Markets: Fed Rather Than Middle East Worries

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers could mean lower 2yr U.S. government bond yields. ECB easing in June will in the short-run likely be a European centric event for markets, given that the BOE/Riksbank and SNB are also easing.

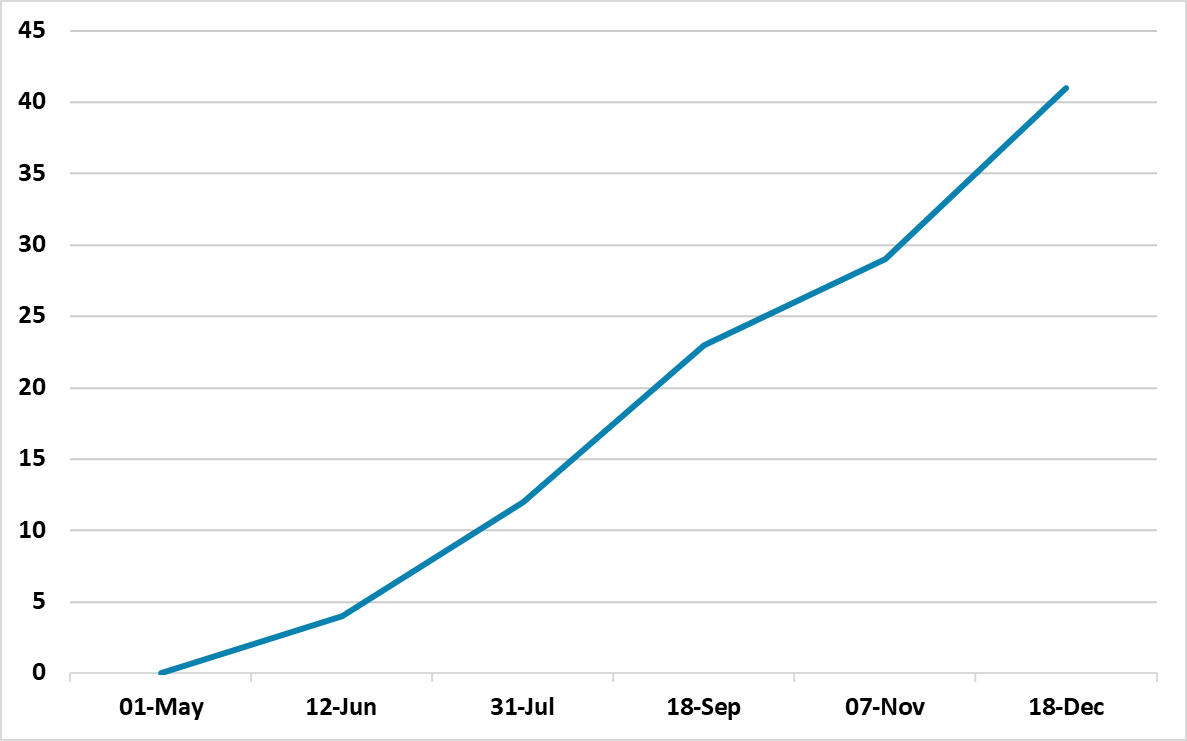

Figure 1: Asset Allocation for the next 9 Months

Source: Bloomberg/Continuum Economics

Global risk sentiment is deteriorating as we progress through April, but we see this largely as a function of the shift in Fed easing expectations rather than Iran/Israel tensions. U.S. government bonds have not shown a flight to quality bid and have risen in recent weeks. The USD is stronger against DM currencies, but this is a function of U.S. government bond yields rising more than EZ yields, as the ECB continues to hint at a June 6 cut amid more controlled inflation than the U.S. (here). A counterattack by Israel is likely, but the question is whether it will be directly against Iran or Iran allies in other countries. If the latter then this is a path towards de-escalation. Nevertheless, the situation in the Middle East is fluid and needs to be watched closely. Long-term more intermittent clashes between Iran and Isreal could be evident. If Iran sought to close the straights of Hormuz it would likely prompt a spike in oil prices and concerns about a hit to global growth. At the moment, such a scenario is possible but unlikely and does not impact wider financial market pricing and the key is really the Fed.

U.S. money markets are now only discounting one full 25bps cut (Figure 1) at or after the November 7 FOMC meeting. Fed Powell on Tuesday shifted tone and no longer downplayed the recent run of stronger than expected U.S. inflation readings and signaled that the Fed Funds target would likely remain higher for longer. This will likely be the message at the May 1 FOMC meeting, meaning that the market is back to data watching and the June 12 FOMC new dots for direction in the remainder of Q2. The shift to less expected Fed cuts and recent U.S. real sector data is the primary driving force behind the rise in U.S. government bond yields in recent weeks. We also see it as being the key in the drift lower in the U.S. equity market, given that valuations had become very stretched by the end of Q1 (here). We had highlighted that a 5% correction in U.S. equities is feasible (here) and we believe this is now underway and at current 12mth forward P/E it could be argued that the market needs a 10% correction from the peak.

However, U.S. equities still have the good growth and corporate earnings story, while the Tech and AI story also remains in place. Slower real sector growth or no more monthly inflation upside surprises would likely mean that the money market shifts to discounting 2-3 cuts. The U.S. equity market is vulnerable to a sharp economic slowdown that really hits corporate profits, but the broad array of economic data is not providing any hints in this direction. We certainly see the lagged feedthrough of 2022/23 monetary tightening, plus the rundown of U.S. household savings acting to slow growth in H2 towards 1% quarterly pace on SAAR basis in the U.S., but this is a soft rather hard economic landing. Our bias is that U.S. equities are undergoing a correction and that U.S. 2yr yields are not discounting enough cumulative easing in 2024/25 and will likely come down as the year progresses.

Does it matter for global markets if the ECB cuts in June? No for most non-European markets in the short-run, as USD based finance is more important in the Americas and Asia – while we also see a further 10bps policy rate hike from the BOJ in June in their slow policy normalization process (here). European government bond yields have largely decoupled from U.S. in recent weeks and already discount a consistent easing cycle and thus a noticeable drop in EZ yields is unlikely on a June ECB cut. EZ equities outperformance are also dependent on a clear economic recovery appearing, which we do not see in 2024 (here). The other issue for EZ equities is that Russia could make land gains in the Ukraine during the late spring/summer and cause jitters for EZ equities. Nevertheless, an ECB rate cut in June would be important multi month, as we see a further 25bps in September and more easing arriving in December. BOE/Riksbank and further SNB easing would also be arriving, which would underline the message that once inflation and economic conditions allow that DM central banks will reduce the degree of restrictive policy and move back towards neutral rates.