Data Previews

View:

October 02, 2025

Preview: Due October 3 - U.S. September ISM Services - August bounce was flattered by seasonal adjustments

October 2, 2025 3:45 PM UTC

We expect slippage in September’s ISM services index to 51.0 from 52.0, still above the levels seen in May, June and July, but implying a subdued pace of economic growth.

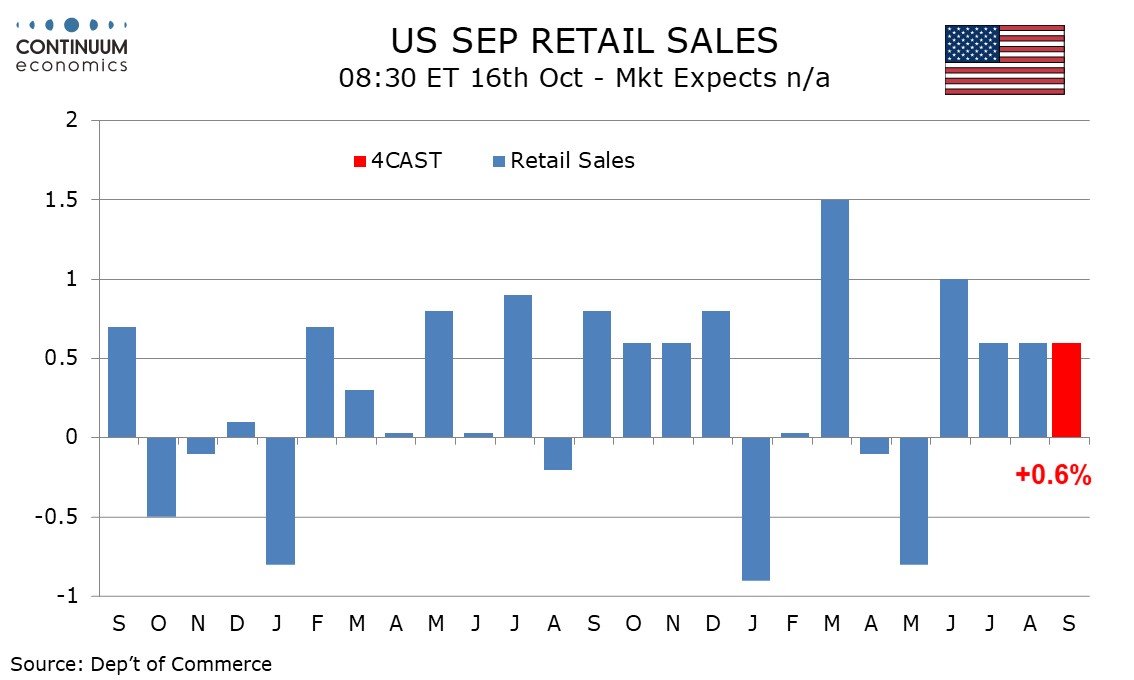

Preview: Due October 16 (dependent on shutdown ending) - U.S. September Retail Sales - Still growing, if more on prices than volumes

October 2, 2025 12:53 PM UTC

We expect a third straight 0.6% increase in retail sales in September, with slightly over half of the increase coming in prices, leaving only moderate growth in real terms. We also expect 0.6% increase ex autos but a slightly weaker 0.5% increase ex autos and gasoline.

October 01, 2025

Preview: Due October 16 (dependent on shutdown ending) - U.S. Setember PPI - Closer to trend after strong July and weak August

October 1, 2025 7:36 PM UTC

We expect September PPI to rise by 0.4% overall and 0.3% ex food and energy, with the latter gain coming near the average of a 0.7% bounce in July that was corrected by a 0.1% decline in August. Ex food, energy and trade we expect a moderate 0.2% increase after gains of 0.3% in August and 0.6% in Ju

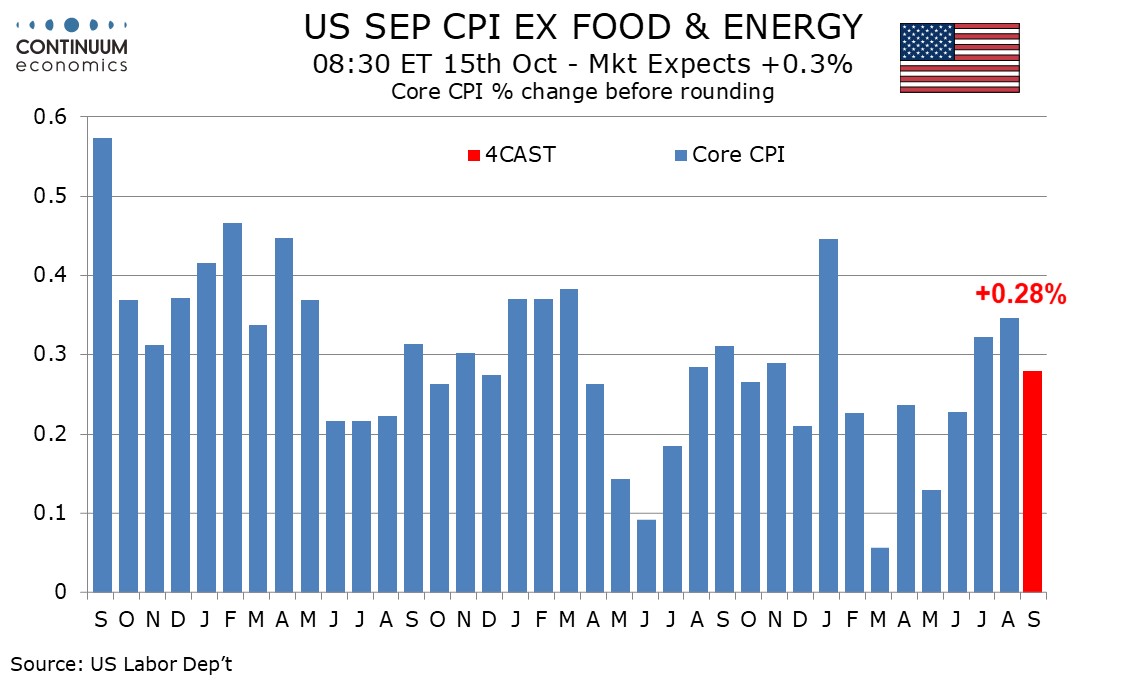

Preview: Due October 15 (dependent on shutdown ending) - U.S. September CPI - Firm but a little less so in core rate

October 1, 2025 6:29 PM UTC

We expect September CPI to increase by 0.4% overall and by 0.3% ex food and energy, matching August’s outcomes after rounding, though before rounding we expect overall CPI to be rounded down from 0.425%, and the core rate to be rounded up from 0.28%, contrasting August data when headline CPI was r

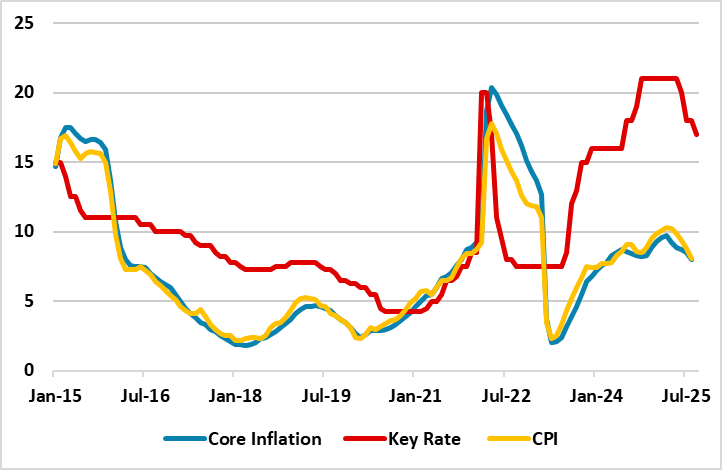

Russia’s Inflation is Expected to Continue to Soften in September

October 1, 2025 1:35 PM UTC

Bottom Line: We expect Russian inflation to continue its decreasing pattern in September, after hitting the softest rate since April of 2024 with 8.1% YoY in August, particularly thanks to lagged impacts of previous aggressive monetary tightening coupled with softening services and food prices. Sep

September 30, 2025

Preview: Due October 1 - U.S. September ISM Manufacturing - Firmer but still short of neutral

September 30, 2025 3:00 PM UTC

We expect a September ISM manufacturing index of 49.0, returning to June’s level after rising to 48.7 in August from 48.0 in July. The index has not been above neutral since February.

Preview: Due October 1 - U.S. September ADP Employment - May get more attention if Federal government shuts down

September 30, 2025 12:33 PM UTC

We expect a rise of 45k in August’s ADP estimate for private sector employment growth. This would match our forecast for overall non-farm payrolls but underperform our 50k forecast for private payrolls, correcting from three straight modest outperformances.

September 25, 2025

Preview: Due October 7 - U.S. August Trade Balance - Deficit to reverse most of a July increase

September 25, 2025 4:48 PM UTC

We expect an August trade deficit of $60.2bn, down from $78.3bn in July but slightly wider than June’s $59.1bn deficit that was the narrowest since March 2023. The deficit remains in a correction from elevated pre-tariff levels that brought a record high of $136.4bn in March.

Preview: Due September 26 - U.S. August Personal Income and Spending - Savings higher after GDP revisions

September 25, 2025 3:04 PM UTC

We expect August data to show 0.3% gains in both overall and core PCE prices, with personal income also up by 0.3% and personal spending slightly stronger at 0.4%. The data will incorporate historical revisions through Q2 seen with the GDP revisions.

September 24, 2025

Preview: Due October 1 - U.S. September ADP Employment - May get more attention if Federal government shuts down

September 24, 2025 5:19 PM UTC

We expect a rise of 45k in August’s ADP estimate for private sector employment growth. This would match our forecast for overall non-farm payrolls but underperform our 50k forecast for private payrolls, correcting from three straight modest outperformances.

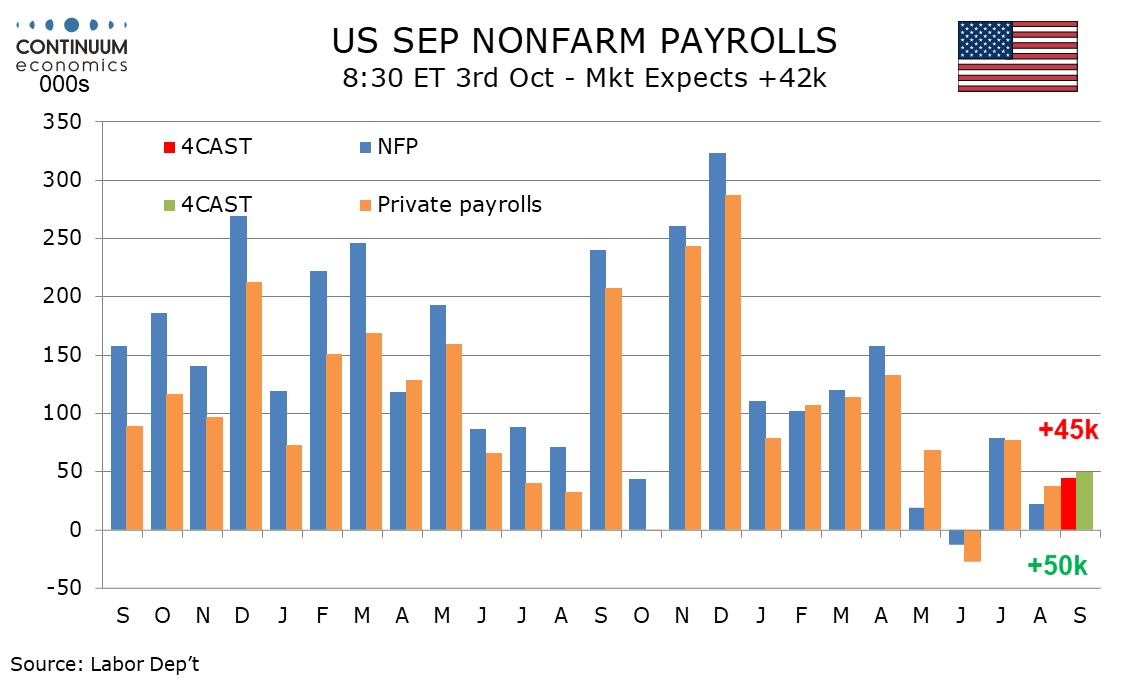

Preview: Due October 3 - U.S. September Employment (Non-Farm Payrolls) - Still subdued, but slightly stronger than in August

September 24, 2025 3:28 PM UTC

We expect September’s non-farm payroll to show another subdued rise, of 45k, with 50k in the private sector, but marginally stronger than July’s respective gains of 22k and 38k. We expect unemployment to slip to 4.2% from 4.3% on a fall in the labor force, while average hourly earnings maintai

Preview: Due September 25 - U.S. August Advance Goods Trade Balance - Returning to trend

September 24, 2025 12:53 PM UTC

We expect an August goods trade deficit of $96.0bn, down from $102.8bn in July and slightly wider than the average of July and June’s $84.5bn. The deficit will be similar to May’s and well below the Q1-pre-tariff levels, but not far from the pre-election trend.

Preview: Due September 25 - U.S. August Durable Goods Orders - Correcting lower

September 24, 2025 12:47 PM UTC

We expect August durable goods orders to fall by 1.0% in a third straight fall, though still not fully reversing a surge of 16.6% in May, while ex transport orders fall by 0.5% in a correction from a 1.0% July increase, that was the strongest of three straight gains.

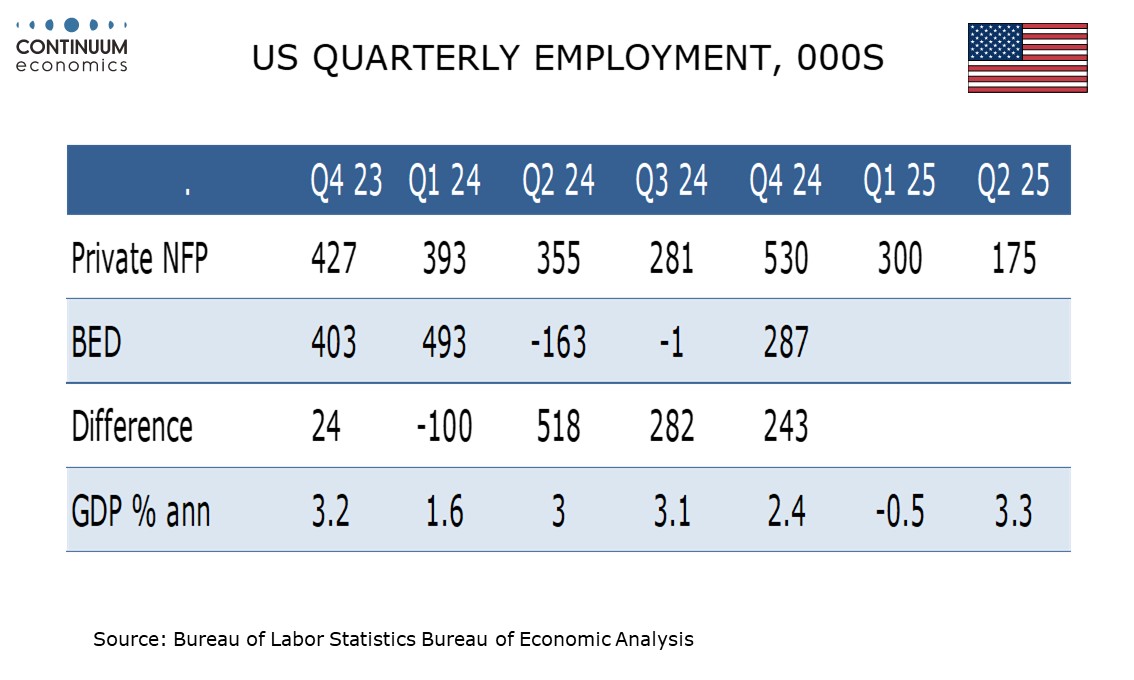

Preview: Due September 25 - U.S. Final (Third) Estimate Q2 GDP - Historical revisions due

September 24, 2025 12:28 PM UTC

We do not expect any significant revision in the third (final) estimate of Q2 GDP from the second (preliminary) estimate of 3.3%. However the data will include historical revisions, and here risk is on the downside, particularly for 2024.

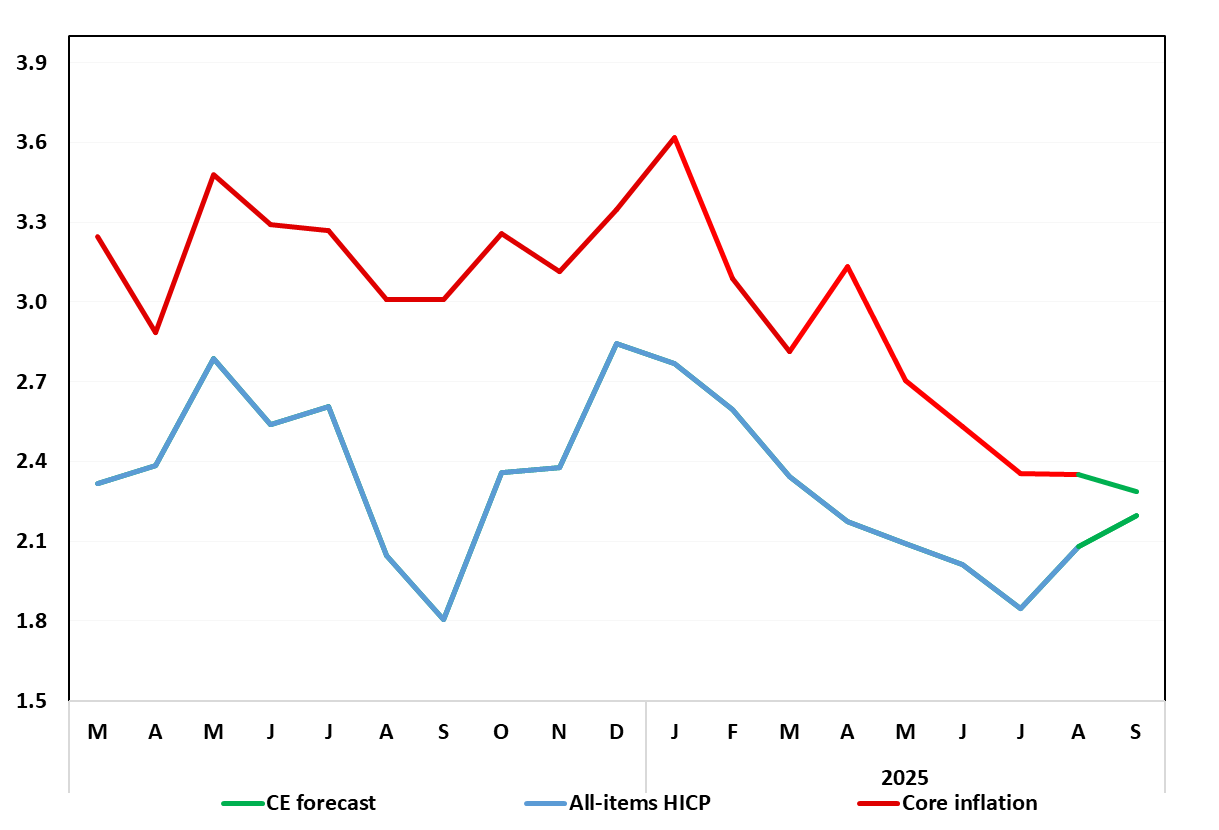

EZ HICP Preview (Oct 1): Headline Inflation to Edges Higher as Services Slows to Fresh Cycle-low

September 24, 2025 10:54 AM UTC

As we have underlined of late, HICP inflation – at target for the last three months – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not be altered by the flash HICP dat

September 23, 2025

Preview: Due October 3 - U.S. September ISM Services - August bounce was flattered by seasonal adjustments

September 23, 2025 4:08 PM UTC

We expect slippage in September’s ISM services index to 51.0 from 52.0, still above the levels seen in May, June and July, but implying a subdued pace of economic growth.

Preview: Due October 1 - U.S. September ISM Manufacturing - Firmer but still short of neutral

September 23, 2025 3:00 PM UTC

We expect September’s ISM manufacturing index to 49.0, returning to June’s level after rising to 48.7 in August from 48.0 in July. The index has not been above neutral since February.

German HICP Preview (Sep 30): Headline Higher But Core to Fall Further?

September 23, 2025 2:21 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that

Preview: Due September 24 - U.S. August New Home Sales - Stable trend, downside risk

September 23, 2025 2:07 PM UTC

We expect an August new home sales level of 625k, which would be a 4.1% decline if July’s 0.6% decline to 652k is unrevised. The level would be the lowest since October 2023. Trend has been fairly stable but the NAHB survey suggests there may be some near term downside risk.

September 22, 2025

Preview: Due September 25 - U.S. August Existing Home Sales - Slightly weaker for sales and prices

September 22, 2025 12:59 PM UTC

We expect August existing home sales to slip by 2.5% to 3.91m to resume a modestly negative trend after a 2.0% increase in July. This would take the level to its lowest since September 2024.

Preview: Due September 23 - U.S. September S&P PMIs - Recent strength difficult to sustain

September 22, 2025 12:37 PM UTC

We expect September’s S and P PMIs to slip, manufacturing to 51.5 from 53.0 and services to 53.5 from 54.5. We expect slippage more because recent strength looks difficult to sustain rather than because of any clear signals for weakness.

Preview: Due September 23 - U.S. Q2 Current Account - Correction from record pre-tariff deficit

September 22, 2025 12:28 PM UTC

We expect a Q2 US current account deficit of $256bn, down from the record $450.2bn in Q1, when imports surged in anticipation of tariffs, before correcting sharply lower in Q2. Q2’s deficit would then be the lowest since Q4 2023. As a proportion of GDP the deficit would be 3.4%, down from 6.0% in

September 16, 2025

Preview: Due September 26 - U.S. August Personal Income and Spending - Core PCE Prices moving higher

September 16, 2025 3:36 PM UTC

We expect August data to show 0.3% gains in both overall and core PCE prices, with personal income also up by 0.3% and personal spending slightly stronger at 0.4%. The data will incorporate historical revisions through Q2 due with the annual GDP revision scheduled for September 25.

Preview: Due September 25 - U.S. August Advance Goods Trade Balance - Returning to trend

September 16, 2025 2:44 PM UTC

We expect an August goods trade deficit of $96.0bn, down from $102.8bn in July and slightly wider than the average of July and June’s $84.5bn. The deficit will be similar to May’s and well below the Q1-pre-tariff levels, but not far from the pre-election trend.

September 15, 2025

Preview: Due September 16 - Canada August CPI - Higher as year ago weakness drops out

September 15, 2025 1:09 PM UTC

Weakness a year ago is likely to see August Canadian CPI picking up on a yr/yr basis, we expect to 2.0% from 1.7%. The Bank of Canada’s core rates are likely to remain fairly stable, and above the 2.0% target.

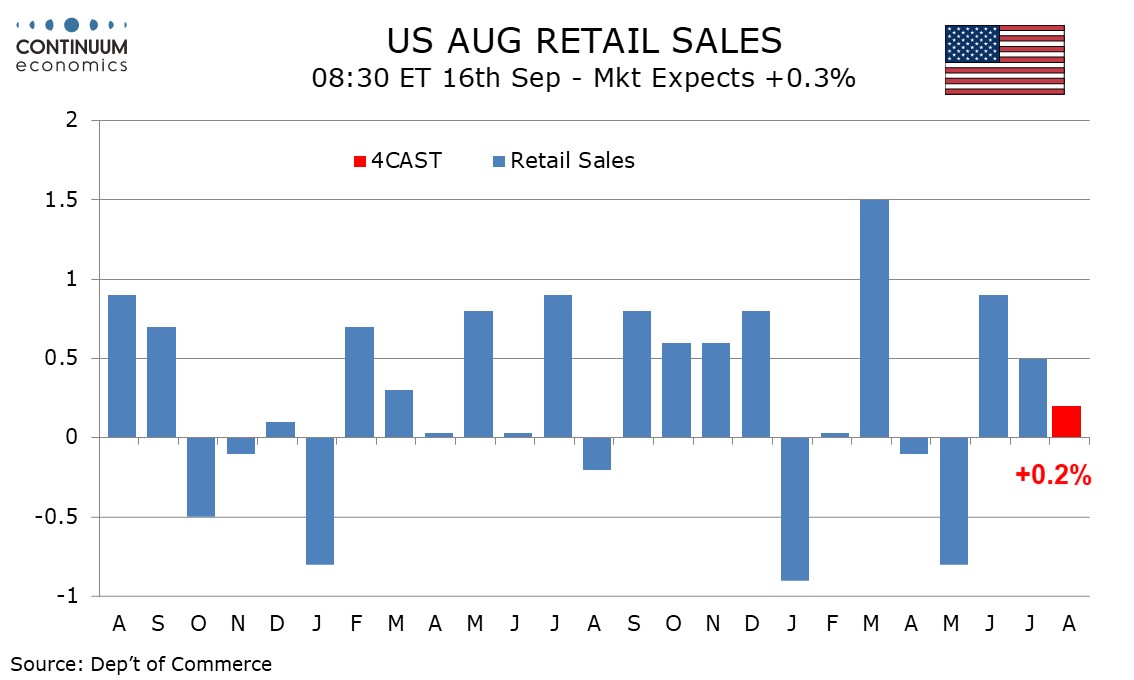

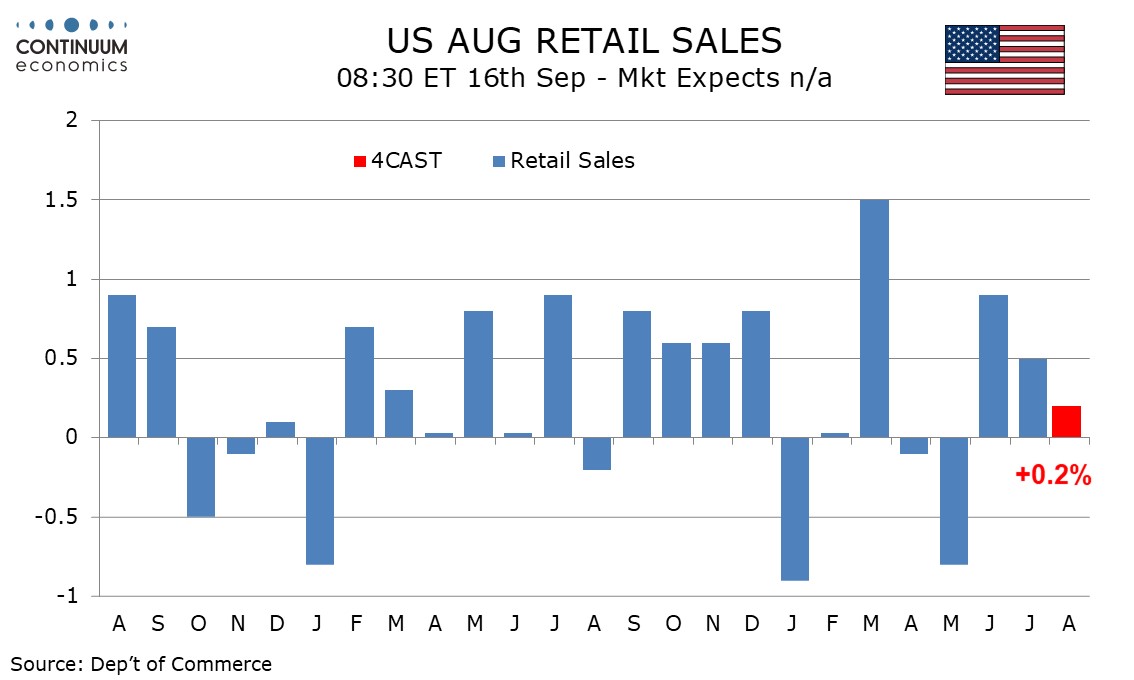

Preview: Due September 16 - U.S. August Retail Sales - Autos to slip, but core rates to maintain trend

September 15, 2025 12:16 PM UTC

We expect a modest 0.2% increase in August retail sales restrained by a correction lower in auto sales. However we expect the core rates ex autos and ex autos and gasoline to maintain trend with gains of 0.4%.

September 12, 2025

Preview: Due September 25 - U.S. Final (Third) Estimate Q2 GDP - Historical revisions due

September 12, 2025 6:30 PM UTC

We do expect any significant revision in the third (final) estimate of Q2 GDP from the second (preliminary) estimate of 3.3%. However the data will include historical revisions, and here risk is on the downside, particularly for 2024.

Preview: Due September 23 - U.S. September S&P PMIs - Recent strength difficult to sustain

September 12, 2025 5:13 PM UTC

We expect September’s S and P PMIs to slip, manufacturing to 51.5 from 53.0 and services to 53.5 from 54.5. We expect slippage more because recent strength looks difficult to sustain rather than because of any clear signals for weakness.

Preview: Due September 23 - U.S. Q2 Current Account - Correction from record pre-tariff deficit

September 12, 2025 1:22 PM UTC

We expect a Q2 US current account deficit of $256bn, down from the record $450.2bn in Q1, when imports surged in anticipation of tariffs, before correcting sharply lower in Q2. Q2’s deficit would then be the lowest since Q4 2023. As a proportion of GDP the deficit would be 3.4%, down from 6.0% in

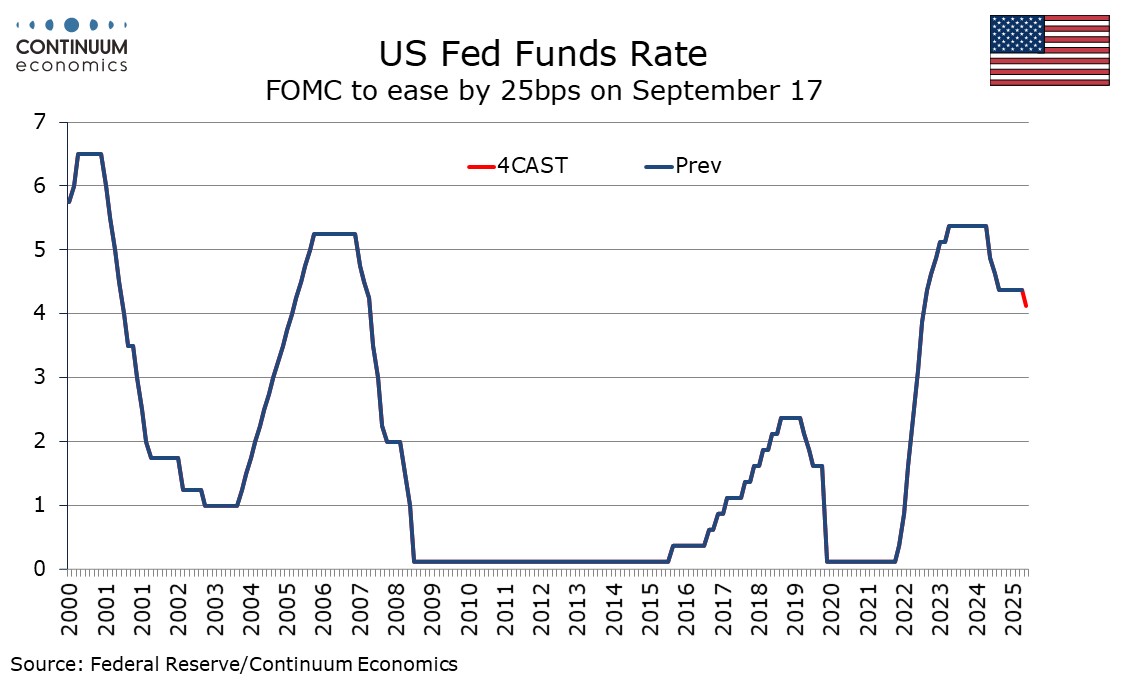

FOMC Preview for September 17: 25bps Easing on Increased Labor Market Risk

September 12, 2025 10:30 AM UTC

The FOMC meets on September 17 and we expect a 25bps easing to a 4.0-4.25% Fed Funds target range. The FOMC will continue to see similar upside risks to inflation but increased downside risks to the Labor Market. The dots are likely to continue to expect only one more move in 2025, but three moves i

September 10, 2025

Preview: Due September 25 - U.S. August Durable Goods Orders - Correcting lower

September 10, 2025 1:57 PM UTC

We expect August durable goods orders to fall by 1.0% in a third straight fall, though still not fully reversing a surge of 16.6% in May, while ex transport orders fall by 0.5% in a correction from a 1.0% July increase, that was the strongest of three straight gains.

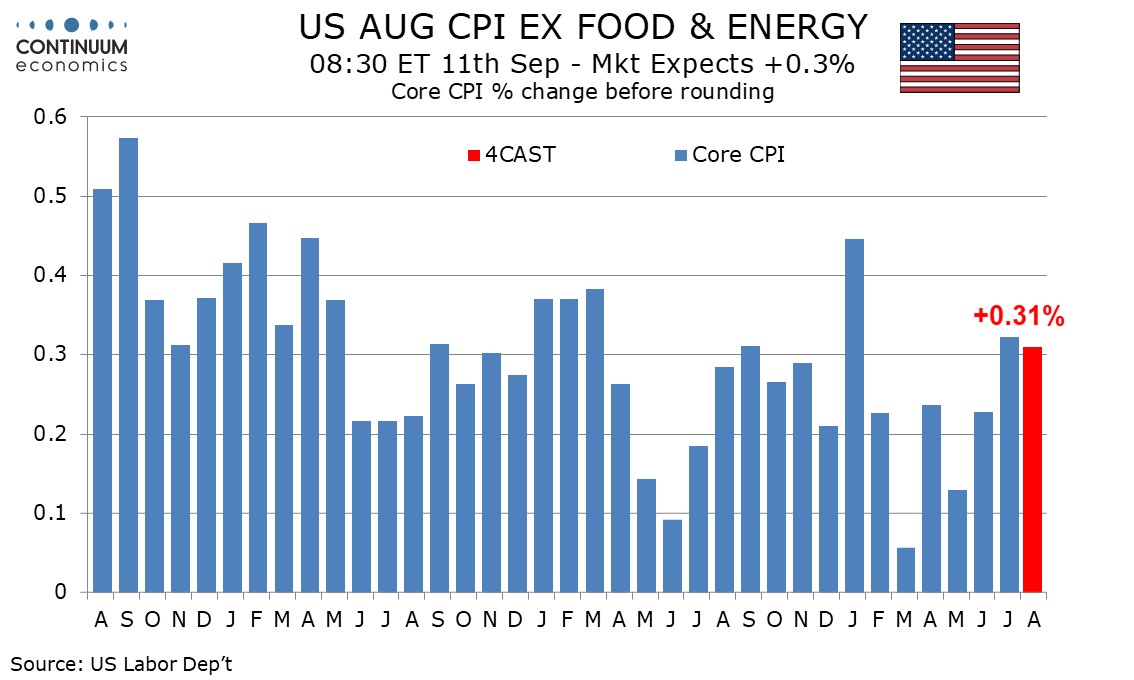

Preview: Due September 11 - U.S. August CPI - Tariff impact slowly building

September 10, 2025 1:15 PM UTC

We expect August CPI to increase by 0.4% overall and by 0.3% ex food and energy, with the respective gains before rounding being 0.37% and 0.31%. This would be the second straight gains slightly above 0.3% in the core rate with the impact of tariffs starting to escalate.

UK CPI Preview (Sep 17): Goods Inflation the Recent Problem, Not Services?

September 10, 2025 9:05 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Partly due to rounding and fuel (and possibly food) costs, we see the headline rising a notch to 3.9% in the August figure, this foresh

September 09, 2025

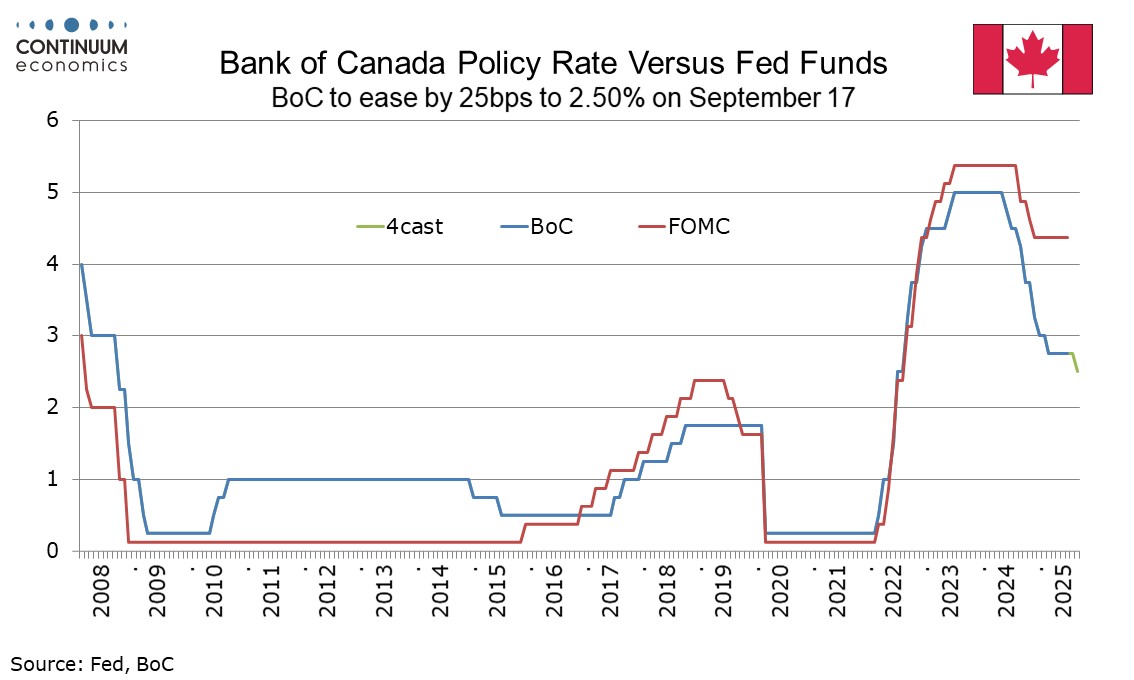

Bank of Canada Preview for September 17: Weak data justifies resumption of easing

September 9, 2025 6:26 PM UTC

After the Bank of Canada’s last meeting on July 30 we expected rates to be left on hold in September before easing resumed in October. However with data since that meeting having been mostly weak, a 25bps easing, the first move since March, now looks likely at the September 17 meeting, to 2.5%. We

Preview: Due September 24 - U.S. August New Home Sales - Stable trend, downside risk

September 9, 2025 2:58 PM UTC

We expect an August new home sales level of 625k, which would be a 4.1% decline if July’s 0.6% decline to 652k is unrevised. The level would be the lowest since October 2023. Trend has been fairly stable but the NAHB survey suggests there may be some near term downside risk.

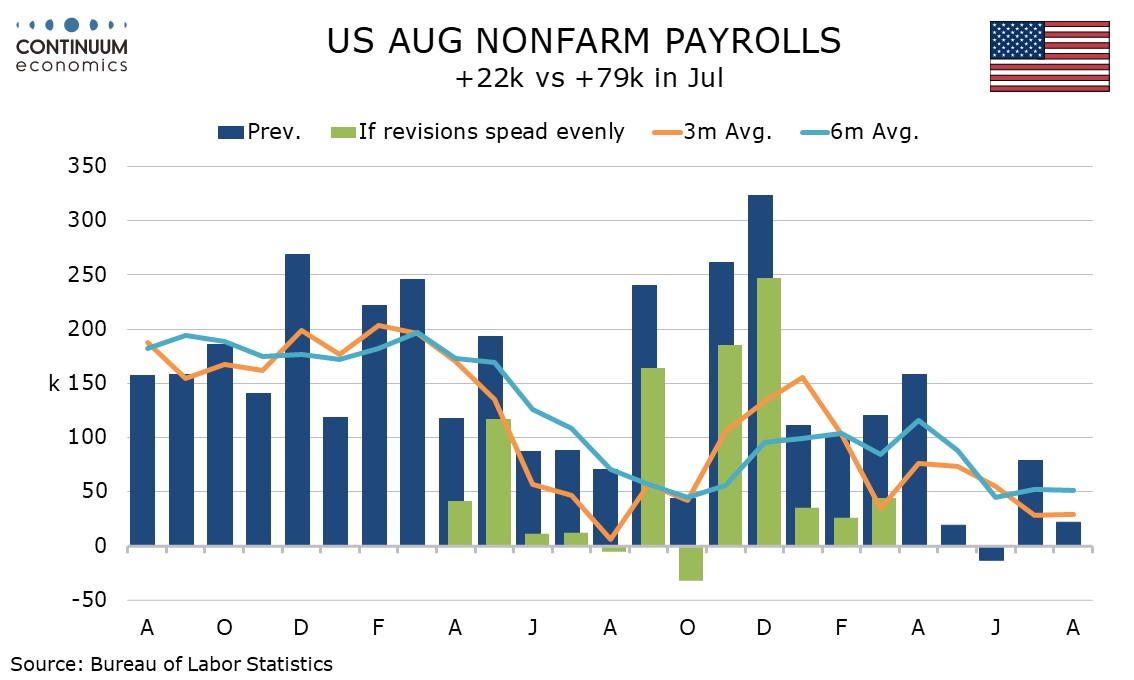

U.S. March 2025 Non-Farm Payroll Benchmark Revised Down by a Preliminary 911k

September 9, 2025 2:32 PM UTC

The preliminary estimate for the downward revision to the March 2025 non-farm payroll benchmark at -911k is steeper than generally than expected and exceeds even the unusually sharp 818k negative revision reported a year ago for the March 2024 benchmark. The data will be incorporated into the Januar

Preview: Due September 10 - U.S. August PPI - A moderate gain after a surge in July

September 9, 2025 12:40 PM UTC

We expect August PPI to rise by 0.3% overall and 0.2% ex food and energy, moderate gains after shocking surges of 0.9% in each series in July, which broke a string of mostly subdued outcomes from February through June. Ex food, energy and trade, we expect a 0.3% increase to follow a 0.6% rise in Jul

September 08, 2025

Preview: Due September 23 - U.S. August Existing Home Sales - Slightly weaker for sales and prices

September 8, 2025 7:12 PM UTC

We expect August existing home sales to slip by 2.5% to 3.91m to resume a modestly negative trend after a 2.0% increase in July. This would take the level to its lowest since September 2024.

Expecting a Negative Non-Farm Payroll Benchmark Revision

September 8, 2025 3:25 PM UTC

Tuesday sees the release of the preliminary Labor Dep’t estimate for the March 2025 non-farm payroll benchmark, with expectations for a significant negative, possibly as large as the -818k preliminary estimate for the March 2024 benchmark delivered a year ago. The eventual revision to March 2024 p

September 05, 2025

September 04, 2025

Preview: Due September 16 - U.S. August Retail Sales - Autos to slip, but core rates to maintain trend

September 4, 2025 6:53 PM UTC

We expect a modest 0.2% increase in August retail sales restrained by a correction lower in auto sales. However we expect the core rates ex autos and ex autos and gasoline to maintain trend with gains of 0.4%.

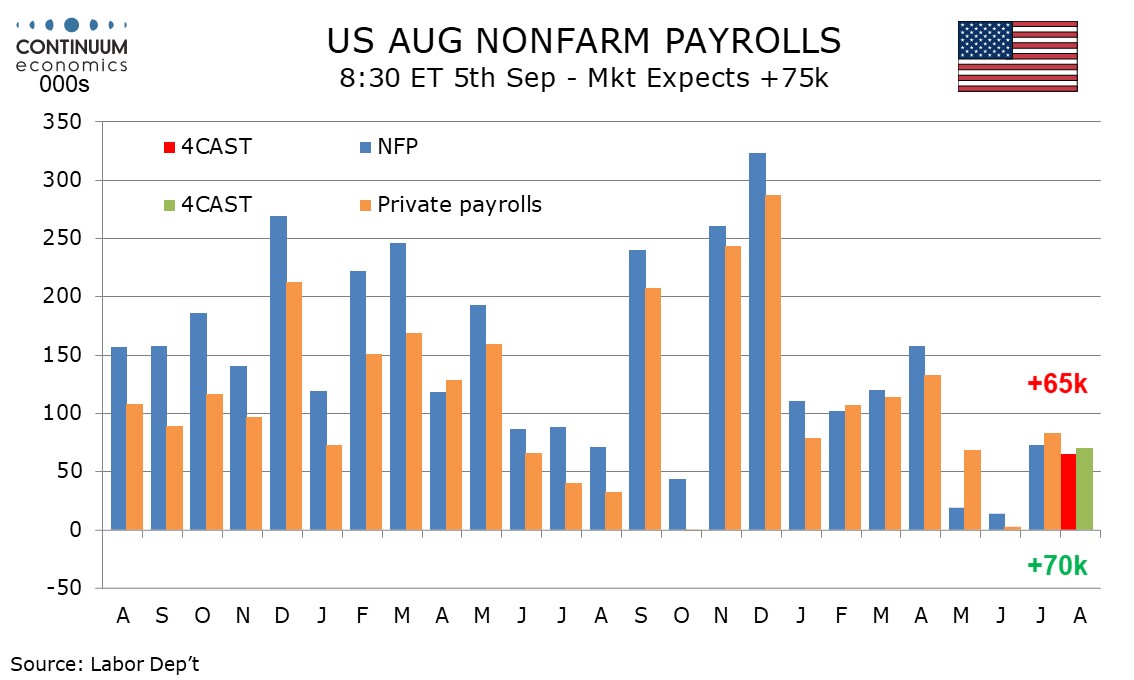

Preview: Due September 5 - U.S. August Employment (Non-Farm Payrolls) - Similar to July's, still not recessionary

September 4, 2025 2:45 PM UTC

We expect August’s non-farm payroll to look similar to July’s, with a rise of 65k versus 73k in July, above the 14k rise of June and the 19k rise of May but well below the trend that was running above 100k through April. We also expect unemployment to remain at July’s 4.2% rate and a second st

September 03, 2025

Preview: Due September 4 - U.S. August ISM Services - Holding above neutral, with stronger prices

September 3, 2025 1:26 PM UTC

We expect an increase in August’s ISM services index to 51.5, up from 50.1 in July but still keeping the index in the subdued 49.9 to 51.6 range that has been seen since March.

Preview: Due September 4 - U.S. July Trade Balance - Deficit to rise as imports from China rebound

September 3, 2025 12:39 PM UTC

We expect a July goods trade deficit of $79.2bn, up from $60.2bn in June. The deficit will compare to a Q2 average of $64.0bn but remain well below Q1’s pre-tariff average of $130.2bn. It will be similar to where trend was before the November election result signaled higher tariffs were coming.

Preview: Due September 4 - U.S. August ADP Employment - Slower than July which corrected a June decline

September 3, 2025 12:23 PM UTC

We expect a rise of 60k in August’s ADP estimate for private sector employment growth. This would be a slowing from 104k in July which outperformed the non-farm payroll, with July’s improved data looking in part corrective from a 23k decline in June.

August 29, 2025

Preview: Due September 16 - Canada August CPI - Higher as year ago weakness drops out

August 29, 2025 7:15 PM UTC

Weakness a year ago is likely to see August Canadian CPI picking up on a yr/yr basis, we expect to 2.0% from 1.7%. The Bank of Canada’s core rates are likely to remain fairly stable, and above the 2.0% target.

Preview: Due September 4 - U.S. July Trade Balance - Deficit to rise as imports from China rebound

August 29, 2025 4:24 PM UTC

We expect a July goods trade deficit of $79.2bn, up from $60.2bn in June. The deficit will compare to a Q2 average of $64.0bn but remain well below Q1’s pre-tariff average of $130.2bn. It will be similar to where trend was before the November election result signaled higher tariffs were coming.