Canada November CPI - Subdued but little further progress on BoC core rates

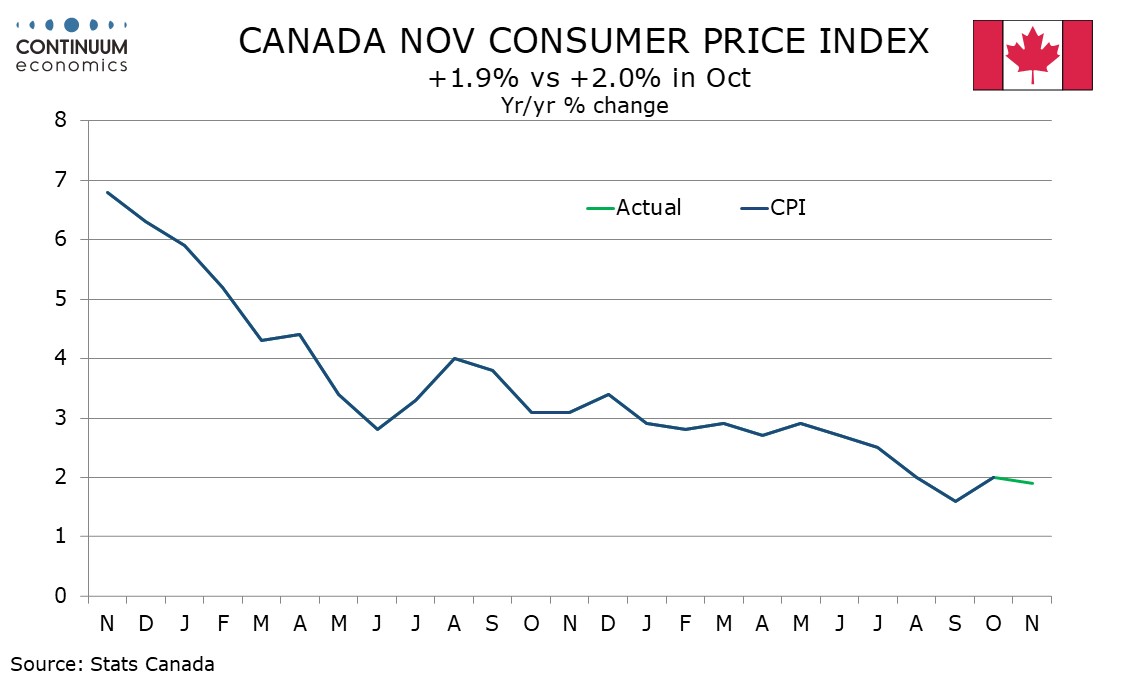

November Canadian CPI is slightly weaker than expected overall at 1.9% from 2.0% yr/yr, and subdued on the month, though there was little further progress on the Bank of Canada’s core rates. This supports expectations that the BoC will ease further, but at a more gradual pace than the 50bps moves seen in the last two meetings.

Overall CPI has been on or below target in each of the last four months. A temporary sales tax holiday will depress December and January data but the BoC has stated it will look though that.

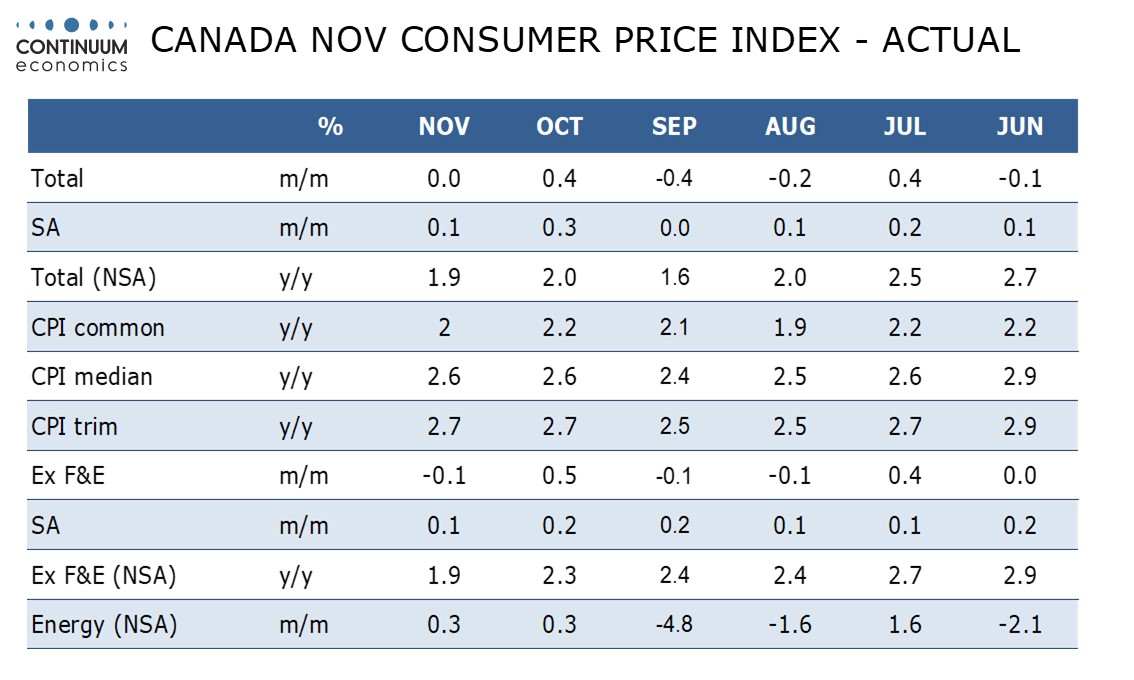

On the month CPI was unchanged with a 0.1% decline ex food and energy. The seasonally adjusted data showed subdued gains of both 0.1% overall and ex food and energy. Over the last six months the seasonally adjusted ex food and energy rate has seen three gains of 0.1% and three of 0.2%, which is consistent with inflation running at a pace marginally under the 2% target.

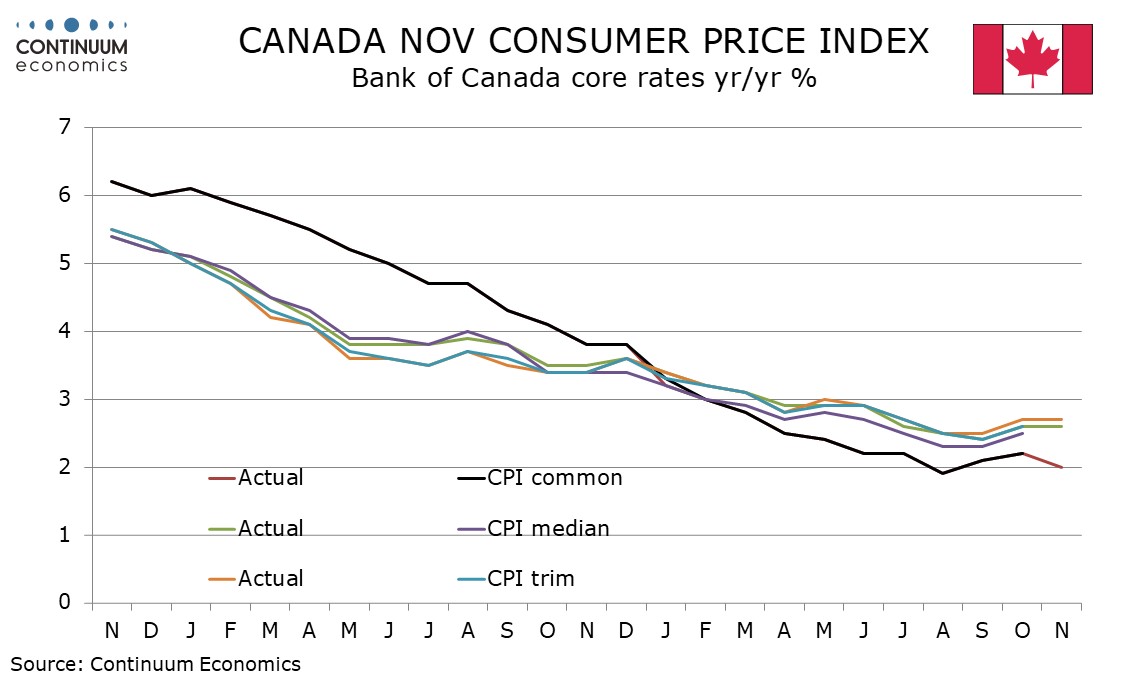

The yr/yr ex food and energy pace slowed to 1.9% from 2.3%, but this is not one of the BoC’s three core rates. Here CPI-Common fell to 2.0% from 2.2% but the more closely watched CPI-Median and CPI-Trim were both disappointingly unchanged, at from upwardly revised October paces of 2.6% and 2.7% respectively, both remaining above the paces seen in August and September. While these numbers are disappointing, overall the data presents a subdued picture.