Norges Bank Preview (May 8): Policy Easing Flagged but Not Yet Materializing?

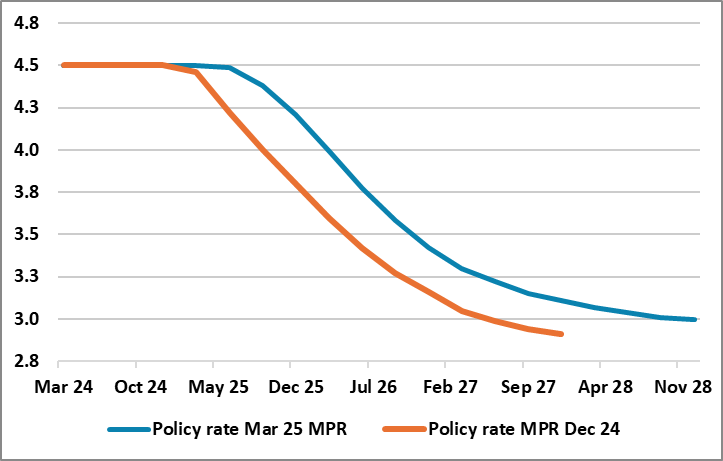

It does seem very likely that the Norges Bank will again keep policy on hold when it gives it next verdict on May 8, albeit with a risk that if it has access to what may be much friendlier CPI data officially due the day after, it could ease, or at least be more explicit about when the rate cut cycle may begin. As for recent history, and as was perhaps the more likely case, the Norges Bank in late March did not deliver on the rate cut it had been flagging very clearly until very near that juncture. Instead, it kept the policy rate at 4.5% on the back of inflation having been markedly higher than expected and where wage growth in 2024 turned out higher than projected. But in a clearly far from hawkish signal, policy easing is still seen starting this year and where the outlook still sees similar easing cycle to that previously envisaged but merely some 4-6 months later (Figure 1). With no new forecasts or Monetary Policy Report (MPR) due this month, on balance this outlook is nevertheless likely to be retained, encompassing a weaker real economy data and the risk of global trade tensions, an ensuing weaker GDP picture has led to a larger output gap emerging.

Figure 1: Policy Easing Deferred

Source: Norges Bank

This helps bring inflation (now very much overshooting) back towards target but only 2-3 years hence according to the Norges Bank. We think that the circa 4% rate projected by year end is too high against these justifiable risks and that a rate well under 4% is more likely, not least as we see a larger and earlier output gap. Indeed, we see CPI-ATE inflation down 0.3 ppt to a 3-mth low of 3.1% in data due the day after the Bard’s decision, these numbers likely to be made available to the Board, although a much weaker number may be needed to sway the Norges Bank this time around as that April projection largely chimes with the forecast made by the Bank in March.

Regardless, while inflation has moved further above target, it has been boosted by a series of one-offs and also by the CPI basket re-weighting. The question remains whether the (hawkish) Norges Bank judged price pressures appear to be more persistent than it previously assumed – this does not seem to be the case. Indeed, amidst a significant reassessment, these considerations do not really seem to have altered the Boards (admittedly hawkish)’ mindset. It thinks that the output gap has narrowed, and output is now close to potential. But with downgrades made change as GDP growth is pared back to just over 1% in the next three years, this returns an ever-clearer output gap into next year.

As for that outlook, the Norges Bank also worries about business costs, but has noted previously two-sided risks around it, encompassing the risk of an increase in international trade barriers but with less overt concern about the weak currency once again. The worry is that higher tariffs will likely dampen global growth, but the implications for price prospects in Norway are uncertain. We still see some up to 100 bp of rate cuts in 2025 – ie likely to be more than 50 bp greater than the Norges Bank is advertising and at least the same amount of cuts in 2026!