Published: 2025-09-23T16:08:22.000Z

Preview: Due October 3 - U.S. September ISM Services - August bounce was flattered by seasonal adjustments

-

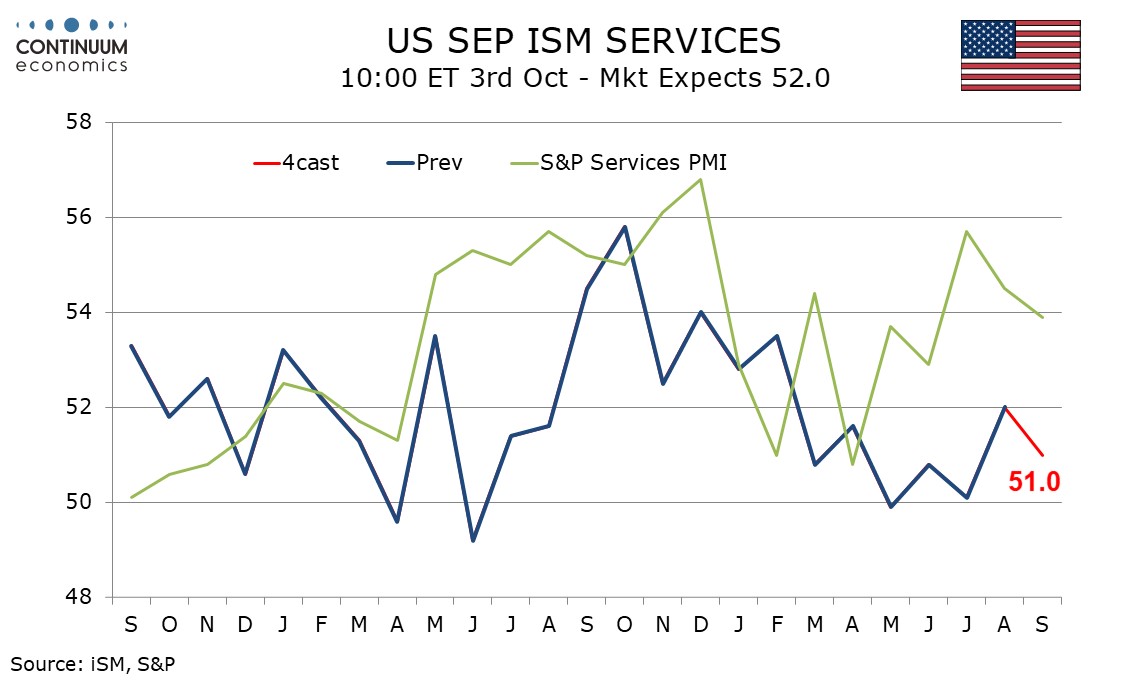

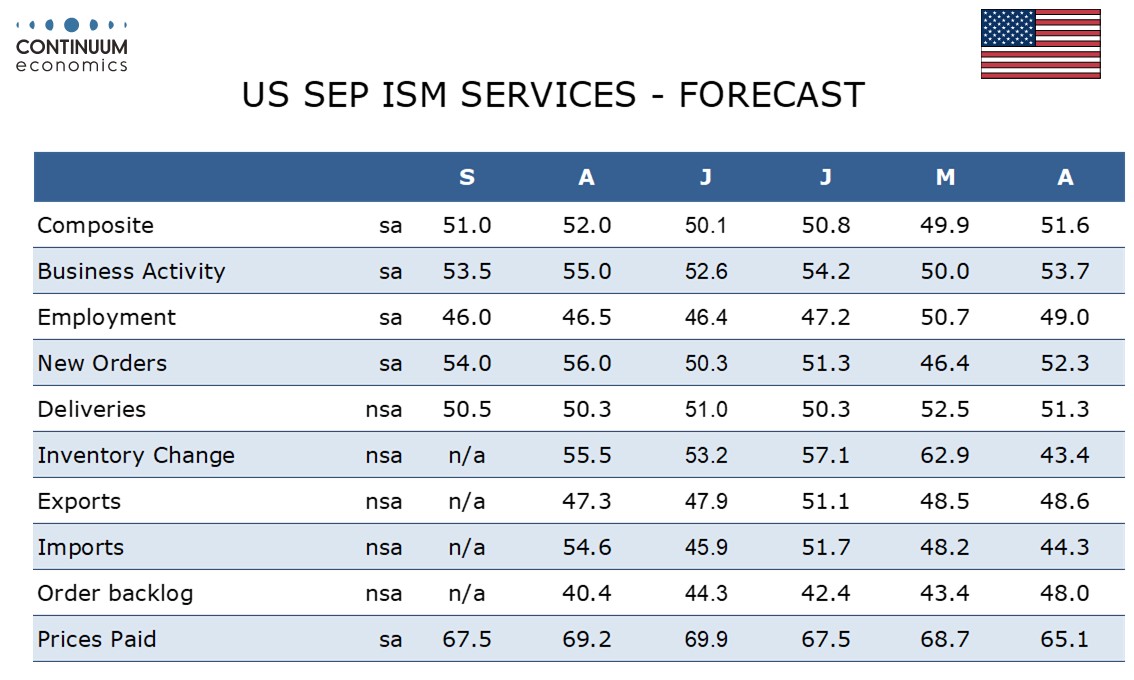

We expect slippage in September’s ISM services index to 51.0 from 52.0, still above the levels seen in May, June and July, but implying a subdued pace of economic growth.

August’s improvement from July’s near neutral 50.1 was assisted by more supportive seasonal adjustments. September’s seasonal adjustments look tougher, particularly for new orders, which we see slipping to 54.0 from 56.0, and business activity which we see slipping to 53.5 from 55.0. We expect a modest dip in employment to 46.0 from 46.5 but a marginal rise in delivery times to 50.5 from 50.3 to complete the breakdown of the composite.

Prices paid do not contribute to the composite and here we expect a dip to 67.5 from 69.2, though still keeping the index in a fairly tight range, and stronger than the pre-tariff trend.

The S and P services PMI is still quite firm at 53.9 but has seen two straight slowings. Regional Fed service sector surveys are mostly soft, with the Richmond Fed’s less positive, the Philly Fed’s still negative if less so, and the Empire State’s increasingly negative.