Canada February CPI - Acceleration clearer as sales tax holiday ends

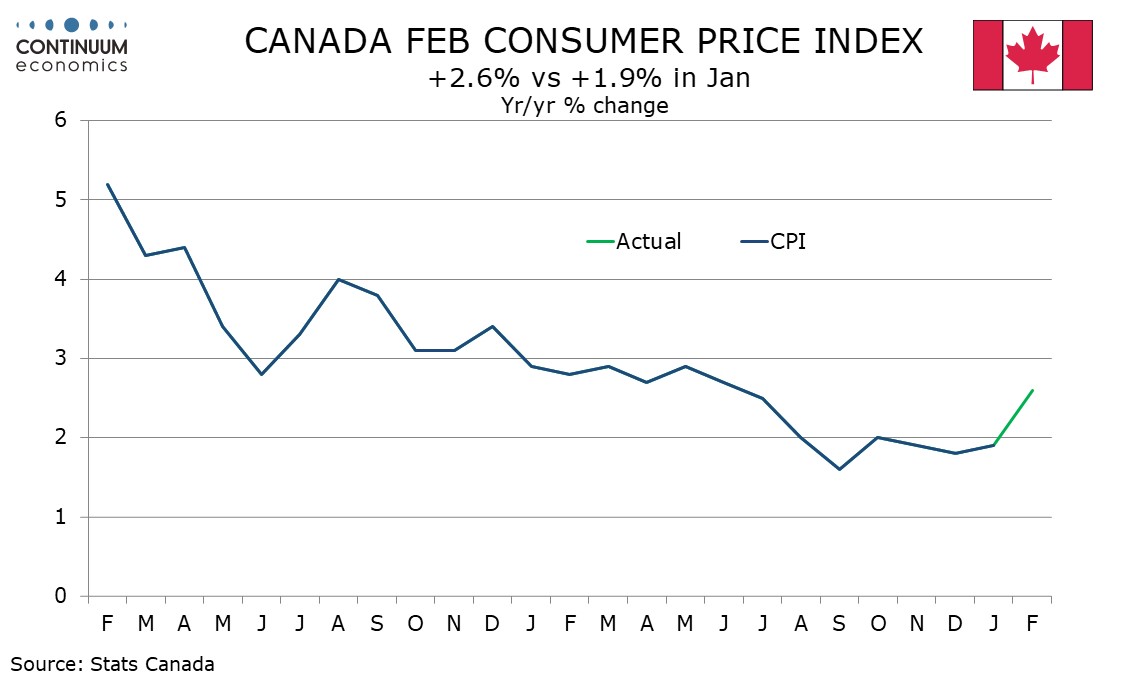

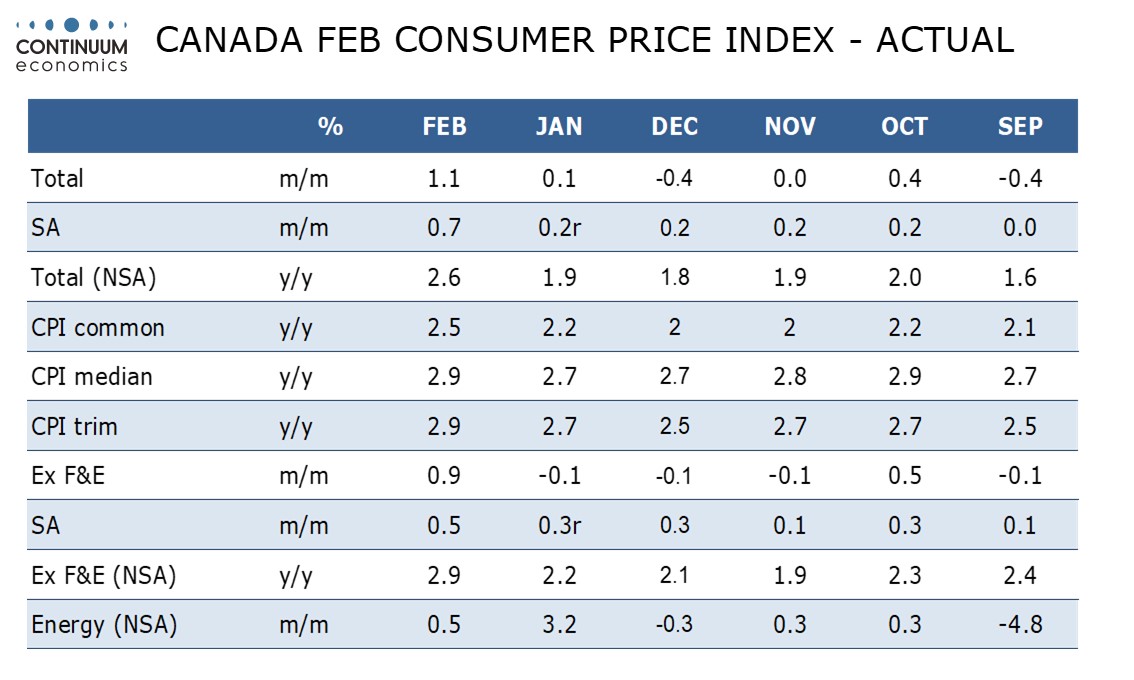

February Canadian CPI at 2.6% yr/yr from 1.9% in January is significantly stronger than expected, with the rise inflated by the mid-February expiry of a sales tax holiday that started in mid-December. This will lift March data further. The Bank of Canada’s core rates are also stronger, suggesting CAD weakness in response to trade tensions is supporting prices.

Ahead of the temporary sales tax holiday, the Bank of Canada had expected a fall in CPI to 1.5% yr/yr, meaning the 1.9% January outcome was disappointing, with the latest data giving a better signal on the true picture, though only in March will the impact of the tax holiday be over.

On the month CPI rose by 1.1% with a 0.9% increase ex food and energy. Seasonally adjusted the gains were 0.7% overall and 0.5% ex food and energy, the latter following gains of 0.3% in both December and January, with January revised up from 0.1%. This confirms a recent acceleration in trend, most likely brought about by CAD weakness.

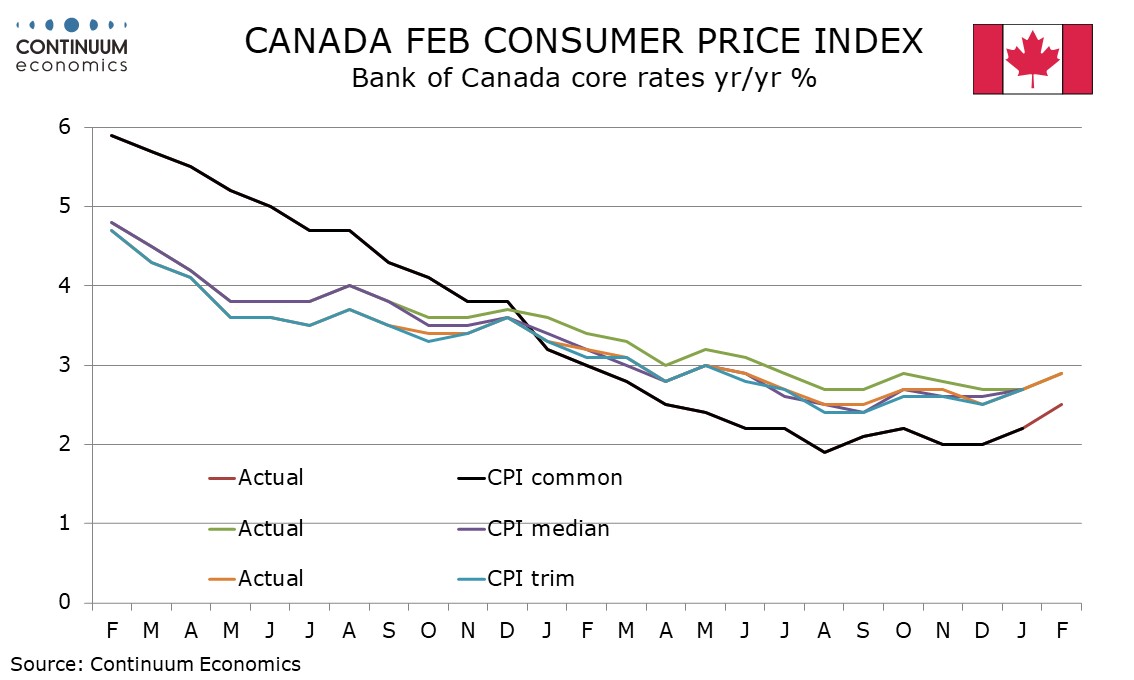

The ex food and energy rate is not one of the BoC’s core rates, but they are stronger, CPI-Median and CPI-Trim both rising to 2.9% yr/yr from 2.7%, and CPI-Trim rising to 2.5% from 2.2%. The average of the three rates at 2.77% is the highest since May 2024, and up from 2.4% in December, pushing what had been steady progress towards the BoC’s 2.0% target into reverse.