Norges Bank Preview (Jan 25): Marking Time

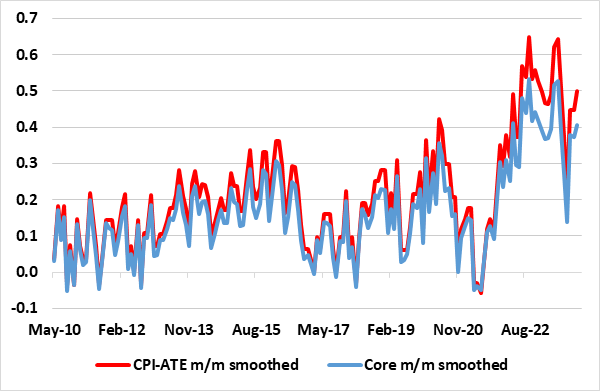

The Jan 25 Norges Bank meeting will be something of a non-event. The Board will leave rates on hold, this widely expected outcome coming after the latest slightly softer than expected but still resilient CPI data (Figure 1) and as-expected GDP numbers since the surprise hike last month. There will be a repetition of the policy to stay on hold for some time rhetoric as the Norges Bank battles along with other central banks against markets that are anticipating early and aggressive easing. But there will be few, if any, new insights, not least as there is no updated Monetary Policy Report. But markets will be alert to any comments about the exchange rate which rallied strongly after the hike last month but where this appreciation is now starting to unwind. It is clear that., at least to the Norges Bank, the exchange rate is a crucial part if its inflation assessment, last month underscoring that krone depreciation makes it more challenging to bring down inflation.

Figure 1: Inflation Showing Some Resilience?

Source: Stats Norway, data are seasonally adjusted by CE

Exceeding most expectations, the Norges Bank raised its policy rate by a further 25 bp to 4.5% at its latest Board meeting, thereby exercising the bias it communicated previously. It seems that the Norges Bank was, indeed, very well prepared to be the last DM central bank to hike having been the first in this cycle. Why? It may have decided that the data at the time was not persuasive enough to deter it from the hike it previously flagged. Notably since the previous meeting there had been some disappointing CPI set of numbers still not clearly flagging a marked easing of CPI pressures so that the Board’s projections still see CPIF inflation above target out to 2026. In addition, there has been some resilience in real activity data.

But this was a dovish hike so to speak, as the Norges Bank is hardly suggesting any further such moves and has instead brought forward its perceived first rate cut to Q3 next year, albeit this still some 3-4 months later than currently priced in by markets. Amid survey data pointing to recession and where CPI data has been distorted by swings in food prices rather than discretionary items, we think the Norges Bank is being too hawkish, not least given its own projection of an output gap of close to 1% persisting out to 2026. This output gap picture will weigh (further) on inflation and to a degree that makes us still think that that rate cuts may arrive mid-2024.