Bank of Canada Preview for January 29: Easing to continue but more cautiously

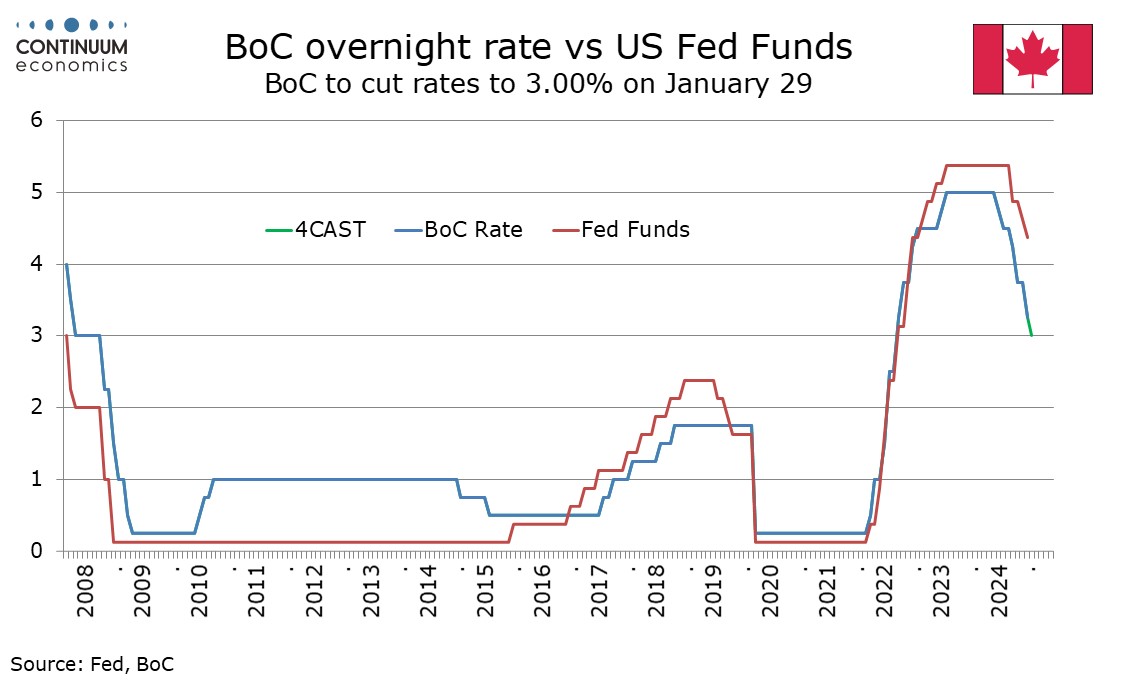

The Bank of Canada meets on January 29, and will make its decision a few hours before one is made by the FOMC. The BoC decision will be following two straight easings of 50bps, though minutes from the last meeting, on December 11, showed a debate between 25bps and 50bps, and that they expected a more gradual pace going forward. We see the Canadian economy as remaining weak enough, and with significant downside risk, to justify a 25bps easing in January, to 3.0%.

There have been some signs that the Canadian economy is starting to respond to lower interest rates. Despite a downside surprise in Q3 GDP consumer spending gained momentum, while employment growth has picked up, though a fall in unemployment in December failed to reverse a rise in November. Wage growth lost momentum in both November’s and December’s employment reports. October GDP picked up but preliminary signals for November are weaker. We expect Q4 GDP will be seen as slightly slower than the 2.0% the BoC projected in October, while still picking up from Q3.

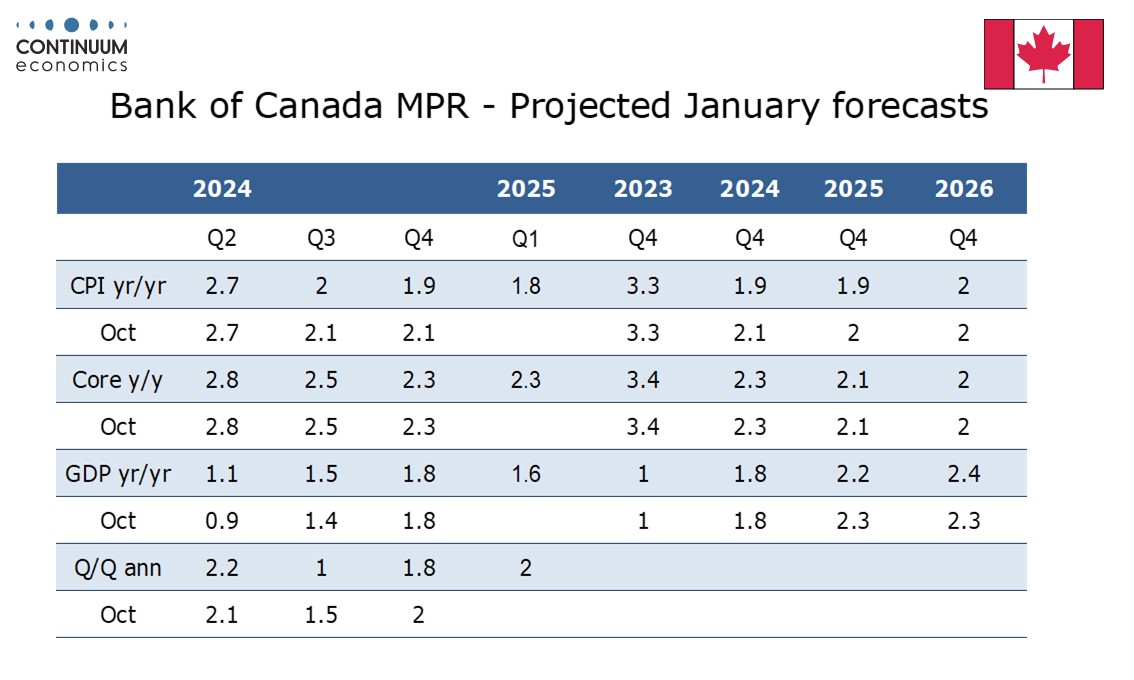

Near term inflation forecasts will probably be revised down from those made in October, though this will be largely on a holiday in the Goods and Services Tax from mid-December through mid-February which the BoC will look through. December CPI is due on January 21. Still, underlying inflationary momentum now looks close to the 2.0% target, even if the BoC’s core rates are still running a little above on a yr/yr basis.

We doubt the BoC will adjust its forecasts for 2025 and 2026 much. The picture on the tariffs threatened by Trump on day one of his administration (January 20) will be clearer by the time of the meeting though uncertainty will probably still be high enough for the BoC to stress it as well as downside risk to its GDP forecasts. Weakness of the CAD will be seen as an upside risk to inflation, particularly if the Fed pauses in January and potentially beyond, but is unlikely to prevent another BoC easing. The BoC would not want to give a signal that they could already be done without clearer signs of the economy regaining momentum.

December’s 50bps easing moved rates to the upper end of the 2.25-3.25% range that the BoC regards as neutral. With the Canadian economy still seen as in excess supply with near target inflation the case persists for moving towards an accommodative stance, albeit cautiously. We expect Canadian rates to reach 2.5% by mid-2025. Should Trump impose 25% tariffs on Canadian exports, Canada would probably fall into recession, though any Canadian retaliatory tariffs would raise Canadian inflation.