Norges Bank Review: Policy Unchanged, Rhetoric Unchanged

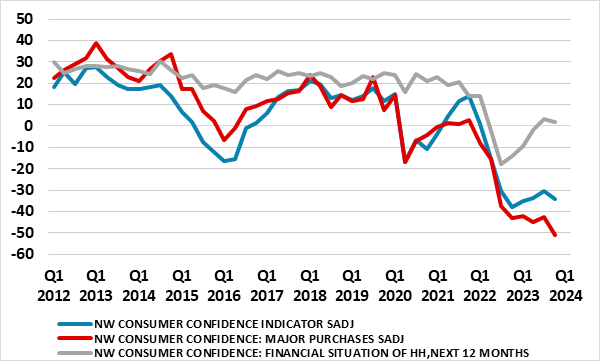

As was very much expected, this month’s Norges Bank meeting was something of a non-event. The Board left rates on hold, and also retained the thinking aired at the December meeting when it hiked rates somewhat surprisingly. There was a repetition of the ‘policy to stay on hold for some time ahead’ rhetoric as the Norges Bank battles along with other central banks against markets that are anticipating early and aggressive easing. But there were few, if any, new insights, not least as there was no updated Monetary Policy Report. It perhaps more clearly communicated a neutral policy outlook (the Committee assesses that the policy rate is now sufficiently high) amid a clear recognition that the current stance is restrictive. This slightly shift may have been motivated by recent data as the Board described the economy as being weak as opposed to cooling down, this very much reflected in weak consumer survey data (Figure 1).

Markets may be alert to comments about the exchange rate which rallied strongly after the hike last month but where this appreciation has largely unwound. In this regard, it was noted that the currency has depreciated further, but where against a backdrop of the ‘weak’ economy, the Board realized that any hike or even thereat of a hike may be counter-productive, however much the Board believes that krone depreciation makes it more challenging to bring down inflation.

Figure 1: Consumers Increasingly Depressed?

Source: Stats Norway

Exceeding most expectations, the Norges Bank raised its policy rate by a further 25 bp to 4.5% at the December Board meeting, thereby exercising the bias it communicated previously. But as of this month no further hiking is either occurring or is being considered. For the first time it was admitted that underlying inflation has declined further and that economic growth is weak, the latter very much underscored by ever weaker consumer confidence readings which point to an increased reluctance to spend (Figure 1). But from the Board’s perspective, both inflation and economic activity have been broadly in line with the projections in the December 2023 Monetary Policy Report so that the overall prospects for the Norwegian economy do not appear to have changed materially since the previous Report.

Notably, amid market expectations envisaging policy easing within the next six months, the latest statement was not as a candid as that in December which suggested no easing until the autumn. This gives the Board a little more policy flexibility, albeit with no clear signs that there is a great appetite to exercise it. But amid survey data pointing to recession and where CPI data has been distorted by swings in food prices rather than discretionary items, we think the Norges Bank is being too hawkish, not least given its own projection of an output gap of close to 1% persisting out to 2026. This output gap picture will weigh (further) on inflation and to a degree that makes us still think that that rate cuts may arrive by mid-2024. We forecast 100 bp of rate cuts in 2024 and a same-sized drop through 2025.