India’s Core Sector Growth Slows to 3%: Infrastructure Holds Firm, Energy Falters

India’s September core sector data encapsulates a pivotal juncture for the economy — resilient infrastructure activity offset by energy vulnerability. Slowing core output implies lower industrial output growth over Q2-FY26.

India’s core sector (infrastructure) growth eased sharply to 3% yr/yr in September 2025, reflecting a dual narrative of strength in infrastructure-linked industries and weakness in energy supply chains. For policymakers, the data offers both reassurance about the durability of public investment and a warning that energy bottlenecks could undermine the broader industrial recovery if left unchecked.

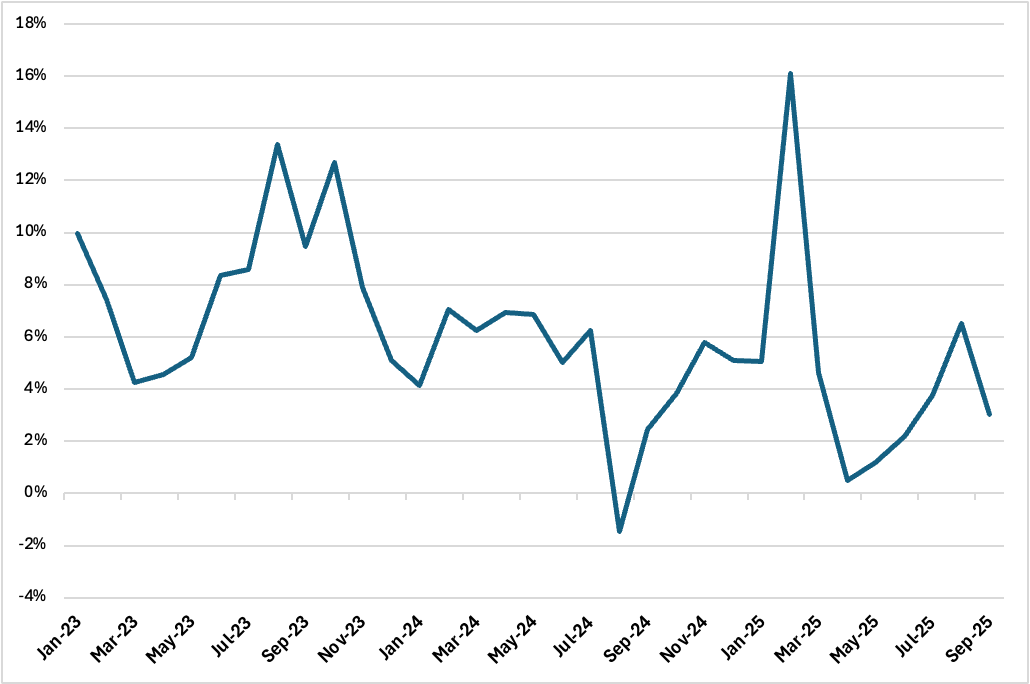

Figure 1: India Core Sector Output (% yr/yr)

Source: Ministry of Commerce and Industry, Continuum Economics

The Index of Eight Core Industries (ICI) — which forms over 40% of the Index of Industrial Production (IIP) — underscored this divergence. Steel output rose 14.1%, cement 5.3%, and fertilizers 1.6%, sustained by continued construction demand and pre-festive restocking. Electricity generation also grew modestly (2.1%), reflecting stable power consumption in urban and industrial regions. However, energy-heavy sectors weighed on the aggregate figure. Coal (-1.2%), crude oil (-1.3%), natural gas (-3.8%), and refinery products (-3.7%) all contracted, reversing gains seen earlier in the year. Cumulatively, core output grew 2.9% in H1 FY26, marking a slowdown from the 5.8% pace recorded in the previous half-year.

The slowdown reveals the economy’s growing dependence on construction-led momentum — fuelled by government capital expenditure and a resilient urban real estate cycle — while energy fragility remains a drag. Lower output in oil, coal, and gas raises concerns over input costs, fuel import bills, and industrial power reliability, particularly for manufacturing sectors with thin margins. Strong steel and cement output points to sustained progress in housing, roads, and urban infrastructure, key anchors of India’s 6.8% growth trajectory. Yet, if energy supply chains remain constrained, they could amplify pressures on the current account and temper near-term GDP momentum.

Given the core sector’s weight in the IIP, September’s moderation likely signals a softer IIP print for the month and possibly a weaker industrial showing in Q2 FY26.