Norges Bank Preview: Nothing New to Note?

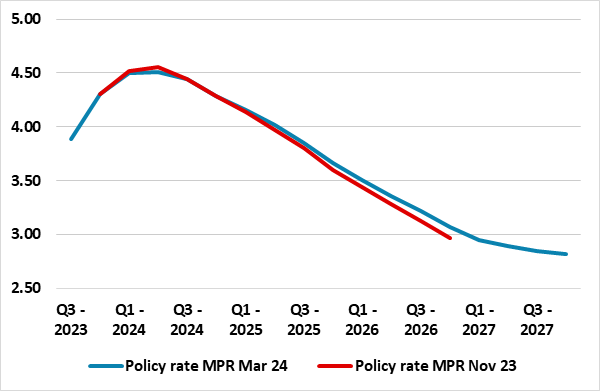

Surprising few, the Norges Bank Board is very likely to leave its policy rate at 4.5% for a third successive meeting when it gives it next verdict on May 3. It is also likely to retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhetoric, this more formally evident in what were modest revisions to the policy path outlined in the March meeting which suggested no easing before Q3, if then (Figure 1). This next policy decision will come with no updated forecasts but will be examined to see to what degree the recent inflation undershoot may have changed thinking – not at all given what looks to have been a perkier real economy however much affected by unseasonable weather. At this juncture we adhere to our view that the Norges Bank may actually start to ease in June but stress that, amid a still weak krone, our rate cut expectation may be premature.

Figure 1: Rate Profile Path to Hint at Nothing Imminent?

Source: Norges Bank

Perkier Real Activity

At the last (March) assessment, the updated forecasts accepted a softer recent inflation backdrop but revised up its real activity backdrop so that the recent price undershoot dissipated through 2025 due to a smaller output gap. Indeed, it adhered to its existing policy rate projection suggesting no cuts before this autumn Figure 1), actually envisaging a little firmer path out through 2026, but still a likely terminal rate of around 3%. However, it seemed that the Board was uncertain, possibly due to the wide differences across industries through the Norwegian economy and to a degree that it is still accepting a possibility of having to hike further. But the overall policy outlook was still balanced as it weighed risks of earlier easing (hurting the currency) against waiting too long.

Regardless, the smaller output gap (that now only appears next year rather than this, is seemingly a reflection of the slightly sturdier GDP backdrop of the last year but is still somewhat puzzling. Obviously, this generates a firmer-than-otherwise inflation outlook, and one that keeps inflation (CPI-ATE) above the 2% target throughout the forecast horizon, ie out to 2027. That the Board is still considering starting to cut rates and then keep easing, may be an indictment of this inflation projection with the Board instead basing policy on risks than firm projections.

Currency Dynamics Dissected

This may as much reflect not only the improved inflation picture of late but a realization that with many other DM central banks implying a potentially imminent rate cut cycle may mean that the Norges Bank may have to follow suit. Admittedly, the Bank may feel it can/should defer rate cuts well into H2 as this may help support the still weak krone, but this runs the risk of accentuating a weak economy, encompassing near record consumer confidence fragility, especially in regard to a willingness to make major purchases. This may be the underlying factor behind fresh recent currency weakness, especially given the clear policy caution the Board has flagged.

But the main issue the Board will discuss this time around will surely be the weaker CPI data seen of late. Indeed, core inflation fell to 4.5% last month, the lowest in 20 months, and below the 4.7% forecast by analysts and Norges Bank. Notably, much of the drop came from imported inflation, this more a sign of softer global price pressures than an indictment of currency dynamics on inflation.

Not least against a backdrop where the updated projections seem to take no account of likely looming rates cuts by other central banks, we think he Board is being too cautious and we still think rate cuts may arrive by mid-year, especially given the more recent drop in underlying price pressures. But currency consideration and excessive overall caution are likely to mean than any rate cut hints from the Norges Bank will remain consistent with nothing before September.