EM Country Research

View:

January 05, 2026

Venezuela: Oil and Geopolitics

January 5, 2026 12:02 PM UTC

· Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot

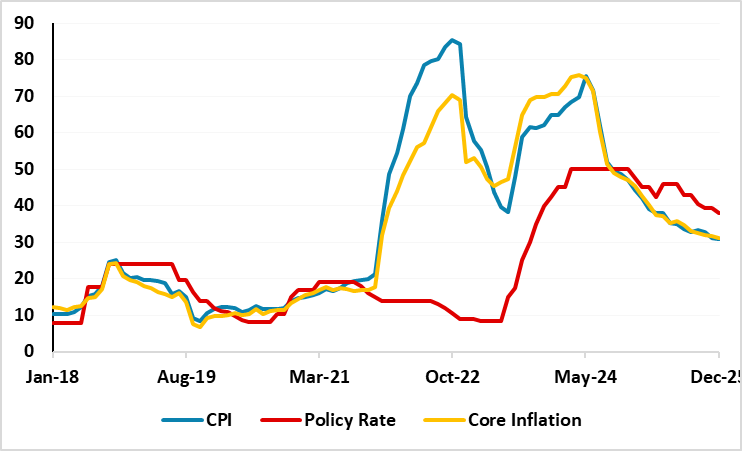

Turkiye Closes the Year with Inflation Easing to 30.9% y/y in December

January 5, 2026 11:25 AM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on January 5, Turkiye’s inflation softened to 30.9% y/y in December backed by the lagged impacts of previous monetary tightening. Food, housing and education drove the inflation in December as education prices recorde

January 02, 2026

December 23, 2025

Trump’s Peace Framework as a Path to a Late 2026 Settlement?

December 23, 2025 1:48 PM UTC

Bottom Line: With Russia maintaining its long-held demands in Ukraine and negotiations intensifying around President Trump’s latest peace proposal, our baseline view is that this framework will serve as the primary catalyst for a settlement. We anticipate a Russia-friendly peace deal (70% probabil

December 22, 2025

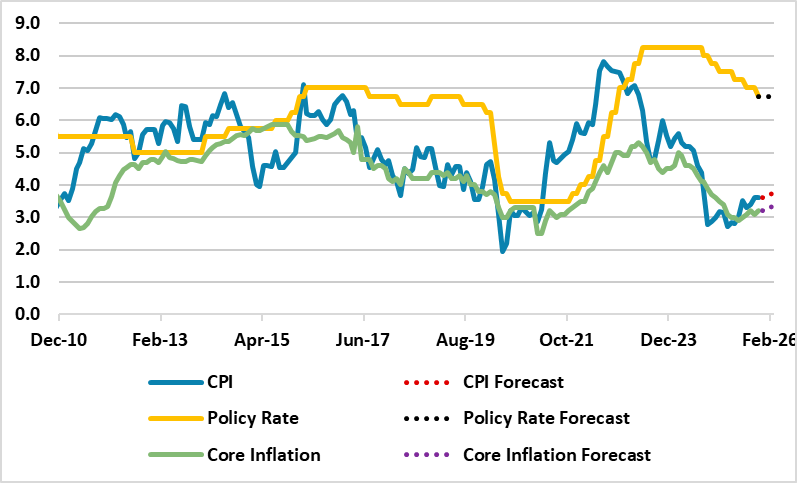

Russia’s Inflation is Expected to Continue to Soften in December

December 22, 2025 2:11 PM UTC

Bottom Line: After edging down to 6.6% in November, we expect Russian inflation to continue its decreasing pattern in December owing to lagged impacts of previous aggressive monetary tightening and relative resilience of RUB. December inflation figures will be announced on December 29, and we forese

December 19, 2025

Mexico: 25bps Cut and Now Pause

December 19, 2025 8:15 AM UTC

Banxico cut by 25bps to 7.0% as expected with a downward revision to 0.3% for 2025 GDP growth. Below trend GDP is forecast in 2026 and we see this prompting further easing in March and June 2026 by 25bps each, but MXN weakness restraining Banxico pace. We then see Banxico going on hold for the rem

December 18, 2025

EM FX Outlook: High Real Yields Still Help

December 18, 2025 12:14 PM UTC

• EM currency 2026 prospects come against a backdrop of a further but slower USD depreciation against DM currencies, but inflation differentials, domestic central bank policy and politics also matter. We forecast the Mexican Peso (MXN) will likely be more volatile, as President Donald Tru

December 17, 2025

South Africa Inflation Moderately Softens to 3.5% y/y in November

December 17, 2025 5:08 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on December 17 that annual inflation softened moderately to 3.5% y/y in November from 3.6% the previous month, but food and restaurant prices remained worrisome. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 pe

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 16, 2025

Asia/Pacific (ex-China/Japan) Outlook: Managing Slower Growth Without Losing the Cycle

December 16, 2025 2:43 PM UTC

· Asia’s 2026 growth is normalizing, not weakening, though the growth outlook reflects resilience under mounting strain rather than acceleration. Larger investment-led economies such as India and Malaysia are sustaining momentum through public capex, infrastructure pipelines, and indu

Commodities Outlook: A Balancing Act

December 16, 2025 10:15 AM UTC

Global oil demand is expected to be modest, with weak consumption in the U.S. and China, while India will support demand in 2026 and 2027. Non-OPEC supply is expected to expand moderately in 2026, whereas OPEC’s policy will respond to demand but remains puzzling. Supply trends in 2027 are likely t

EMEA Outlook: Uncertainties Give Mixed Signals

December 16, 2025 7:00 AM UTC

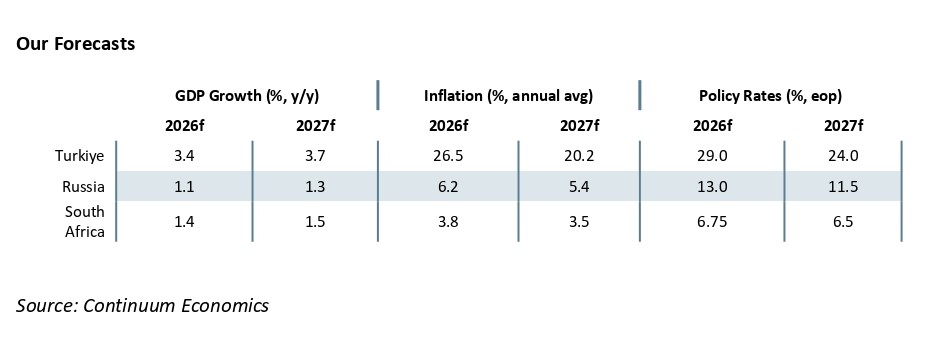

· In South Africa, we foresee average headline inflation will stand at 3.8% and 3.5% in 2026 and 2027, respectively. Upside risks to inflation remain such as, utility costs, and supply chain destructions. We see growth to be 1.4% and 1.5% in 2026 and 2027, respectively. Risks to the growth

December 15, 2025

China: Weak Growth

December 15, 2025 7:39 AM UTC

• November figures show weak growth and are a concern for momentum going into 2026. Retail sales continues to be hurt by adverse wealth effects and slow job and income growth. Though the authorities are promising to boost consumption, we see this only being modest rather than aggressive

December 11, 2025

China Outlook: Headwinds Get Stronger

December 11, 2025 10:30 AM UTC

· Private domestic demand remains modest, with consumption ranging from modest to moderate (slowed by the housing wealth hit and soft jobs/wage growth) and investment further impacted by the ongoing adverse drag of the residential property bust. China’s authorities prefer a long and

Exceeding Expectations: Russia Inflation Eased Fast to 6.6% y/y in November

December 11, 2025 8:15 AM UTC

Bottom Line: Russian inflation continued its decreasing pattern in November and edged down to 6.6% owing to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB despite food and services prices continued to surge in November. We think the inflation will continue

Brazil: March 50bps Cut?

December 11, 2025 8:00 AM UTC

BCB remain focused on getting inflation converging towards the centre of the inflation target range at 3% looking at the December statement. It appears that the economic weakness is not yet great enough to get the BCB to signal a January cut. Nevertheless, with headline inflation falling, the real i

December 09, 2025

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

December 08, 2025

December 04, 2025

China/Japan: The Australia Playbook or Grey Warfare

December 4, 2025 10:05 AM UTC

China will likely escalate pressure on Japan to back down over it less pacifist stance on self-defense, as it wants to drive a wedge between Japan and the U.S. One option is to repeat the 2020 copybook when China banned coal imports from Australia for 3 years. A 2nd alternative is grey warfare a

December 03, 2025

December 02, 2025

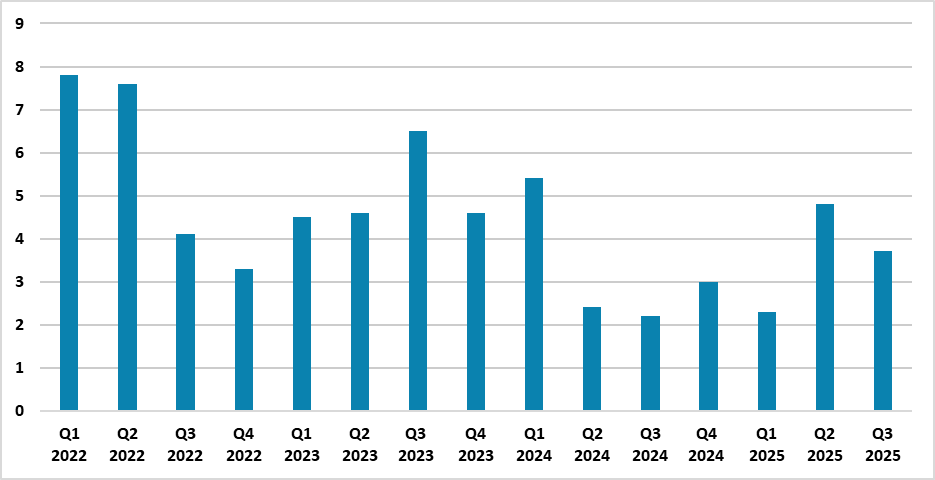

South African GDP Growth Hit 2.1% y/y in Q3, Marking the Fastest Expansion Since Q3 2022

December 2, 2025 8:03 PM UTC

Bottom Line: Department of Statistics of South Africa (Stats SA) announced Q3 GDP growth on December 2. South African economy grew by 2.1% YoY in Q3, the fastest expansion since Q3 2022. We think that the growth momentum will continue to be supported by low inflation, improved consumer sentiment, fe

December 01, 2025

Turkish Economy Expanded by 3.7% in Q3 Backed by Robust HH Consumption and Investments

December 1, 2025 10:41 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced GDP growth for Q3 on December 1. Turkish economy grew by 3.7% YoY in Q3 backed by household consumption, investments, and government spending.

November 28, 2025

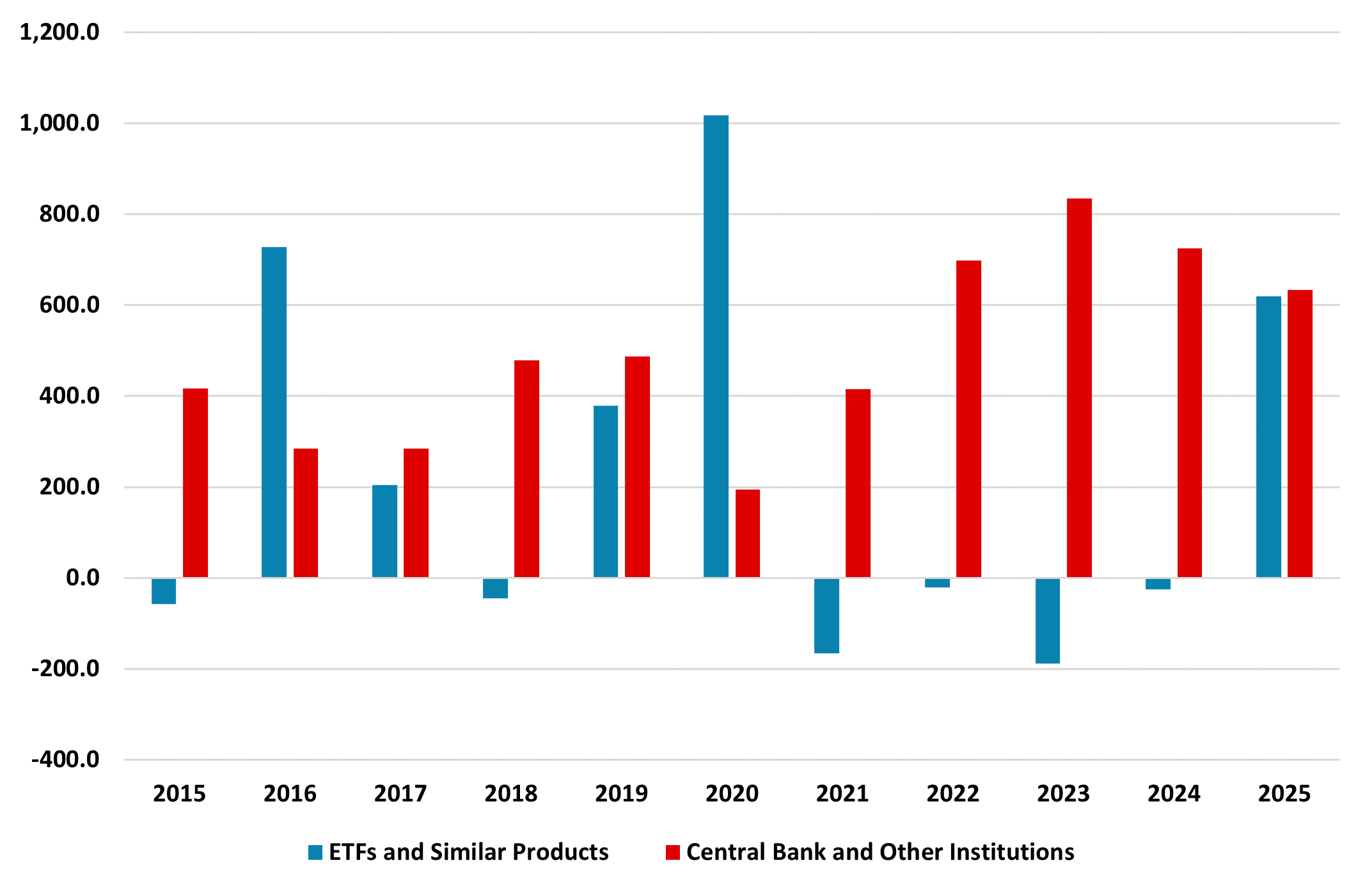

China’s Hidden Gold Buying: Why?

November 28, 2025 1:05 PM UTC

Speculation has been growing in the gold market that the surge in unrecorded gold purchases could be linked to China.

Overall, some unreported buying of gold by China could have occurred in 2025 and also in 2022-24. This could be a combination of wanting to avoid upsetting Trump during a tense U.S.-C

November 27, 2025

Turkiye GDP Growth Preview: Economy will Expand by Around 4% in Q3

November 27, 2025 4:22 PM UTC

Bottom Line: Turkish Statistical Institute (TUIK) will announce Q3 GDP growth on December 1 and we expect that Turkish economy will expand around 4.0% YoY backed by investments, strong construction and industry activities in Q3. Of course, growth figure could hit below our expectations due to the we

USMCA Renegotiation: Hostage To Trump

November 27, 2025 2:55 PM UTC

• Trump could decide to go on an early offensive over the July 2026 USMCA review or could wait until after the November congressional elections to act tough given it could cause new cost of living fears for U.S. voters. This could mean that at times the USMCA negotiations are upsetting fo

November 24, 2025

Turkiye Inflation Preview: Inflation will Likely Soften to 32.0% in November

November 24, 2025 6:43 PM UTC

Bottom line: After hitting 32.9% annually in October, we expect Turkiye’s inflation will likely soften to around 32.0% in November backed by moderate food prices while upside-tilted inflation risks continue to limit the downward trend during the ongoing disinflationary process. We foresee MoM in

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 19, 2025

South Africa Inflation Edged Up to 3.6% y/y in October, Marking the Highest Reading Since September 2024

November 19, 2025 3:53 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on November 19 that annual inflation edged up to 3.6% YoY in October due to accelerated transport, alcoholic beverages and tobacco, and recreation costs. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 percenta

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 17, 2025

Financial Stability Risks: Vulnerable To A Recession

November 17, 2025 1:00 PM UTC

The November Fed financial stability review highlights continued concern over hedge funds and insurance company leverage, while the IMF GSFR is concerned about U.S. equity market overvaluation and growing links between banks and non-bank financial intermediaries. However, the main adverse shock wo

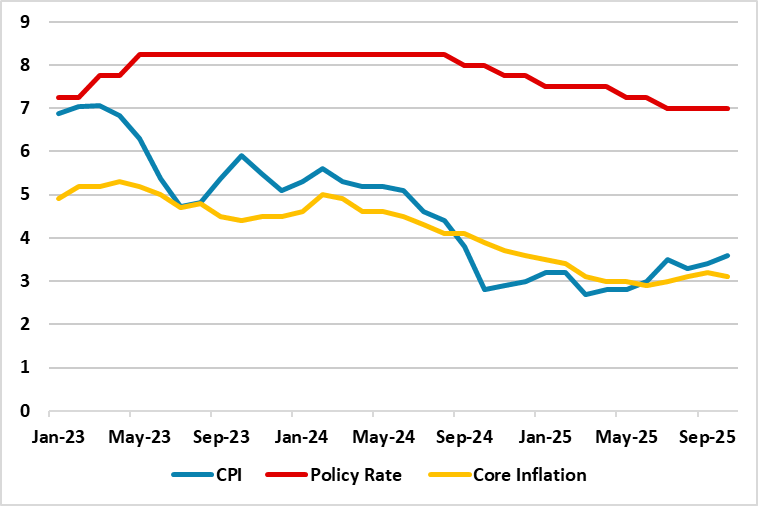

India CPI Review: Inflation Cools to Historic Lows

November 17, 2025 8:04 AM UTC

India’s October inflation print confirms a rare moment of macro alignment—low inflation, solid growth, and room for monetary easing. The RBI now faces a high-conviction window to cut rates in December, but must stay vigilant against creeping food price risks as FY26 progresses.

November 14, 2025

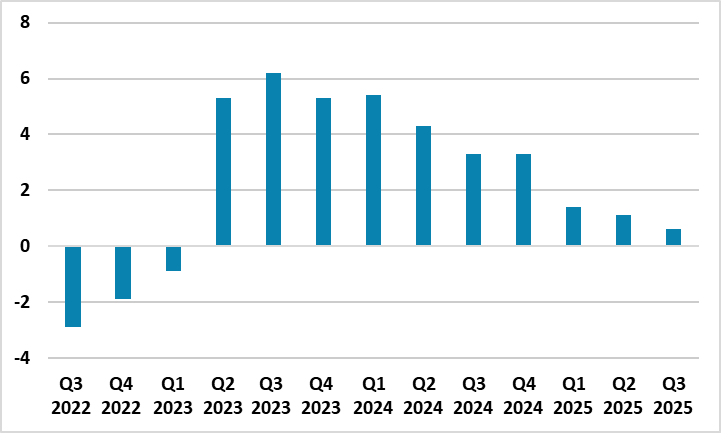

Slowest Rate of Growth for Russia Since Q1 2023: 0.6% y/y in Q3 2025

November 14, 2025 6:06 PM UTC

Bottom Line: According to Ministry of Economic Development’s preliminary figures, Russia's GDP expanded by a moderate 0.6% y/y in Q3, marking the slowest rate of growth since Q1 2023 showing the economic slowdown in Russia is more evident now. We think Central Bank of Russia’s (CBR) previous agg

Russia’s Inflation Softened to 7.7% y/y in October

November 14, 2025 5:00 PM UTC

Bottom Line: As expected, Russian inflation continued its decreasing pattern in October and edged down to 7.7% thanks to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB particularly after July. Despite fall in inflation; we think the inflation will continue

China: Unbalanced Growth

November 14, 2025 8:15 AM UTC

· The slowdown in China retail sales continues, with excess production still evident. Nevertheless, the slowdown in industrial production and private sector business investment suggests that companies are becoming less upbeat about domestic demand. Underlying growth is 4.0%, though

November 10, 2025

China: CPI Rises Helped By Government Pressure

November 10, 2025 8:24 AM UTC

• Less food price decline, plus government pressure to curtail price wars, helped headline and core CPI move higher. However, the September industrial production and retail sales figure shows that the imbalance between supply and domestic demand remains in place. The imbalance of supply a

November 07, 2025

India’s Fiscal Deficit Swells, Yet 4.4% Target Still Within Reach

November 7, 2025 7:30 PM UTC

India’s fiscal performance in H1 reflects a calculated front-loading of capex to support growth, while record non-tax revenues offer a buffer. Execution risks remain in H2, but the government appears confident in meeting its 4.4% deficit target without derailing market or reform momentum.

India CPI Preview: Disinflation Deepens: October CPI Forecast at 1.1%

November 7, 2025 5:43 PM UTC

We forecast October CPI at 1.1% yr/yr, with risks tilted to the downside. The disinflationary trend is broad-based, but unlikely to last into early 2026. RBI still has room to cut, but may prefer to assess the durability of food price softness before moving

China’s 2nd Tier Banking Problems

November 7, 2025 2:45 PM UTC

China’s residential property bust continues to feedthrough to some bank’s non-performing loans and financial stability. Even so, the latest PBOC financial stability report shows the percentage of high risk rated banks has not increased over the last 12 months, while China authorities early warni

Banxico: December In Doubt and Pause Closer

November 7, 2025 9:56 AM UTC

The December Banxico meeting is not guaranteed to see a further 25bps cut, with the November Banxico statement showing more caution over persistent core inflation pressures and given the cumulative easing already seen. Combined with the risk of a Fed pause in December, plus Banxico’s Mexican Peso

November 06, 2025

Russia’s Inflation is Expected to Continue to Soften in October Likely Hitting Below 8.0% y/y

November 6, 2025 2:39 PM UTC

Bottom Line: We expect Russian inflation to continue its decreasing pattern in October thanks to lagged impacts of previous aggressive monetary tightening coupled with softening food prices and decreasing core inflation. October inflation figures will be announced on November 14, and we foresee Yr/Y

November 03, 2025

Inflation Slightly Edged Down in October: But MoM Stood High at 2.5%

November 3, 2025 10:50 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced October inflation figures on November 3. Turkiye’s y/y inflation moderately softened to around 32.9% in October from 33.3% in September while upside-tilted inflation risks continued limiting the downward trend during the ongoing disinfla

China: Fiscal Stimulus Modest Rather than Large?

November 3, 2025 9:07 AM UTC

• Overall, we see around a Yuan2.0-2.5trn fiscal stimulus for 2026 and some of this could be announced in December but the majority in March 2026. This reflects the fiscal constraints on China authorities; the targeted focus in the 2026-31 five year plan and reluctance to spending on hous

October 31, 2025

U.S./China Trade Framework: Avoiding Escalation

October 31, 2025 7:48 AM UTC

· The U.S./China framework deal avoids renewed escalation of trade tension, but is unlikely to be followed by a comprehensive trade deal in 2026 as China does not want major import and bilateral trade commitments. The economic effects will likely be small and the deal main aim app

October 30, 2025

Turkiye: Macroeconomic Problems Limit Long Term Growth

October 30, 2025 12:25 PM UTC

Bottom line: We forecast 3.5%-4.0% GDP growth in Turkiye in the 2026-2030 period. We are concerned with the macroeconomic problems will stay critical until 2027/2028, including stubborn inflation, trade and budget deficits, and weakening Turkish Lira (TRY). Despite growing population and young labor

Breakthrough in Sight: India and US Move Towards Bilateral Trade Agreement

October 30, 2025 6:05 AM UTC

The India–US trade deal now seems within reach after months of deadlock, with both sides signalling convergence on major issues. For Indian exporters, particularly in textiles, marine products, and engineering goods, the removal of US tariffs would provide a timely boost amid global demand uncerta

October 28, 2025

Turkiye Inflation Preview: Inflation will Slightly Soften in October Despite Risks Dominate

October 28, 2025 4:43 PM UTC

Bottom line: After hitting 33.3% annually in September, we expect Turkiye’s inflation will likely soften moderately to around 32.5% in October while upside-tilted inflation risks limiting the downward trend during the ongoing disinflationary process. September inflation suggested that the pace o

India’s Core Sector Growth Slows to 3%: Infrastructure Holds Firm, Energy Falters

October 28, 2025 6:14 AM UTC

India’s September core sector data encapsulates a pivotal juncture for the economy — resilient infrastructure activity offset by energy vulnerability. Slowing core output implies lower industrial output growth over Q2-FY26.