Commodities Outlook: Fundamentals Kick In

West Texas Intermediate (WTI) is projected to end 2024 at USD82. We anticipate that the voluntary cuts introduced in November 2023 will likely be reversed during H1 2025 and not in Q4 2024, as initially communicated by OPEC+. The scenario is built on our expectation that demand will not increase sufficiently in H2 to justify the movement in Q4. For 2025, we foresee a loose market characterized by strong production from both OPEC and non-OPEC members. Additionally, stable rather than booming demand is likely to persist, leading WTI prices to reach USD72 by the end of next year.

We have revised our copper forecast upwards to USD10,200 per ton by the end of 2024, reflecting growing supply concerns. However, we caution that short-term speculative investor demand may not align with underlying fundamentals. Risks such as moderated demand in copper-intensive sectors, a sluggish property sector in China, and the potential impacts of tariffs imposed by the U.S. and EU on China’s electric vehicle and solar panel industries could weaken demand growth for this commodity. As we move forward into next year, we expect copper to end 2025 at USD10,900 per ton.

Gold remains as one of the better performer assets, and we expect it will reach USD2,350 per ounce by the end of 2024. A significant factor driving the upward trend in gold prices is the robust interest from central banks in acquiring the precious metal. The People’s Bank of China (PBOC) has particularly influenced the market, despite reporting no gold purchases in May. We interpret this as a strategic pause and anticipate a resumption of buying activity in the months ahead.

Oil: The Path of Voluntary Cuts

Both supply and demand forces remain equally important in determining the trajectory of oil prices. On the production front, we expect the environment to be dominated by policies concerning OPEC+, although increasing supply from non-OPEC members will still be relevant. At its June 2 meeting, the cartel decided to extend its cuts, amounting to a total of 3.66 million b/d, until the end of 2025. Likewise, a group of countries that had implemented voluntary supply cuts of 2.2 million b/d since November 2023 decided to extend them until the end of the third quarter of 2024.

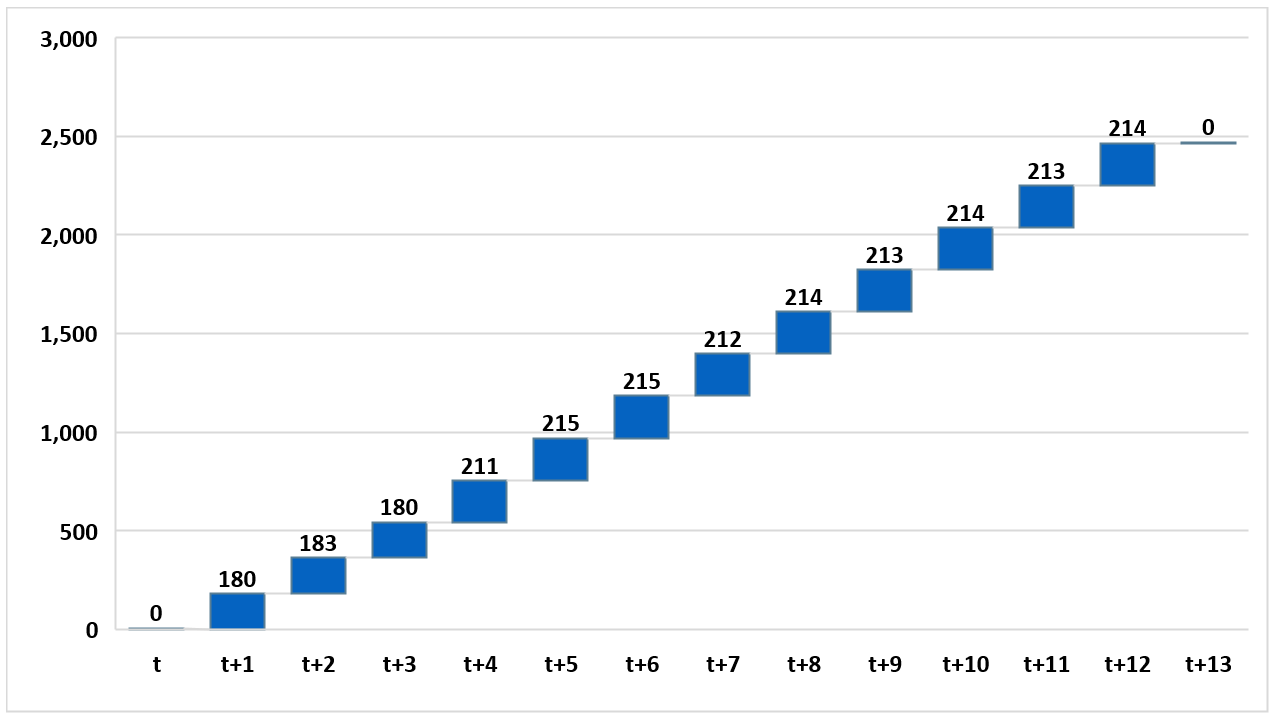

Looking forward, and despite of the cartel’s announcement, we maintain our view that the voluntary cuts will not be reversed this year. Instead, we expect the group to gradually bring those barrels back to the market starting in the first half of 2025. This baseline scenario is supported by statements from various leaders of the cartel, who have clarified that the implementation of the planned reversal of voluntary cuts will depend on market conditions. In this regard, we believe that demand is not set to grow significantly (see below) in order to justify such a movement. Moreover, if the voluntary cuts are actually reversed during the last quarter of the year, this would mean an addition of 543 thousand b/d by the end of this year (Figure 1).

Figure 1: Planned Phase-out of only November 2023 Voluntary cuts (thousand b/d)

Note: t+1 represents the initial month of the anticipated reversal, indicated as October 2024 in OPEC’s press release; therefore, t+12 corresponds to October 2025.

Source: Continuum Economics / OPEC

Indeed, we foresee that oil demand will not pick up sufficiently for the group to reverse the voluntary cuts. While we expect an increase in consumption during Q3 2024 due to seasonal patterns, we anticipate moderate growth towards the end of the year, reflecting our views of slower economic growth rates in the second half of the year compared to H1 2024 in China and the U.S. Specifically, and as outlined in the China chapter, consumption trends have slowed in 2024, and this is expected to continue into 2025. The country’s travel industry has not recovered to pre-pandemic levels, with a structural shift from foreign to domestic trips impacting short-term demand prospects for jet fuel. A weaker yuan and the transition towards electric vehicles are also set to limit oil demand growth in China. On the upside, however, the country continues to benefit from buying oil at a discount from Russia. In the United States, the economy has started to lose momentum, as discussed in our U.S. chapter, and moderate growth in consumption is anticipated. The delayed start of rate cuts is another factor limiting demand growth.

Since our view remains consistent with the one expressed in our March outlook, we still see WTI to end 2024 at USD82. Looking into 2025, we foresee a supply scenario in which the voluntary cuts will likely be reversed, and these barrels will progressively return to the market. This movement would come given the need to recover some of the market share lost to non-OPEC members and as the internal pressures from countries wanting to produce more than their assigned quotas rise. Regarding the cartel-wide cuts, we believe OPEC+ will indeed maintain them until the end of next year. Coupled with a growing availability of oil in the market, we believe next year’s demand will not be significantly robust. Hence, we have slightly revised down our forecast for next year from USD77 to USD72 per barrel.

Copper: Speculative Demand vs Fundamentals

Copper saw a rally in prices during Q2 2024, hitting an all-time high above USD11,000 per ton in May. The rally was mostly explained by rising worries over the ability to meet demand requirements, complemented by a boost in investor sentiment concerning the market potential of the industry.

In China, new property sector investment, which has historically supported and led demand for copper, is set to remain weak despite the government’s efforts to support the industry. While the direct effect is evident through lower construction starts, this also implies reduced demand for products such as home appliances and heating, ventilation and air conditioning systems. We have previously argued that China’s growing interest and investment in clean energy-related industries such as solar panels and electric vehicles could partially offset the demand lost from the housing sector. While we still believe this will be a consolidating trend in the coming years, there are risks associated with it. For instance, Bloomberg reported last February that global sales growth of electric vehicles decreased from 62% in 2022 to 31% in 2023. Additionally, recent U.S. tariffs on China’s electric vehicles and solar panels, along with European tariffs on China’s electric vehicles, could constrain the growth of these industries.

Globally, demand would be supported by the trajectory of interest rates. For instance, the European Central Bank has already cut policy rate in June, and we expect the Federal Reserve (Fed) to follow suit starting in September. This shift in monetary policy could improve the construction sector in these regions, particularly in 2025 when the effects of policy easing would take hold. In the U.S., this change of policy would result in a depreciation of the USD, making copper relatively cheaper to other countries.

As outlined at the beginning of this section, supply has been one of the factors triggering prices. There is a valid concern that supply won’t be able to keep up with demand for two main reasons. First, copper miners have become conservative in investing in new projects, as reported by S&P Global, because it can take up to ten years or more to bring a new mine into operation. Consequently, there are only a few new mines being planned globally. Second, existing mines are aging, and thus becoming less productive. To a lesser extent, existing mines are subject to closures for various reasons (strikes, weather, government regulations), disrupting supply flows. Given the depth of these structural constraints, we anticipate minimal to no change in the supply outlook for this year.

We have revised upwards our copper forecast to USD10,200 per ton for the end of 2024 in light of the supply picture. Looking into 2025, we do not expect any major supply shocks that pose downside risks to copper. In terms of demand, we anticipate a similar status quo, with demand fueled by green industries such as electric vehicles and solar panels (although a victory for Donald Trump in the U.S. presidential election may further restrict demand growth), which could be supported by a favorable environment characterized by lower policy rates, thereby boosting construction projects. Rallies like the one seen earlier this year should not be surprising in the next few years, particularly driven by investor expectations. However, for these movements to become a trend rather than just a rally, they must be justified by fundamentals. We now look copper at USD10,900 per ton by the end 2025.

Gold: A Tactical Pause by the PBOC

In an environment characterized by high interest rates and a strong USD, a normal behavior would dictate that gold prices should be lower than current levels. However, the typical relationship has been disrupted primarily due to central bank buying. According to the World Gold Council's 2024 Central Bank Gold Reserves survey, 29% of central bank respondents plan to increase their gold reserves in the next year. Among the surveyed institutions, decisions on reserve management are primarily influenced by interest rate levels, inflation concerns, and geopolitical instability.

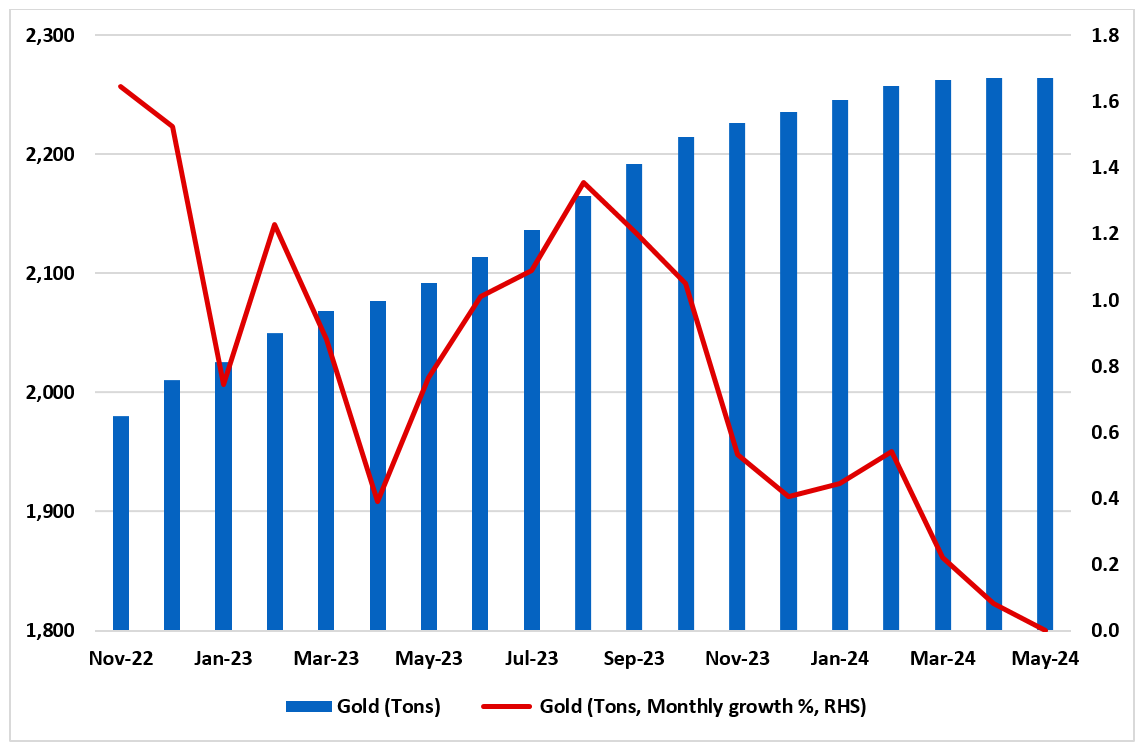

The PBOC has been a key player in this context. Starting in November 2022, the institution embarked on a gold-buying spree to diversify its reserves and hedge against currency depreciation. However, the PBOC reported no gold purchases in May (Figure 2), which we interpret as a strategic pause due to high prices. Looking forward, we anticipate that PBOC will resume buying in the coming months. Failure to do so would exert downward pressure on gold prices.

Figure 2: PBOC Gold Holdings

Source: Continuum Economics / PBOC

Another factor, albeit to a lesser extent, influencing gold prices is the trajectory of policy rates among developed economies, particularly in the Eurozone and the U.S. We forecast 10-year US Treasury yields to reach 4.0% by the end of 2024 and end 2025, which represents a marginal drop and could modestly support gold prices. Additionally, a weaker USD resulting from U.S. policy easing could provide further support by helping sentiment.

Geopolitical risks, consumer demand variations across countries, and supply factors appear to have minimal impact on the trajectory of gold prices. For instance, we do not foresee major developments in the China-Taiwan, Russia-Ukraine, Israel-Hamas conflicts, so we anticipate that geopolitical risks will not significantly impact gold prices. Consumer demand might differ among regions; for example, China's demand could weaken while India's remains robust, reflecting their respective economic outlooks. Finally, mine production remains strong according to the World Gold Council and we believe it does not exert significant influence on the metal's price.

Based on these considerations, we have fine-tuned our gold price forecast upward to USD2,350 per ounce by the end of 2024, assuming continued strong central bank demand and the Fed initiating an easing cycle. Looking ahead to 2025, we anticipate central bank demand will remain a significant influence, albeit with a potential slowdown in purchasing by year-end. Consequently, we project gold prices to stabilize around USD2,200 per ounce by the end of 2025.