Canada January CPI - BoC core rates accelerate

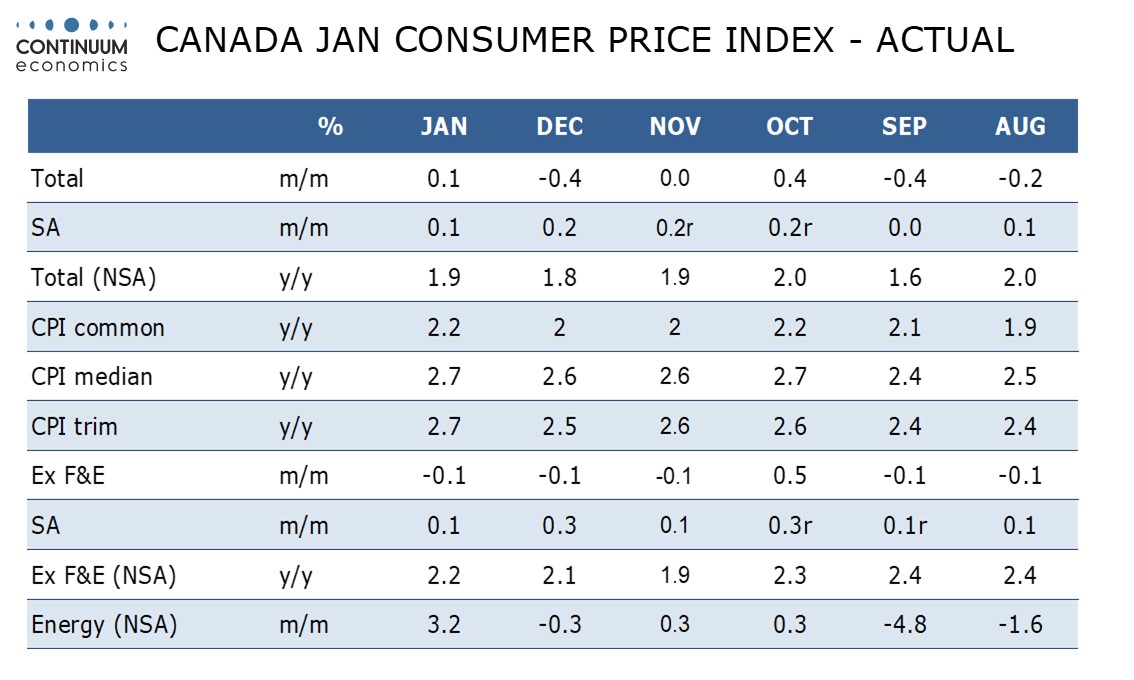

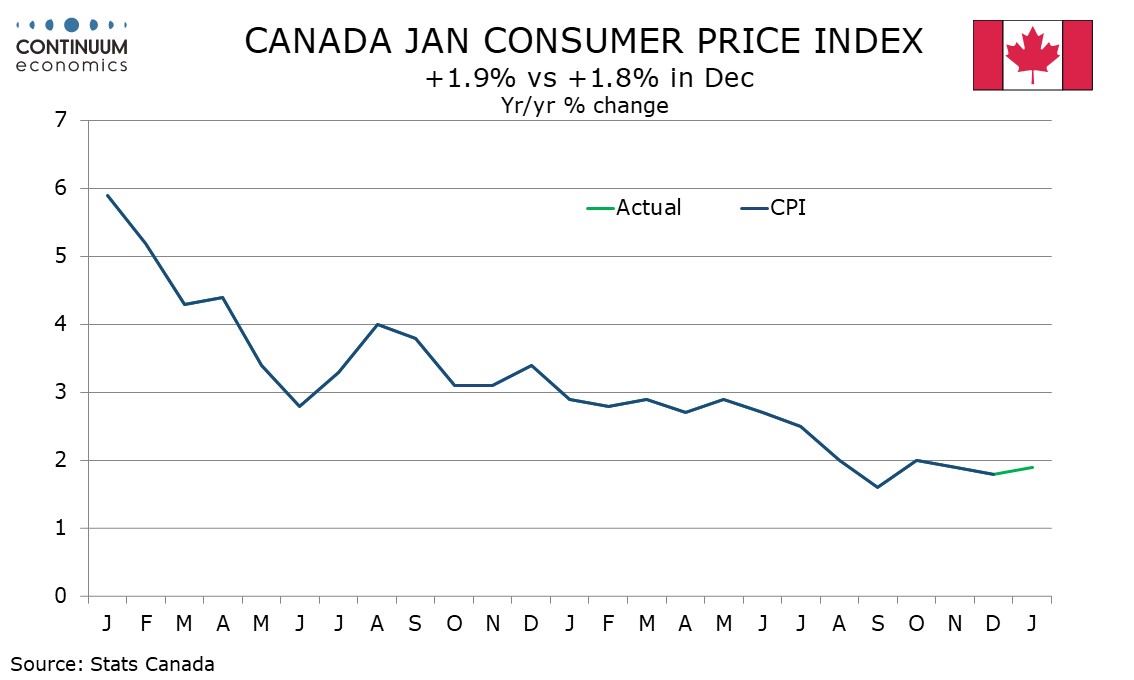

January Canadian CPI at 1.9% yr/yr is in line with expectations, but up from 1.8% in December despite a sales tax holiday, with increases in the Bank of Canada’s three core rates suggesting some acceleration in underlying inflationary pressures.

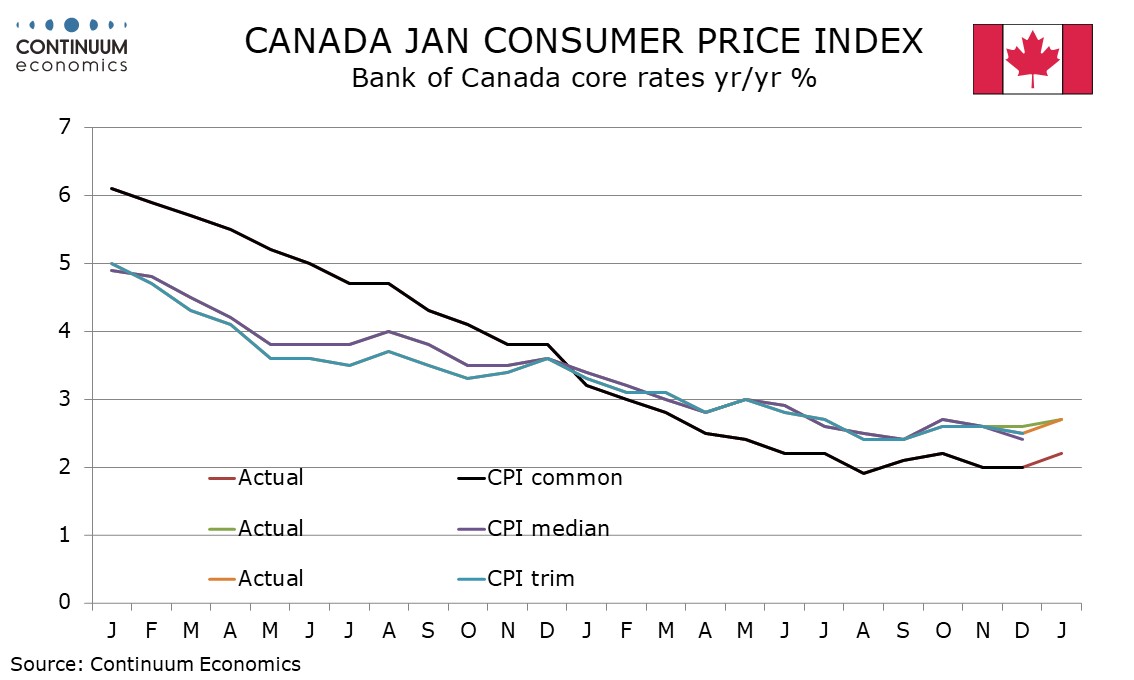

CPI-Trim rose to 2.7% from 2.5%, CPI-Median rose to 2.7% from 2.6% and CPI-Common rose to 2.0% from 2.2%, putting the average of the three at 2.53%, the highest since June 2024. CAD weakness is probably putting some renewed upside pressure on inflation. This leaves the March 12 BoC decision uncertain, though the BoC will need to see whether Trump goes ahead with tariffs before making the decision.

On the month CPI rose by 0.1% both seasonally adjusted and unadjusted with ex food and energy CPI falling by 0.1% unadjusted and up by 0.1% seasonally adjusted. The data was restrained by a temporary sales tax holiday which started in mid-December and will extend through mid-February, suggesting upwards pressure on the February and March CPIs. Despite the restraint, ex food and energy CPI, not one of the BoC’s core rates, rose to 2.2% yr/yr from 2.1%.

The sales tax holiday caused sharp declines in some components on the month, notably food purchased from restaurants and alcoholic beverages purchased from stores. However, surprising strength was seen in household operations, furnishings and equipment, with a 0.8% seasonally adjusted monthly gain, and clothing and footwear, up by 0.9%. Shelter saw a moderate rise of 0.3%.