Commodities Outlook: Fragile Foundations

Oil prices in the short to medium term will be shaped by demand in China and the U.S. In particular, we expect weak data in China to continue weighting on oil prices in Q4 2024, with limited upside risks from supply-side developments. In 2025, demand growth will likely remain slow in the first half, with some recovery in the U.S. and Europe by year-end. Non-OPEC production is set to remain strong, and countries within OPEC+ are likely to raise production (by reducing voluntary production cuts) in early 2025 looking to regain market share. We forecast oil prices at USD 75 by end-2024 and USD 68 by end-2025. Main risks include OPEC policy shifts, weaker than expected demand, and geopolitical tensions.

Copper prices are highly influenced by economic activity in China, the world's largest consumer of the metal. The downturn in China's property sector has dampened short-term optimism, while government measures and potential stimulus are targeted rather than aggressive. Despite a decline in copper prices after peaking in May 2024, we think demand from emerging industries like electric vehicles and solar panels may offset some of this weakness. Positive U.S. developments, including monetary easing and a weaker USD, could support copper prices. Our revised forecasts are USD 9,500 by end-2024 and USD 10,000 by end-2025.

We expect gold prices to continue their upward momentum, despite a slowdown in central bank demand, which has been the primary driver of the price rally. The U.S. easing cycle and a potential USD depreciation are likely to drive renewed demand, while geopolitical tensions, especially around U.S.-China relations, could further support gold as a safe haven. We forecast gold at USD 2,600 by end-2024 and USD 2,700 by end-2025. However, if declining rates do not lower real yields and demand remains weak, gold prices could fall below USD 2,400 in 2025.

Oil: Demand Concerns and OPEC+ Puzzling Policy

We expect demand developments, particularly in China and the United States, to dictate the trajectory of oil prices in the short to medium term. In the last quarter of 2024, we anticipate oil prices to respond to weaker-than-expected demand, especially in China. Simultaneously, we do not foresee significant upside risks from supply-side changes that could overshadow demand developments. For 2025, we project slow demand growth in the first half of the year, with some improvement in the U.S. and Europe during H2. On the supply side, non-OPEC production is expected to remain robust, and we anticipate a progressively production increase from certain OPEC+ members throughout the year.

Data from the U.S. Energy Information Administration (EIA) positions the United States (20%), China (16%), and Europe (14%) as the leading regions in terms of global oil consumption during 2024; thus, the commodity’s prices will react to demand developments in these regions. In the U.S., we anticipate an economic slowdown that will deepen in the last quarter of 2024 and will not display signs of recovery until the second half of 2025. Thus, we expect the positive indicators seen in terms of jet fuel and diesel consumption in the U.S. during summer 2024 to start to fade away, not only attributed to the end of seasonal demand but also to the slower economic growth. The beginning of the monetary easing cycle will be viewed positively by the oil market; nevertheless, as our U.S. growth forecasts displays, it will take a couple of quarters for the monetary easing to feed through the real economy.

China’s relevance in the oil market cannot be dismissed. Figures from the EIA show that during the 2010s, China accounted for an average of 40% of annual global oil demand growth. In 2023, China’s demand increase alone represented 50% of global oil demand growth. As noted in our China chapter, although some leisure-related consumption sectors continue to grow, momentum is slowing. We expect a more significant deceleration in the coming quarters, which will likely reduce oil consumption growth. Additionally, the growing adoption of electric vehicles is contributing to a decline in diesel demand. The broader impact extends beyond the transportation sector (air travel and passenger vehicles) to construction and industrial demand, both of which are expected to weaken in line with our outlook on China’s economic slowdown. Furthermore, closely monitoring the petrochemical sector will be critical, as this sector has accounted for 75% of China's oil demand growth between 2019 and 2023, as per the International Energy Agency (IEA).

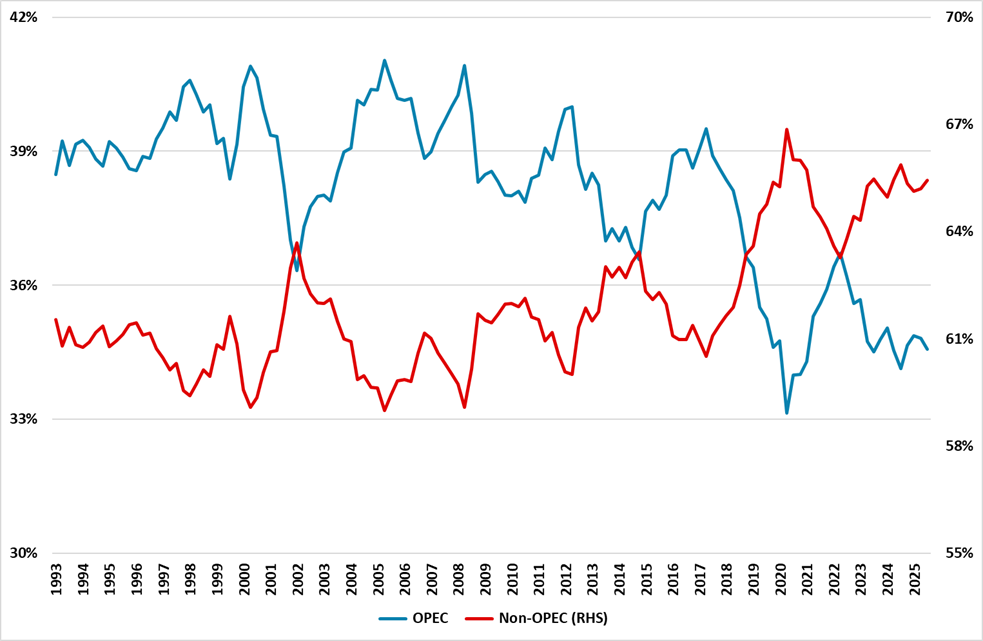

Looking at the supply landscape, the key question is whether the group of OPEC+ countries that implemented voluntary supply cuts of 2.2 million b/d since November 2023 will begin to progressively increase production in December 2024 (originally planned for October) or not. Our view is that this group faces a tough decision: either they extend the cuts to try to support oil prices or proceed with the planned production hike. We maintain our view from last outlook that this group is likely to increase production in Q1 2025 for three main reasons – although we recognize it is a close call. First, the cuts have not boosted oil prices and are now failing to support them. Second, OPEC+ has lost market share to non-OPEC producers (Figure 1). Third, some members of the group may be seeking to raise their own production levels. In its June 2 meeting, the cartel extended its cuts—totaling 3.66 million b/d—through the end of 2025, and we expect this decision to hold. Meanwhile, non-OPEC production, particularly from countries like Brazil, Guyana, and the United States, is set to remain strong.

Figure 1: Crude Oil Production Share (OPEC vs Non-OPEC)

Source: Continuum Economics/EIA

As a result, we have revised down our WTI forecast to USD 75 by the end of 2024. For 2025, we expect oil to be in the low 60s during H1 thanks to increasing supply and decreasing demand; furthermore, the recovery in the U.S. and Europe during H2 2025 leads us to forecast oil at USD 68 by the end of 2025. Risks to this outlook include a deviation in OPEC policy from what is outlined in our base scenario. While an extension of voluntary cuts would likely have little impact given the weak demand outlook, further cuts—though unexpected—cannot be entirely ruled out, considering the unpredictability of OPEC's policies. Then, on the demand side, there is a significant downside risk, as weaker-than-expected consumption could push prices below USD 60. Lastly, negative developments in global conflicts, such as the Russia-Ukraine war or the Israel-Hamas conflict, could potentially support and boost oil prices.

Copper: Short Term Bullish Bets Scrapped

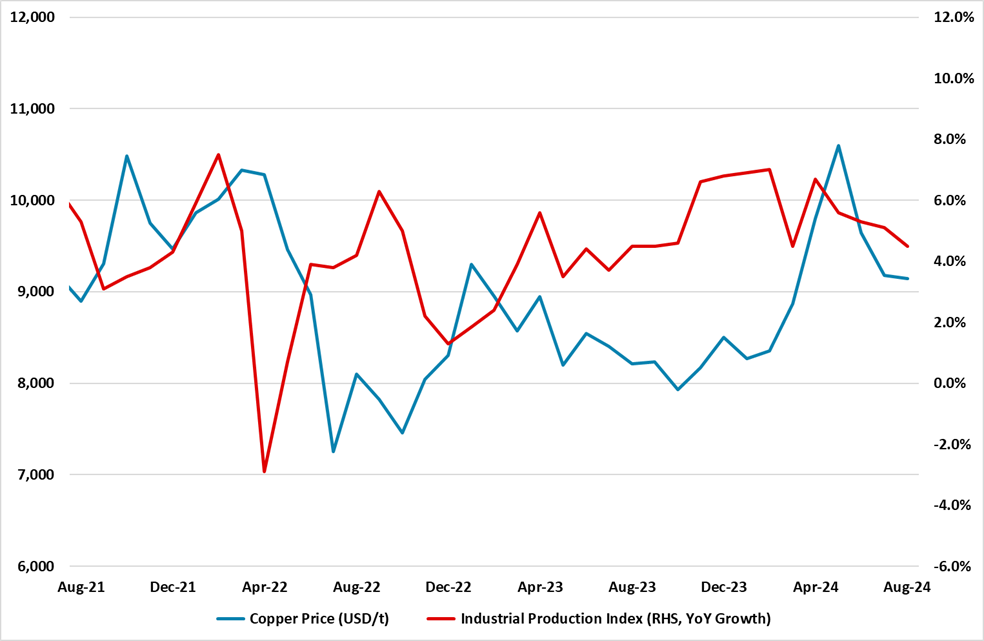

Copper prices are linked to economic activity in China (Figure 2), which accounts for over half of global demand for the metal. In recent years, China's property sector has significantly influenced copper prices; however, the sector's current downturn has tempered short-term bullish sentiment. Indeed, we highlighted the relevance and increasing problem that the country is facing in terms of a worsening property sector in our China chapter. Even though the government has implemented some measures to help the industry and is considering on providing more support, we believe it has limited scope to provide the required stimulus to revitalize the residential property sector.

Figure 2: Copper Price and China Industrial Production Index

Source: Continuum Economics

While copper prices lost momentum after peaking in May 2024 due to weakness in the property sector, emerging industries related to clean energy, such as electric vehicles and solar panels, are expected to partially mitigate the reduced demand from real estate. For instance, data from China’s Passenger Car Association reveals that sales of electric vehicles and plug-in hybrids in August increased by 42% YoY, backed up by government subsidies for trading in old vehicles. However, we believe these sectors are set to face significant challenges. Firstly, the projected economic slowdown throughout 2025 in China may dampen domestic demand for electric vehicles as consumers become more cautious with their spending. Secondly, international demand is impacted by tariffs imposed by Europe and the U.S. Lastly, excess production noted in the China chapter is occurring in the solar panel industry. Should this industry falter, it could mean a reset for the sector affecting copper demand.

Recent U.S. developments are positive for copper. The start of the monetary easing cycle is expected to reduce financial pressures on manufacturers and construction firms. Additionally, this shift may weaken the USD, making copper relatively cheaper for importing companies. While we believe there is a valid concern of copper not being able to meet demand needs, we expect this will likely materialize later in the decade, as sectors related to clean energies and AI data centers mature and their demand outpaces supply. Heading into 2025, we foresee no significant supply shocks that could materially impact copper prices, aside from typical industry disruptions such as labor strikes or natural disasters. Accordingly, we have revised our copper price forecast downward to USD 9,500 by the end of 2024 and USD 10,000 by the end of 2025.

Gold: How Far Can the Rally Go?

We expect gold prices to maintain upward momentum, though the factors that initiated the price surge in 2022 are showing signs of deceleration. In a high-interest-rate environment, market fundamentals typically suggest a downward trend for the metal. However, strong demand from central banks has been pivotal in sustaining and driving gold prices higher. Nevertheless, recent data shows the Central Bank of the People’s Republic of China (PBOC) has held its gold reserves steady for the last four consecutive months—marking a shift in behavior given China's critical role in this trend. In our view, current elevated prices have likely influenced the PBOC's decision to pause gold purchases. We anticipate the trend will resume, possibly in 2025, as China's gold reserves remain low compared to other emerging markets and as it seeks to diversify its holdings to mitigate financial and geopolitical risks.

Looking beyond the PBOC, the World Gold Council reported that 81% of central banks anticipate an increase in gold holdings by their peers through June 2025. While gold prices have been driven by both reported and unreported demand from central banks, additional support has come from heightened geopolitical risks and, more recently, ETF inflows. We expect jewelry demand to continue declining in countries like China, in line with the slowing economic outlook we foresee. In fact, the China Gold Association reported a 27% drop in gold jewelry sales during the first half of 2024. In relation to geopolitical tensions such as Russia-Ukraine and Israel-Hamas, we believe these conflicts will provide some support for gold prices. However, we do not see them driving prices higher unless there is a significant escalation, which is not part of our baseline scenario.

With central bank and consumption-driven demand slowing, several key factors are still supporting gold prices. First, the start of the easing cycle in the U.S. is expected to benefit gold; for instance, ETFs backed by physical gold saw their inflows extend for the fourth consecutive month in August. As detailed in our U.S. and DM Rates outlook, we forecast the Fed Funds rate to drop to the 4.25%-4.50% range by the end of 2024 and to 3.00%-3.25% by the end of 2025. Similarly, we project 10-year U.S. Treasury yields to stabilize around 3.55% by year-end 2024 and 3.7% by year-end 2025. Second, this easing cycle is likely to depreciate the USD, making gold more affordable globally and potentially driving renewed central bank demand. Third, as we approach a new presidential campaign in the U.S., fiscal stress and a divided Congress could create a favorable environment for gold. Lastly, from a geopolitical perspective, a potential election of Donald Trump could escalate tensions with China, positioning gold as a safe-haven asset amid rising geopolitical risks.

Bringing these elements together, we forecast gold to reach USD 2,600 by end-2024 and USD 2,700 by end-2025. The primary risk lies in the nature of current investor expectations. Specifically, if gold prices are primarily driven by falling rates without a corresponding decline in real yields—and this is not supported by robust central bank or consumer demand—then a market correction could occur. In such a scenario, we may see gold dropping below USD 2,400 in 2025.