Published: 2025-09-23T15:00:38.000Z

Preview: Due October 1 - U.S. September ISM Manufacturing - Firmer but still short of neutral

9

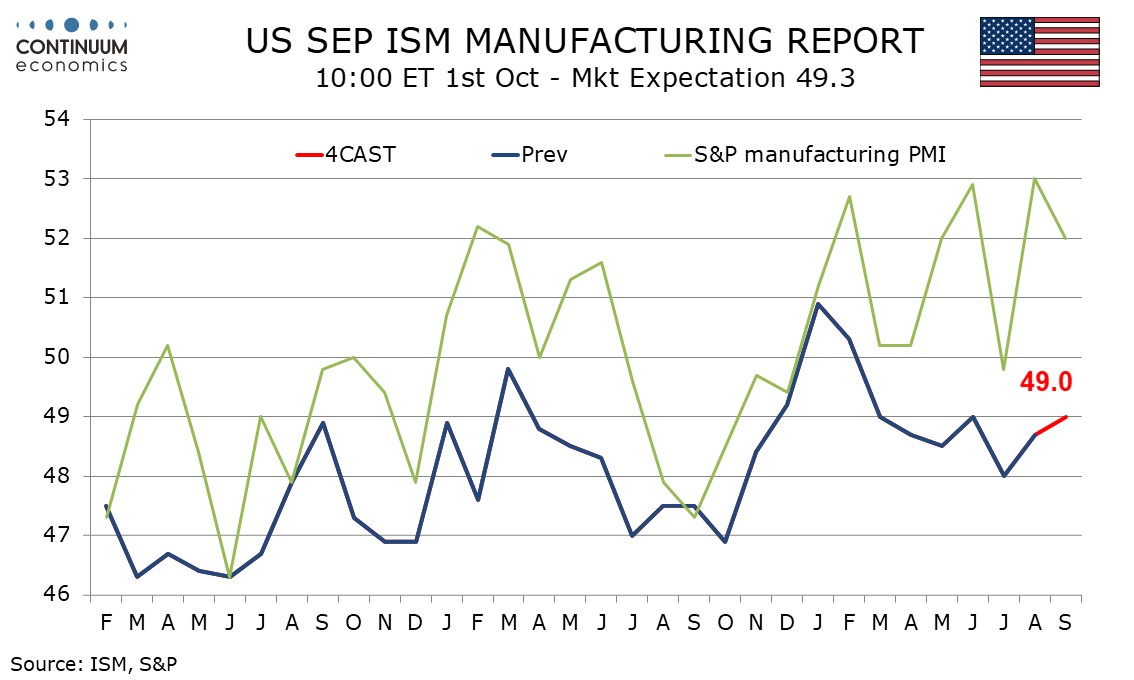

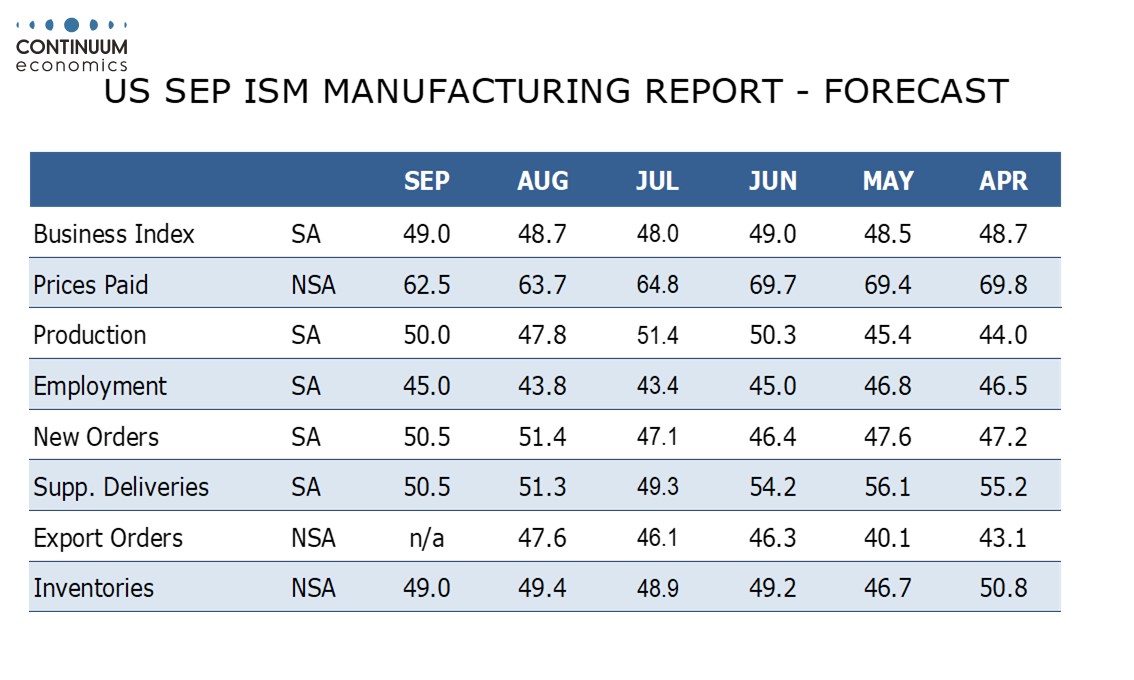

We expect September’s ISM manufacturing index to 49.0, returning to June’s level after rising to 48.7 in August from 48.0 in July. The index has not been above neutral since February.

August’s detail showed new orders at 51.4, its first positive reading since January, which is a positive signal. We expect new orders to remain positive, if a little less so at 50.5. We expect improvements in production to 50.0 from 47.8 and employment to 45.0 from 43.8. However we see restraint coming from deliveries, slipping to 50.5 from 51.3, and inventories, to 49.0 from 49.4.

Prices paid do not contribute to the composite but after coming in above 69 from March through June have since begun to moderate, falling to 64.8 in July and 63.7 in August. We expect further slippage to 62.5 in September, still well above trend seen through 2024.

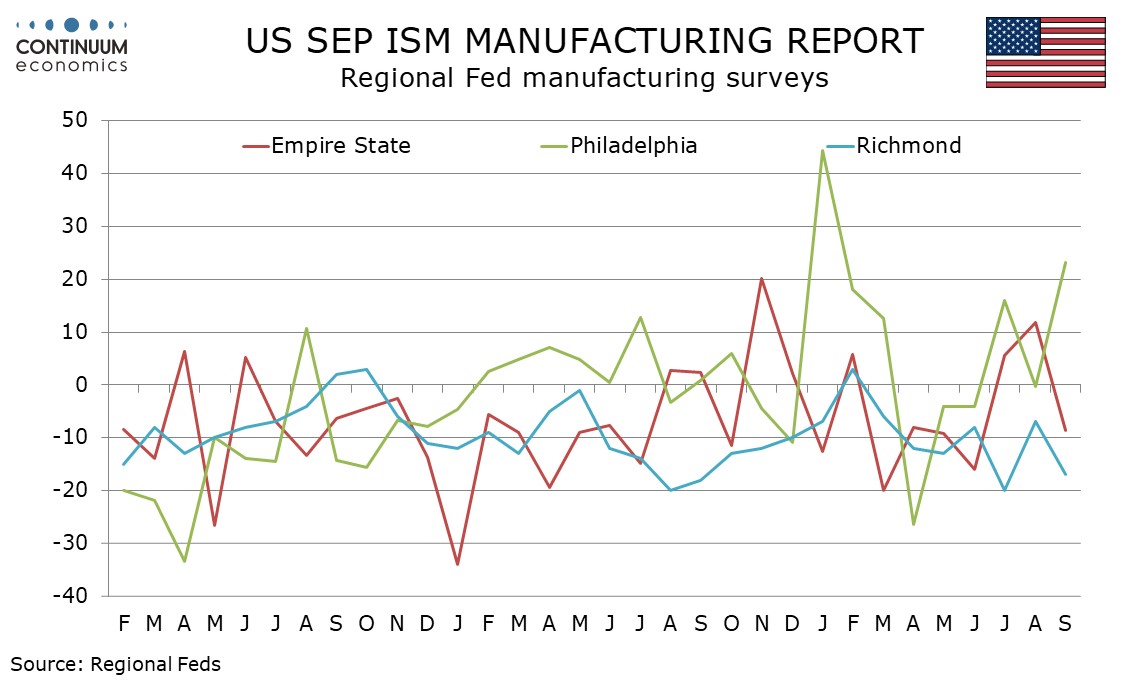

Other surveys give few clear signals. The S and P manufacturing PMI was still positive but less so. The Philly Fed’s survey was significantly stronger but the Empire State’s and Richmond Fed indices were weak.