Canada November GDP - A weak month with tariffs threatening

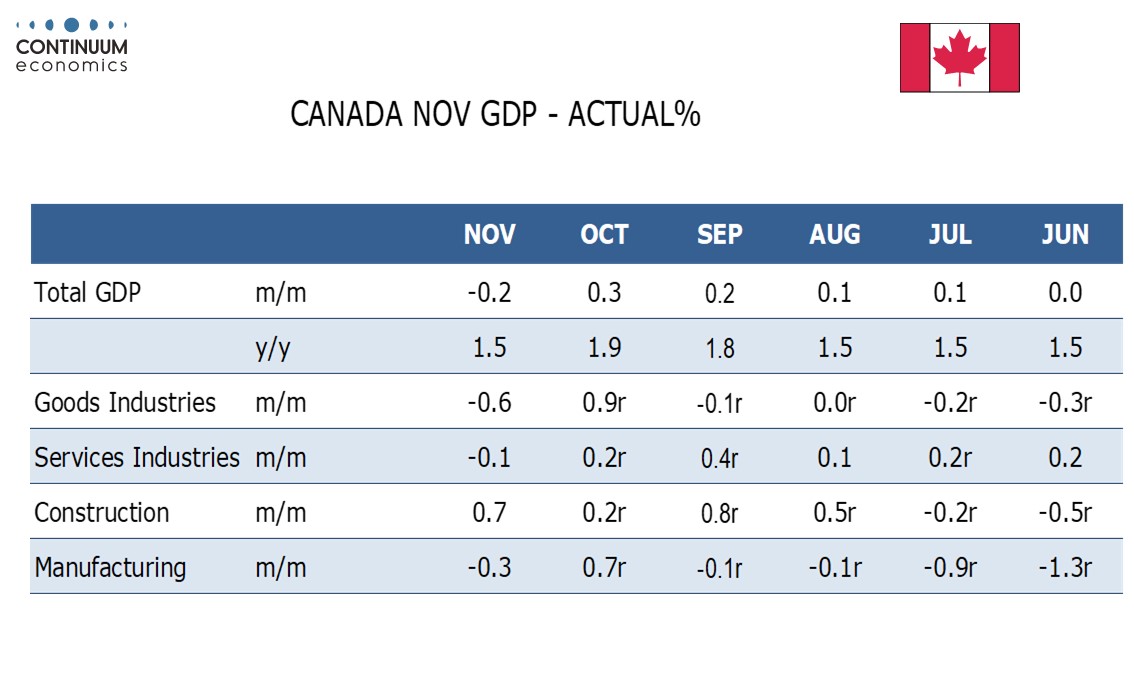

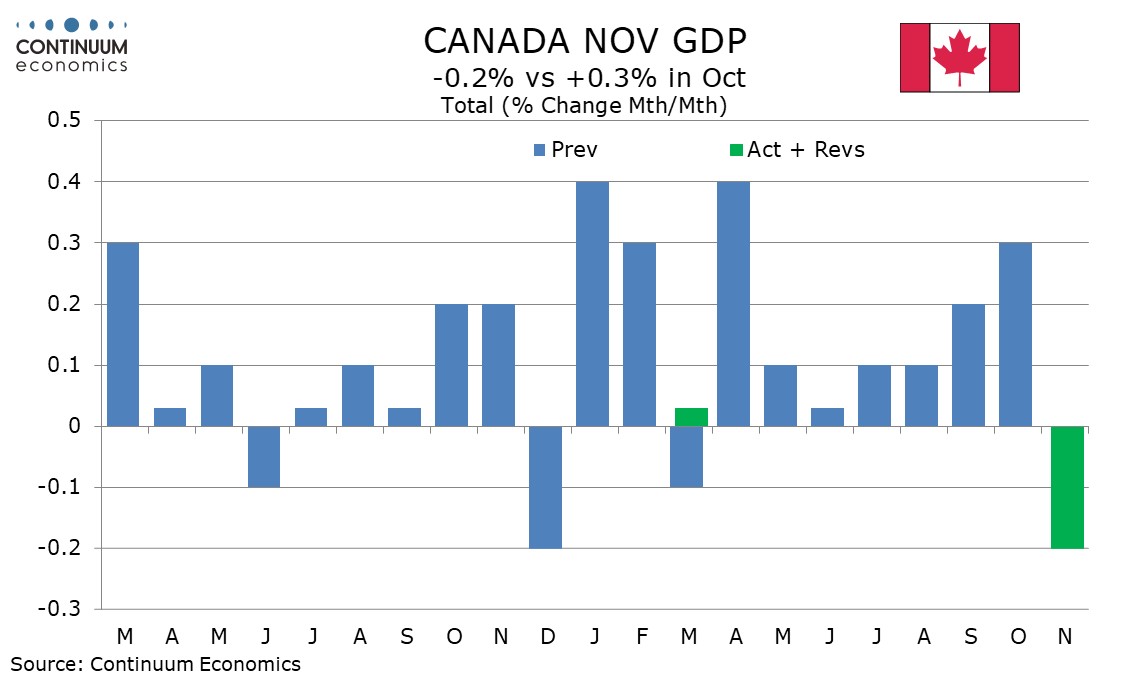

November Canadian GDP with a 0.2% decline was weaker than the -0.1% estimate made with October’s release, where the increase was unrevised at 0.3%, The preliminary estimate for December is for a rise of 0.2%, which if accurate would leave Q4 GDP near a 1.8% annualized estimate made by the Bank of Canada.

The BoC is looking for growth to pick up in 2025, seeing a 2.0% pace in Q1, but the BoC’s baseline forecasts assume an absence of tariffs which are now at high risk of being imposed by Trump tomorrow. The GDP release states that exports to the US make up 17.8% of Canadian GDP and support 2.4 million jobs. Sustained US tariffs would almost certainly cause a significant Canadian recession.

The weakness of November GDP was broad based with goods down by 0.6%, the decline led by mining, and services down by 0.1%, with transport and warehousing particularly weak at -1.3%, largely due to strikes in the postal, rail and water transport sectors. Transport and warehousing is expected to remain weak in December with the anticipated growth coming from retail, manufacturing and construction.