Trump Tariffs: Bad for The U.S., to Canada and to Mexico

In announcing 25% tariffs on Canada and Mexico, as well as additional 10% tariffs on China, Trump exceeded the expectations of many, including ourselves. The situation is fluid with Mexico (but not yet Canada) receiving a one-month delay, but the risks of a lasting trade war need to be seriously considered and views updated. Damage has already been done and unless Trump is stopped by the courts or climbs down, Canada and Mexico face recessions and the US looks likely to see growth significantly reduced.

The US economic outlook will take a hit

In the United States, the most obvious impact of the tariffs will be higher prices. Full pass through would lift inflation by over 1% but Canadian and Mexican attempts to remain competitive are likely to provide some restraint. What pass through there is will be felt quickly, delivering some strong U.S. monthly inflation data starting in February. This will reduce real disposable income and weigh on consumer spending, and also reduce potential for Fed easing. Recessions in two large neighbors and a stronger USD will reduce demand for US exports even without what appears to be a strong desire on the part of Canadian consumers to boycott US-made goods. US exports are likely to fall by more than US imports as a consequence of the tariffs.

In our December outlook we expected US GDP to rise by 2.5% in 2025 with each quarter above 2.0%. While it is still too early to say how long the tariffs will persist, GDP growth close to 1.0% would be likely if they do through the year. We expected core PCE prices to rise by 2.4% in 2025. Should the tariffs persist, 3.0% may be a conservative estimate.

Our revised FOMC view

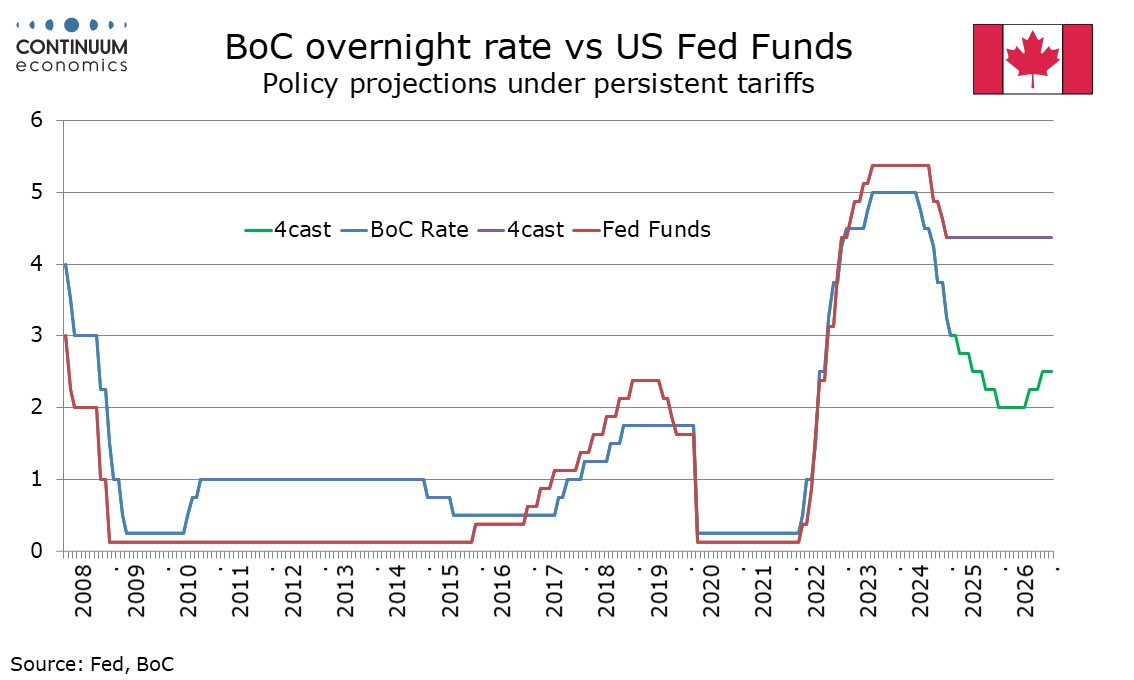

We had expected the Fed to ease two more times in 2025, in March and Q2. No matter how soft January data is with February CPI set to be lifted by tariffs a March easing now looks unlikely. We also no longer expect a move in Q2, seeing rates remaining at the current 4.25%-4.5% for the rest of the year. We had expected tariffs to arrive in greater force in 2026 than 2025, and saw 75bps pf tightening in that year. With heavy tariffs now here, if the picture stabilizes continued steady policy could be seen through 2026, with scope for easing to resume should tariffs be removed or significantly cut. In such a fluid situation, steady policy through 2026 is not likely, but is probably the best estimate to make when balancing multiple risks.

Trump’s motivations are difficult to understand rationally, but hopes that he was simply threatening tariffs to get concessions on the border have been disappointed. It may be that Trump genuinely believes that trade deficits are always bad and that removing them would provide a painless boost for the United States’ economy. If he persists in this belief against mounting evidence there may be no swift resolution.

Canada facing recession

For Canada, estimates of a 4% hit to GDP may be exaggerated, with potential cushions from a weaker CAD, and fiscal and monetary policy. Still, an economy that was set to grow by near 2% in 2025 now looks set to decline, probably by at least 1.0%. Canada could ease the pain to itself by limiting retaliation against the US, but that would not be in line with where Canadian public opinion is. Canada, with a budget deficit near 2% of GDP, less than a third of that of the US, has scope for fiscal stimulus but with the ruling Liberal government unpopular and facing a likely electoral defeat by the Conservative opposition may struggle to deliver one.

At the latest Bank of Canada meeting Governor Macklem stated that a trade war would weaken growth and boost prices and that the BoC could not lean against both simultaneously, and was vague about how policy would respond. We feel that with the hit to growth likely to be larger than the lift to inflation the BoC will take on a more dovish stance, and that rates will fall as low as 2.0% this year from the current 3.0% rather than bottoming at 2.5% as we had previously expected. Given that they are weighing competing risks, the BoC’s will likely move gradually, with one 25bps move in each quarter (though a move in March would be the second move in Q1 following the easing seen in January). If the situation stabilizes, 2026 may see the BoC edging policy back towards neutral.

Mexico: Tariffs Menace Spurs Uncertainty

A call between Mexican President Claudia Sheinbaum and Donald Trump has delayed the imposition of the 25% tariffs for one month. Since day one after Trump’s election, Mexico has leaned towards cooperation with the U.S. rather than confrontation. Around 40% of Mexico’s GDP is directly tied to the U.S., and the USMCA deal has facilitated the creation of value chains, with products moving in and out of the U.S. and Mexico before finally reaching consumers in U.S.. From December 2023 to November 2024, Mexico has exported around USD 500 billion worth of products to the U.S. As we have been stating, strong demand from the U.S. has been one of the main drivers of Mexico’s higher growth in recent years.

The imposition of the 25% tariffs would represent a significant blow to the Mexican economy. So far, the MXN has hit 21 USD/MXN, depreciating around 2% since the tariff announcement. We believe that now that the tariffs are suspended, some recovery will be seen, though tensions will continue to linger for Mexico. The recent announcement of the “Plan Mexico”, focused on improving Mexican infrastructure to attract new companies looking to manufacture in Mexico and export to the U.S., underscores the administration’s commitment to maintaining good relations with the U.S.

However, the current threats and tensions have already taken their toll on the Mexican economy. We believe most companies will seek clarity on whether investing in Mexico is worthwhile. Despite the Mexican government’s good intentions, Trump is unpredictable, and we cannot rule out the imposition of tariffs even if Mexico meets U.S. demands. Mexico’s economy has already contracted in Q4, and given the current tensions, which will restrain investment into Q2 and show clear signs of weakening domestic demand, we believe Mexico will enter a technical recession in Q1.