Norges Bank Review: A Tweak in Policy Guidance

Aided by more downside inflation surprises and the accelerated pace of central bank easing nearby, speculation that the Norges Bank would ease by year –end had grown, but have now largely dissipated. However, after the widely expected stable policy decision today, the possibility that a cut may be made at the remaining on Dec 19 has increased. Once again, and as with the six previous policy meetings, the Norges Bank kept its policy rate at 4.5% but amended its policy guidance a touch, possibly in recognition of soft inflation outcomes of late (Figure 1). This was very much as we thought and gives the Board a little more policy flexibility, as in December, it will be armed with fresh forecast which could make a policy cut at that juncture more explainable. The scheduled decision on Jan 23 looks set to see the first rate cut, although this is not fully consistent with the little-revised official policy outlook, which indicates a slightly faster decline through 2025. We still see some 150 bp of rate cuts in 2025 – 50 bp more than the Norges Banks is advertising!

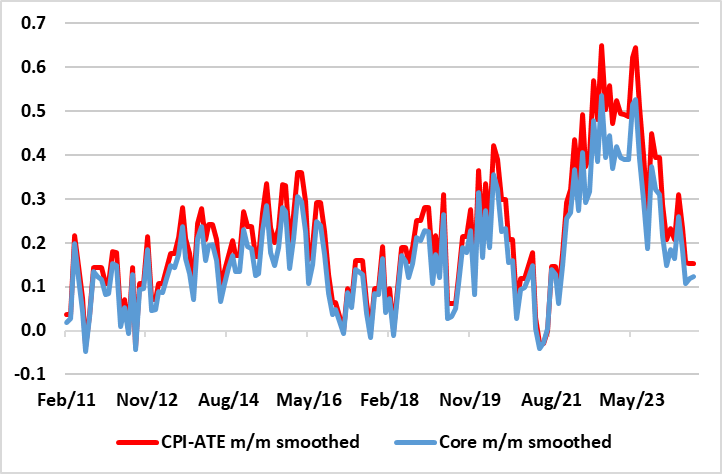

Figure 1: Inflation – What Inflation?

Source: Stats Norway, CE, core is CPI-ATE ex food

The Norges Bank probably still sees policy risks being balanced, despite a slightly disappointing mainland real economy backdrop and what have been broadly softer than (Norges Bank) expectations for CPI data of late, and where underling price dynamics are very weak (Figure 1). This is not fully acknowledged by the Board, which suggested that the outlook for the Norwegian economy does not appear to have changed materially since the previous monetary policy meeting. However, possibly why the Board gave itself more flexibility was that it gave weight to the fact that inflation has slowed faster than expected over the past year and that it was also lower in September than projected. On the other hand, it noted international policy rate expectations have increased, and the krone has been a little weaker than assumed.

As for inflation, adjusted short-term underling CPI data are very much consistent with an undershoot of the target having been evident for some time and are much weaker than in the EZ where the ECB has seen price data persuade to accelerate its easing cycle. But the Board will look at other issues too, noting continued positive results from house prices and will have noted a pick-up in mortgage loan demand that was also evident in its latest Bank Lending survey. However, that seems to have reversed given more up-to-date anecdotal evidence, probably on the back of the jump back in market rates that Norges Bank easing resistance has precipitated.

Even so, the (weak) krone is still at the center of Norges Bank thinking, not least as the currency has softened again of late. This currency preoccupation of the Board seems very puzzling to us as a) this hawkish policy leaning has failed to bolster the currency and b) the weak currency has not prevented a marked fall in inflation encompassing much reduced imported price pressures. In this regard, since the last hike ten months ago, a hawkish tone of keeping rates high for some time has repeatedly failed to unwind krone weakness, this despite the added bonus of a substantial Norwegian current account surplus.