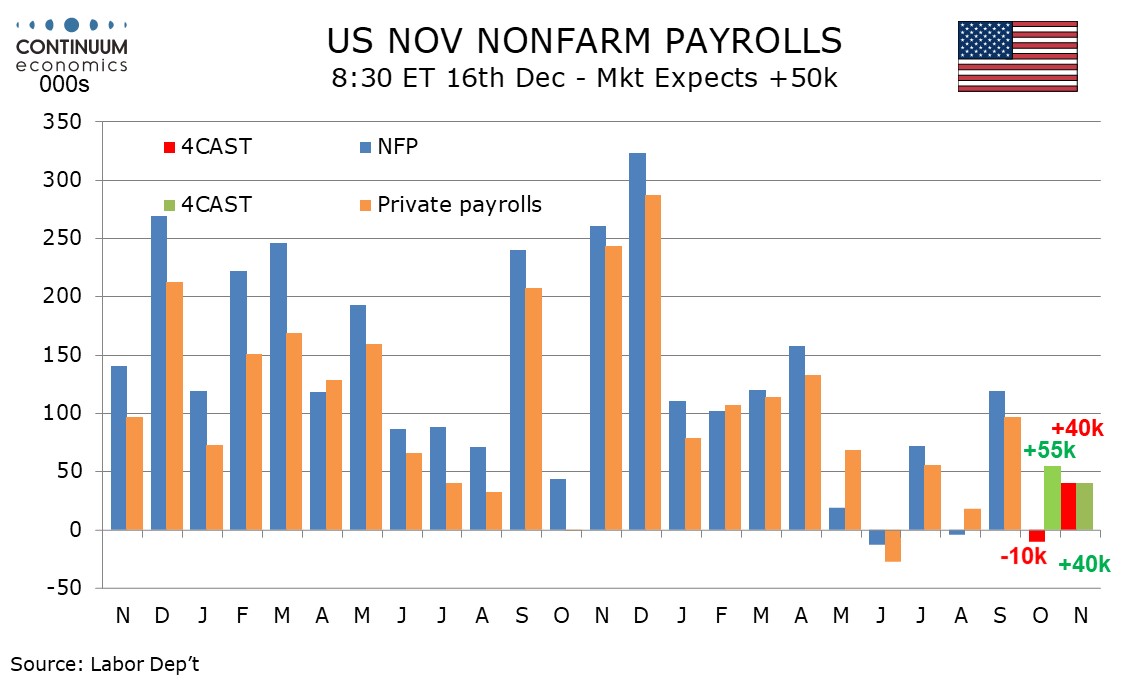

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 15, 2025 3:25 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

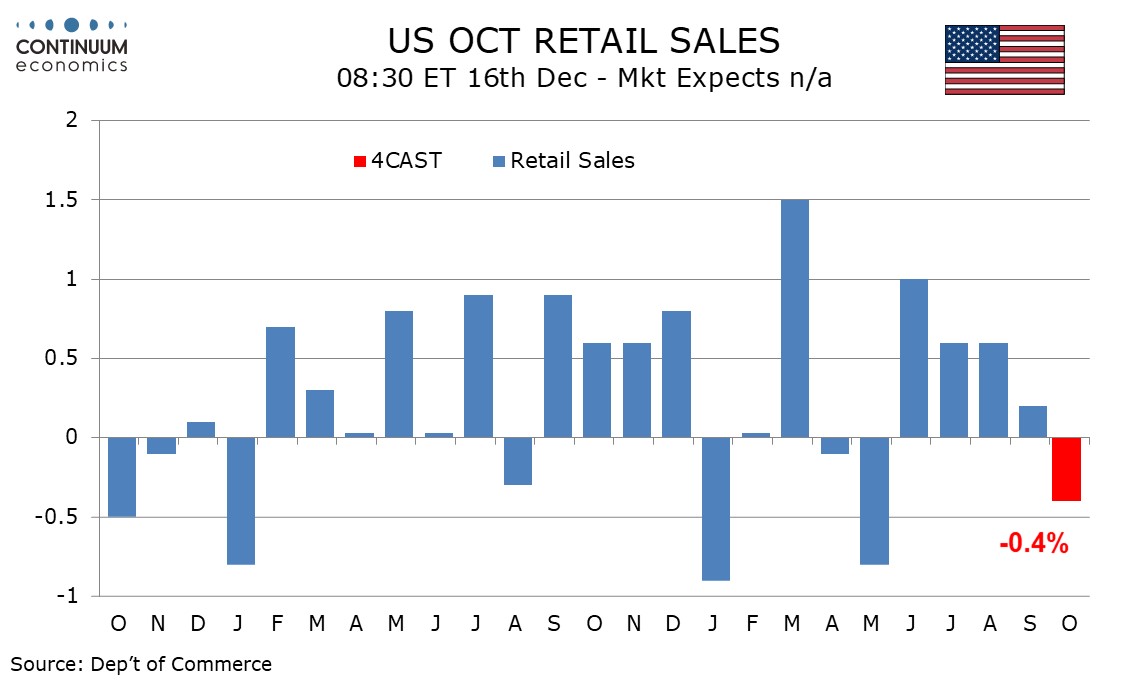

Preview: Due December 16 - U.S. October Retail Sales - Autos to lead a dip

December 15, 2025 1:16 PM UTC

We expect a 0.4% decline in October retail sales in September, with autos set to be the main negative after the expiry of a tax credit for electrical vehicle purchases. Elsewhere however we expect subdued data, with a 0.1% increase ex autos and a rise of 0.2% ex autos and gasoline.

December 12, 2025

U.S. Outlook: Consumers Vulnerable, but Recession Unlikely

December 12, 2025 4:38 PM UTC

• US GDP growth is likely to look solid in Q3 2025 supported by resilient consumer spending, but with slowing employment growth and resilient inflation weighing on real disposable income that will be difficult to sustain. However, while consumers look vulnerable, business investment looks h

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

December 11, 2025

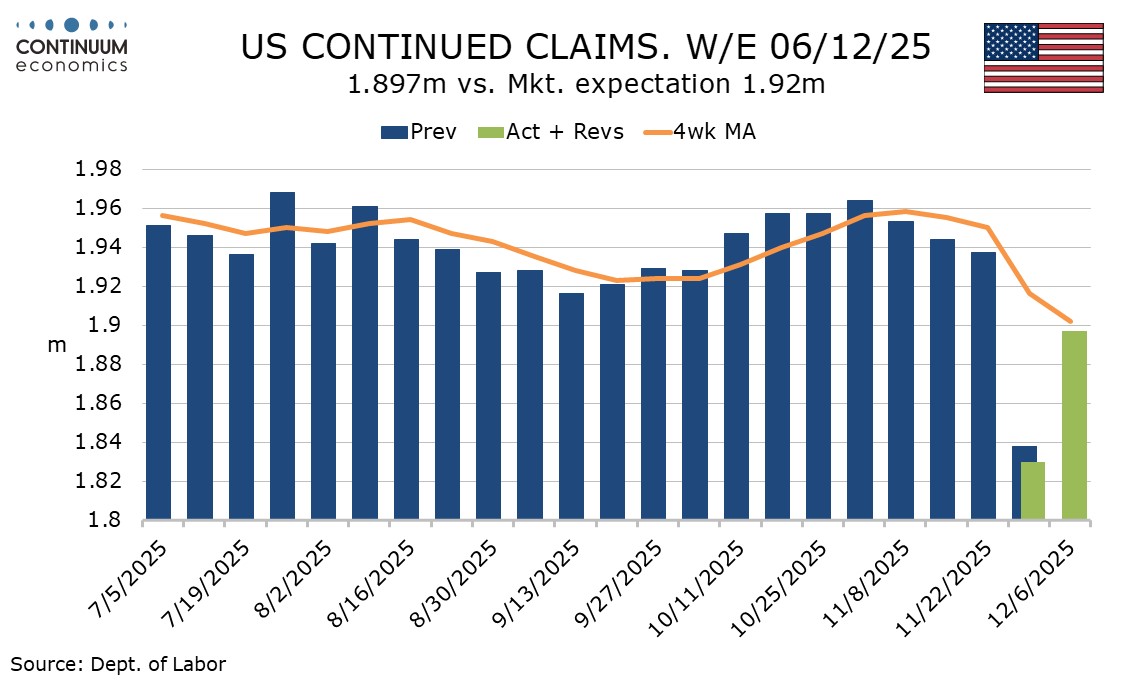

U.S. Initial Claims rebound from holiday drop, September trade deficit falls on surge in gold exports

December 11, 2025 2:14 PM UTC

After a sharply below trend outcome last week of 192k (revised from 191k) in a week that included the Thanksgiving holiday and may have seen seasonal adjustment problems, initial claims have rebounded above trend to 236k. The 2-week average is 214k, slightly below the 218k seen two weeks ago and the

December 10, 2025

Fed: Slower 2026 Easing

December 10, 2025 8:34 PM UTC

Powell in the press conference made clear that the Fed is now in a wait and see mood, with policy rates entering a broad measure of neutral policy rates. This means further weakening in labor demand and then consumption would be required to prompt an early 2026 cut. We are less upbeat than the Fed

FOMC eases by 25bps, dots unchanged from September

December 10, 2025 7:21 PM UTC

The FOMC has eased by 25bps as expected to a 3.50-3.75% Fed Funds target range, with two hawkish dissents for no change from Schmid (who dissented in October) and Goolsbee, while Miran again dissented for a steeper 50bps ease. The dots are unchanged from September, implying one 25bps ease in both 20

Preview: Due December 11 - U.S. September Trade Balance - Canadian data suggests a wider deficit

December 10, 2025 1:48 PM UTC

We expect a September trade deficit of $70.5bn, up sharply from August’s $59.6bn but still below July’s $78.2bn. We expect exports to fall by 0.5% after a 0.1% August increase while imports rise by 2.8% after a 5.1% July decline. This could weigh on estimates for Q3 GDP, now due on December 23

December 09, 2025

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 9, 2025 5:01 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

December 08, 2025

Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

December 8, 2025 2:00 PM UTC

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October b

AI and U.S. Equities

December 8, 2025 8:50 AM UTC

· The AI story has driven broad momentum in the U.S. equity market, but will likely become narrower driver in 2026 and 2027, as not all big AI/tech companies will generate clear explosive revenue from areas outside cloud computing and semiconductor chips. Companies that are also depende

December 05, 2025

Preview: Due December 16 - U.S. October Retail Sales - Autos to lead a dip

December 5, 2025 8:06 PM UTC

We expect a 0.4% decline in October retail sales in September, with autos set to be the main negative after the expiry of a tax credit for electrical vehicle purchases. Elsewhere however we expect subdued data, with a 0.1% increase ex autos and a rise of 0.2% ex autos and gasoline.

FOMC Preview for December 10: A close call for a 25bps easing

December 5, 2025 4:09 PM UTC

The FOMC meets on December 10 in what looks sure to be a hotly debated decision, though a 25bps easing in the Fed Funds target range to 3.50-3.75% looks likely, justified by labor market risks. However, at least two hawkish dissents for unchanged policy are likely. The meeting will deliver updated d

U.S. September Core PCE Prices consistent with CPI, December Michigan CSI sees inflation expectations fall

December 5, 2025 3:27 PM UTC

September PCE prices at 0.3% overall, 0.2% ex food and energy are in line with expectations with the respective gains before rounding at 0.269% and 0.198%. December’s Michigan CSI has seen inflation expectations easing, which will provide some comfort to the Fed.