Canada January Employment - Rate cuts helping, but tariff risk persists

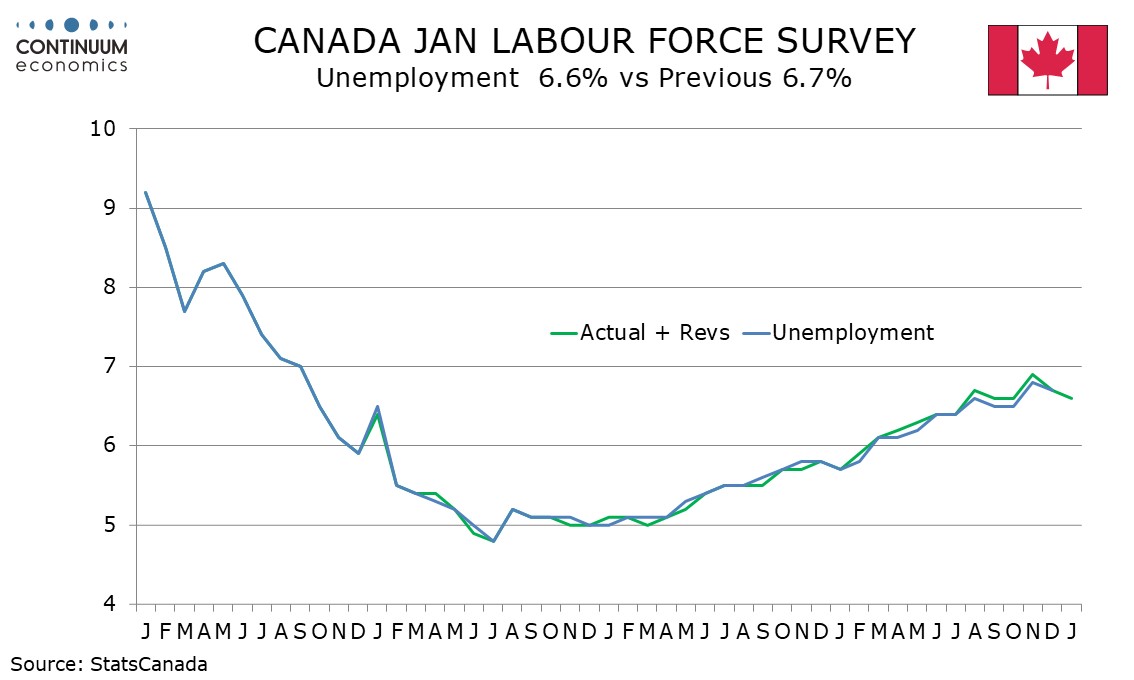

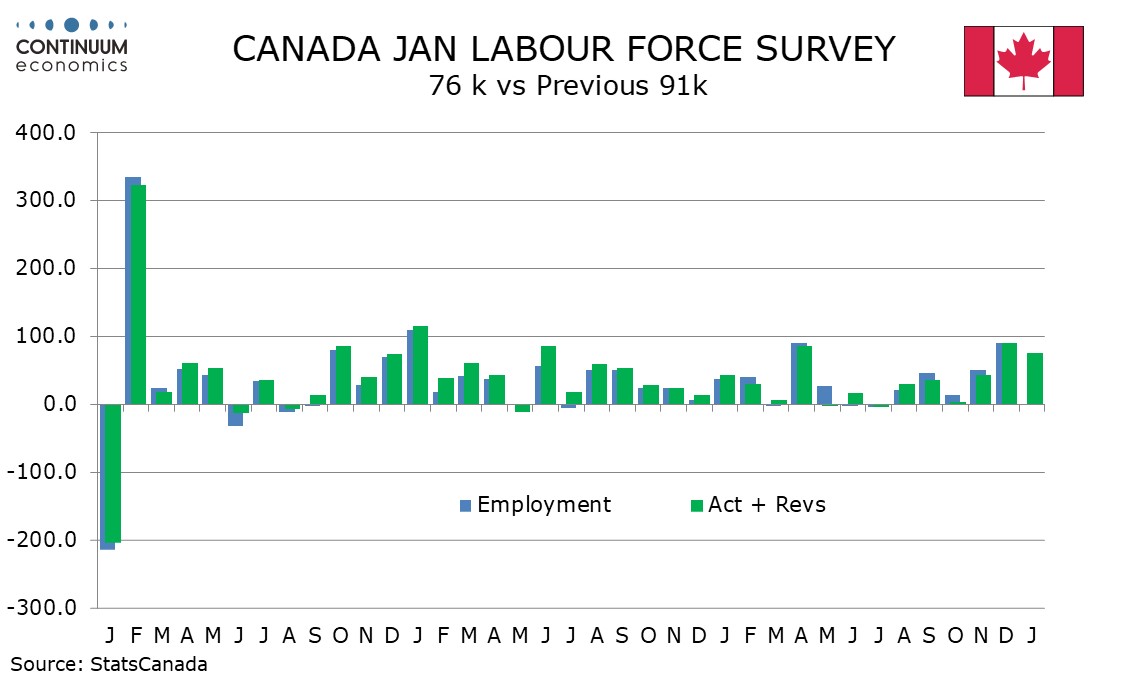

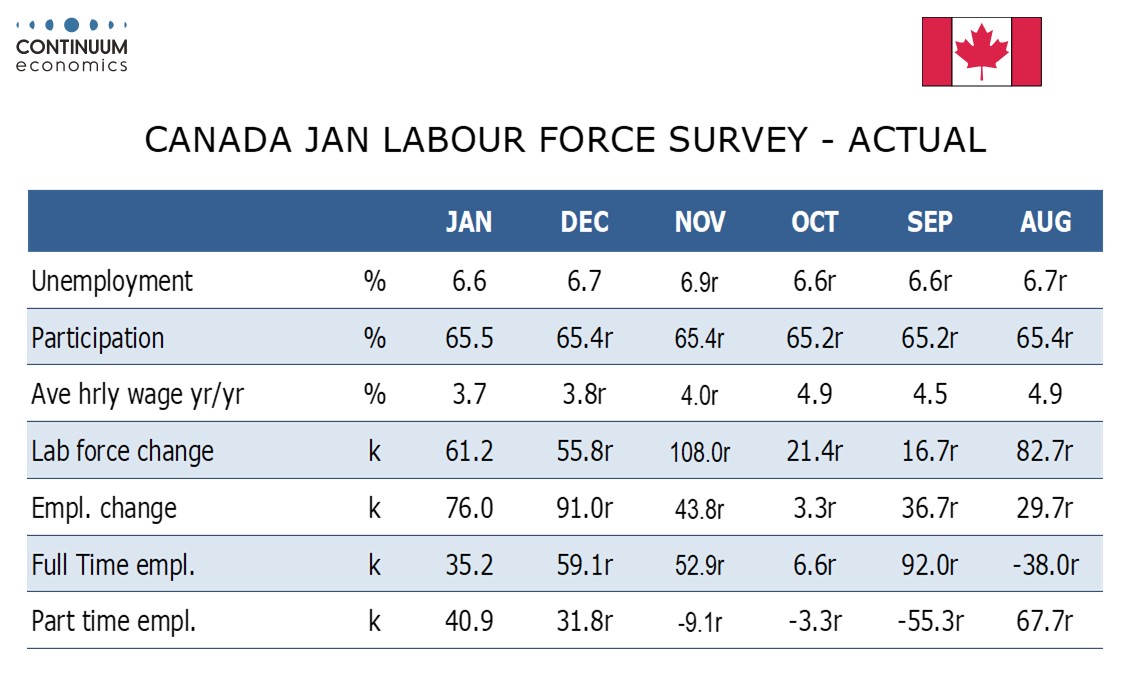

Canada has delivered a strong employment report in January, with a 76k increase allowing unemployment to slip to 6.6% from 6.7%, though wages slipped to 3.7% yr/yr from 3.8%. This backs a Bank of Canada view expressed at January’s meeting that growth is responding to rate cuts without lifting inflation, but whether that can continue will depend on whether tariffs are imposed on Canada.

Unlike the strong gains of December and more so November, the public sector did not play a part, declining by 8.4k, with private sector employment up a strong 57.2k and self-employment up by 27.4k. Part time jobs at 40.9k outpaced full time at 35.1k, but the latter is still healthy.

By industry however the data is mixed, with manufacturing surprisingly strong at 33.1k. This sector will be the most vulnerable to any US tariffs. Construction was also solid at 19.3k meaning that the bulk of the job growth came from goods. Services rose by only 22.5k, with 21.7k coming in professional, scientific and technical. Other components of the services breakdown were generally subdued.

It is looking like November’s 6.9% unemployment rate will prove a peak but is still well above the 5.0% level where 2022 ended. That helps explain why wages, until recently stubbornly high, are starting to slow.