Norges Bank Review: Policy Easing Continues to be Deferred?

It was hardly a surprise that the Norges Bank again kept policy on hold when it gave its latest verdict as was the fact that it failed to be any more explicit about when the rate cut cycle may begin. Instead, while still suggesting rate cuts later this year, it cautions about premature easing. This is somewhat hindsight forecasting given that until the stable policy decision six weeks ago it had been flagging very clearly a rate cut by March. As a result, it has kept the policy rate at 4.5% on the back of inflation in recent months having been markedly higher than expected. But it did note that recent global trade tensions complicate the policy outlook, both by adding to downside risks for both growth but also adding to downward pressure on the krone.

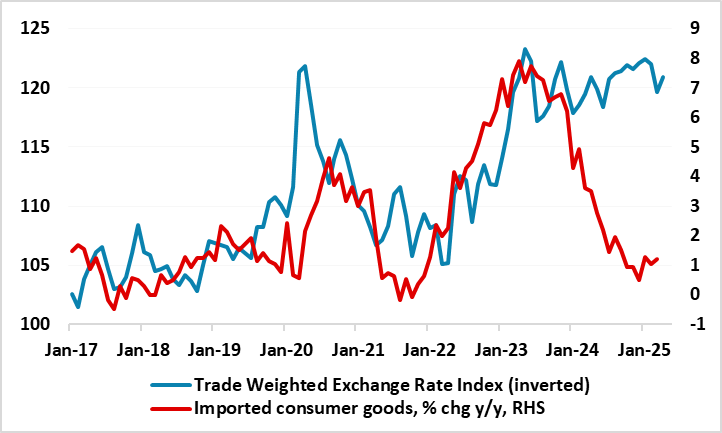

Figure 1: Weak Krone Not to Blame for Inflation Spike

Source: Stats Norway

The Board does acknowledge that with trade barriers having become more extensive, there is uncertainty about future trade policies. But somewhat puzzlingly, it suggests this could pull Norway’s interest rate outlook in different directions. On the one hand, the global growth outlook appears to be weaker, and oil prices have fallen. Norway’s main trading partners are now expected to make more rate cuts than previously. On the other hand, the krone has weakened somewhat and been weaker than assumed.

Once again, the (weak) krone is at the centre of Norges Bank thinking. This currency preoccupation of the Board seems very puzzling to us as a) this hawkish policy leaning has failed to bolster the currency and b) the weak currency has not prevented a marked fall in inflation encompassing much reduced imported price pressures, at least prior to November numbers. Regardless, currency weakness has not prevented imported consumer goods inflation from falling and the latter (at around 1% y/y) is hardly responsible for the current CPI overshoot (Figure 1). As a result, it is worth underscoring that, since the last hike 15 months ago, a hawkish tone of keeping rates high for some time has repeatedly failed to unwind krone weakness, this despite the added bonus of a substantial Norwegian current account surplus. But perhaps bad habits are hard to break.

What is clear is that the Norges Bank has an inflation remit, not a currency one. Yes, the currency is an ingredient into the inflation picture (something that the IMF has helped fuel), albeit one that affects more the price level than the rate of price changes – other factors determine the latter more.

This hawkish line if thinking from the Norges Bank helps bring inflation (now overshooting) back towards target but only 2-3 years hence. We think that the circa 4% rate projected in March for year end is too high against and that a rate well under 4% is more likely, not least as we see a larger and earlier output gap. Indeed, we see CPI-ATE inflation down 0.3 ppt to a 3-mth low of 3.1% in data due tomorrow. Overall, we still see some up to 100 bp of rate cuts in 2025 – ie likely to be more than 50 bp greater than the Norges Bank has been advertising and at least the same amount of cuts in 2026!