Preview: Due October 16 (dependent on shutdown ending) - U.S. Setember PPI - Closer to trend after strong July and weak August

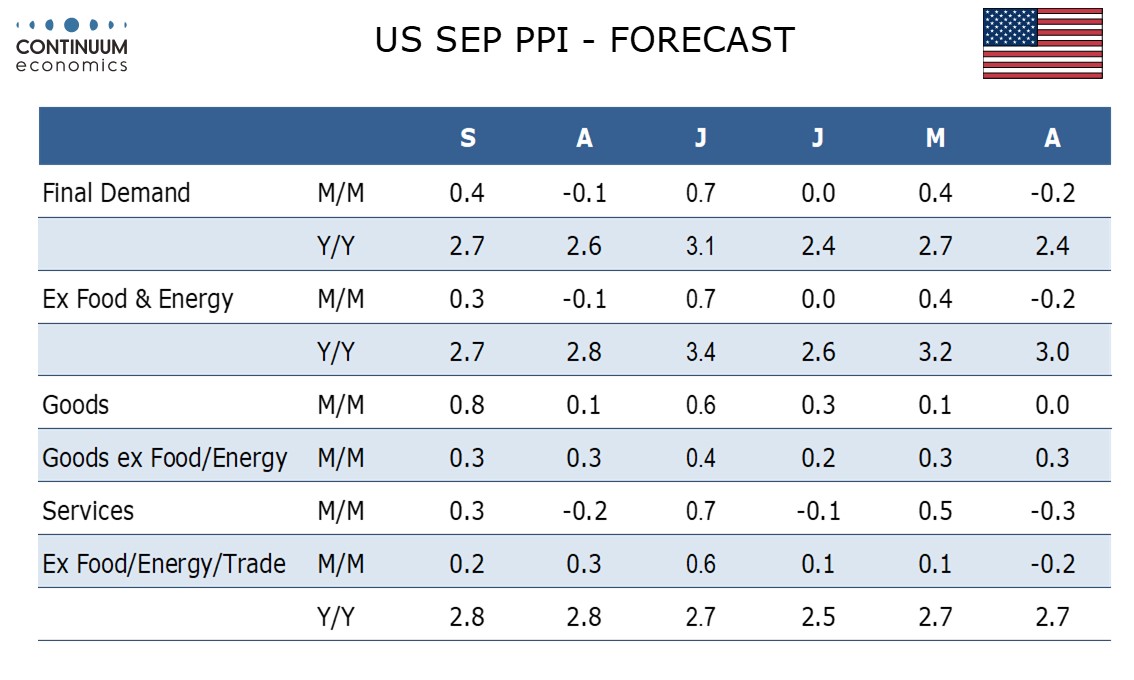

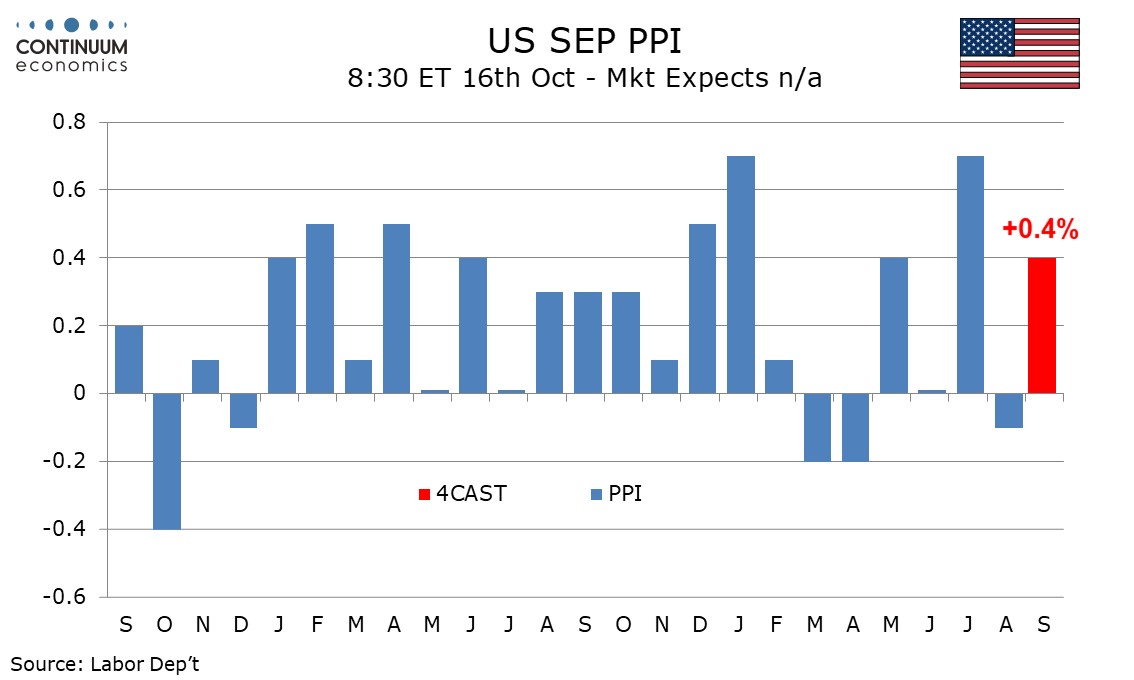

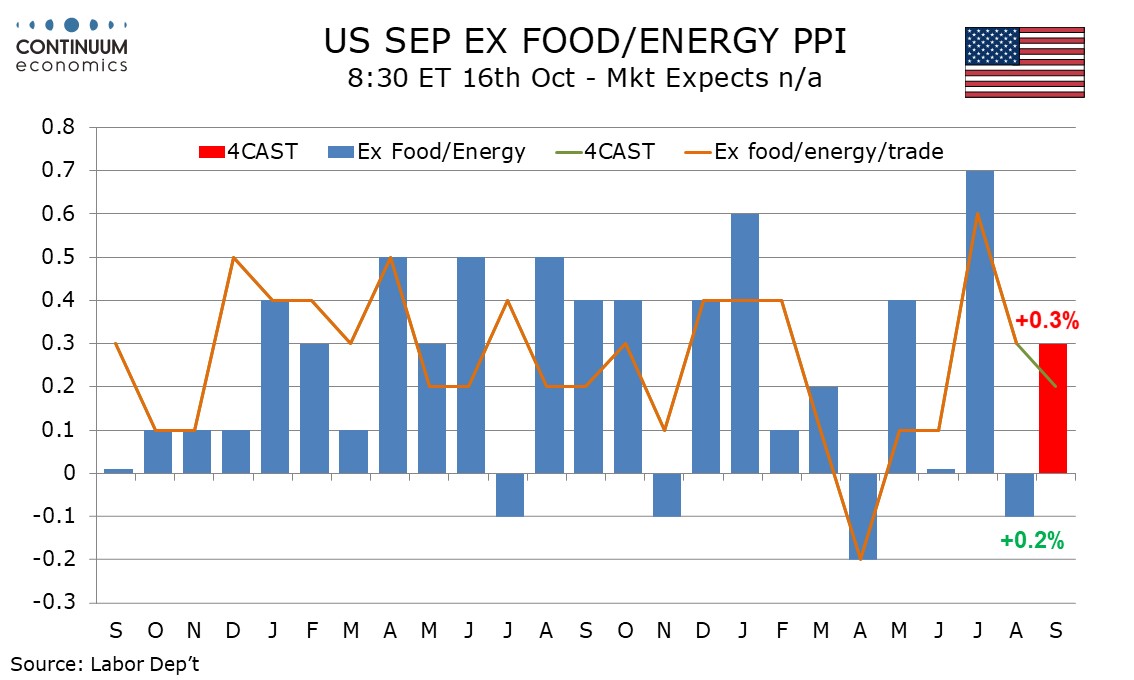

We expect September PPI to rise by 0.4% overall and 0.3% ex food and energy, with the latter gain coming near the average of a 0.7% bounce in July that was corrected by a 0.1% decline in August. Ex food, energy and trade we expect a moderate 0.2% increase after gains of 0.3% in August and 0.6% in July.

The release date remains uncertain as long as the government shutdown persists. Higher gasoline prices are likely to lead a 2.5% increase in energy while we expect a 0.5% increase in food, supported by tariffs. Goods PPI ex food and energy has been trending around 0.3% per month through 2025 to date, compared with slightly less than 0.2% through 2024, and we expect that to continue.

Services have been recently volatile with strong gains of 0.5% in May and 0.7% in July, corrected by slippage of 0.1% in June and 0.2% in August. We expect a 0.3% increase in September, to be led by trade which fell by 1.7% in August, more than fully reversing a 1.0% increase in July. Excluding food, energy and trade we expect only a 0.2% increase in September PPI, slower than both August’s 0.3% and July’s 0.6%, which broke a string of subdued outcomes from March through June.

We expect yr/yr growth of 2.7% in both overall and ex food and energy PPI, the former up from 2.6% and the latter down from 2.8%. We expect the ex food, energy and trade PPI to remain at August’s 2.8% yr/yr pace.