Bank of Canada Preview for March 12: Tariff risks justify a further 25bps easing

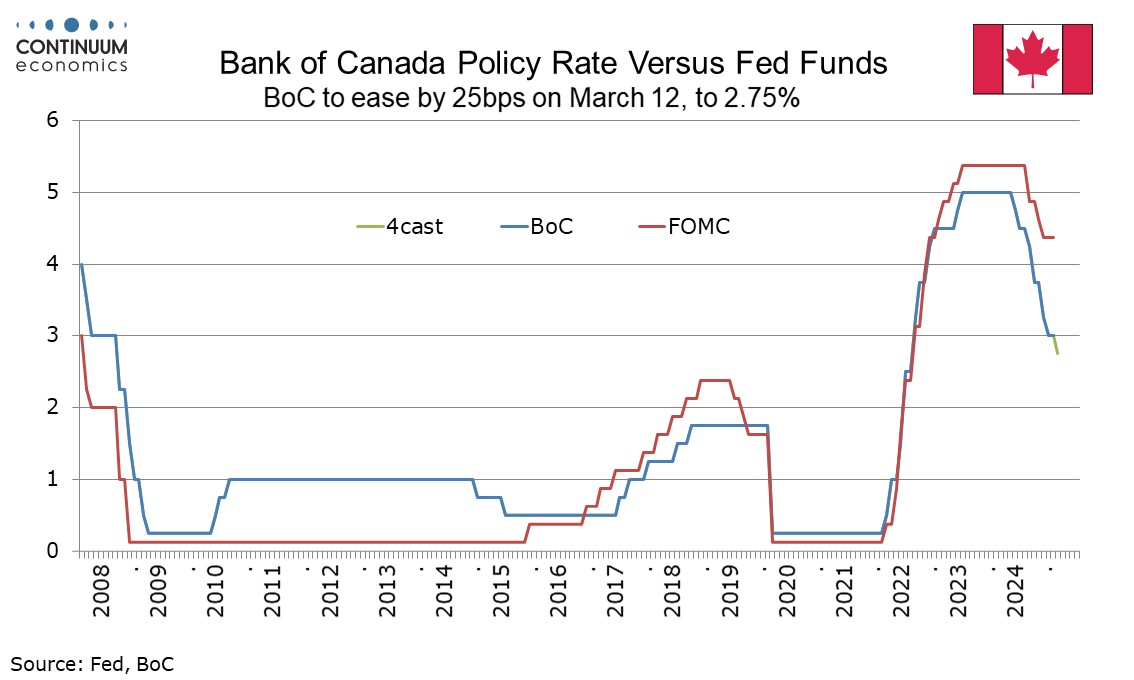

The Bank of Canada meets on March 12, and while the tariff picture is still anything but clear, we expect a 25bps easing to 2.75%. The economic damage done by the ongoing tension is already likely to be significant, and may become seriously so. Inflationary risks have increased, and the Canadian economy ended 2024 on a positive note. However, unless uncertainty is resolved, and that would require a long-term deal, an easing looks justified.

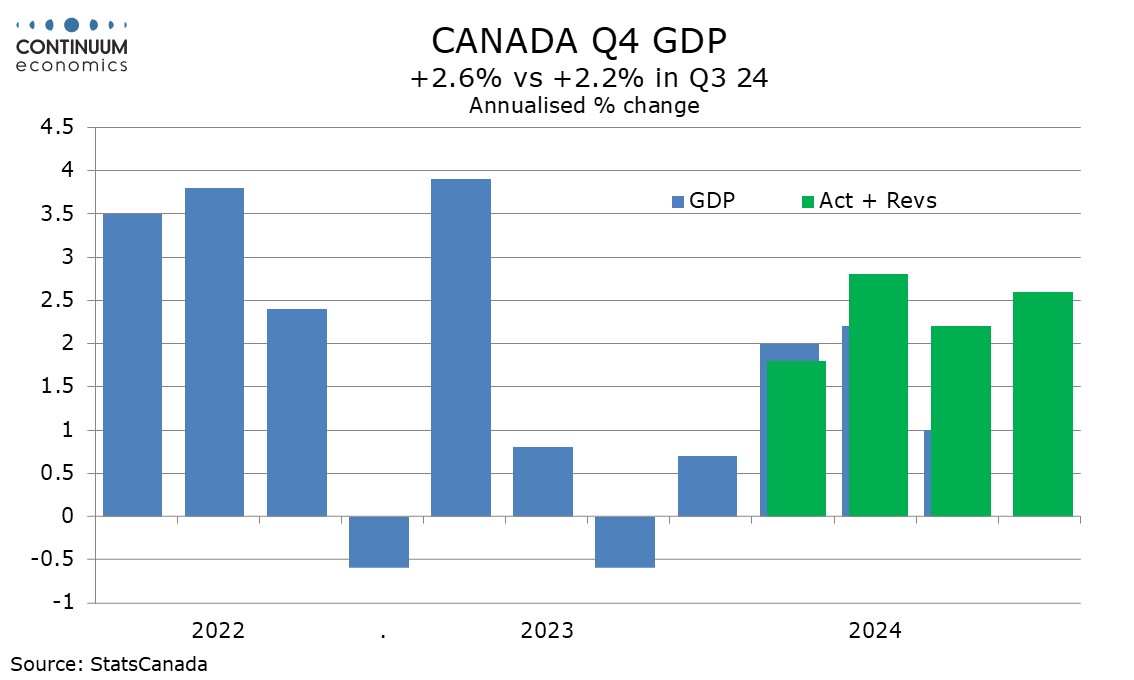

This meeting sees no Monetary Policy Report, and the BoC is probably relieved that means they are not required to update their January forecasts, which assumed no tariffs. Since January Canadian data has generally come in stronger than expected, as the economy responds to BoC easing, that reached 200bps with January’s 25bps move. Q4 GDP rose by a much stronger than expected 2.6% annualized, with upward revisions to the preceding two quarters putting yr/yr growth at 2.4%. Q4’s details were more impressive still, with a 5.6% annualized rise in domestic demand, while preliminary indications for January are for a healthy monthly GDP rise of 0.3%. The unemployment rate is also showing signs of having peaked.

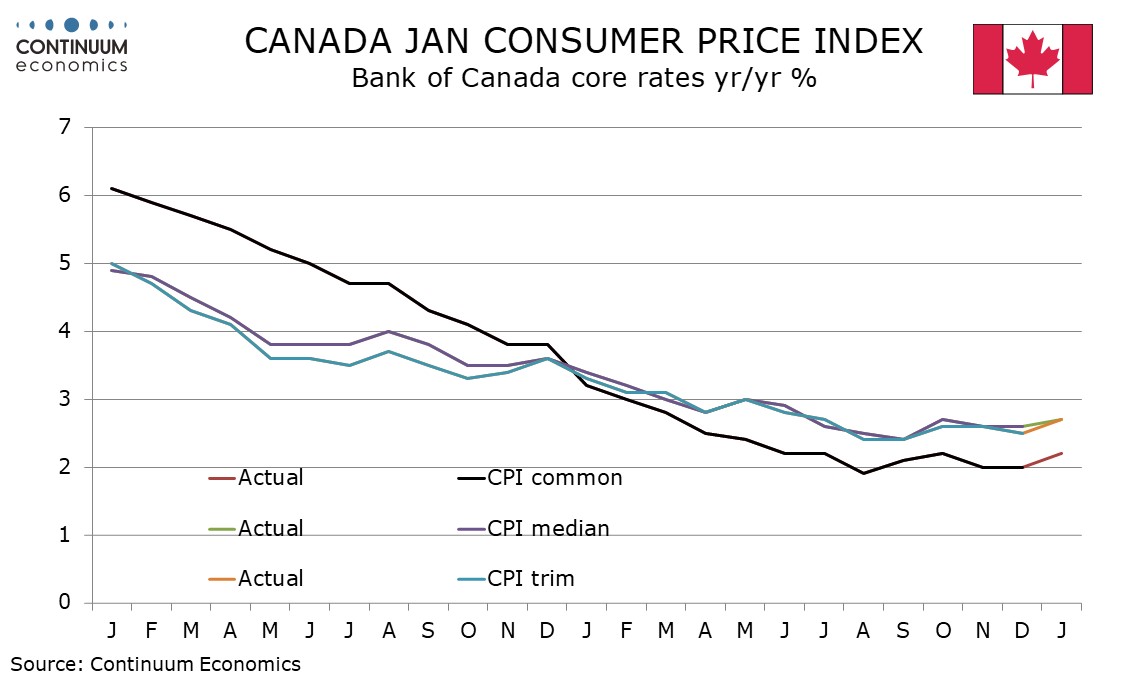

Inflation has also shown signs of picking up, probably in response to CAD weakness. January CPI at 1.9% yr/yr came despite a temporary sales tax holiday which the BoC had suggested was likely to reduce CPI temporarily to 1.5%, and the BoC’s core rates picked up, CPI-Median and CPI-Trim both to 2.7%, and CPI-Common to 2.2%, all above the 2.0% target. Had tariffs not been an issue at this meeting, the Bank of Canada would have been very likely to have left rates unchanged.

However, the tariff threat is serious. Bank of Canada modeling of the impact of 25% US tariffs shows economic output initially falling, then steadying and beginning to grow again in 2026, but on a path that is permanently about 2.5% lower. The BoC’s January projection saw growth of around 1.8% in both 2025 and 2026, but in the tariff scenario a hit of almost 3% is expected over the two years, all but wiping out growth. The boost to inflation, given expected Canadian retaliation, is seen as significant too, with the lift to inflation from a baseline near 2% rising to a peak of 0.655% in early 2026, and remaining at 0.4% of above until mid-2028.

The BoC concluded it cannot restore the lost output, and at most it can smooth the decline in demand, but how much support it can provide is constrained by the need to control inflation. We feel that with an economy in recession, and inflation within 1.0% of its 2.0% target, the BoC would provide some policy support, taking rates down to around 2.0%, but cautiously. For the forthcoming meeting however economic damage from uncertainty is already real, and inflationary risks are still uncertain. This justifies a 25bps easing. A rate of 2.75% would be in the midpoint of the 2.25-3.25% range the BoC sees as neutral. For an economy facing significant risk of recession, that does not seem overly dovish.