EM FX Outlook: USD Decline v Inflation Differentials

- For 2024, EM currencies should have a tail wind of a further decline in the USD versus DM currencies, which will have a direct correlation effect but also benefit flows into EM bonds and equities. However, the slowdown in U.S. inflation means that most EM countries’ inflation will likely be higher than the U.S. in 2024, after the high U.S. inflation phase in 2022-23. More EM central banks will ease in 2024 taking advantage of the global picture and better domestically controlled inflation (outside of Argentina and Turkey). This means competing forces on EM currencies.

· In spot terms, we see the Indonesian Rupiah (IDR) and Malaysian Ringgit (MYR) rising against the USD as Fed rate cuts narrow interest rate differentials and a move away from an overvalued USD occurs. Brazilian Real (BRL) and Mexican Peso (MXN) will likely be stable against the USD, as still wide interest rate differentials are counterbalanced by the strength seen in these currencies in 2023. Chinese Yuan (CNY) will likely lose ground against the USD, as we see China preferring a soft CNY to partially counterbalance for the shift of exports away from China centric supply chains.

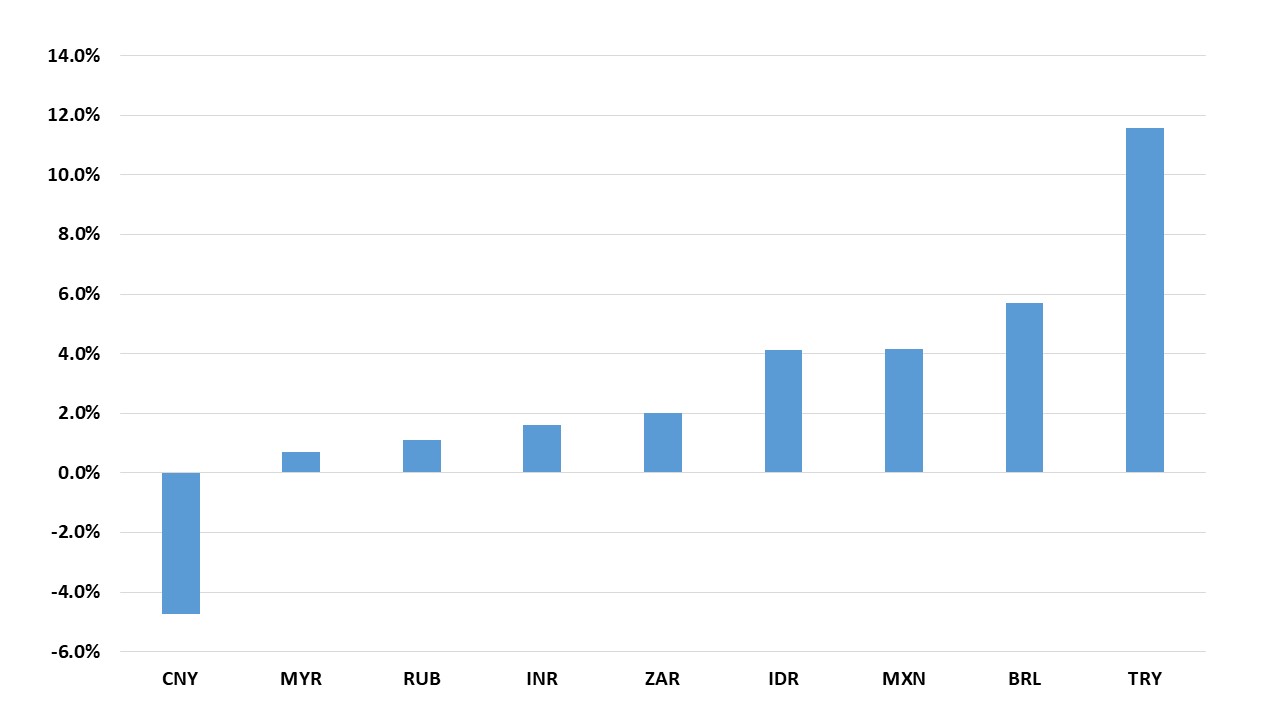

· In total currency terms (Figure 1), wide interest rate differentials become a force. BRL and MXN will remain attractive, but the Turkish Lira (TRY) at times could also attract carry trades. CNY will be the big loser, as interest rate differentials also remain adverse against the USD, as well as spot losses.

· Risks to our views: A recession in the U.S. would likely mean a larger decline of the USD versus DM currencies and spillover to benefit EM currencies. Alternatively, a renewed surge in U.S. 10yr yields could help the USD generally, but also cause funding problems for weak EM and frontier countries.

Figure 1: Our Forecast for Total Returns by end-2024 (vs. USD)

Source: Continuum Economics. Note: Spot prices as of December 18

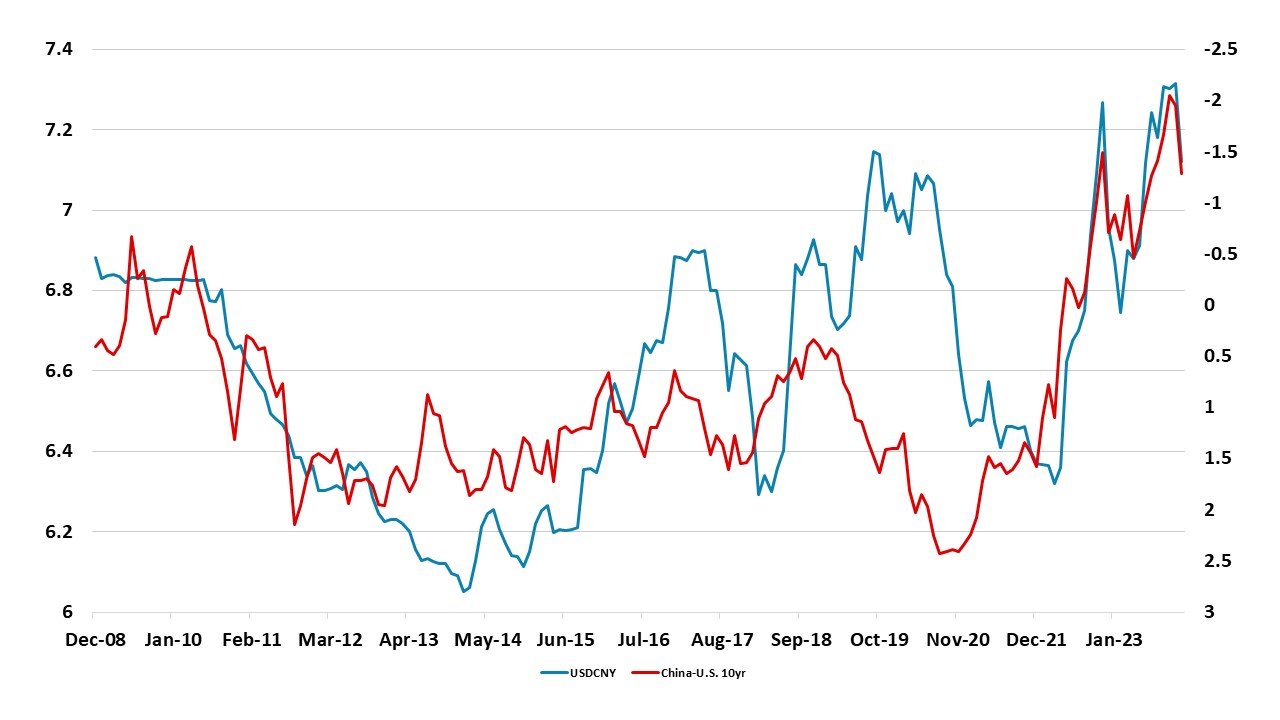

EM Asia FX

Our view remains that interest rate differentials and concerns about exports will remain a constraint to further Yuan gains. Though the market is now projecting consistent Fed rate cuts in 2024/25, we would still see the 10yr government bond yield spread narrowing only to around the 120-150bps area in 2024-25, as U.S. 10yr government bonds yields are likely to decline more slowly than the front-end of the curve and 10yr China yields can decline with 1% inflation. Figure 2 suggests that this is consistent with USDCNY in the 7.00-7.25 area. Additionally, China authorities understand that the weakness of exports is partially due to a strategic shift of some supply chains away from China to India/Vietnam/Mexico, which is clear in comparing China export growth into the U.S. v Mexico for example. Additionally, with inflation well below target, China does not have to worry about the import price and inflation effects from a moderate decline in the Yuan. This could mean that China’s authorities favor a modest decline in the Yuan in 2024/25, even when the USD more generally is declining from its overvalued levels. Thus we see scope for Yuan losses to resume through 2024, though the trend will be choppy and we see 7.30 by end 2024. Some further small Yuan losses are likely in 2025, despite further cuts from the Fed as long-term sentiment towards China will likely sour still further. We see 4.0% growth for China in 2025 and then slowing to 3.0% by 2027 (here). We see 7.35 by end 2025.

Figure 2: 10yr China-U.S. Government Bond Spread (%) and USDCNY (%)

Source: Datastream, Continuum Economics

Looking ahead to 2024, other EM Asia currencies are anticipated to strengthen slightly or stabilize. This shift is primarily attributed to the expected weakening of the USD as the Federal Reserve pivots towards easing consistently in 2024. Specifically, the USD/IDR exchange rate is projected to see an expected decrease to 14,990 by the end of 2024. The broadly positive Indonesian economic and political outlook should also help sentiment. Meanwhile, India's economy is anticipated to outperform its regional counterparts in 2024, positioning it as a viable alternative to China and attracting increased capital inflows. However, there are challenges such as a wide current account deficit and higher inflation than the U.S. Considering these dynamics, the USD/INR exchange rate is expected to reach 83.0 by end 2024. These Asian currencies are forecasted to witness only marginal weakening from their current levels in 2025, as their central banks will partially follow the Fed in cutting rates.

LatAm

The Brazilian Real (BRL) continued to show notable stability, and we believe it has finally reached what we consider its fair value, hovering around 4.9 BRL/USD. This stability can be attributed to the government's efforts to restore investor confidence, resulting in reduced BRL volatility during the first year of Lula's tenure. A pivotal factor contributing to this stability is the substantial interest rate gap between Brazil and advanced economies. In recent months, the expectation of a lower Fed Funds rate in 2024 has also contributed to the overall stability of the Brazilian currency. The Brazilian Central Bank (BCB) will continue to cut rates in 2024, and the yield gap versus the U.S. will narrow modestly, although we see the BCB making a pause in rate cuts in 2024. However, Brazil will continue to carry one of the highest interest rate premiums, which will contribute to the overall strength of the BRL.

One of the important factors that will test BRL strength will be the fiscal risks and a stagnation of export growth. We don’t expect Brazilian exports to perform as well in 2024 as they did in 2023. China's growth is slowing, and agricultural production will not grow strongly, curtailed by El Niño. Regarding the fiscal risk, it is clear that Brazil will not fulfill the 0% fiscal deficit target for 2024 and Debt/GDP in the next year. The overall perception is that the situation is far from catastrophic, but it is one of the reasons why we see the BRL strengthening stopping in 2024. Our end 2024 forecast is that the BRL will decline marginally from the current 4.9 USD/BRL to 4.95. Then, in 2025, we believe it will reach 5.05.

Figure 3: Mexico Exchange Rate (Inverse), 10-year Yield Spread, and Policy Rate Spread with U.S.

Source: Datastream and Continuum Economics

The Mexican Peso (MXN) has surprised during 2023, demonstrating remarkable resilience. Similar to Brazil, this strength can be attributed to the substantial interest rate differential with the United States and the outstanding performance of Mexican exports, particularly to the U.S. However, this strength will also be tested in 2024. Mexico passed a bill increasing the fiscal deficit in 2024 (here). Additionally, Banxico will likely cut more than the Fed, diminishing the interest rate gap. To this mix, we will likely see an increase in the volatility of MXN as Mexico will face elections in 2024, as campaigners will always promote big changes to Mexico's orthodox macroeconomic framework. However, most see it crystal clear that MORENA, the left party from current President Lopez-Obrador, will remain in power, and Congressional seats will remain more or less the way they are now. Therefore, no major change in Mexican politics is expected. We see the MXN being capped after this year’s appreciation, but still wide interest rate differentials will mean stability and we forecast 17.4 end 2024 for USD/MXN and 17.4 for end 2025.

Argentina has the most uncertainty around its exchange rate. The government has announced a strong devaluation of the official exchange rate in a clear attempt to unify the official rate with the black market rate. We foresee a series of reforms to equalize the multiple exchange rates into only one while keeping the restriction for the general public to access the scarce Central Bank FX reserves. This unification has strongly increased our forecast for Argentina Peso (ARS). We now see the USD/ARS ending 2023 at 890, rising to 1600 in 2024, and to 2400 in 2025. We see no room for dollarization in Argentina, and we will keep an eye on the basis on which the new IMF deal will be renegotiated.

EM EMEA

Emerging market currencies continue to be under pressure since domestic inflationary pressures remain strong along with budget deterioration and we are heading towards an election year in 2024 in South Africa, Russia and Turkiye. On the global level, volatility in commodity prices and China, U.S. & EU slowdowns can likely have negative impacts on the EMEA currencies in 2024, while monetary easing by developed country central banks can help emerging market currencies.

In South Africa, we expect the economy will be supported by a trade surplus in 2024 coupled with probable Fed and ECB easing which can increase investor’s appetite for South Africa and relieve pressure on the South African Rand (ZAR). However, it is worth mentioning that we expect a moderate fall in the trade surplus mostly due to global slowdown, particularly from China and the EU.

We do foresee an end to SARB tightening and likely easing to start in Q2 of 2024 if the CPI trajectory allows (we forecast a slowdown to 4.9% for 2024 CPI), and we think the easing process will help fixed income returns. Despite the positive outlook, downside risks remain for the ZAR such as deterioration in the fiscal performance, concerns over the power and logistics crisis and most importantly the election outcome. In this framework, we see a small ZAR weakening against the USD to 18.5 by end 2024. We do foresee some moderate volatility during the year as South Africa will hold presidential elections in May-August, but any Q4 ZAR recovery will be weak due to uncertainty about the 2024 election impact on policy.

As we rightly forecast in the September outlook, it appears USD/Turkish Lira (TRY) would move to 30 by the end of 2023. We see losses for TRY in the next year as imports are growing faster than exports, inflation remains elevated, trade and budget deficits increase, and foreign capital inflows remain weaker than expected. We predict the USD/TRY rate at 37.5 and 45 by the end of 2024 and 2025, respectively.

Despite the negative TRY trajectory, the central bank continues to regain credibility via determined key rate hikes and we foresee an improvement in foreign capital inflows thanks to a return to traditional economic policy making processes, and this should slow the TRY pace of decline in H2 2024 onwards. We also see some success in slowing Turkish inflation in 2024 and 2025, which will slow the necessary pace of depreciation.

Like TRY, stability in Russian ruble (RUB) continues to be muddled as monetary tightening has picked up pace and restrictive monetary policy sustainability concerns remain. The RUB also remains mostly uninvestable due to the ongoing war in Ukraine creating severe risks, elevated inflation, and decreasing trade income among other macroeconomic concerns.

The fall in the current account surplus was also remarkable in 2023 so far. According to the CBR’s figures in November, the country’s foreign trade surplus in goods fell 61.5% YoY to $104 billion in the first 10 months of 2023 from $271.6 billion in the same period of 2022. We anticipate further deterioration in the trade balance is likely in 2024 and 2025, particularly if war related sanctions and the Russian oil price cap remain.

Our forecasts for the USD/RUB exchange rate by the end of 2024 and 2025 are 98.2 and 99.2, respectively, as we expect no immediate return by foreign investors in the coming years. Taking into account that the current account surplus is shrinking and inflation spiking, we foresee the RUB remaining weak. The authorities may also intend to allow continued RUB weakness to sustain competitiveness during a period of CBR’s hawkish stance, which has been proved by recent hikes of the policy rate up to 16%.

Figure 4: USD/ZAR Rate (LHS) and 10yr SA-U.S. Government Bond Yield Differentials Inverted (RHS)

Source: Datastream, Continuum Economics