Norges Bank Preview (Jun 20): Continued Caution?

Given the thrust of recent data and the Board’s clear caution, the Norges Bank is very likely to leave the policy rate at 4.5% for a fourth successive meeting at its next Board meeting with the decision due on June 20. It is also likely to retain the thinking first aired at the December meeting, namely ‘policy to stay on hold for some time ahead’ rhetoric, the question being whether the effective six-month period of unchanged rates is considered to be sufficiently long to flag any cuts in coming months. Formal rate forecast will be updated this time around with the release of a fresh Monetary Policy Report which is likely to repeat existing forecasts of no easing before September, albeit with a possibly more formal hint that the current tight monetary policy stance may be needed for somewhat longer than thus. This very much rules out any easing before the September 19 meeting. Notably, the Board seems more preoccupied by slightly better real economy data than the further inflation undershoot that has emerged of late. Albeit with risks if deferral, we still see the first Norges Bank rate cut in September, with two further moves later this year, all due to what we think are even clearer disinflation trends.

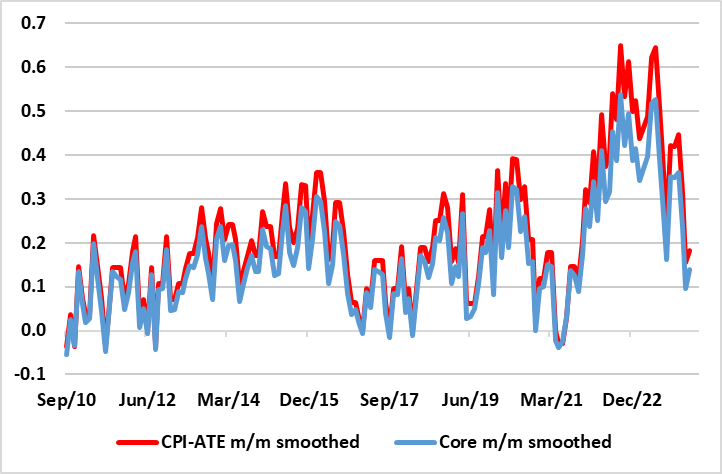

Figure 1: Disinflation Clear(er) and Broad(er)

Source: Stats Norway, CE, smoothed is 3mth mov avg

Against a backdrop of continued currency weakness, the Norges Bank Board has almost disregarded the recent inflation undershoot, instead preferring to focus on what it says is a perkier real economy, possibly in the hope that this may bolster sentiment in the FX market and thus the currency. As for inflation, we think the Board has underestimated the extent to which it has retreated of late on an underlying basis, this very much evident in seasonally adjusted data, for various core measures; we have computed a core measure in which food is excluded from the familiar CPI_ATE figure (Figure 1). Both this core and the CPI-ATE measures show recent seasonally adjusted m/m dynamics to be running at pace below 0.2% per month, ie consistent with the 2% target, if not an undershoot. And this is in spite of the impact of rental inflation (around 17% of the CPI) running still at over 4% y/y.

This begs the question whether Norges Bank policy is actually buttressing inflation as higher interest rates therefore mean higher inflation as rents are largely being driven by (high) mortgage rates. Indeed, the underlying rate of inflation excluding rents may be much lower than the annual rate of CPI_ATE inflation.

Even so, a weaker currency, higher global rate expectations, slightly stronger growth, a recovering housing market and more generous pay settlements than expected are all factors that will be playing on the minds of the ever- cautious Norges Bank, clouding any assessment that even y/y inflation had been slightly lower than officially expected. Indeed, the Board may be swayed by its latest regional survey where the contacts concerned reported that full capacity utilization has increased and contacts also revised up their wage growth estimates for 2024 and 2025 to 5.2% and 4.3%, respectively

We are wary about the apparent recovery in activity, not least given the impact of what has been unseasonable weather patterns and monthly GDP data that have fallen in four of the last five months of data. Regardless, given the Board’s (what we see as excessive) caution, the risks are clearly skewed towards cuts coming later than we anticipate. Amid an economy with a tight labour market and rapidly rising wages but low productivity growth, the Board may very well worry about inflation persistence, certainly on the costs push side. Notably, the Norges Bank was the first DM central bank to start hiking; it clearly has not wanted to be the first to start easing and it may instead be among the last!