Norges Bank Review: Caution Prevails

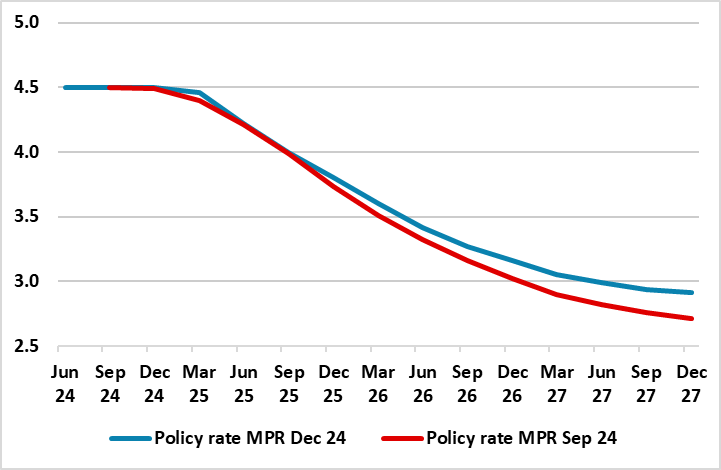

Surprising no-one, another (ie eighth successive) stable policy decision was forthcoming at this latest Board decision so that the policy rate at 4.5% has been in place for a year. The statement was more open about policy being eased but only after two more meetings, so that the first cut will come in March next year. The revised forecasts saw higher growth numbers but where the inflation outlook shaved back somewhat amid what was termed inflation pressures that appear to have been slightly more subdued than previously assumed. But the worry about business costs actually saw the policy outlook raised slightly (Figure 1), but with two-side risks around it, encompassing the risk of an increase in international trade barriers but with less overt concern about the weak currency this time around. Higher tariffs will likely dampen global growth, but the implications for price prospects in Norway are uncertain. The scheduled decision on Jan 23 could still see the first rate cut, although this is now less likely. We still see some 125 bp of rate cuts in 2025 – 25 to 50 bp more than the Norges Bank is advertising!

Figure 1: Cautious Policy Outlook Hardly Revised?

Source: Norges Bank

As Figure 1 also shows the Board anticipates that policy will continue easing all the way out to 2027, albeit basically settling at just under 3%. It is under if this is regarded as a neutral or terminal rate. How this policy outlook arises is unclear as targeted inflation (CPI-ATE) is seen staying above target through the forecast horizon, ie around 2.4% in 2027.

The Norges Bank still sees policy risks being balanced, this view buttressed by a firmer than expected mainland real economy backdrop, the question being the extent to which the latter may as much reflect improved supply side developments related to productivity. But this did not feature (via a reassessment of the output gap) in the updated economic projections which still look too optimistic to us, not least given that they are based around a EZ picture for next year which sees 1.1% GDP growth almost twice what we envisage.

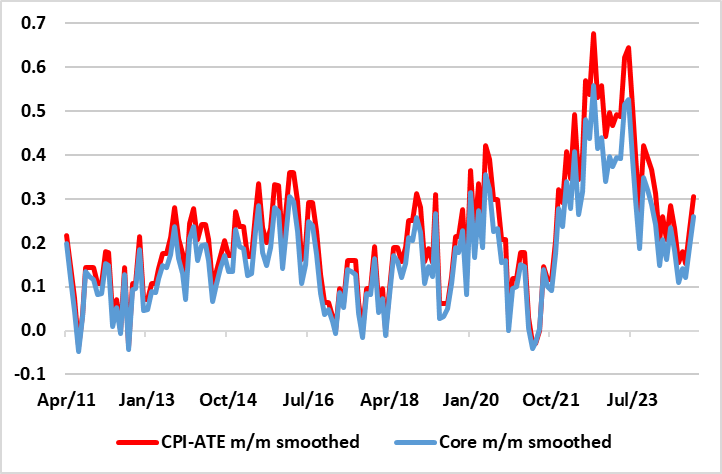

Figure 2: Disinflation Settling Down?

Source: Stats Norway, CE, core is CPI-ATE ex food

But it is the apparent return of inflation stubbornness that holds the key to policy making for the ever-cautious Norges Bank Board. It does seem that the Board has not been unduly perturbed by the latest CPI numbers, implicitly noting underling price dynamics that have been very weak (Figure 2). Indeed, adjusted short-term underling CPI data are very much consistent with an undershoot of the target having been evident for some time and are much weaker than in the EZ where the ECB has seen price data persuade to accelerate its easing cycle. But the Board will have looked at other issues too, most notably an impression that activity in the Norwegian economy appears to be holding up better than the Board previously projected, this seemingly prompting 0.3 ppt upgrades to the 2024 and 2025 GDP outlooks. As suggested above, these look optimistic. All of which reflects a marked irony: among DM central banks the one with the lowest underlying inflation backdrop is the one most resolutely refraining from actual rate cuts and having been the first to tighten will be the last to start easing!