Bank of Canada

View:

August 13, 2025

Bank of Canada Minutes from July 30 - Differences of opinion on whether further easing would be needed

August 13, 2025 7:32 PM UTC

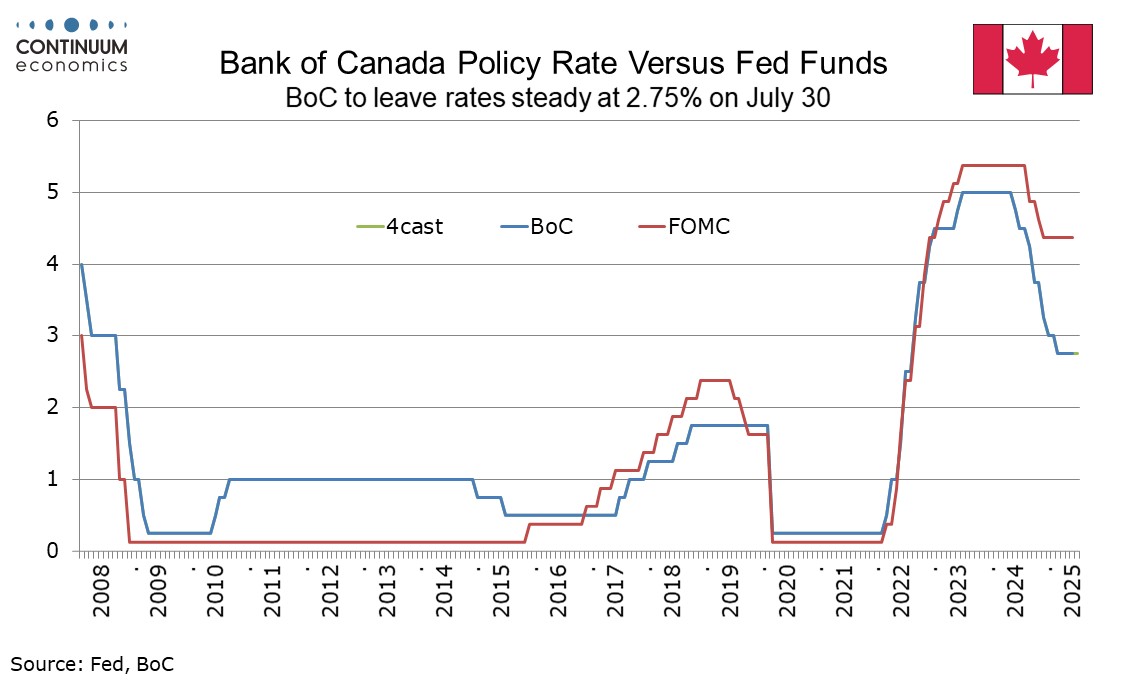

The Bank of Canada has released minutes from its July 30 meeting, which saw rates left unchanged at 2.75% with Governor Macklem stating after the meeting that there was a clear consensus to do so. However the minutes show that some felt the rate had been reduced sufficiently, while others felt that

August 08, 2025

Canada July Employment - A weak month after a strong month

August 8, 2025 12:54 PM UTC

Canada’s surprisingly strong June employment report has been followed by a significant correction lower in July, with a fall of 40.8k to follow a rise of 83.1k, Full time work is negative over the two months, a 51.0k fall after a 13.5k increase, while part time work with a rise of 10.3k extended a

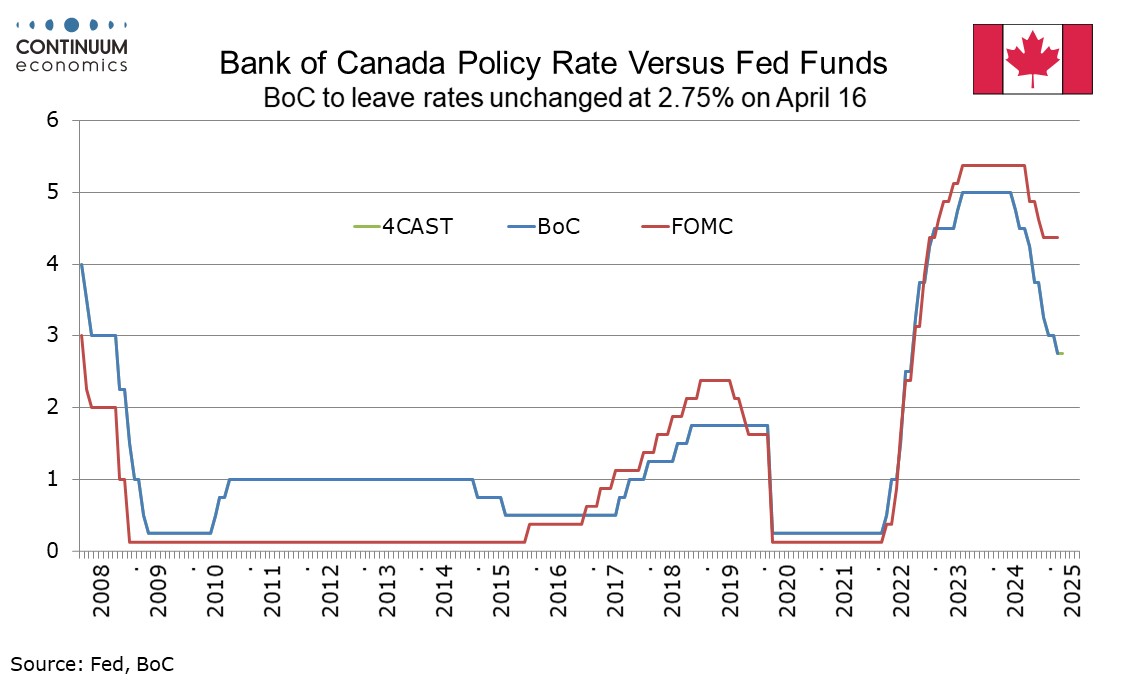

July 30, 2025

Bank of Canada - Consensus to hold, but cautious bias towards easing

July 30, 2025 3:34 PM UTC

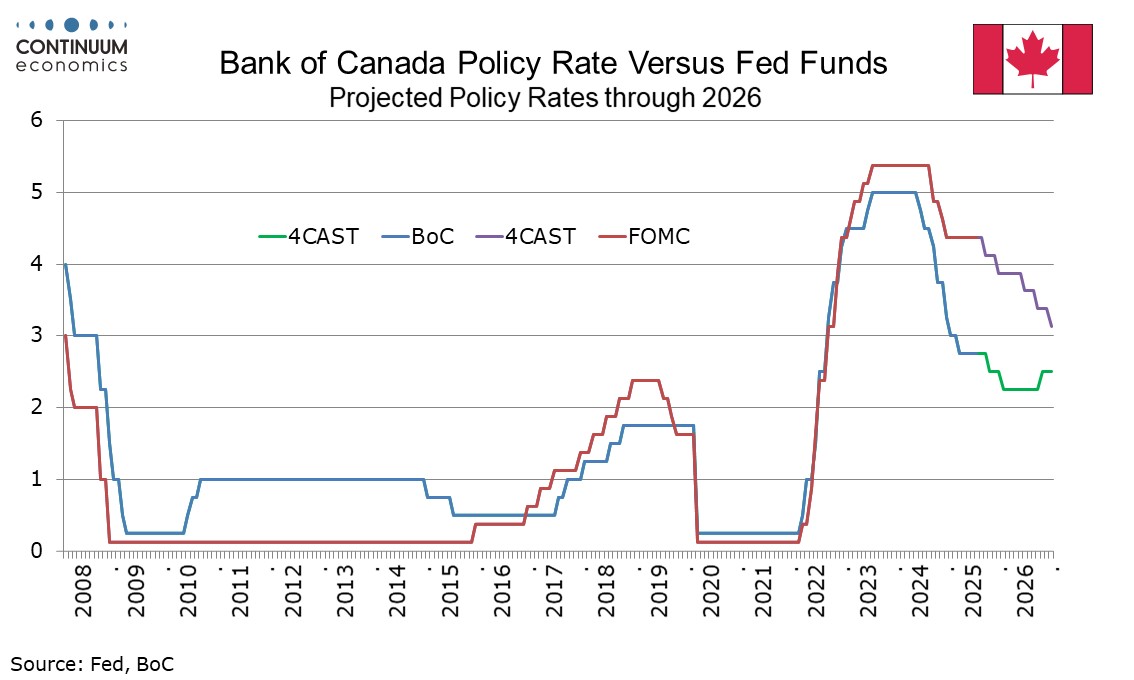

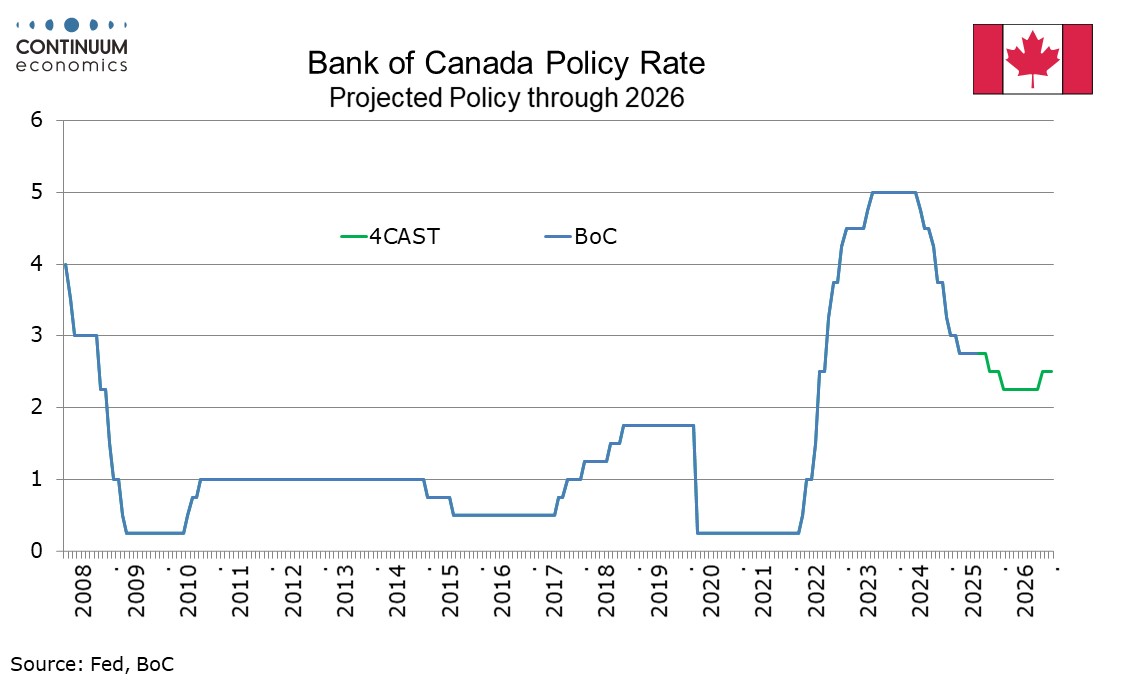

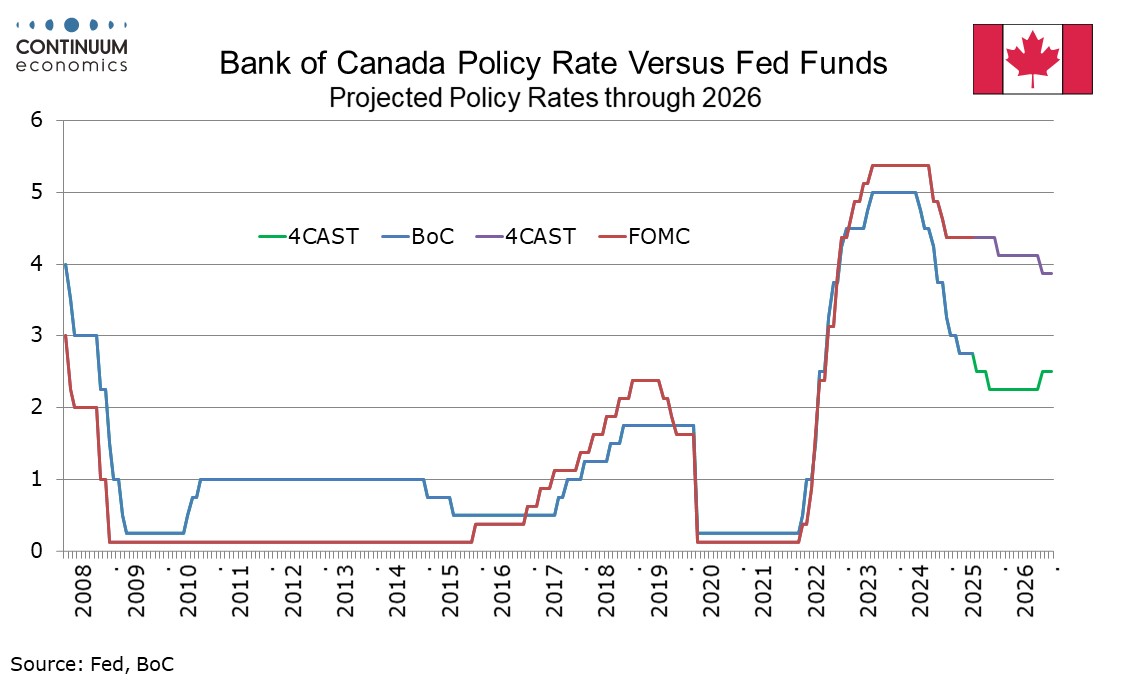

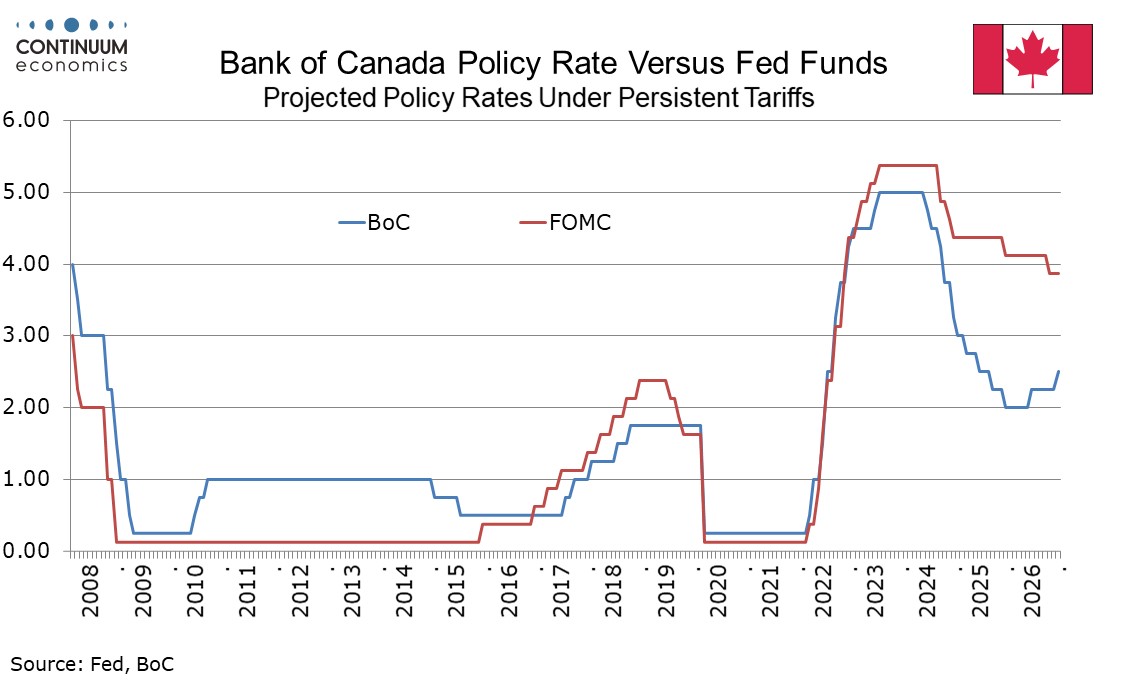

Bank of Canada Governor Tiff Macklem stated that there was a clear consensus to leave rates steady at 2.75% at the latest meeting, as was also the case in June. There does however appear to be scope for further easing ahead. We still expect rates to bottom at 2.25% and end 2026 at 2.5%, but we now

July 15, 2025

Bank of Canada Preview for July 30: Hold after firm data with uncertainty high

July 15, 2025 3:30 PM UTC

The Bank of Canada meets on July 30 and what had been seen as a close call between a 25bps easing and unchanged now looks likely to leave rates unchanged at 2.75%. Continued above target core CPI data and a strong employment report for June argue against easing, though uncertainty remains high with

Canada June CPI - Argues against a July BoC easing

July 15, 2025 1:18 PM UTC

June CPI was as expected with yr/yr growth at 1.9% after two straight months at 1.7%, though without April’s abolition of the Consumer Carbon Tax would be standing around 2.5%. The Bank of Canada’s core rates showed no progress lower, and coupled with Friday’s strong employment report for June

July 11, 2025

Canada June Employment - Strong gain broad based but hard to sustain if tariff escalation persists

July 11, 2025 1:02 PM UTC

Canada’s June employment report with a rise of 83.1k is sharply ahead of expectations, even when noting that most of the gains came in a 69.5k rise in part time employment. The data may have been supported by a temporary easing of trade tensions that have subsequently escalated with yesterday’s

June 24, 2025

Canada May CPI - Mixed data leaves July BoC decision a close call

June 24, 2025 12:49 PM UTC

May Canadian CPI has come in as expected, unchanged at 1.7% with this yr/yr rate still restrained by the abolition of the consumer carbon tax which took 0.7% off the rate in April. The BoC’s core rates are on balance slightly softer, but do not fully reverse acceleration seen in May, leaving the J

June 18, 2025

June 06, 2025

Canada May Employment - Strong gains in full time and private sector work

June 6, 2025 1:32 PM UTC

Canada’s May employment report saw unemployment at 7.0% from 6.9% rising to the highest since September 2021. However a rise of 8.8k in employment is stronger than expected with the detail showing strong gains in full time and private sector employment. Yesterday Bank of Canada’s Kozicki said th

June 04, 2025

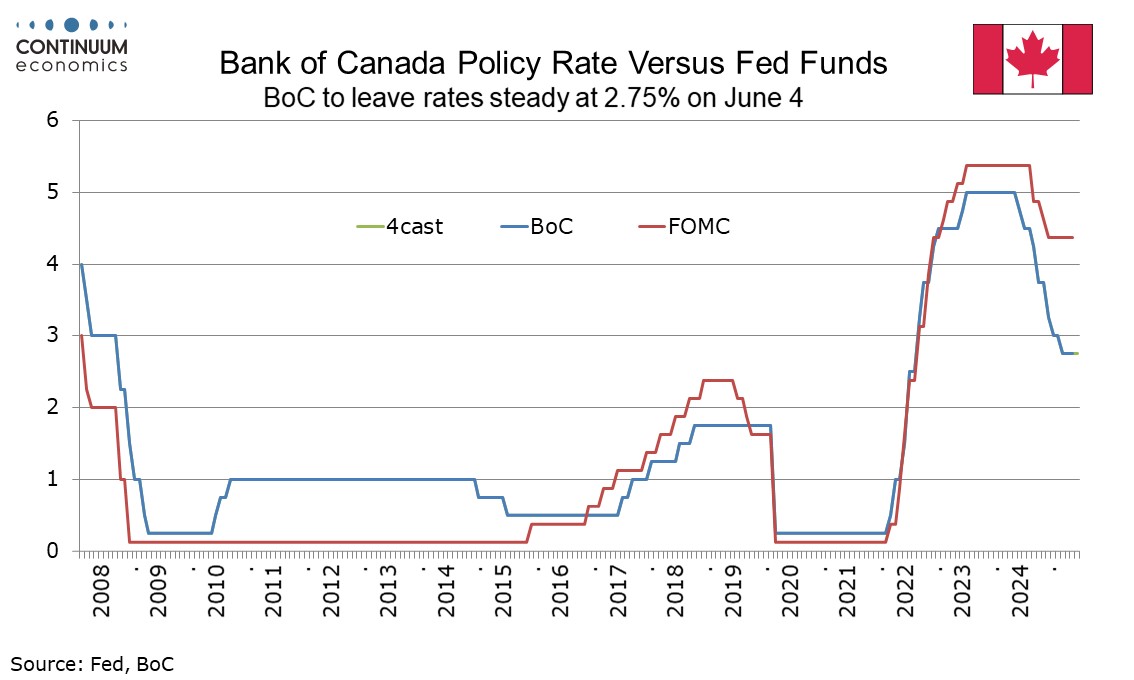

Bank of Canada - Consensus to hold in June, but we now expect easings in July and October

June 4, 2025 3:54 PM UTC

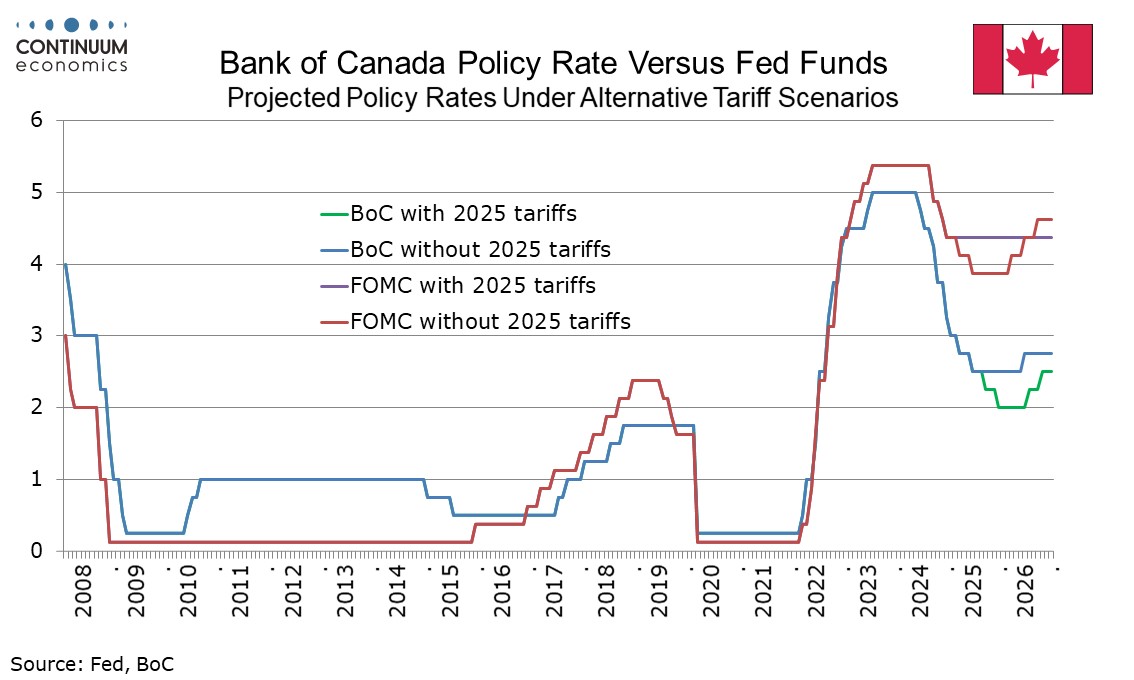

Governor Tiff Macklem stated that the Bank of Canada’s decision to leave rates unchanged at 2.75% was a clear consensus. There was more diversity of views on the path forward, though members thought there could be a need for easing, depending on data. We now expect two further easings in 2025, in

Canada: BoC's Macklem - Consensus to hold at this meeting but scope for future easing seen

June 4, 2025 2:04 PM UTC

The opening statement from BoC's Macklem suggests the decision to hold at this meeting was not the close call seen by many, but scope for future easing is seen, depending on how data evolves.

May 30, 2025

Bank of Canada Preview for June 4: A close call for another policy pause

May 30, 2025 3:43 PM UTC

The Bank of Canada meets on June 4 and it is a close call between leaving rates unchanged at 2.75% and a 25bps easing to 2.5%, though we now lean to the former. The statement is unlikely to give any forward guidance and we still expect further easing this year as the economy weakens in response to U

May 20, 2025

Canada April CPI - Core rates highest for over a year

May 20, 2025 12:56 PM UTC

April Canadian CPI in falling to 1.7% yr/yr from 2.3% is slightly stronger than expected with the fall fully due to the ending of a carbon tax. The BoC’s core rates are stronger than expected, CPI-Median at 3.2% from 2.9%, CPI-Trim at 3.1% from 2.8% and CPI-Common at 2.5% from 2.3%.

May 09, 2025

Canada April Employment - Private sector detail weak

May 9, 2025 12:48 PM UTC

Canada’s April employment gain is modest at 7.4k, and whole full time employment was up by 31.5k there was also a 37.1k increase in public administration. This makes the report on balance weak, particularly with unemployment rising to 6.9% from 6.7%.

May 08, 2025

Canada: BoC's Macklem - Getting closer to lower-tariff scenario from April MPR

May 8, 2025 6:11 PM UTC

The BoC is getting less pessimistic about the tariff scenario, though we are not yet in the better of two scenarios outlined in April's MPR, just closer. Earlier today the BoC's Financial Stability Report saw resilience in the financial system with reduced consumer debt relative for income, while no

April 25, 2025

Canada Election: Liberal Victory Likely, Stable Policy Expected

April 25, 2025 4:21 PM UTC

Canada’s election takes place on Monday. A victory for the ruling Liberals looks likely, but polls are close enough to mean that a hung parliament or even a majority for the opposition Conservatives, while unlikely, is not to be ruled out. Should the Conservatives spring a surprise, a more concili

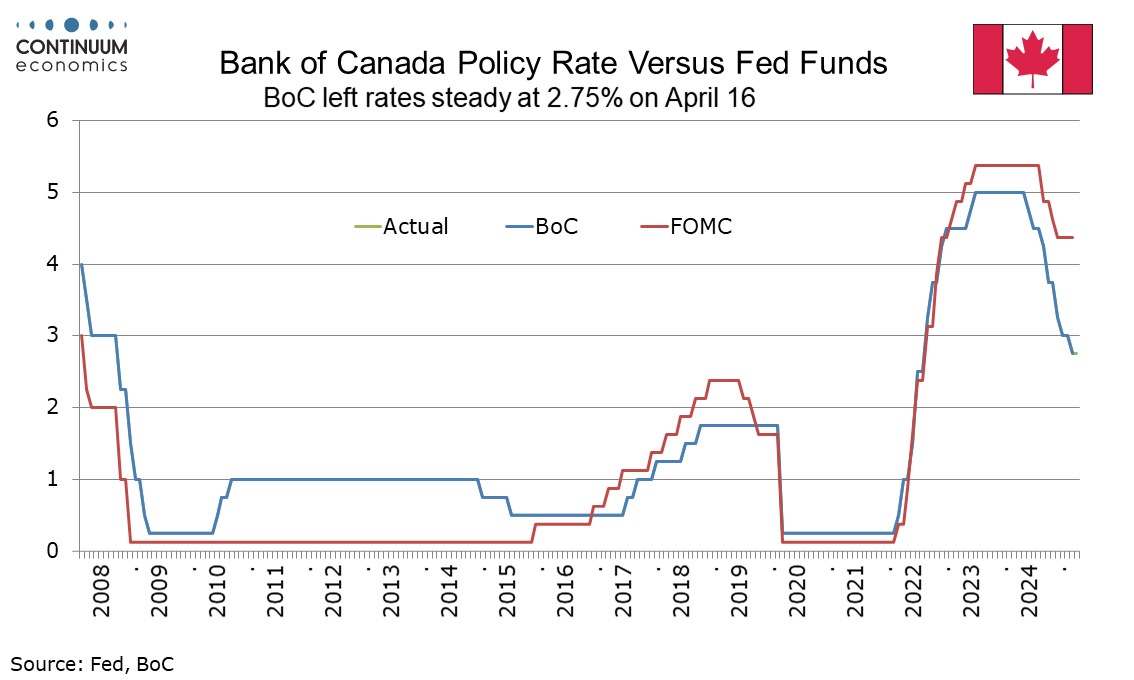

April 16, 2025

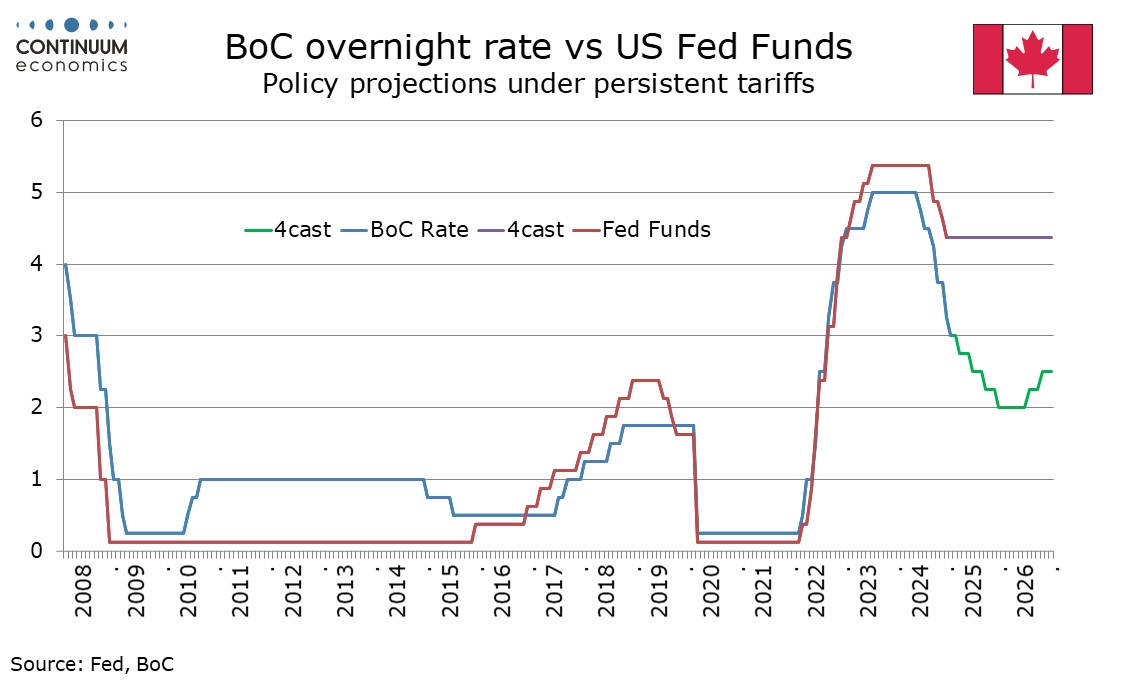

Bank of Canada - Proceeding carefully, but risks still lean towards further easing

April 16, 2025 4:28 PM UTC

The Bank of Canada left rates unchanged at 2.75% as expected. The statement concluded that the BoC will proceed carefully, noting that monetary policy cannot resolve trade uncertainty or offset the impacts of a trade war, but it can and must maintain price stability in Canada. While this shows cauti

April 15, 2025

Canada March CPI - Correction lower led by travel costs

April 15, 2025 12:54 PM UTC

March Canadian CPI in falling to 2.3% yr/yr from 2.6% is significantly weaker than expected. Lower prices for gasoline and travel tours were cited as negative influences, the latter surely impacted by the unwillingness of Canadians to travel to the USA. The BoC core rates are on balance slightly s

April 08, 2025

Bank of Canada Preview for April 16: Easing to pause, but unlikely to be done

April 8, 2025 2:04 PM UTC

The Bank of Canada meets on April 16 and we expect that strength in some recent data and high uncertainty will see rates left unchanged at 2.75%. There will be little forward guidance and the accompanying Monetary Policy Report may avoid providing its usual economic forecasts. We do not expect that

April 07, 2025

Canada - BoC Q1 Business Outlook Survey shows caution, Consumer Survey more pessimistic

April 7, 2025 2:57 PM UTC

The Bank of Canada’s Q1 business outlook survey is weaker, though probably not by enough to shock the Bank of Canada. The survey was conducted in February, when tariffs were a worry but not yet a reality.

April 04, 2025

Canada March Employment - Consistent message of weakness

April 4, 2025 1:22 PM UTC

Canada’s March employment with a 32.6k decline is the steepest fall since a brief plunge in the lockdowns of January 2022 and highlights the recessionary risks posed by US tariffs. Unemployment rose to 6.7% from 6.6% while wage growth slowed significantly, to 3.5% from 4.0%.

March 26, 2025

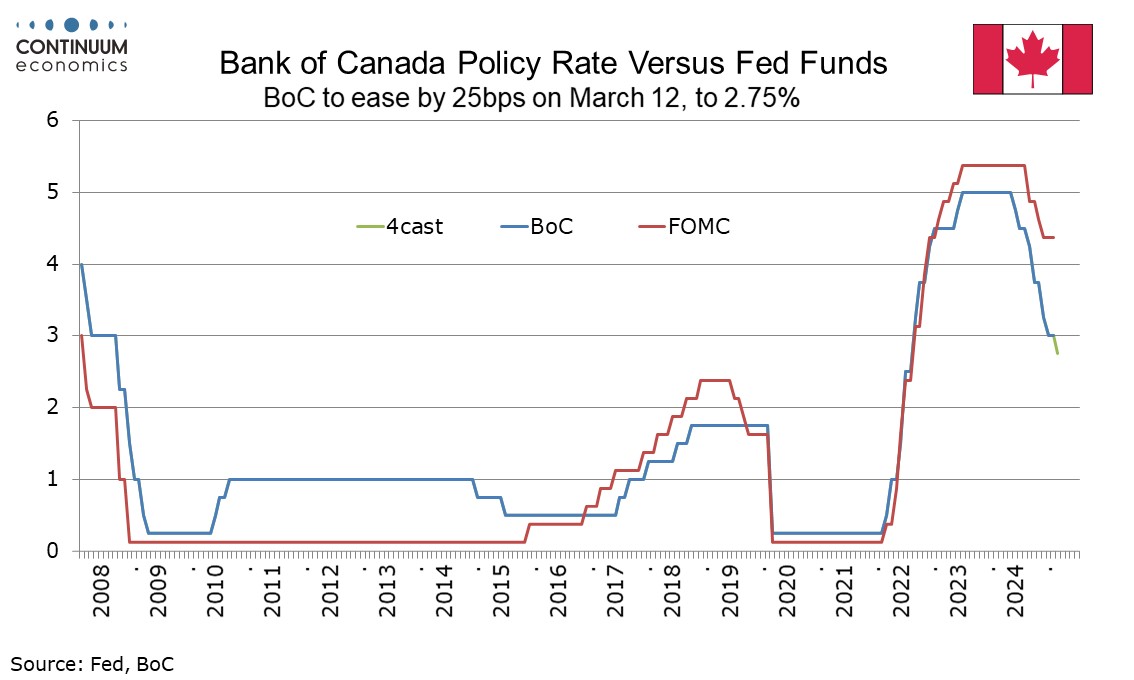

Bank of Canada Minutes from March 12 - Debate over the 25bps easing, agreement to proceed carefully

March 26, 2025 6:19 PM UTC

The Bank of Canada has released minutes from its March 12 meeting, and these show some debate about the meeting’s decision to ease by 25bps to 2.75% and agreement to proceed carefully with further changes to policy. A lot can happen before the BoC next meets on April 16, but these minutes suggest

March 20, 2025

March 18, 2025

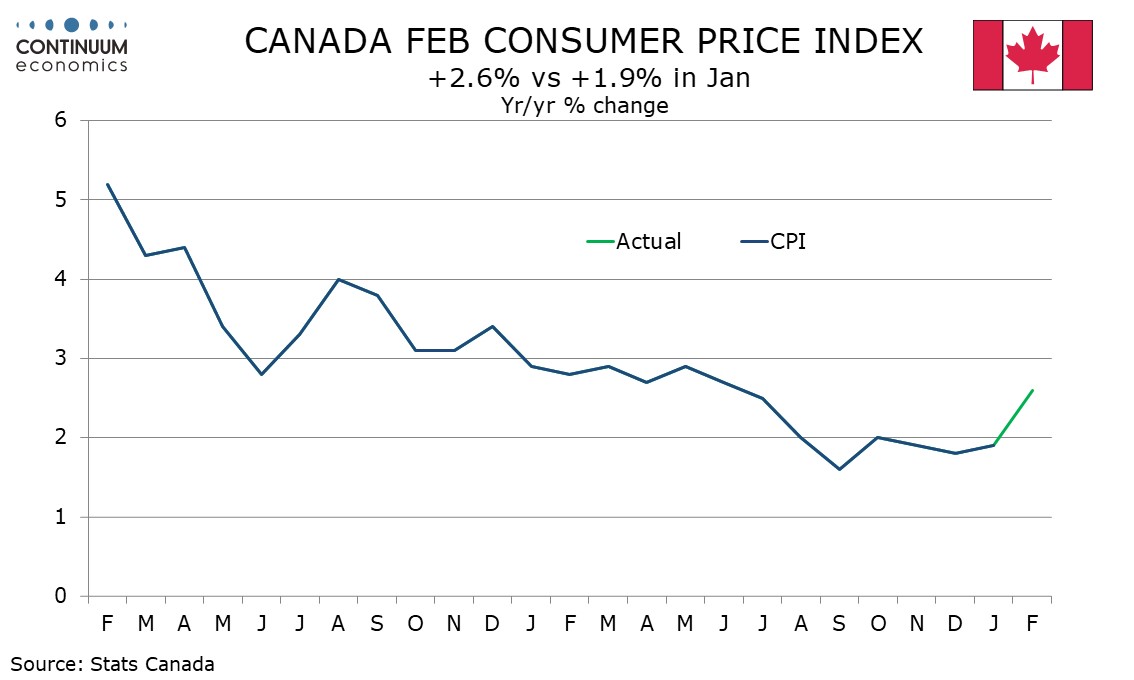

Canada February CPI - Acceleration clearer as sales tax holiday ends

March 18, 2025 12:51 PM UTC

February Canadian CPI at 2.6% yr/yr from 1.9% in January is significantly stronger than expected, with the rise inflated by the mid-February expiry of a sales tax holiday that started in mid-December. This will lift March data further. The Bank of Canada’s core rates are also stronger, suggesting

March 12, 2025

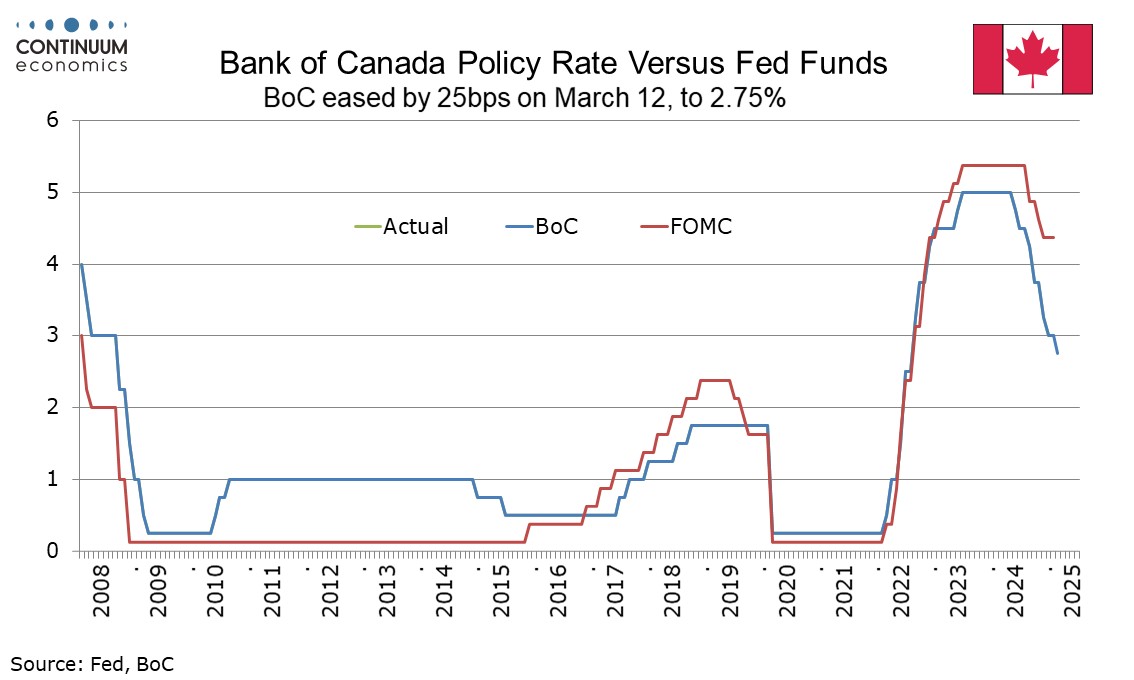

Bank of Canada - With risks on both sides, timing matters

March 12, 2025 3:47 PM UTC

The Bank of Canada eased as expected by 25bps to 2.75%, a level it sees as neutral. Given massive uncertainty clear forward guidance is impossible but they made no attempt to hide the gravity of the problem, Governor Tiff Macklem stating Canada is facing a new crisis from which the economic impact c

March 07, 2025

Canada February Employment - Weather may explain this weak month, but tariff risks ahead

March 7, 2025 2:19 PM UTC

Canada’s February employment with a marginal rise of 1.1k has seen a pause after three straight strong months. With StatsCanada citing snowstorms as an issue not too much should be read into this subdued month, though trend is likely to slow in the months ahead as US tariffs are imposed.

March 05, 2025

Bank of Canada Preview for March 12: Tariff risks justify a further 25bps easing

March 5, 2025 5:51 PM UTC

The Bank of Canada meets on March 12, and while the tariff picture is still anything but clear, we expect a 25bps easing to 2.75%. The economic damage done by the ongoing tension is already likely to be significant, and may become seriously so. Inflationary risks have increased, and the Canadian eco

Trump Latest Thinking

March 5, 2025 11:07 AM UTC

Bottom line: President Donald Trump signaled that he is committed to tariffs to raise revenue; bring production back to the U.S. and get fairer trade relations. This three part approach will likely shape implementation of further product and reciprocal tariffs from April. However, reports sugges

March 04, 2025

Trump Tariffs: Bad for The U.S. Worse For Canada

March 4, 2025 3:48 PM UTC

When Trump announced 25% tariffs on Canada and Mexico in February, we put up a piece outlining the likely economic consequences, which became dated by the end of the day as Mexico and Canada won a one month delay in return for some concessions at the border. We are now recycling that story, with som

February 21, 2025

February 18, 2025

Canada January CPI - BoC core rates accelerate

February 18, 2025 1:53 PM UTC

January Canadian CPI at 1.9% yr/yr is in line with expectations, but up from 1.8% in December despite a sales tax holiday, with increases in the Bank of Canada’s three core rates suggesting some acceleration in underlying inflationary pressures.

February 12, 2025

Bank of Canada Minutes Back 25bps Easing, Less Clear on Potential Tariff Implications

February 12, 2025 7:09 PM UTC

The Bank of Canada has released minutes from its January 29 meeting, which show no signs that the decision to ease by 25bps saw much debate. Uncertainty due to tariff risks was seen as supporting the decision. However, should a trade war with the US be seen, the minutes show a more balanced view, co

February 07, 2025

Canada January Employment - Rate cuts helping, but tariff risk persists

February 7, 2025 2:40 PM UTC

Canada has delivered a strong employment report in January, with a 76k increase allowing unemployment to slip to 6.6% from 6.7%, though wages slipped to 3.7% yr/yr from 3.8%. This backs a Bank of Canada view expressed at January’s meeting that growth is responding to rate cuts without lifting infl

February 03, 2025

Trump Tariffs, or Not: Trying to Make Sense of a Policy Farce

February 3, 2025 11:46 PM UTC

So, after a weekend and a day of drama we are back to where we were on Friday morning. Forecast updates made on the imposition of tariffs will not be thrown in the trash can, but now will be held as an alternative should Trump decide to go ahead on March 1 after postponing them from February 1 (whic

Trump Tariffs: Bad for The U.S., to Canada and to Mexico

February 3, 2025 6:34 PM UTC

In announcing 25% tariffs on Canada and Mexico, as well as additional 10% tariffs on China, Trump exceeded the expectations of many, including ourselves. The situation is fluid with Mexico (but not yet Canada) receiving a one-month delay, but the risks of a lasting trade war need to be seriously con

January 31, 2025

Canada November GDP - A weak month with tariffs threatening

January 31, 2025 2:18 PM UTC

November Canadian GDP with a 0.2% decline was weaker than the -0.1% estimate made with October’s release, where the increase was unrevised at 0.3%, The preliminary estimate for December is for a rise of 0.2%, which if accurate would leave Q4 GDP near a 1.8% annualized estimate made by the Bank of

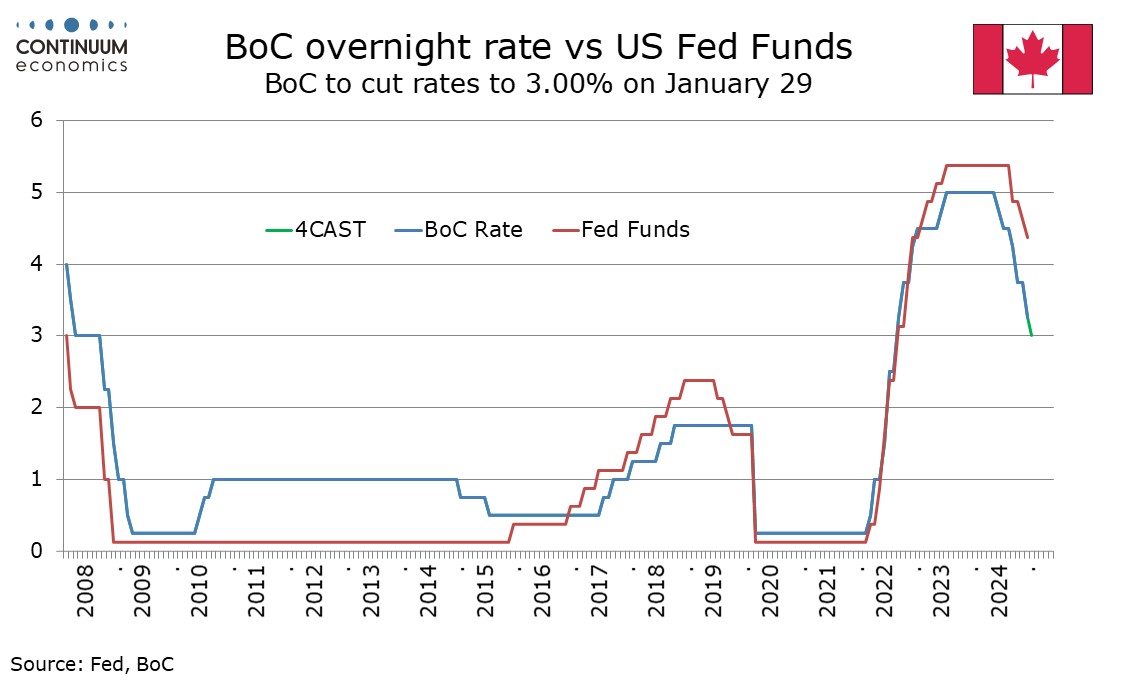

January 29, 2025

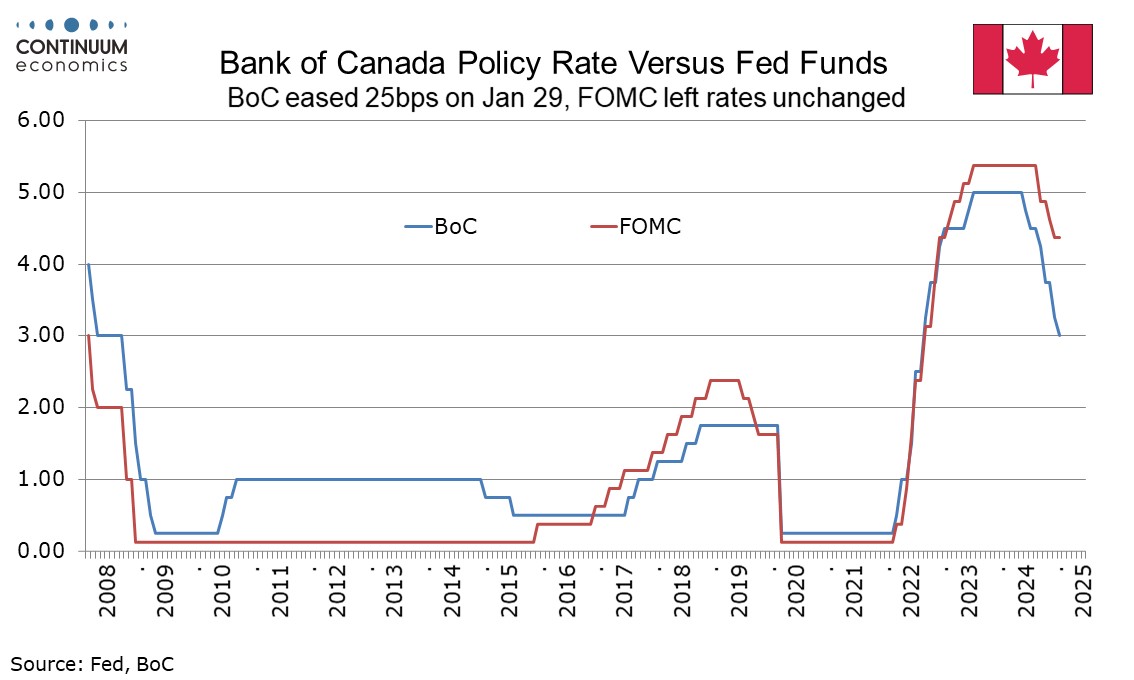

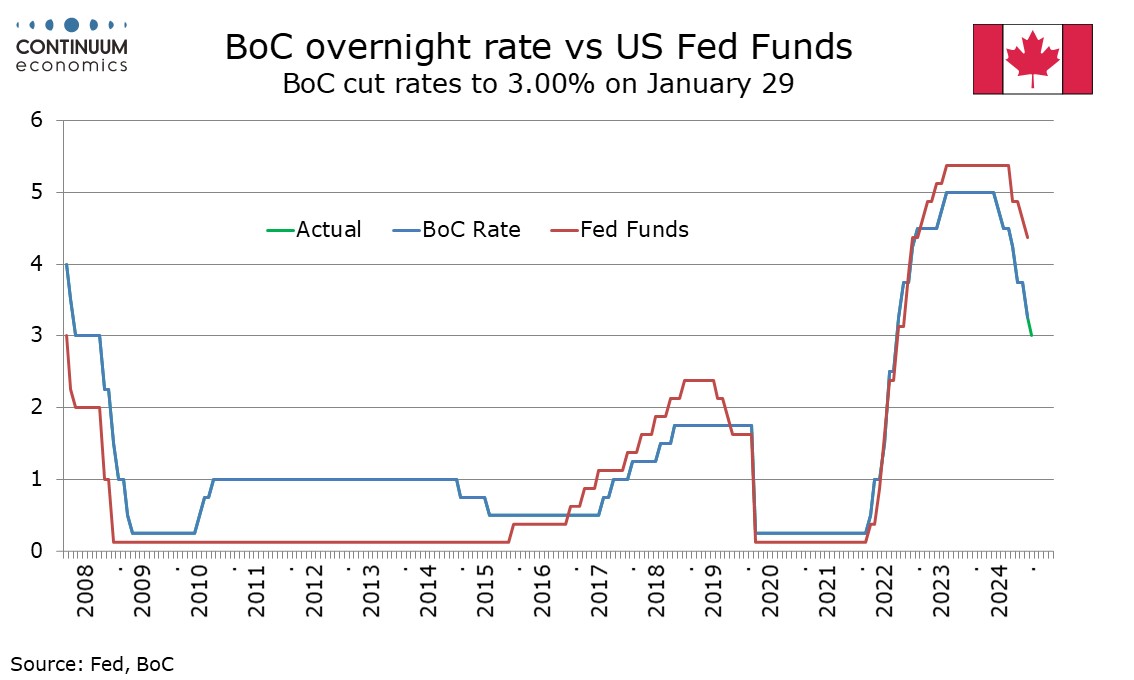

Bank of Canada eases by 25bps as expected, sees balanced risks if a trade war can be avoided

January 29, 2025 4:21 PM UTC

The Bank of Canada eased by 25bps to 3.0% as expected, and confirmed the ending of Quantitative Tightening, as had been outlined by Deputy Governor Toni Gravelle on January 16. The BoC has delivered some fairly optimistic forecasts, but these are made assuming an absence of tariffs, given that the B

January 16, 2025

January 13, 2025

Bank of Canada Preview for January 29: Easing to continue but more cautiously

January 13, 2025 5:23 PM UTC

The Bank of Canada meets on January 29, and will make its decision a few hours before one is made by the FOMC. The BoC decision will be following two straight easings of 50bps, though minutes from the last meeting, on December 11, showed a debate between 25bps and 50bps, and that they expected a mor

January 10, 2025

Canada December Employment - Strong job growth but again flattered by the public sector

January 10, 2025 2:26 PM UTC

Canada has followed a healthy 50.5k increase in November employment with a substantially stronger 90.9k increase in December, though the acceleration in full time work to 57.5k from 54.2k was marginal. While some of the detail is less impressive, the data suggests the economy is gaining momentum, as

December 17, 2024

Canada November CPI - Subdued but little further progress on BoC core rates

December 17, 2024 2:06 PM UTC

November Canadian CPI is slightly weaker than expected overall at 1.9% from 2.0% yr/yr, and subdued on the month, though there was little further progress on the Bank of Canada’s core rates. This supports expectations that the BoC will ease further, but at a more gradual pace than the 50bps moves

December 16, 2024

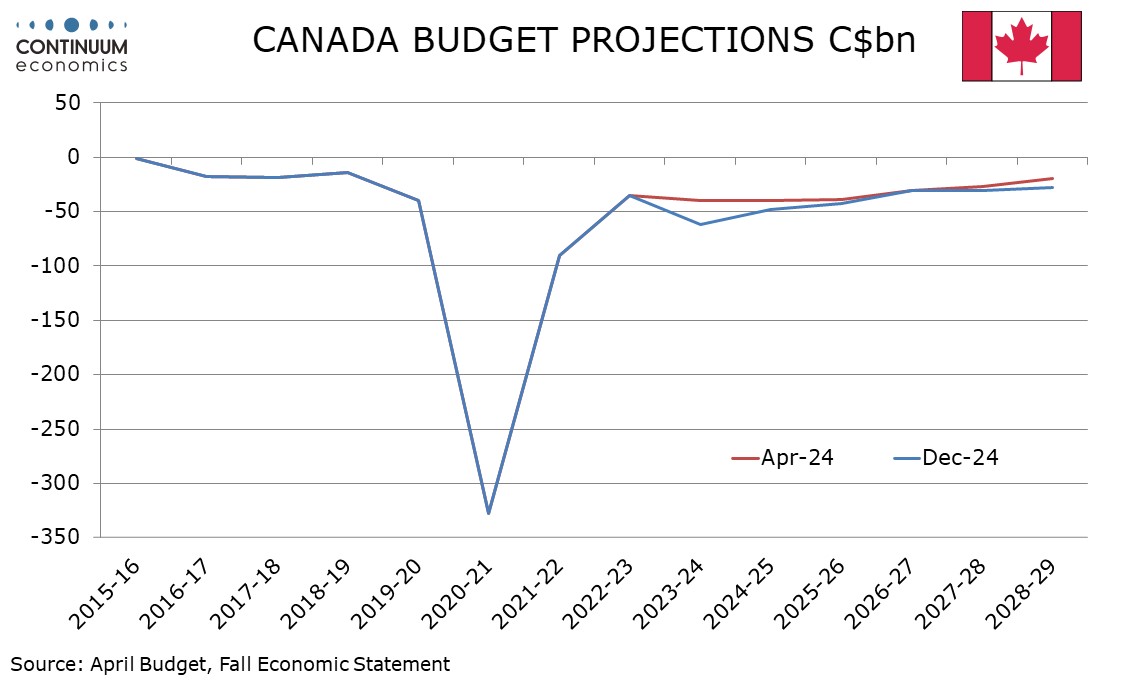

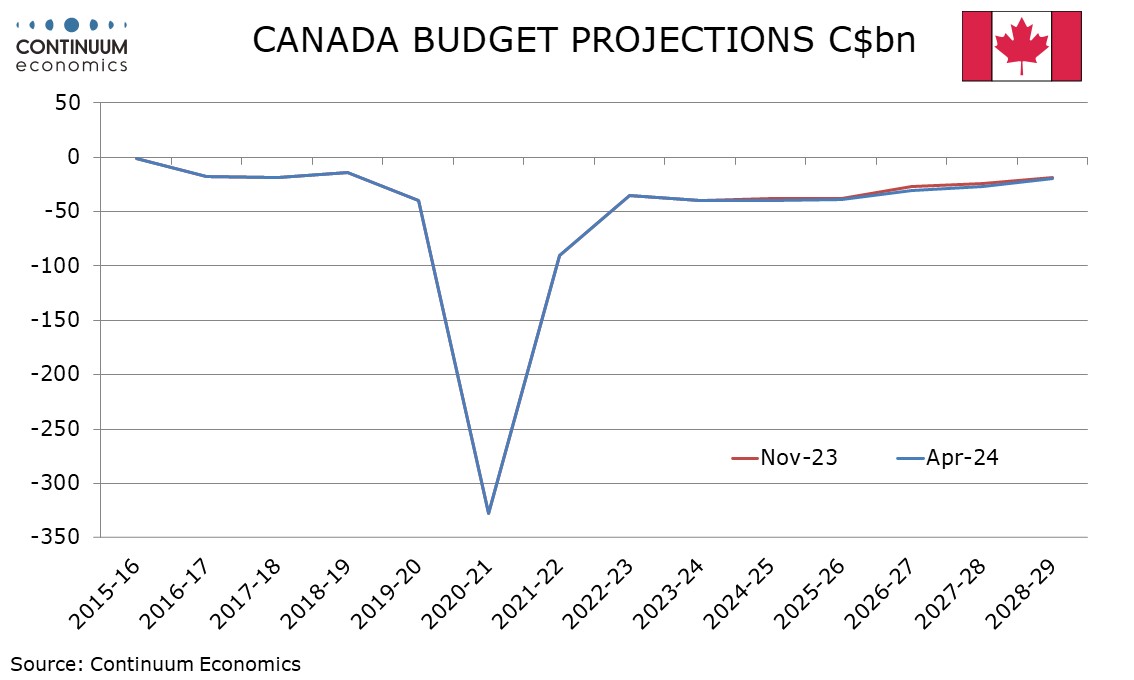

Trump Tariff Threats Causing Policy Division in Canada

December 16, 2024 6:19 PM UTC

Trump’s tariff threats are being felt in Canadian politics, with Finance Minister Chrystia Freeland’s resignation, due to disagreements with Prime Minister Justin Trudeau’s plans to give the economy fiscal support, with Freeland preferring to “keep the powder dry” given the risks Canada fa

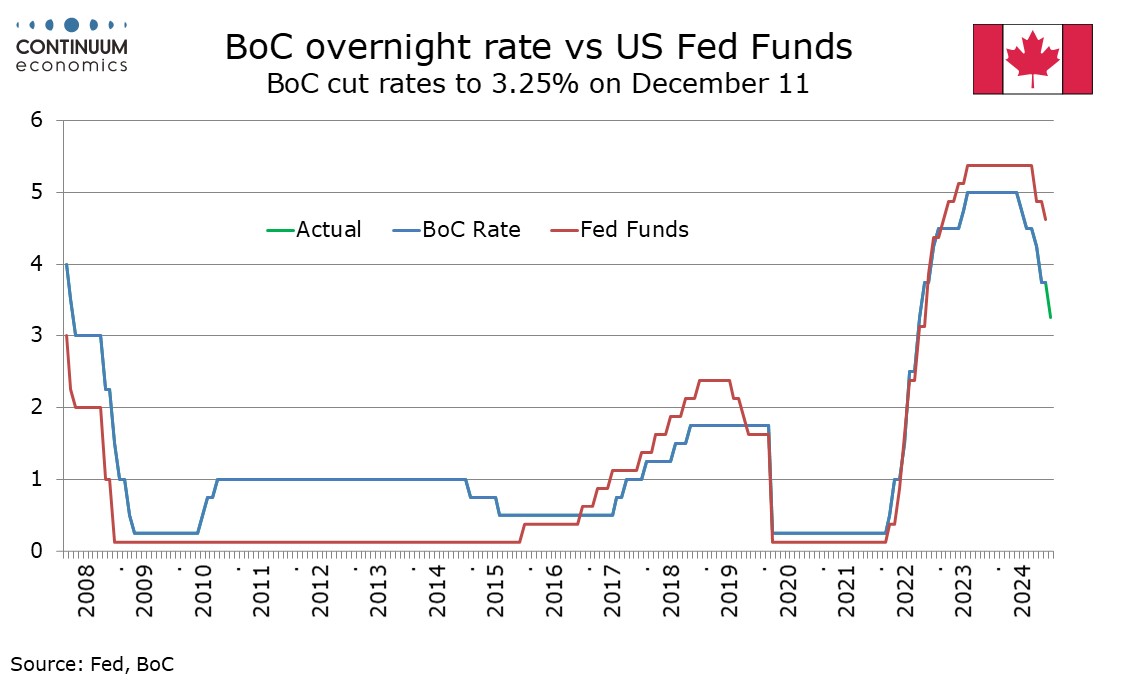

December 11, 2024

Bank of Canada delivers a second straight 50bps easing but sees a more gradual approach in 2025

December 11, 2024 4:29 PM UTC

The Bank of Canada has delivered a second straight 50bps easing, taking the rate to 3.25%, as largely expected. This puts the rate at the upper end of the 2.25-3.25% range the BoC sees as neutral, and Governor Tiff Macklem stated he now anticipates a more gradual approach to policy. We expect three

December 06, 2024

Canada November Employment - Strong job growth came largely in the public sector

December 6, 2024 2:29 PM UTC

Canada’s 50.5k increase in employment was stronger than expected in November, and fully explained by a 54.2k rise in full time work. However, with 45k of the new jobs created coming in the public sector the data is less impressive than it initially seems. With unemployment up and wages slower we c