Trump Tariffs, or Not: Trying to Make Sense of a Policy Farce

So, after a weekend and a day of drama we are back to where we were on Friday morning. Forecast updates made on the imposition of tariffs will not be thrown in the trash can, but now will be held as an alternative should Trump decide to go ahead on March 1 after postponing them from February 1 (which was already a postponement from inauguration day). He probably won’t.

Markets were whipsawed on Friday after a Reuters report suggested the tariffs would be postponed until March 1 before the White House shortly after stated they were going ahead. It now looks like the Reuters report came from reliable sources, but Trump was unhappy with the leak, needing to get the impression of concessions from Mexico and Canada, so went ahead with the announcement. Still, this is all speculation. It is possible the stock market reaction influenced him, though if so, it suggests it does not take that much from the markets to force policy changes. A more charitable interpretation of Trump’s thought process would be that Mexican and Canadian concessions on the supply of fentanyl impressed him, though it is unclear how much difference they will make, and it contrasts with Trump’s long-held aversion to trade deficits, on which Mexico and Canada have pledged little.

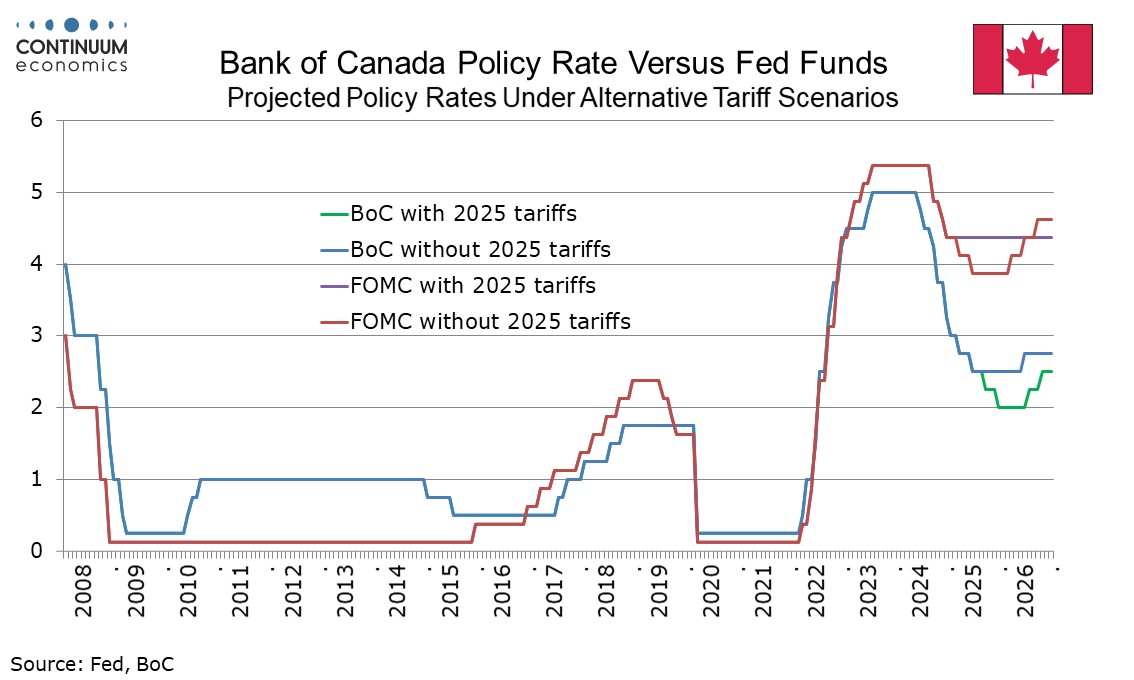

Little can be ruled out given Trump’s unpredictable nature, though we will return to predicting monetary policy on the assumption of no major tariffs this year. Before the tariff announcement we had two 25bps easing from both the FOMC and the BoC this year, rather than none from the FOMC and four from the BoC as we suggested under tariffs. However, without tariffs the risk is for less than two from each rather than more, though we will await Trump’s March 1 decision and data for early March before finalizing the call.

Our forecasts made in December had tightening from the FOMC in 2026 on an assumption that tariffs would come in that year (to pay for tax cuts) rather than 2025. That is still possible, though Trump’s apparent climbdown this time reduces the risk that tariffs will be introduced in 2026. The 2026 tightening call cannot be seen as a confident one, dependent on both policy and timing of policy to be decided by the highly unpredictable Trump.