Commodities Outlook: A Promising Horizon

- West Texas Intermediate (WTI) is predicted to fluctuate between $70 and $95 per barrel throughout the year, reaching $82 by the end of 2024. Geopolitical tensions, demand from China, and OPEC+ production cuts are the leading factors influencing prices. Looking ahead, with gradual easing of cuts expected during H1 2025 and increased oil production from non-OPEC countries, prices are forecast to reach $77 per barrel by the end of 2025.

- Copper demand in China is poised for a structural shift, with growth no longer primarily reliant on the property sector but on the electric vehicles and solar panels industries. In light of a series of headwinds impacting supply, we have revised our forecast upwards for copper to $9,100 per ton by the end of 2024. It will become increasingly important to monitor trade developments between the U.S. and Europe with China which could impact copper-intensive industries. We see copper at $9,400 per ton by the end of 2025.

- Gold is anticipated to retain its status as a top-performing asset in 2024, bolstered by central bank purchases aiming to diversify reserves. Additional support may come from monetary easing in the U.S. and Europe. Geopolitical tensions and healthy demand from sectors such as technology and jewelry also exert influence on prices. We forecast a year-end price of $2,200 per ounce for 2024 and $2,100 per ounce by the end of 2025 (assuming a slowdown in central bank buying next year).

Oil: Looking for Guidance

WTI price has fluctuated in the range of $70 and $85 per barrel during the first quarter of the year. More recently, prices have remained anchored in the upper range as markets look for guidance, assessing both upside (geopolitical tensions and production cuts) and downside risks (demand growth expectations). Our baseline demand and supply scenarios indicate that oil would fluctuate between $70 and $95 per barrel throughout the rest of the year; specifically, we foresee WTI at $82 per barrel by the end of 2024.

On the demand front, China’s consumption will be key in the narrative of oil prices. In this regard, we remain conservative on the oil needs of the Asian country. First, we interpret that the pent-up demand of oil post-pandemic will slow. Second, we argue that the targeted fiscal stimulus provided by the government is not sufficient to boost consumption for crude. Third, the country’s push for electric vehicles will progressively continue capping oil’s demand growth. In other regions, the outlook varies. In the U.S., consumption has proven to be more resilient than expected. Moreover, in the midst of a soft landing coupled with the start of a monetary easing cycle, demand for oil is set to remain healthy. Unlike the U.S., the bleak economic growth that we expect in Europe would not be a factor setting the tone for oil prices.

Our baseline supply scenario remains consistent with the one from our previous assessment. Indeed, as we anticipated, OPEC+ members extended their productions cuts into the second quarter of the year. Looking ahead, increasing output from non-OPEC countries together with a lack of significant demand growth, leads us to expect that these cuts will be extended into the second half of the year and slowly reversed during H1 2025.

We foresee that several risks could affect our baseline scenario and thus, our forecast. The first one is related to geopolitical conflicts, including the war in Ukraine and the ongoing tensions in the Middle East. Our view, however, is that the market has already incorporated most of the risk premium associated with the Israel-Hamas conflict. Nevertheless, if an escalation takes place in either conflict and the disruptions in the oil market become more tangible, we could see WTI surpassing the upper bound of our estimated range for the year. Secondly, a change in OPEC’s policy, such as reversing the cuts earlier than expected or non-compliance with production quotas, could undermine the cartel’s position to influence oil prices. Certainly, either of these scenarios could alleviate market pressure and result in a drop in oil prices. Finally, weaker than expected demand in China would pressure prices lower than in our baseline scenario.

Consistent with our expectations of OPEC+ gradually easing production cuts in H1 2025 to regain market share and taking into account the ongoing rise in oil production from non-OPEC countries alongside the absence of significant global economic growth to drive oil demand, we anticipate oil prices to reach $77 by the end of 2025.

Copper: Green Transition to Replace Property Sector?

Policies affecting the property and construction sectors in China will naturally influence the narrative of copper prices. In fact, the country’s housing minister recently underscored a shift in China’s strategy toward the property sector. In particular, the approach will migrate from one that has focused on speed and quantity to one that will focus on building affordable housing, renovating urban villages and constructing emergency public facilities. This shift of paradigm is consistent with our view (here) in which we argue that the property sector will not see a rebound in the coming years and thus boost copper demand. However, this is just one side of the story regarding China’s demand for the metal; the other one relates to the country’s growing interest in expanding its electric vehicles (Figure 1) and solar panel industries. The demand for copper has remained resilient in the country despite the property downturn because of the developments in these other two industries. Our view is that these sectors will provide support to prices and be determinants in the coming years to define the price of the metal.

In the rest of the world, three additional factors will be relevant in guiding the price of copper. First is the anticipated pivot in the Fed’s monetary policy, which is expected to start easing by the end of the second quarter, weakening the USD and making copper – a commodity priced in USD – relatively cheaper. Then, lower interest rates could also promote new investments in the industry as borrowing costs decrease. Finally, a recovery in global manufacturing would also support the demand for the commodity.

Developments in the supply side of the equation are becoming increasingly relevant, in particular, as the market has been hit by a series of headwinds. By the end of 2023, Panama’s government ordered the shutdown of First Quantum Minerals Ltd. copper mine, which is estimated to produce 1.5% of the world’s copper production – as reported by Bloomberg. More recently, amid an expansion of China’s smelting and refining capacity, which has resulted in lower treatment and refining charges, a group of smelters in the country agreed to cut production. These supply constraints are expected to be accompanied by a series of disruptions that have a history within the industry, including strikes in Peruvian and Chilean mines, as well as operational and weather difficulties.

As a result of the newest supply chain disruptions, we have revised upwards our forecast to $9,100 per ton by the end of 2024. In this regard, we remain cautious amid the uncertainty surrounding China’s property sector demand, which could be a drag on the commodity’s price. Looking into 2025, we believe demand growth will continue its pace and even though supply disruptions might have eased by the end of the year, the market could still see deficits. It will also be relevant to monitor trade developments between the U.S. and Europe with China, as new tariffs on electric vehicles and solar panels could hurt the demand for copper. We now see copper at $9,400 per ton by end 2025.

Figure 1: Sales of New Energy Vehicles in China (Millions)

Source: Continuum Economics / China Association of Automobile Manufacturers

Gold: Momentum to Persist

Gold is expected to remain one of the better performer assets throughout 2024. From a demand perspective, central bank buying continues to be the most relevant factor in providing support to the metal’s price. These entities have carried on diversifying their FX reserves to protect against currency, financial, and geopolitical risks. In this regard, as we have argued in previous assessments, the People’s Bank of China continues to be the key central bank buyer; however, data from the World Gold Council suggests that, compared to other economies, China lags in terms of its gold holdings as a proportion of their foreign reserves (here). Thus, our view is that this trend would likely continue for the rest of the year.

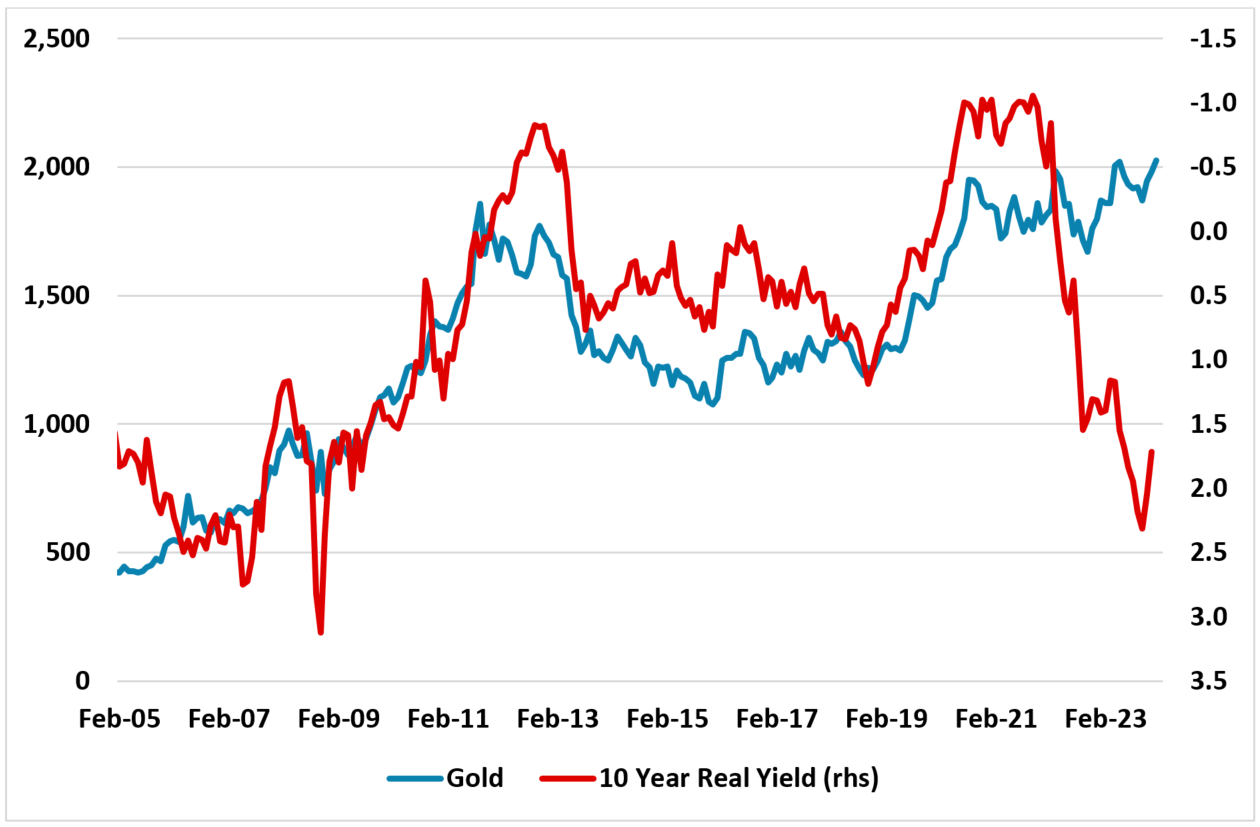

A second element that could provide support to gold prices will be the start of a monetary easing cycle in the United States and Europe; in particular, we see 10yr US treasuries at 3.9% by the end of 2024. It is worth noting that since real yields started an upward trend during the first quarter of 2022, the inverse relationship between the commodity’s price and 10yr US treasuries has fallen apart (Figure 2) – which we believe is mostly explained by central bank buying. If central bank buying slowed dramatically, it could mean a reconnect with real U.S. 10yr yields and a gold price fall. Given our forecast of just a marginal drop in 10yr U.S. treasury yields during 2024, we think the shift in policy rates will provide support but not boost the metal’s price. In this matter, a weaker USD resulting from the U.S. policy easing, would be another supportive element.

Additional factors will also play a role in guiding gold’s price. The first one has to do with the risk premium associated to geopolitical conflicts, namely Ukraine-Russia, China-Taiwan and Israel-Hamas. Also, demand from the private consumption sector (technology and jewelry) are expected to remain healthy – particularly in countries such as China and India. Our analysis leads us to forecast gold price at $2,200 per ounce by the end of 2024. For next year, the main question remains whether the buying spree from central banks will continue, and while there is no definite answer, we think that it would likely slow down by the end of 2025. This scenario, coupled with a deceleration in the pace of the Fed's monetary policy easing could then drag gold’s prices to $2,100 by the end of 2025.

Figure 2: Gold Price (USD) and 10 Year U.S. Treasury Real Yields Using Breakeven Inflation (Inverse, %)

Source: Continuum Economics