Norges Bank Preview (Dec 19): Still Resistant

Despite what seems to be an accelerated pace of central bank easing nearby, speculation that the Norges Bank would ease by year –end had grown, but have now largely dissipated. What seems to be the final nail in the coffin of a rate cut has been the November CPI numbers, higher than consensus but actually in line with Norges Bank expectations but with some pick-up in terms of short-run dynamics (Figure 1). Thus, another (ie eighth successive) widely expected stable policy decision should be forthcoming at the remaining Board decision on Dec 19 so that the policy rate at 4.5% has been in place for a year. Admittedly, last time around in November, the Board but amended its policy guidance a touch, offering it a little more policy flexibility, as this time around, it will be armed with fresh forecast which could make a policy cut at that or some near-term juncture more explainable. The scheduled decision on Jan 23 could still see the first rate cut, although this is not fully consistent with the little-revised official policy outlook, which may still suggest nothing before March. We still see some 150 bp of rate cuts in 2025 – 50 bp-plus more than the Norges Bank is advertising!

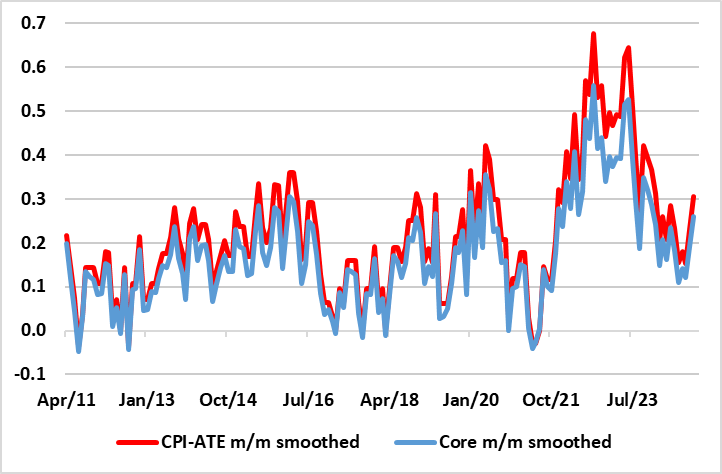

Figure 1: Disinflation Stalling?

Source: Stats Norway, CE, core is CPI-ATE ex food

The Norges Bank probably still sees policy risks being balanced, this view buttressed by a firmer than expected mainland real economy backdrop, the question being the extent to which the latter may as much reflect improved supply side developments related to productivity. If so, this may feature (via a reassessment of the output gap) in the updated economic projections which still look too optimistic to us, not least given that they are based around a EZ picture for next year which sees 1.3% GDP growth almost twice what we envisage.

But it is the apparent return of inflation stubbornness that holds the key to policy making for the ever-cautious Norges Bank Board. Until these November CPI numbers, there had been repeated broadly softer than (Norges Bank) expectations for CPI data and where underling price dynamics had been very weak (Figure 1). This has changed somewhat but we still think that the trend in adjusted short-term underling CPI data are very much consistent with an undershoot of the target having been evident for some time and are much weaker than in the EZ where the ECB has seen price data persuade to accelerate its easing cycle. But the Board will look at other issues too, noting continued positive results from house prices and will have noted a pick-up in mortgage loan demand that was also evident in its latest Bank Lending survey. However, that seems to have reversed given more up-to-date anecdotal evidence, probably on the back of the jump back in market rates that Norges Bank easing resistance has precipitated.

Even so, the (weak) krone is still at the center of Norges Bank thinking. This currency preoccupation of the Board seems very puzzling to us as a) this hawkish policy leaning has failed to bolster the currency and b) the weak currency has not prevented a marked fall in inflation encompassing much reduced imported price pressures, at least prior to November numbers. In this regard, since the last hike 12 months ago, a hawkish tone of keeping rates high for some time has repeatedly failed to unwind krone weakness, this despite the added bonus of a substantial Norwegian current account surplus. But perhaps bad habits are hard to break.