Norges Bank Review: Nothing New as Head Stays in the Sand

In its first meeting of the year, the Norges Bank kept rates on hold in what was both an expected and unanimous Board decision. But calling this a decision is possibly a misnomer as nothing was actually decided over and beyond waiting for new information and updated forecasts by the time of the next meeting in March. Admittedly, it was suggested (again) that policy could start to be eased at that next (March) meeting but nothing was hinted at to suggest that the policy outlook beyond then and what was offered in December (Figure 1) was intact given how market rate expectations have shifted in the interim. Indeed, we think the Norges Bank had the choice of cutting rates at this juncture, both to reflect what it admitted have been weaker price pressures and also to signal to markets that the recent repricing of policy ahead and inter-related rise in bond yields is very much unjustified. The economic impact of cutting two months earlier would be minimal. Instead, the overly cautious Norges Bank Board, still overly fixated on the weaker currency despite the latter still seeing falling imported inflation, decided on no action so that the policy rate at 4.5% has now been in place for over a year.

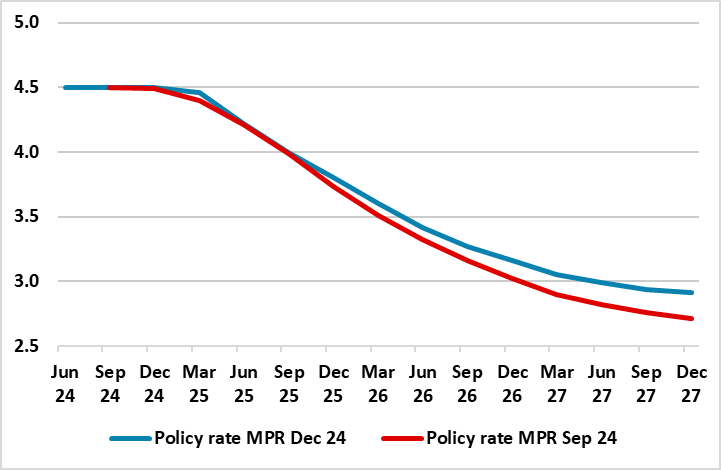

Figure 1: Is Existing Policy Outlook Intact?

Source: Norges Bank

Indeed, the Board chose not to be more vocal about the scale and timing of easing ahead, having had the opportunity to suggest the outlook was largely unchanged from the projections made last month (Figure 1). In fact, it instead possibly reinforced limited easing ahead by underscoring a continued need for policy to remain on the restrictive side. We still see rates falling faster and more sizably with some 150 bp of rate cuts in 2025 – 50 bp-plus more than the Norges Bank is advertising!

Nonetheless, and as Figure 1 also shows the Board anticipates that policy will continue easing all the way out to 2027, albeit basically settling at just under 3%. It is unclear if this is regarded as a neutral or terminal rate. How this policy outlook arises is unclear as targeted inflation (CPI-ATE) is seen staying above target through the forecast horizon, ie around 2.4% in 2027.

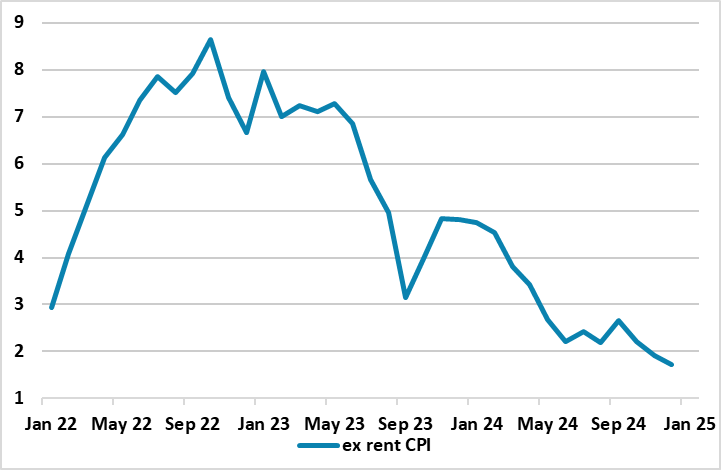

To us this is overly pessimistic. Admittedly, recent price dynamics have stated to suggest that disinflation may have started to flatten out. But this is only against a backdrop where monthly adjusted core readings are largely consistent with the 2% target already being met with m/m CPI-ATE and core outcomes of around 0.2%. And this is in spite of the impact of rental inflation (around 17% of the CPI) running still at well over 4% y/y, implying headline inflation ex-rents now at around 1.7%% (Figure 2). This begs the question whether Norges Bank policy is actually buttressing inflation as higher interest rates therefore mean higher inflation as rents are largely being driven by landlords facing (high) mortgage rates and increased demand for rental accommodation. Moreover, the resilience in rents may help explain the puzzling manner in which consumer confidence has developed of late, ie where households perceive a better financial position but are not willing to consider spending more.

Figure 2: Ex Rent Inflation Already Below Target

Source: Stats Norway, CE

The Norges Bank probably still sees policy risks being balanced, this view buttressed by a firmer than expected recent mainland real economy backdrop, the question being the extent to which the latter may as much reflect improved supply side developments related to productivity. But this did not feature and the Board's economic projections still look too optimistic to us, not least given that they are based around a EZ picture for next year which sees 1.1% GDP growth almost twice what we envisage.