Norway

View:

August 14, 2025

Norges Bank Review (Aug 14): Job Concerns Growing?

August 14, 2025 8:52 AM UTC

After the surprise 25 bp rate cut in June, it was back to humdrum predictability with the widely expected stable policy decision at 4.25%. Regardless, the Board could be attacked for plagiarism given the manner in which the updated press release mimics that seen in June, save for the fact that bot

August 05, 2025

Norges Bank Preview (Aug 14): Amid Very Restrictive Stance, A Policy Pause – Already?

August 5, 2025 1:48 PM UTC

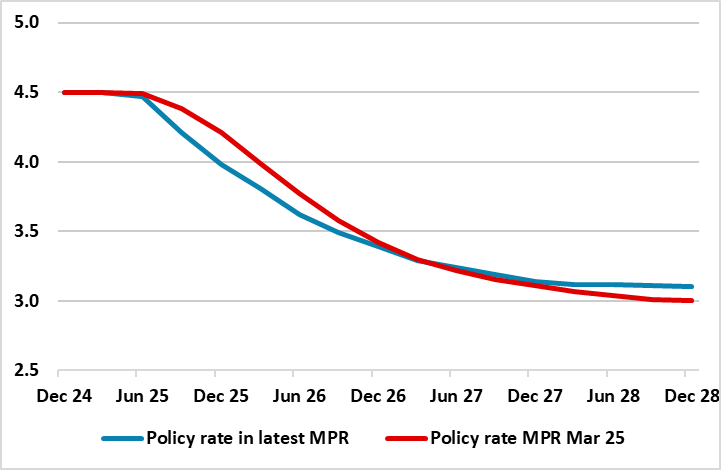

Although surprised, we thought the Norges Bank’s unexpected easing in June was very much warranted, as are the further cuts being flagged in the Monetary Policy Report (MPR) that came alongside – ie two more such moves by end year. We actually envisage up to three more moves this year and arou

June 23, 2025

Western Europe Outlook: The First Shall be Last…

June 23, 2025 7:46 AM UTC

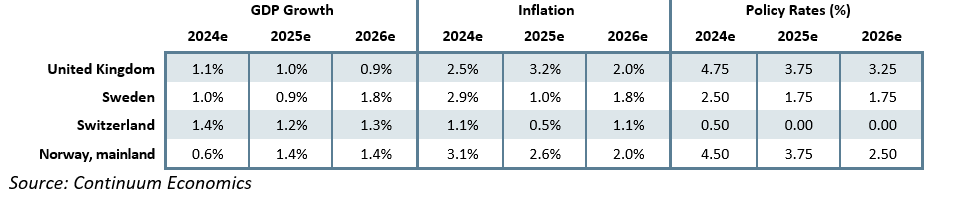

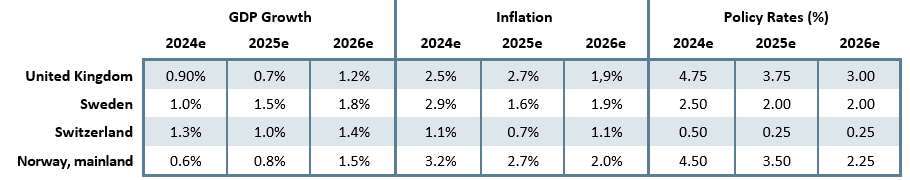

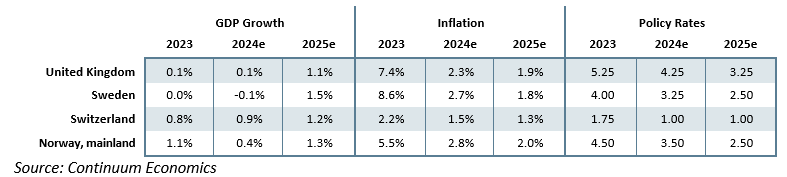

· In the UK, we have upgraded 2025 growth by 0.3 ppt back to 1.0%. But this is purely a result of the Q1 front-loading and instead masks what we think will be essentially a flat GDP profile into 2026. The BoE will likely ease further in H2 by at least 50 bp and maybe faster and then i

June 19, 2025

Norges Bank Review: Coming (Very) Late to the Party

June 19, 2025 8:57 AM UTC

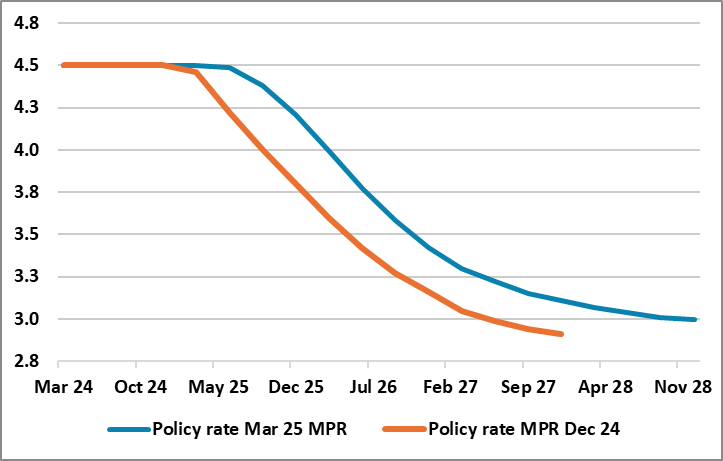

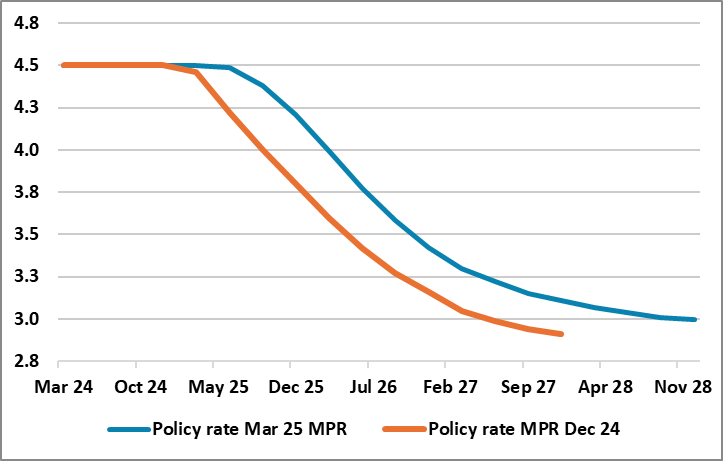

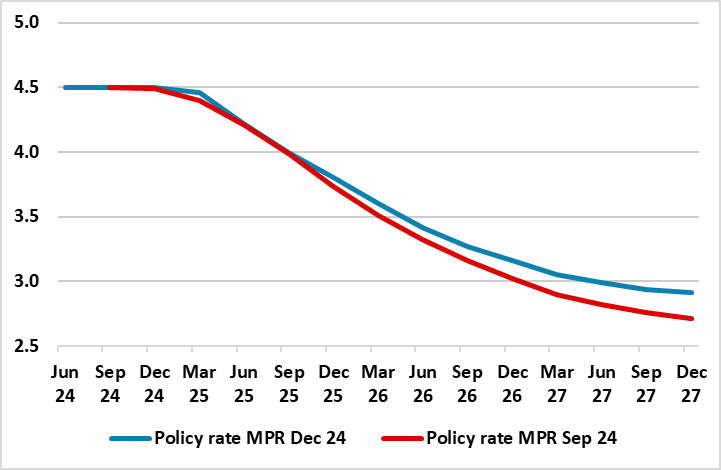

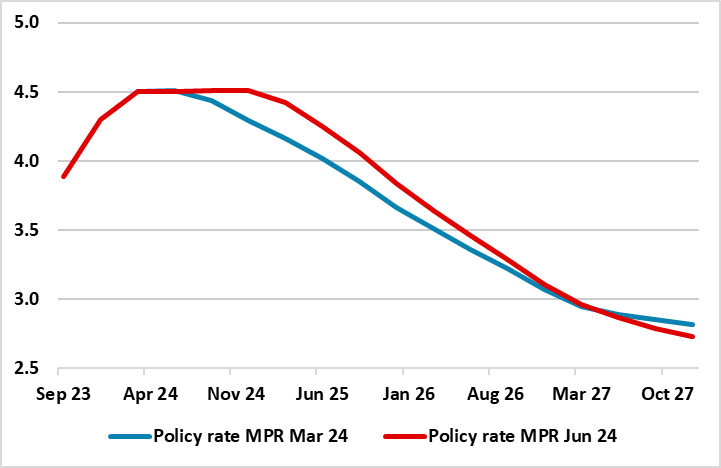

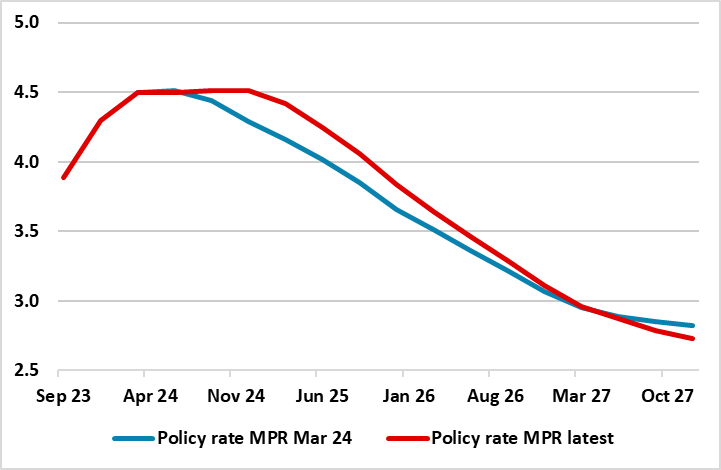

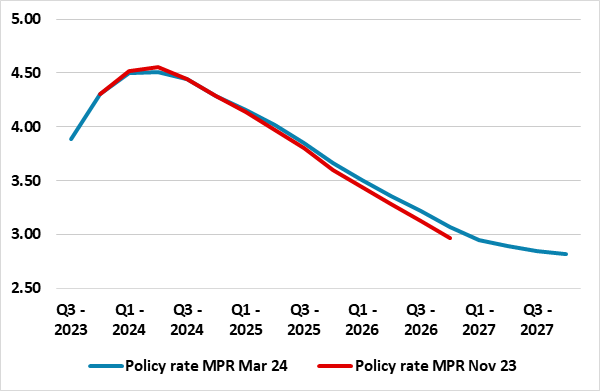

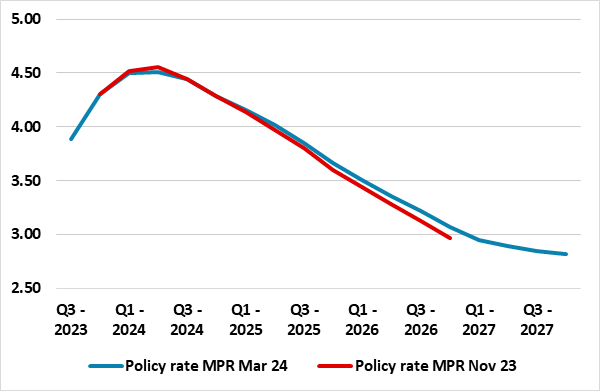

Although we thought the Norges Bank would not start to ease until its next (Aug) meeting, we think the surprise 25 bp policy rate cut (to 4.25%) announced today is very much warranted, as are the further cuts (Figure 1) being flagged in the updated Monetary Policy Report (MPR) – ie two more such m

June 10, 2025

Norges Bank Preview (Jun 19): Policy Easing Schedule Clearer?

June 10, 2025 1:49 PM UTC

It is very unlikely that the Norges Bank will do anything at this month’s Board meeting other than to suggest the easing cycle will start later in the year and that the policy rate will thus remain at 4.5% - for the time being. In fact, it will have to be more explicit about any such a timetable

May 14, 2025

Europe Portfolio Leverage Over Trump

May 14, 2025 9:05 AM UTC

The U.S. will likely introduce a 25% tariff on pharmaceuticals, which will increase pressure on the EU and other European countries (e.g. Switzerland) and also delay serious negotiations close to the 90 day reciprocal tariff deadline on July 9, adding to pressure on Europe by deliberately prolonging

May 08, 2025

Norges Bank Review: Policy Easing Continues to be Deferred?

May 8, 2025 8:49 AM UTC

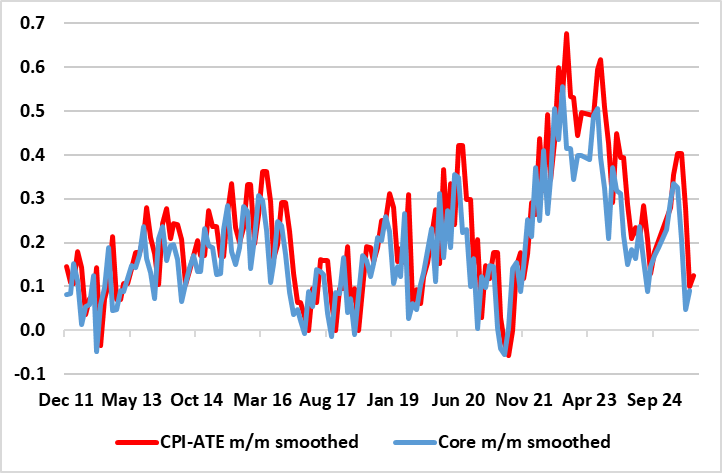

It was hardly a surprise that the Norges Bank again kept policy on hold when it gave its latest verdict as was the fact that it failed to be any more explicit about when the rate cut cycle may begin. Instead, while still suggesting rate cuts later this year, it cautions about premature easing. Thi

May 01, 2025

Norges Bank Preview (May 8): Policy Easing Flagged but Not Yet Materializing?

May 1, 2025 11:04 AM UTC

It does seem very likely that the Norges Bank will again keep policy on hold when it gives it next verdict on May 8, albeit with a risk that if it has access to what may be much friendlier CPI data officially due the day after, it could ease, or at least be more explicit about when the rate cut cycl

March 27, 2025

Norges Review (Mar 27): Policy Easing Delayed but Far From Abandoned?

March 27, 2025 10:01 AM UTC

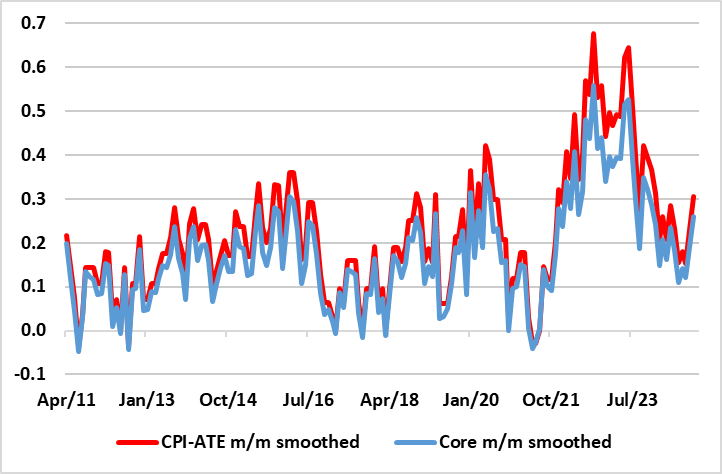

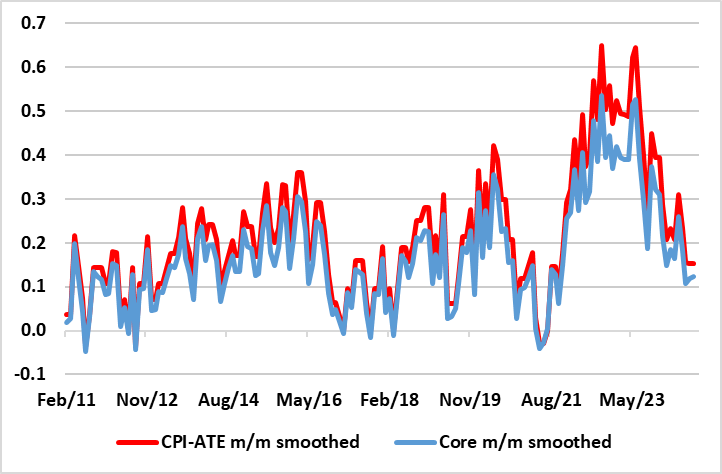

As was perhaps just the more likely case, the Norges Bank did not deliver on the rate cut it had been flagging very clearly until recently. Instead, it kept the policy rate at 4.5% on the back of inflation having been markedly higher than expected and where wage growth in 2024 turned out higher th

March 25, 2025

Western Europe Outlook: Price Pressures - Puzzling or Possibly Persistent!

March 25, 2025 10:47 AM UTC

· In the UK, we continue to retain our below-consensus GDP picture for this year, with growth actually downgraded and with downside risks that may actually be both increasing and materializing. The BoE will likely ease further through 2025 by at least 75 bp and maybe faster and into 202

March 20, 2025

Norges Bank Preview (Mar 27): No Change but a Close Call?

March 20, 2025 3:56 PM UTC

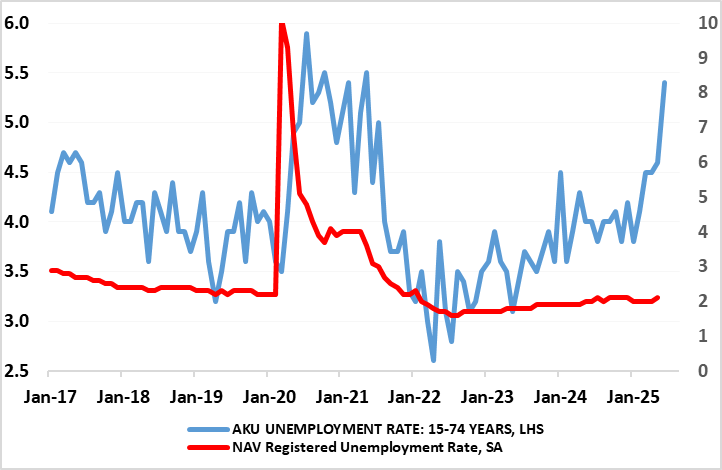

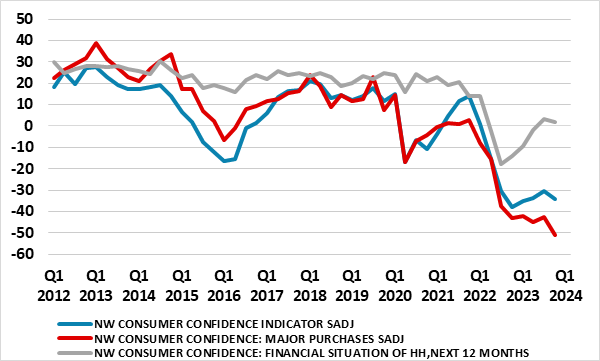

Norway sees the widely awaited Norges Bank decision later this month where recent inflation data have questioned whether the well flagged rate cut will now be delivered – we think the decision may be more finely balances that many are suggesting not least as economic activity signs are mixed even

January 23, 2025

Norges Bank Review: Nothing New as Head Stays in the Sand

January 23, 2025 9:48 AM UTC

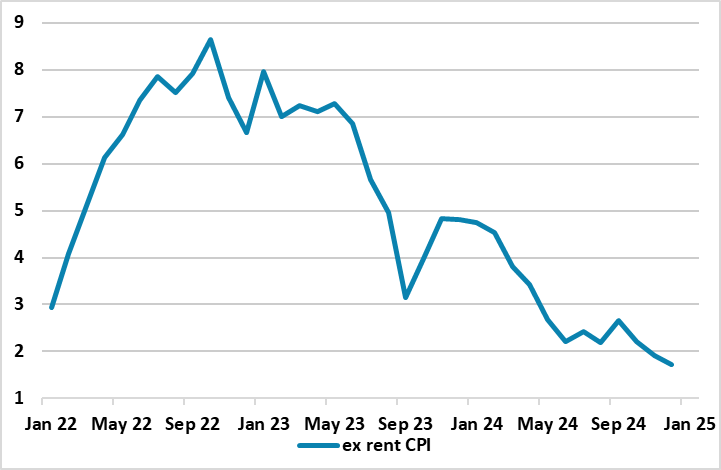

In its first meeting of the year, the Norges Bank kept rates on hold in what was both an expected and unanimous Board decision. But calling this a decision is possibly a misnomer as nothing was actually decided over and beyond waiting for new information and updated forecasts by the time of the ne

January 17, 2025

Norges Bank Preview (Jan 23): A Message to Markets?

January 17, 2025 1:15 PM UTC

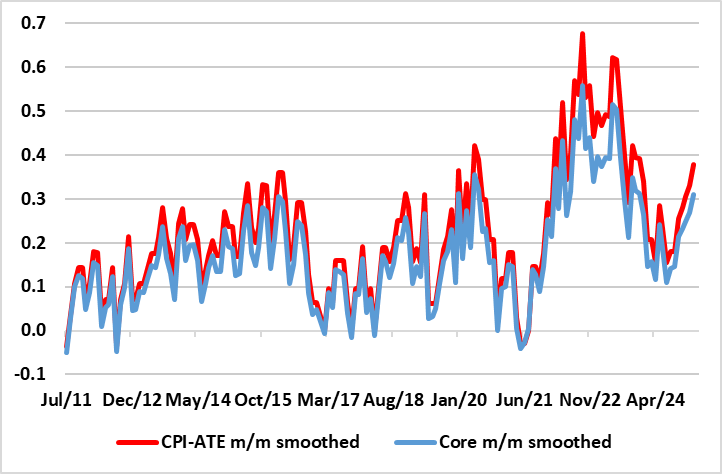

In its first meeting of the year, the Norges Bank is expected to keep rates on hold next Thursday. But it does have the choice of cutting rates, having flagged a move more likely at the meeting due in March, and could do this both to reflect weaker price pressures (especially excluding what are pr

December 19, 2024

Western Europe Outlook: Divergent Policy Thinking

December 19, 2024 2:12 PM UTC

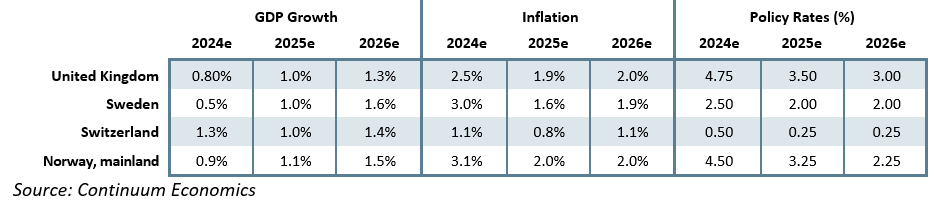

· In the UK, perhaps the main story in our outlook is that we retain our below-consensus GDP picture for next year, with growth of 1.0% and with downside risks. The BoE will likely ease further through 2025 by at least 100 bp and maybe faster and beyond.

· As for Sweden, d

Norges Bank Review: Caution Prevails

December 19, 2024 10:21 AM UTC

Surprising no-one, another (ie eighth successive) stable policy decision was forthcoming at this latest Board decision so that the policy rate at 4.5% has been in place for a year. The statement was more open about policy being eased but only after two more meetings, so that the first cut will com

December 10, 2024

Norges Bank Preview (Dec 19): Still Resistant

December 10, 2024 11:28 AM UTC

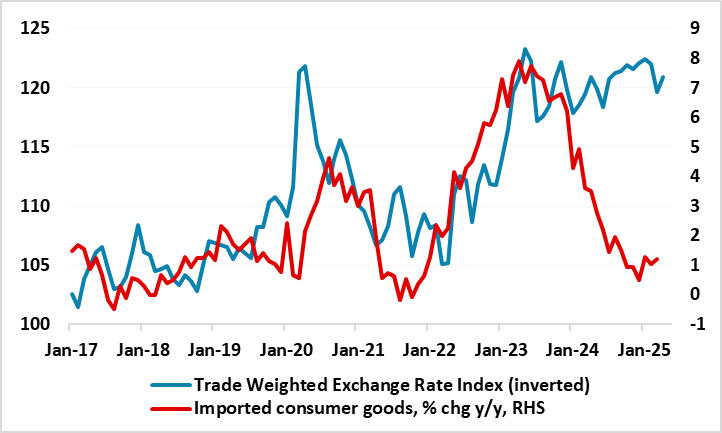

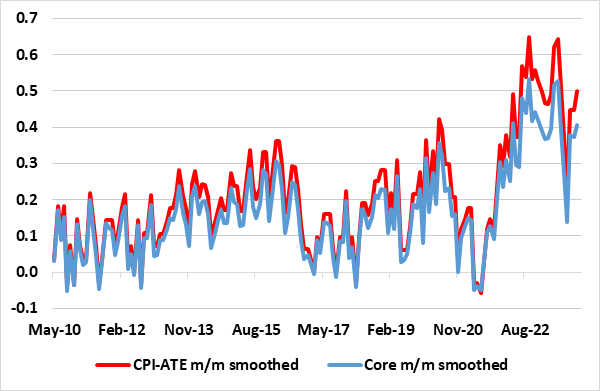

Despite what seems to be an accelerated pace of central bank easing nearby, speculation that the Norges Bank would ease by year –end had grown, but have now largely dissipated. What seems to be the final nail in the coffin of a rate cut has been the November CPI numbers, higher than consensus bu

November 07, 2024

Norges Bank Review: A Tweak in Policy Guidance

November 7, 2024 9:29 AM UTC

Aided by more downside inflation surprises and the accelerated pace of central bank easing nearby, speculation that the Norges Bank would ease by year –end had grown, but have now largely dissipated. However, after the widely expected stable policy decision today, the possibility that a cut may

October 28, 2024

Norges Bank Preview (Nov 7): Options A Little More Open?

October 28, 2024 1:14 PM UTC

Aided by more downside inflation surprises and the accelerated pace of central bank easing nearby, speculation that the Norges Bank would ease by year –end had grown, but now largely dissipated. The Bank has two policy meeting left this year – Nov 7 and Dec 19- but has offered no encouragement

September 26, 2024

Western Europe Outlook: Gradualism vs Reality

September 26, 2024 10:45 AM UTC

· In the UK, while headline GDP numbers look firmer, the real economy backdrop and outlook remains no better than mixed. This should improve a disinflation process driven mainly by friendlier supply conditions. The BoE will likely ease in Q4 and continue doing so through 2025 (we look

September 19, 2024

Norges Bank Review: Heads Still in the Sand?

September 19, 2024 8:57 AM UTC

As with the five previous policy meetings, the Norges Bank kept its policy rate at 4.5% and equally unsurprising moderated its previous hawkish rhetoric - slightly. While it still fought against market expectations by suggesting policy will remain on hold until year end it did drop its recent stress

September 10, 2024

Norges Bank Preview (Sep 19): Less Hawkish Rhetoric?

September 10, 2024 7:37 AM UTC

As has been the case for the five previous policy meetings, the Norges Bank is almost certain to keep its policy rate at 4.5% when the Board offers its next verdict on Sep 19. But amid a slightly disappointing mainland real economy backdrop and what have been softer than (Norges Bank) expectations

August 15, 2024

Norges Bank Review: Head in the Sand?

August 15, 2024 9:44 AM UTC

Surprising few, and with no mention of recent stock market gyrations, the Norges Bank is kept its policy rate at 4.5% for a fifth successive meeting this month, the last hike to the current 4.5% policy rate occurring last December. But amid what have been softer than (Norges Bank) expectations for

August 09, 2024

Norges Bank Preview (Aug 15): Less Hawkish?

August 9, 2024 10:00 AM UTC

Given its recent rhetoric and currency concerns, and in spite of current stock market gyrations, the Norges Bank is very likely to leave its policy rate at 4.5% for a fifth successive meeting next Thursday, the last hike to the current 4.5% policy rate occurring last December. But amid what have b

June 24, 2024

Western Europe Outlook: Easing Cycles Diverge?

June 24, 2024 7:48 AM UTC

· · In the UK, while downside economic risks may have dissipated, the real economy backdrop and outlook is still no better than mixed. This should accentuate a disinflation process hitherto driven mainly by friendlier supply conditions. The BoE will likely ease in Q3 and

June 20, 2024

Norges Bank Review: Excessive Last Mile Caution?

June 20, 2024 9:04 AM UTC

It was always the very high likelihood that the thrust of recent data and the Board’s clear caution would mean that the Norges Bank would leave its policy rate at 4.5% for a fourth successive meeting and this is what duly occurred. Perhaps more notable was that the it was more explicit in stress

June 13, 2024

Norges Bank Preview (Jun 20): Continued Caution?

June 13, 2024 9:25 AM UTC

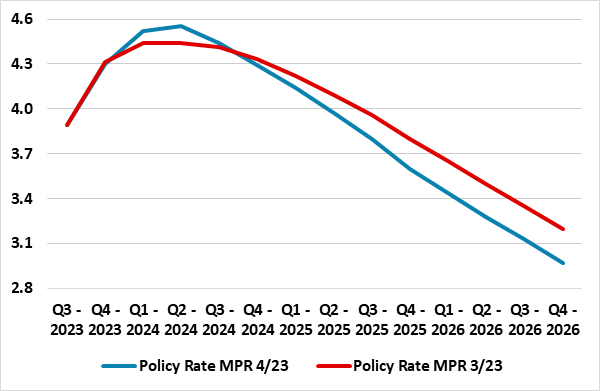

Given the thrust of recent data and the Board’s clear caution, the Norges Bank is very likely to leave the policy rate at 4.5% for a fourth successive meeting at its next Board meeting with the decision due on June 20. It is also likely to retain the thinking first aired at the December meeting,

May 03, 2024

Norges Bank Review: Even More Caution?

May 3, 2024 8:46 AM UTC

Surprising few, the Norges Bank Board left the policy rate at 4.5% for a third successive meeting at its latest Board meeting. It also retained the thinking first aired at the December meeting, namely ‘policy to stay on hold for some time ahead’ rhetoric, this more formally evident in what wer

April 25, 2024

Norges Bank Preview: Nothing New to Note?

April 25, 2024 9:29 AM UTC

Surprising few, the Norges Bank Board is very likely to leave its policy rate at 4.5% for a third successive meeting when it gives it next verdict on May 3. It is also likely to retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhe

March 22, 2024

Western Europe Outlook: Easing Cycle Underway?

March 22, 2024 11:26 AM UTC

· In the UK, downside economic risks may have dissipated but the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already weak domestic backdrop into 2025 that will complement friendlier supply conditions in easing inflation. The BoE will likely e

March 21, 2024

Norges Bank Review: Unrevised Rate Cutting Hints?

March 21, 2024 10:10 AM UTC

Surprising few, the Norges Bank Board left the policy rate at 4.5% for a second successive meeting and even retained the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhetoric. It accepted a softer recent inflation backdrop but revised up

March 12, 2024

Norges Bank Preview: Clearer Rate Cutting Hints?

March 12, 2024 10:26 AM UTC

Unlike, January’s Norges Bank meeting, the decision(s) due on Mar 21 will be far from a non-event. The Board will surely leave rates on hold for a second successive meeting, and may even retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time a

January 25, 2024

Norges Bank Review: Policy Unchanged, Rhetoric Unchanged

January 25, 2024 9:43 AM UTC

As was very much expected, this month’s Norges Bank meeting was something of a non-event. The Board left rates on hold, and also retained the thinking aired at the December meeting when it hiked rates somewhat surprisingly. There was a repetition of the ‘policy to stay on hold for some time ah

January 18, 2024

Norges Bank Preview (Jan 25): Marking Time

January 18, 2024 9:55 AM UTC

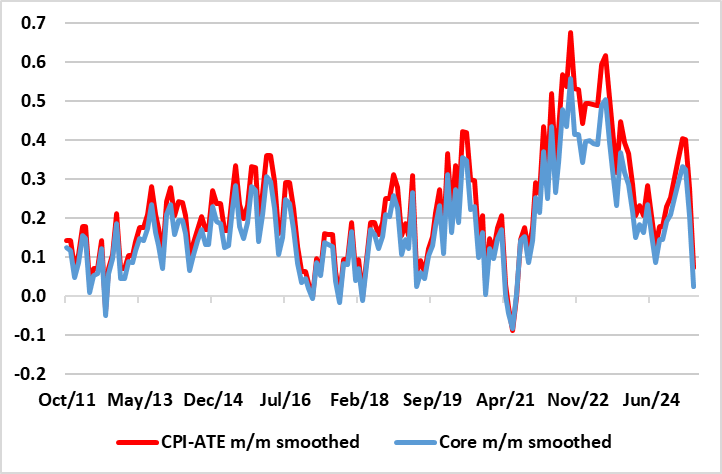

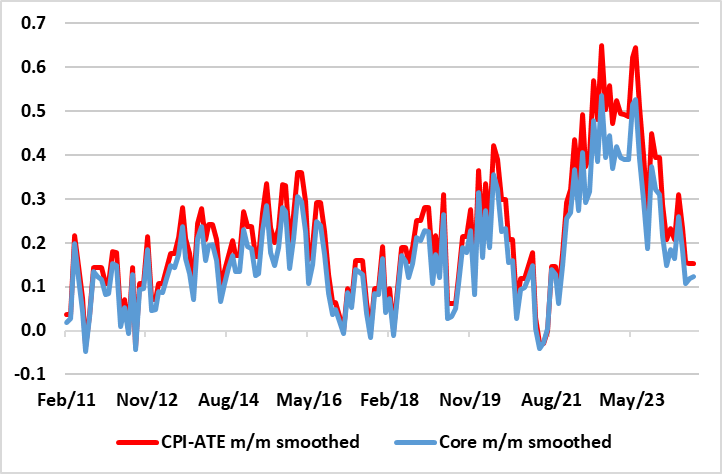

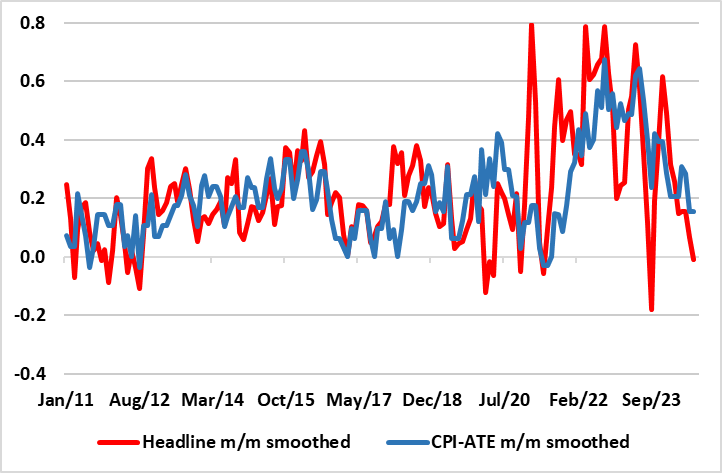

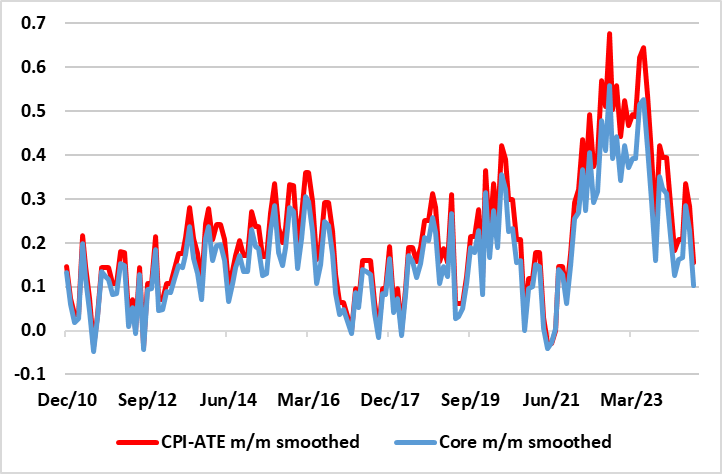

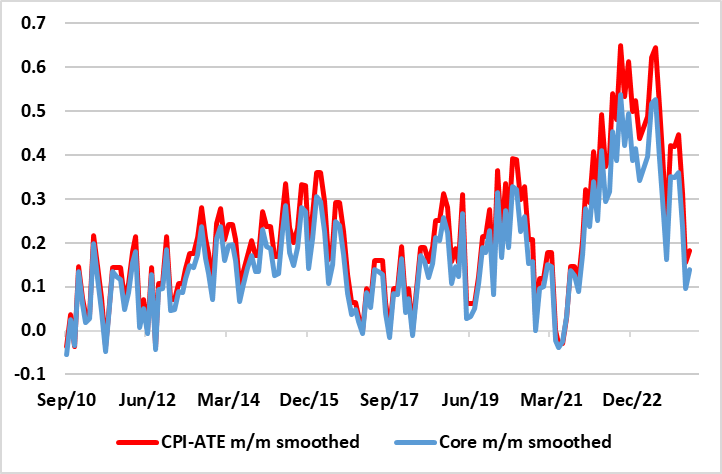

The Jan 25 Norges Bank meeting will be something of a non-event. The Board will leave rates on hold, this widely expected outcome coming after the latest slightly softer than expected but still resilient CPI data (Figure 1) and as-expected GDP numbers since the surprise hike last month. There will

December 15, 2023

Western Europe Outlook: Inflation Succumbing?

December 15, 2023 2:44 PM UTC

· In the UK, downside economic risks may still be materializing as the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already negative domestic backdrop that may now stretch into 2025. The BoE has already paused and will likely ease next year an

December 08, 2023

This week's five highlights

December 8, 2023 10:34 AM UTC

U.S. November NFP Likely firmer due to returning strikers

USD/JPY Slumped on Ueda's Speech

Bank of Canada Tightening Bias Persists but is Reduced

USD/CAD Slipping on Weak Oil

RBA Continue to be data dependent

We expect a 200k increase in November's non-farm payroll, stronger than October's 150k though ex

September 27, 2023

Western Europe Outlook: Policy Peaking

September 27, 2023 9:50 AM UTC

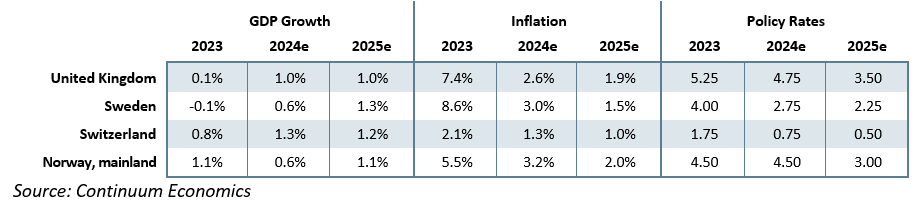

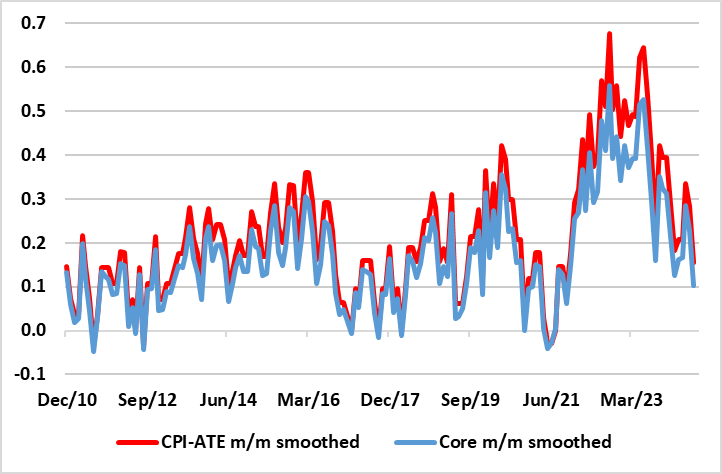

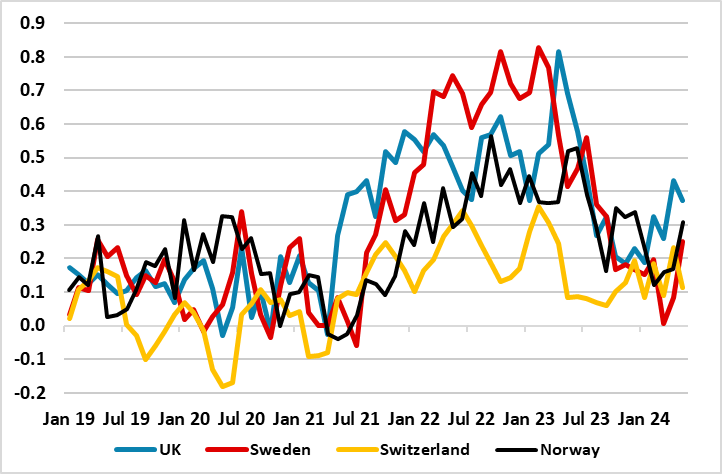

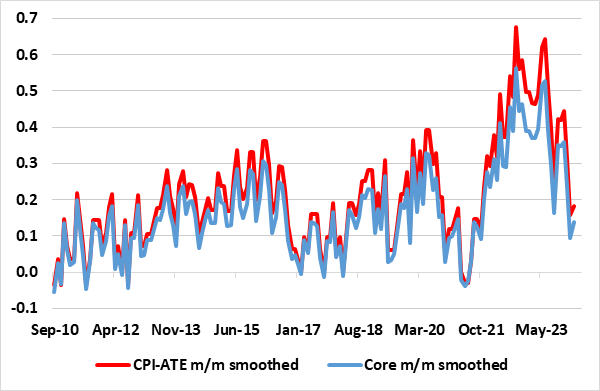

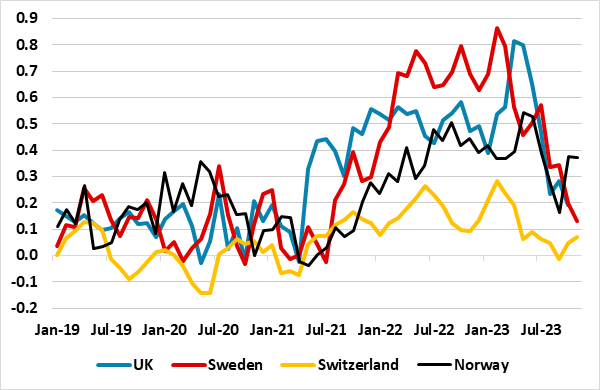

Forecast changes: Compared to our June Outlook, GDP growth forecasts have again seen mixed developments, slightly less poor for the UK and Norway for this year, but with 2024 downgrades seen across the board. But it is the upgraded current year inflation projections that explain the more significant

February 22, 2023

In-Depth Research: Quick Roadmap Central Bank Forecast/Rationale - February 2023

February 22, 2023 10:44 AM UTC

M/T Quick Roadmap – Fundamental MMKT/CB Roadmap and Rationale

February 2023

US FEDERAL RESERVE

The February 1 December FOMC meeting saw the pace of tightening slowed to 25bps. Inflation has slowed, but January's CPI details still show broad based inflationary pressures at a pace well above the Fed's