Norges Bank Preview: Clearer Rate Cutting Hints?

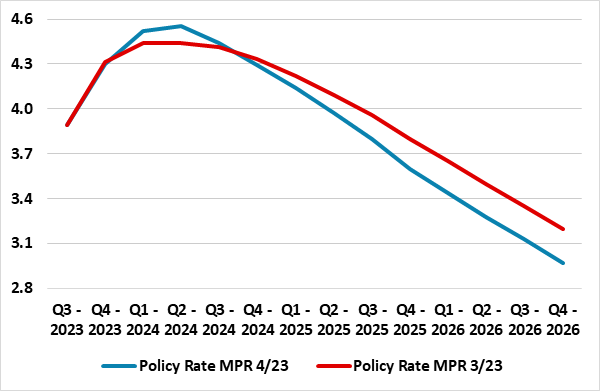

Unlike, January’s Norges Bank meeting, the decision(s) due on Mar 21 will be far from a non-event. The Board will surely leave rates on hold for a second successive meeting, and may even retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhetoric. However, the updated Monetary Policy Report (MPR), which will incorporate a much lower than expected underlying inflation backdrop, alongside side less weak activity, may leave more clear scope (if not rationale) for a cut in rates in Q2, rather than in the autumn as existing Norges Board projections point to (Figure 1). This may as much reflect not only the improved inflation picture (Figure 2) but a realization that with many other DM central banks implying a rate cut cycle starting in June may mean that the Norges Bank may have to follow suit. Admittedly, the Bank may feel it can/should defer rate cuts into H2 as this may help support the still weak krone, but this runs the risk of accentuating a weak economy, encompassing near record consumer confidence fragility, that may be the underlying factor being recent currency weakness.

Figure 1: Policy Rate Profile Can Be Trimmed?

Source: Norges Bank

How Restrictive Does Policy Need to Be?

It is clear that the Bank now assesses that the policy rate is now sufficiently high amid a clear recognition that the current stance is restrictive. Indeed, as of January, no further hiking is being considered, the question being how recent data may have remoulded the Board’s view of how long policy needs to stay at current restrictive levels. Notably, as of then, it was admitted that underlying inflation had declined further and that economic growth was weak, the latter very much underscored by continued very weak consumer confidence readings. But from the Board’s perspective, while economic activity indicators have been broadly in line with the projections in the December 2023 Monetary Policy Report and house price numbers actually better, the (much softer) inflation backdrop is the real story that the Board will have to incorporate this time around.

Inflation Swings to Disinflation

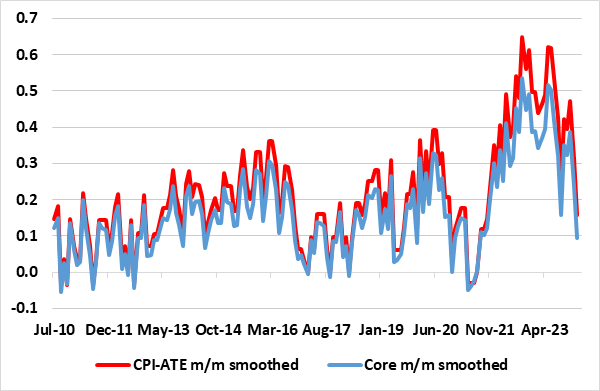

Indeed, February data saw both the headline and underlying inflation rate decline to 18-month lows. Notably, the CPI-ATE measure, which excludes volatile items such as energy, fell to 4.9% y/y last month, well below the pick-up to 5.5% which the Norges Bank had projected. The weakening trend of recent months is even clearer in terms of seasonally adjusted m/m numbers for both CPI-ATE and a more formal core measure (ex food and energy) which we compute. As Figure 2 shows these are now running at a pace very much consistent with a clear undershoot of target, something evident in other DM domains and which we think at least (in the current juncture) is a result of an easing in supply problems. It is against this backdrop that the Board can weigh whether with the 450 bp cumulative tightening still to have anything like its full impact, it can start to make the policy setting less restrictive, as it anticipated weakness demand supporting the recent disinflation process.

Notably, amid market expectations envisaging policy easing within the next six months, the January Board statement was not as a candid as that in December which suggested no easing until the autumn. This gives the Board a little more policy flexibility, albeit with no clear signs that there was a great appetite to exercise it. But the Board this month may want to give itself more formal flexibility and trim the policy rate profile to encompass the start of rate cutting from June.

Figure 2: Marked Fall in Underlying Inflation Increasingly Evident

Source: Stats Norway, Continuum Economics – smoothed is 3 mth mov avg

Indeed, we have long thought the Norges Bank has been too hawkish (Figure 1), not least given its own projection of an output gap of close to 1% persisting out to 2026. This output gap picture will weigh (further) on inflation and to a degree that makes us envisage a 25 bp cut in June. Admittedly, this is actually less of a cut than what we were previously anticipating for the whole of next quarter, but it is still more than markets and of course the Norges Bank have yet to pencil in. Regardless, we still forecast 100 bp of rate cuts in 2024 and a same-sized drop through 2025.