Bank of Canada Minutes Back 25bps Easing, Less Clear on Potential Tariff Implications

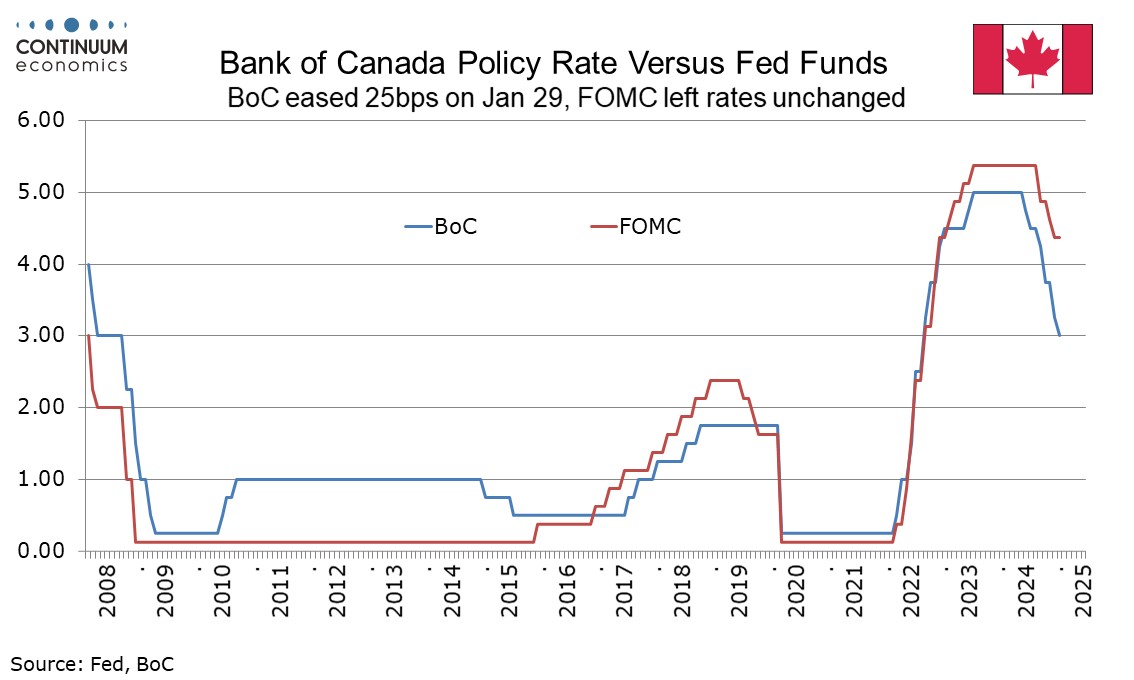

The Bank of Canada has released minutes from its January 29 meeting, which show no signs that the decision to ease by 25bps saw much debate. Uncertainty due to tariff risks was seen as supporting the decision. However, should a trade war with the US be seen, the minutes show a more balanced view, considering upside inflationary risk as well as downside risks to growth.

The minutes note lower interest rates supporting consumer spending and housing activity, and see GDP per person, recently declining despite growth in overall GDP, turning positive in Q1 2025. Risks were seen as reasonably balanced apart from the possible imposition of wide-raging tariffs. It was felt that even if no tariffs were imposed a long period of uncertainty would damage business investment. A protracted trade conflict was seen as likely to hit GDP growth in both the US and Canada, but significantly more for Canada, with the adverse impact on Canadian GDP seen as permanent.

Members agreed that in the event of a trade war, monetary policy would need to guard against second round effects from higher prices of tariffed imports and any lift to inflation expectations. It was agreed that monetary policy would need to balance the impact of a trade war on both output and inflation and this would eb a dynamic process, and that monetary policy would not be able to offset the economic adjustment that permanent tariffs would cause. It was felt that a fiscal policy response could be more effectively targeted. It was decided that given high uncertainty, the BoC would not provide any forward guidance. There is little reason to think that the current 3% rate will mark the end of the easing cycle, though it is unclear how much, if at all, a trade war would extend it.

Members agreed that in the event of a trade war, monetary policy would need to guard against second round effects from higher prices of tariffed imports and any lift to inflation expectations. It was agreed that monetary policy would need to balance the impact of a trade war on both output and inflation and this would eb a dynamic process, and that monetary policy would not be able to offset the economic adjustment that permanent tariffs would cause. It was felt that a fiscal policy response could be more effectively targeted. It was decided that given high uncertainty, the BoC would not provide any forward guidance. There is little reason to think that the current 3% rate will mark the end of the easing cycle, though it is unclear how much, if at all, a trade war would extend it.

The meeting took place shortly before February 1, when Trump initially followed through on his threat to impose a 25% tariff on imports from Canada, with the exception of a 10% tariff on oil, but quickly backed down, granting a reprieve to March 1 in exchange to concessions on the border. Since then, tariffs on aluminum and steel have been imposed, which will hit Canada more than any other nation, though the impact of these tariffs will be small compared to what a blanket tariff would do.