Norges Bank Review: Heads Still in the Sand?

As with the five previous policy meetings, the Norges Bank kept its policy rate at 4.5% and equally unsurprising moderated its previous hawkish rhetoric - slightly. While it still fought against market expectations by suggesting policy will remain on hold until year end it did drop its recent stress of ‘policy to stay on hold for some time ahead’, instead noting that ‘the time to ease monetary policy is approaching’. The scheduled decision on Jan 23 looks set to see the first rate cut, although this is not fully consistent with the little-revised official policy outlook, which indicates a slightly faster decline through 2025. The Bank sees policy risks still seem balanced, despite a slightly disappointing mainland real economy backdrop and what have been broadly softer than (Norges Bank) expectations for CPI data of late, and where underling price dynamics are very weak (Figure 1). Even so, amid this slight change in its rhetoric, the (weak) krone is still at the center of its thinking. This to us seems very puzzling as a) this hawkish policy leaning has failed to bolster the currency and b) the weak currency has not prevented a marked fall in inflation encompassing much reduced imported price pressures d (Figure 2). We now see some 150 bp of rate cuts in 2025 – 50 bp more than the Norges Banks is advertising!

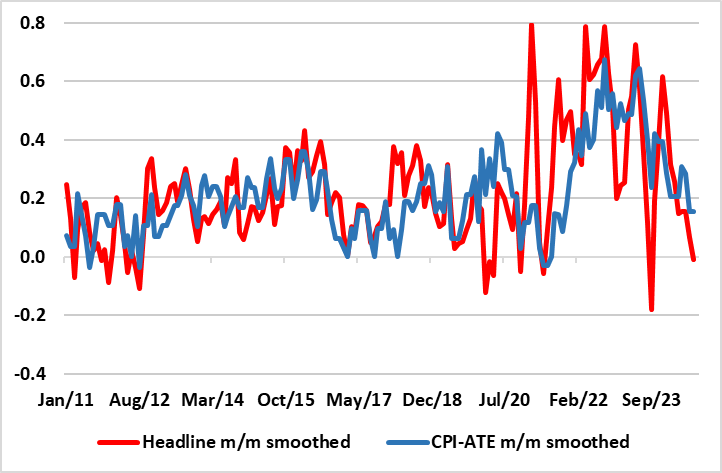

Figure 1: Inflation – What Inflation?

Source: Norges Bank, smoothed is 3-mth mov avg

The Norges Bank last month noted uncertainty about future economic developments, but this was more a result based around the balance of risks stemming from developments in the krone exchange rate and the potential implications for inflation. But possibly advertising that a change of thinking was then under consideration, the Board highlighted then that it will have received more information about economic developments ahead of this next looming monetary policy meeting especially as new forecasts will be presented.

We think any such change in thinking has been long overdue and the slight changes this time around go no way near far enough. In this regard, since the last hike ten months ago, a hawkish tone of keeping rates high for some time has repeatedly failed to unwind krone weakness, this despite the added bonus of a substantial Norwegian current account surplus.

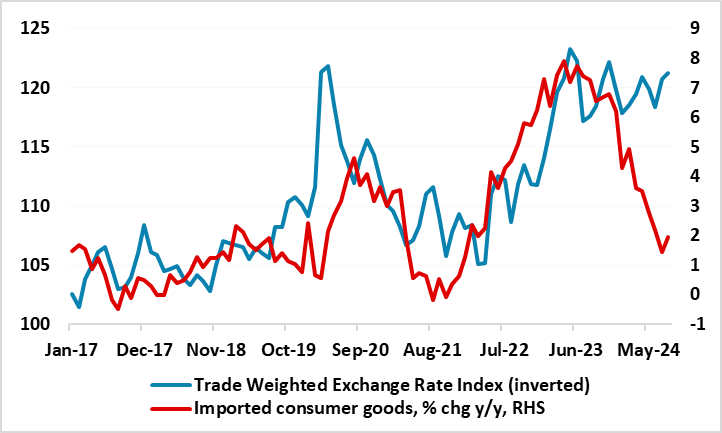

What is clear is that the Norges Bank has an inflation remit, not a currency one. Yes, the currency is an ingredient into the inflation picture (something that the IMF has helped fuel), albeit one that affects more the price level than the rate of price changes – other factors determine the latter more. Regardless, the (weak) krone has not prevented imported inflation falling – now at 1.9%, less than a quarter of the rate some 12 month ago (Figure 2). In addition, the economy has all but stalled, with mainland GDP growth this year likely to come in no higher than 0.6%, an outcome that the Norges Bank has revised its projections down to – also paring back its 2025 outlook to chime with our 1.1% view. This weakness can be summed up as ‘Growth in the mainland economy has been unusually weak over the past year, and this trend continued in Q2 2024’ this view emanating from Statistics Norway

Figure 2: Weak Currency Has Not Stopped Imported Inflation From Tumbling

Source: Stats Norway

Notably this has helped drive inflation down on a broad basis so that the targeted measure CPI-ATE (ie the CPI adjusted for tax changes and excluding energy products) has more than halved in the last year to 3.2% in August. Admittedly, some of this is a result of one-off factors related to childcare costs. Moreover, this rate is still above the 2% target and where Norges Bank projections see it remaining (well) above even out to 2027, albeit where that August outcome is well below existing official projections. But even this is of secondary importance to just how much recent price dynamics have weakened, something that largely backward looking y/y rates are masking.

Indeed, as for inflation, we think the Board has underestimated the extent to which it has retreated of late on an underlying basis, this very much evident in seasonally adjusted data, for various core measures; we have computed a core measure in which food is excluded from the familiar CPI-ATE figure. Both this core and the CPI-ATE measures show recent seasonally adjusted m/m dynamics now to be running at pace nearer 0.1% per month (Figure 1), ie consistent with the 2% target being undershot and actually back (if not below) the average rate in the ‘lowflation’ decade before the pandemic. And this is in spite of the impact of rental inflation (around 17% of the CPI) running still at over 4% y/y, implying headline inflation ex-rents now at 2.5%. This begs the question whether Norges Bank policy is actually buttressing inflation as higher interest rates therefore mean higher inflation as rents are largely being driven by (high) mortgage rates. Moreover, the resilience in rents may help explain the puzzling manner in which consumer confidence has developed of late, ie where households perceive a better financial position but are not willing to consider spending more.

Against this backdrop we think the Norges Bank is still well behind the curve. We think that amid softer global signs and rising monetary easing momentum, it will have to ease faster than it is now flagging, with 150 bp cuts next year as opposed to the 100 bp implicit in Board projections. What puzzles us is that amid current inflation dynamics that suggest inflation is already well below target why the updated projection still point to an inflation overshoot persisting out to 2027, especially given what is seen to be an extended output gap. If the Board really thinks this, then it should, not be flagging any easing at all, but this muddles policy thinking is perhaps at least one factor that makes the FX markets wary of the krone. Regardless, with policy at 4.5%, the Board has ample room to ease and still have a monetary stance that would remain restrictive. All of which reflects a marked irony: among DM central banks the one with the lowest underlying inflation backdrop is the one most resolutely refraining from actual rate cuts.