The Aussie Chapter 4: Chinese Proxy

In "The Aussie", we will look into the "well-known "correlation among the Aussie and well-known benchmark to give our readers a closer look towards factors that have been affecting the movement of the Australian Dollar. In Chapter 4, we will look into the performance of the Aussie relative to the Chinese Yuan. The final chapter will be the conclusive analysis.

In this chapter, we will look into the correlation between Aussie and Chinese Yuan, both on and offshore. The Aussie has been called a proxy trade of Yuan by market participants for its intertwined economic proximity, It is not uncommon to see the Aussie and Yuan moving in a similar direction in the Asia session but let's dive into the pairs to see if such holds throughout the years.

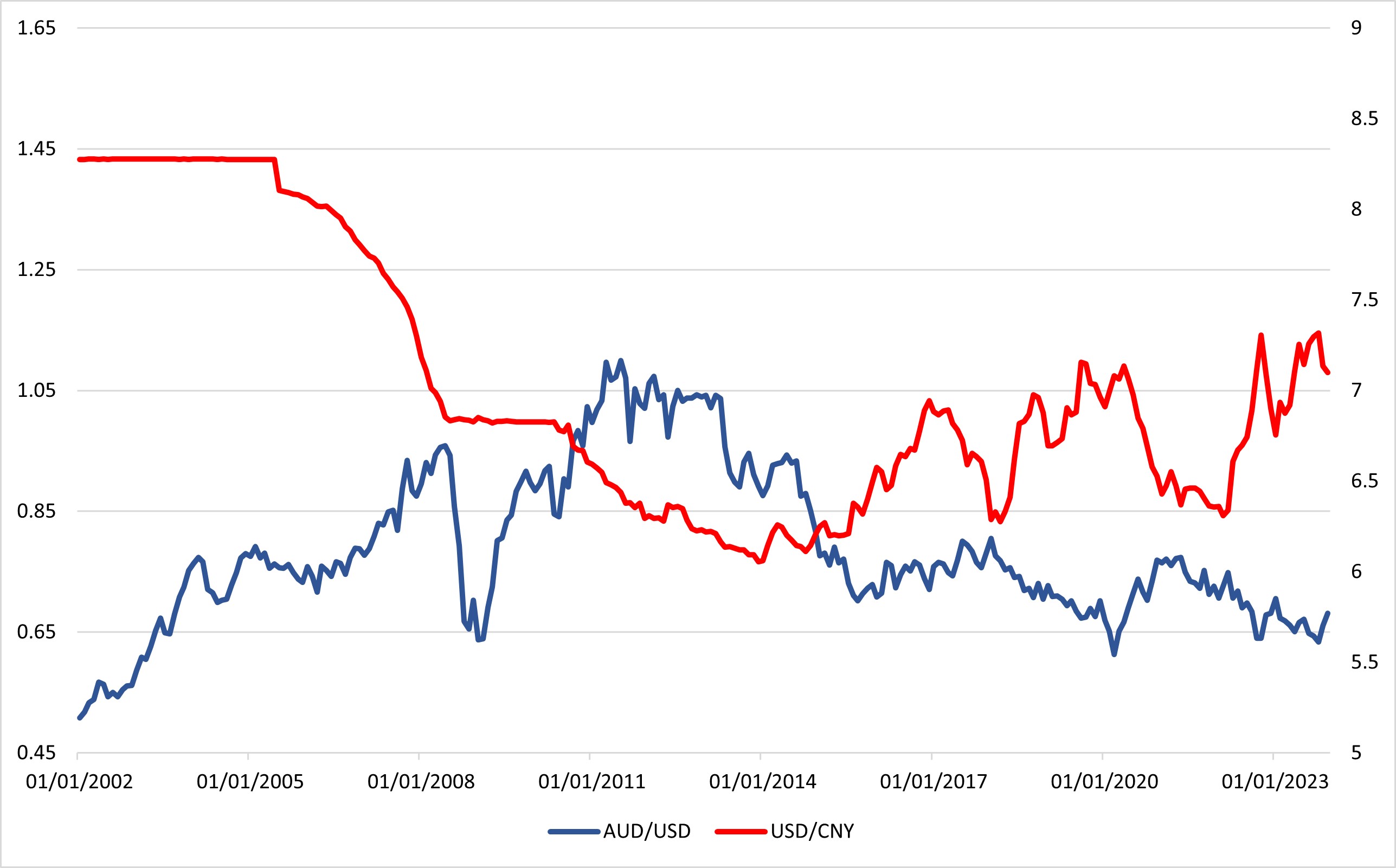

Figure 1: Monthly Performance of AUD/USD and USD/CNY

Figure 1 shows the monthly Performance of AUD/USD and USD/CNY. CNY is the onshore Yuan, with daily reference rate (fixing), and is only allowed to trade within 2% of each side and has restriction in access. In earlier 2000, it was only allowed to trade at a much smaller range.

Disregarding the earlier 2000s, we do see similarities in the path Aussie and Yuan took. The relationship seems to have deepened in recent years since 2018 as both pair closely tracks each other in terms of direction. Before 2018, the correlation is so what weaker for the PBoC contains the damage of major financial crisis by keeping the Yuan's exchange rate steady. The weakest link is between 2012 to 2014 when the performance of Aussie and Yuan against the USD diverged.

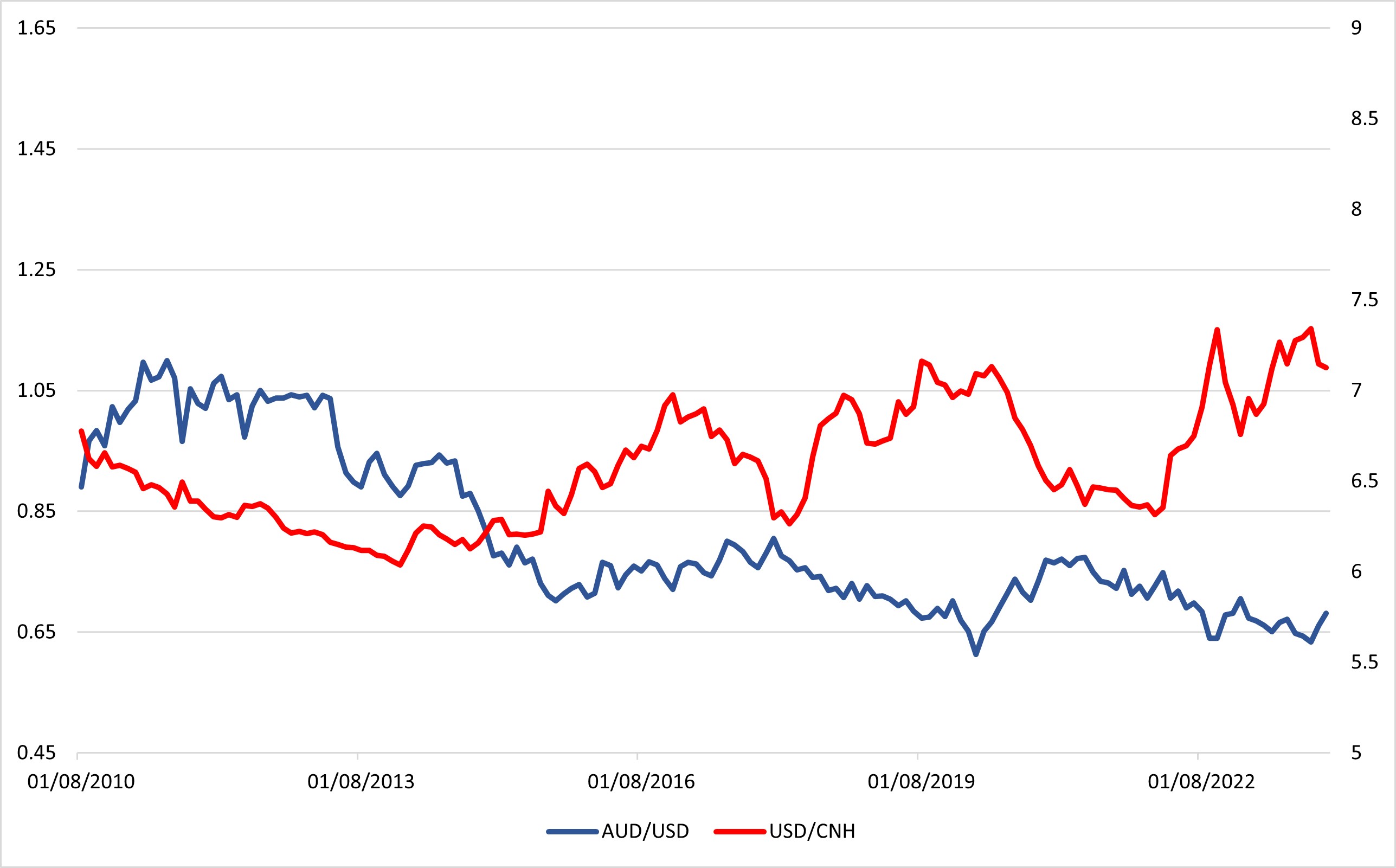

Figure 2: Monthly Performance of AUD/USD and USD/CNH

Figure 2 shows the performance of AUD/USD and USD/CNH. CNH is the offshore Yuan, which is allowed to float freely and accessible to almost everyone.

While theoretically, CNH and CNY should exchange one to one and thus the rate should be the same. But it isn't due to accessibility difference from on and offshore. Similar to USD/CNY, the correlation in performance against the USD seems to have strengthen in recent years since 2014.

While correlation seems to be weak in early 2010s, it looks like the performance between Yuan and Aussie against the USD are showing moderate correlation but far from perfect tracking. It is evidential that major trends tend to be similar between the pairs but short term momentum may part ways. In the final chapter, we will illustrate the through data analytics.