Preview: Due September 26 - U.S. August Personal Income and Spending - Savings higher after GDP revisions

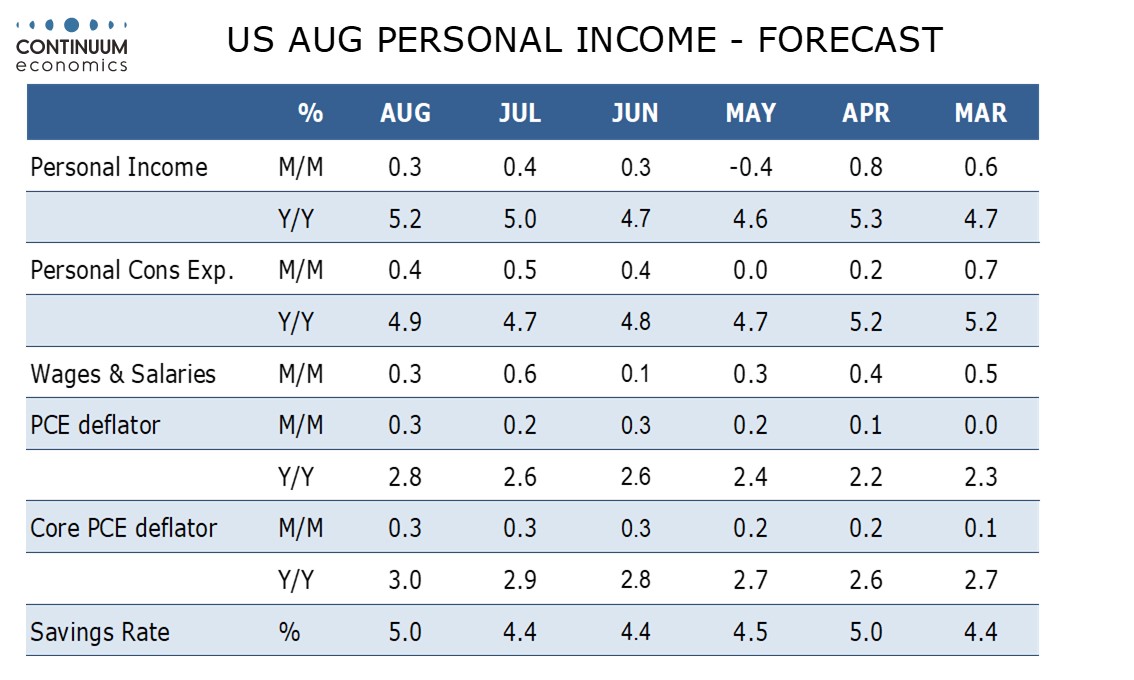

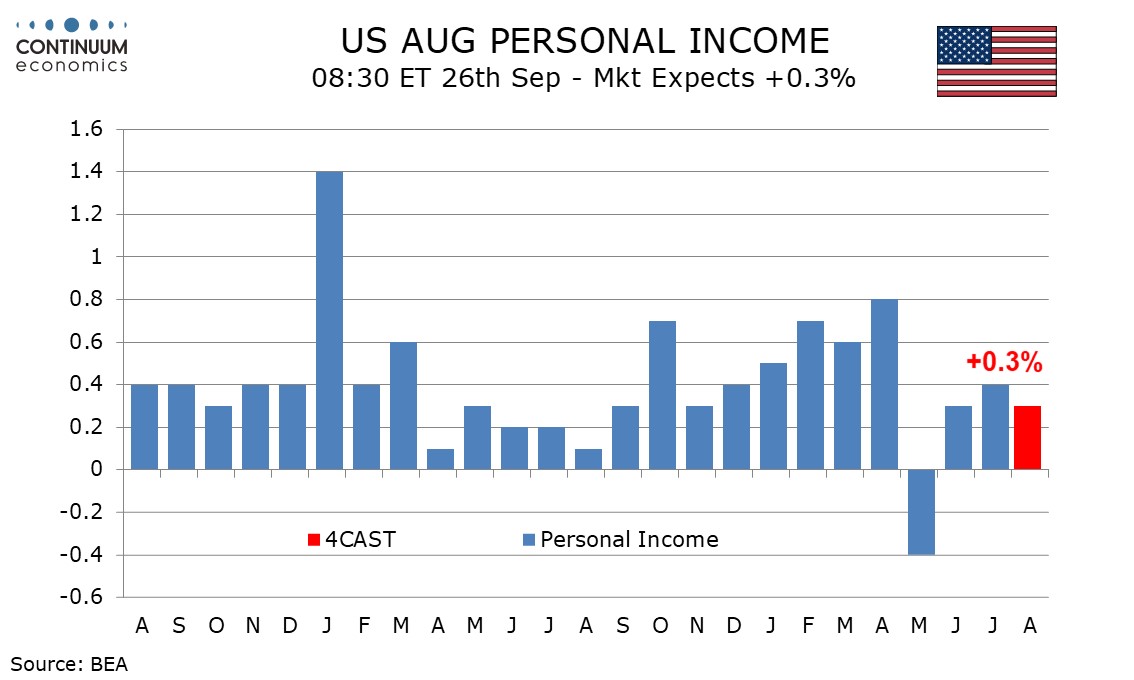

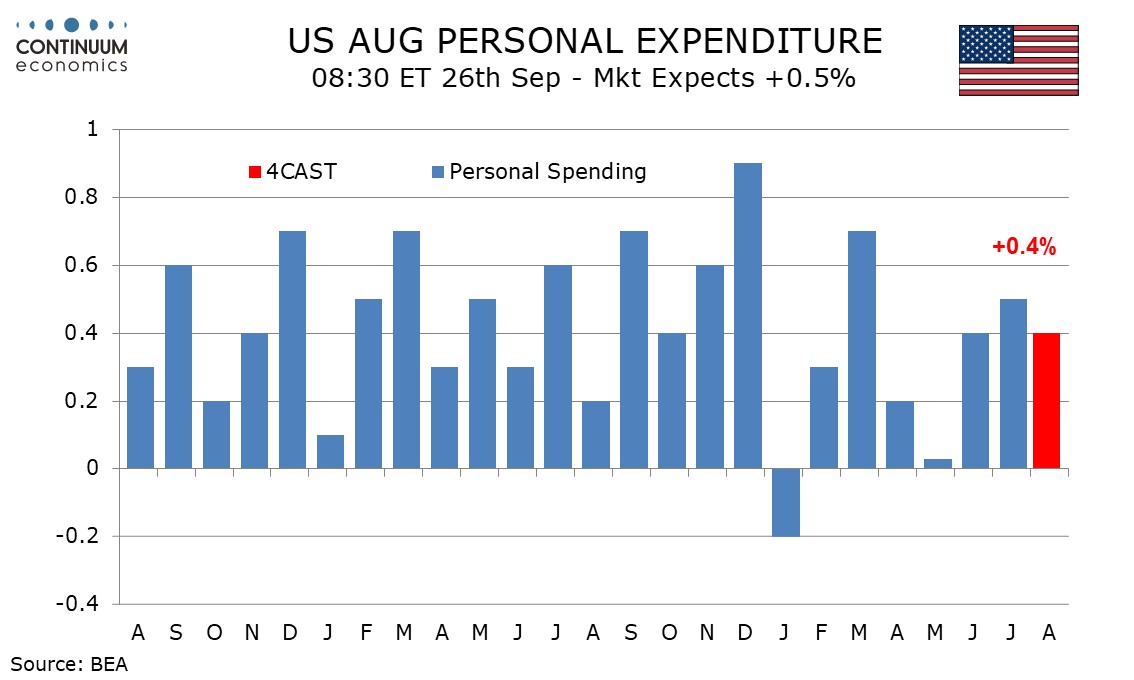

We expect August data to show 0.3% gains in both overall and core PCE prices, with personal income also up by 0.3% and personal spending slightly stronger at 0.4%. The data will incorporate historical revisions through Q2 seen with the GDP revisions.

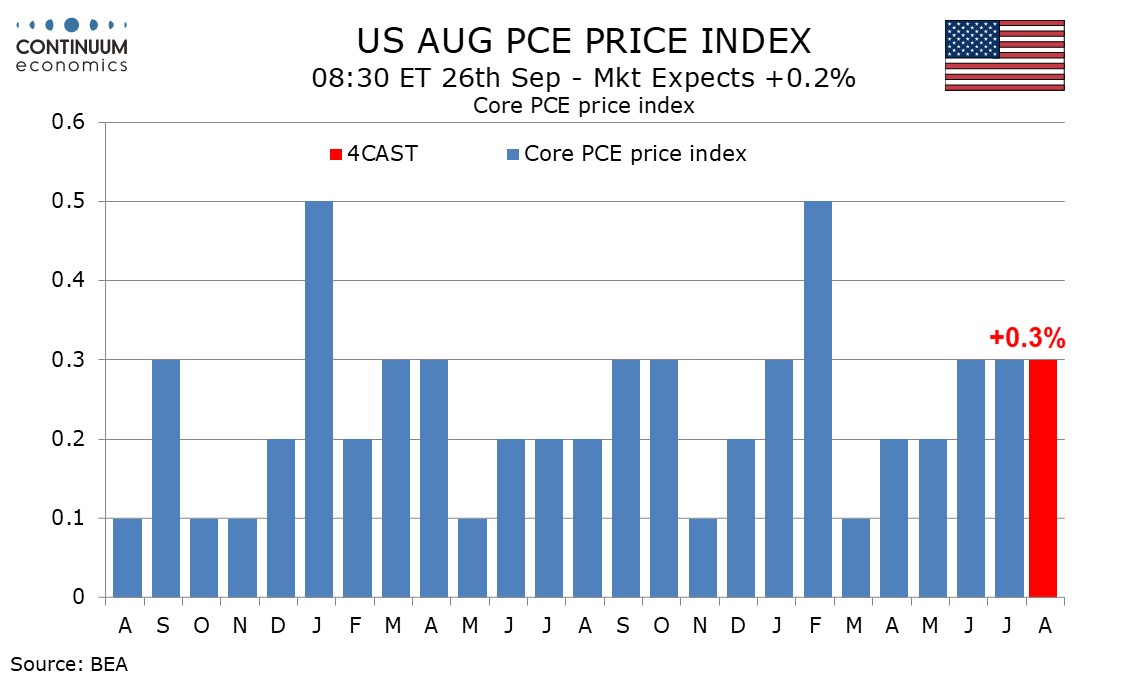

August CPI rose by 0.382% before rounding while core CPI rise by 0.346%. We expect the core PCE price index will be close to 0.3% before rounding while PCE price data tends to be less sensitive to gasoline than the CPI, leaving both headline and core PCE prices up by 0.3%.

Without revisions, which were minor for core PCE prices in the year to Q2, this would leave yr/yr PCE prices at 2.8% from 2.6% while core PCE prices would rise to 3.0% from 2.9%, both reaching their highest pace since March 2024. However, Fed’s Powell has predicted a yr/yr pace of 2.9% for the latter, implying a monthly rise of only 0.2% in core PCE prices.

The subdued non-farm payroll breakdown implies a moderate 0.3% rise in wages and salaries. We expect the other components of personal income to match wages and salaries, with social security unlikely to repeat an unusual a July decline. Historical revisions to income will be positive, but mostly for 2023 rather than more recently.

Retail sales rose by 0.6% but industry data suggest autos may underperform the retail auto data. We expect a 0.4% rise in personal spending, which would match the gains seen in June and July. However service spending was revised significantly higher in Q2. Still, given prior revisions to income, Q2’s savings rate was revised up to 5.3% from 4.6%. This would suggest a savings rate of 5.0% in August rather than our previous estimate of 4.3% that assumed no revisions.