Data

View:

January 05, 2026

U.S. December ISM Manufacturing - Weaker on reversal in inventories

January 5, 2026 3:18 PM UTC

December’s ISM manufacturing index of 47.9 is unexpectedly down from 48.2 and the weakest since October 2024, though the details do not suggest much underlying change in the picture, which remains subdued and a little below neutral.

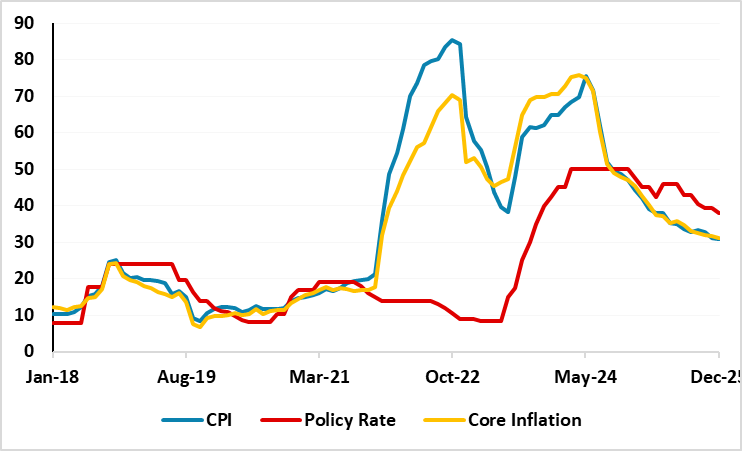

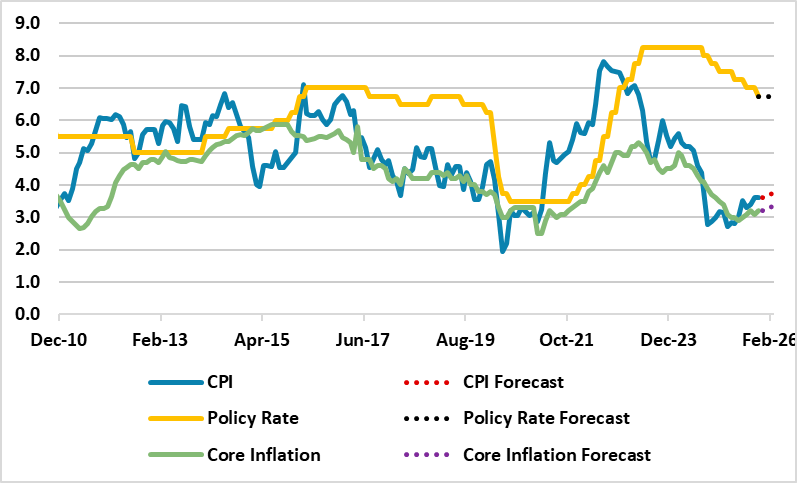

Turkiye Closes the Year with Inflation Easing to 30.9% y/y in December

January 5, 2026 11:25 AM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on January 5, Turkiye’s inflation softened to 30.9% y/y in December backed by the lagged impacts of previous monetary tightening. Food, housing and education drove the inflation in December as education prices recorde

January 02, 2026

Preview: Due January 13 - U.S. September and October New Home Sales - August overstated, but trend poised to improve

January 2, 2026 7:29 PM UTC

Delayed September and October new home sales data will be released on January 13. August data was surprisingly strong, up 20.5% to 800k, and despite signs of improvement in the housing sector since then, we expect September to be softer at 700k, before a bounce to 750k in October.

Preview: Due January 9 - U.S. September and October Housing Starts and Permits - Housing sector starting to pick up

January 2, 2026 4:21 PM UTC

The delayed housing starts and permits data for September in October will be released on January 9. We expect starts to rise by 1.8% in September and 3.0% in October, while permits rise by 0.8% in September and 2.2% in October, both reaching October levels of 1370k in October.

Preview: Due January 8 - U.S. October Trade Balance - Exports to correct from stronger September

January 2, 2026 3:40 PM UTC

We expect an October trade deficit of $60.5bn, up from September’s $52.8bn which was the narrowest since June 2020. The deficit would be marginally above August’s $59.3bn, while remaining well below July’s $77.2bn and March’s record $136.4bn when imports surged ahead of the tariff announceme

Preview: Due January 5 - U.S. December ISM Manufacturing - Stable slightly short of neutral

January 2, 2026 3:05 PM UTC

We expect December’s ISM manufacturing index to remain at November’s level of 48.2, which was down from 48.7 in October and the weakest since July. Trend is fairly stable slightly below neutral.

Preview: Due January 7 - U.S. December ADP Employment - Weekly data suggests November's decline will reverse

January 2, 2026 2:44 PM UTC

Weekly ADP data, showing an average weekly job increase of 11.5k in the four weeks to December 6, suggests a rebound in the December ADP employment report from a negative November, we expect by 50k, which would more than fully reverse November’s 32k decline while leaving trend subdued.

December 23, 2025

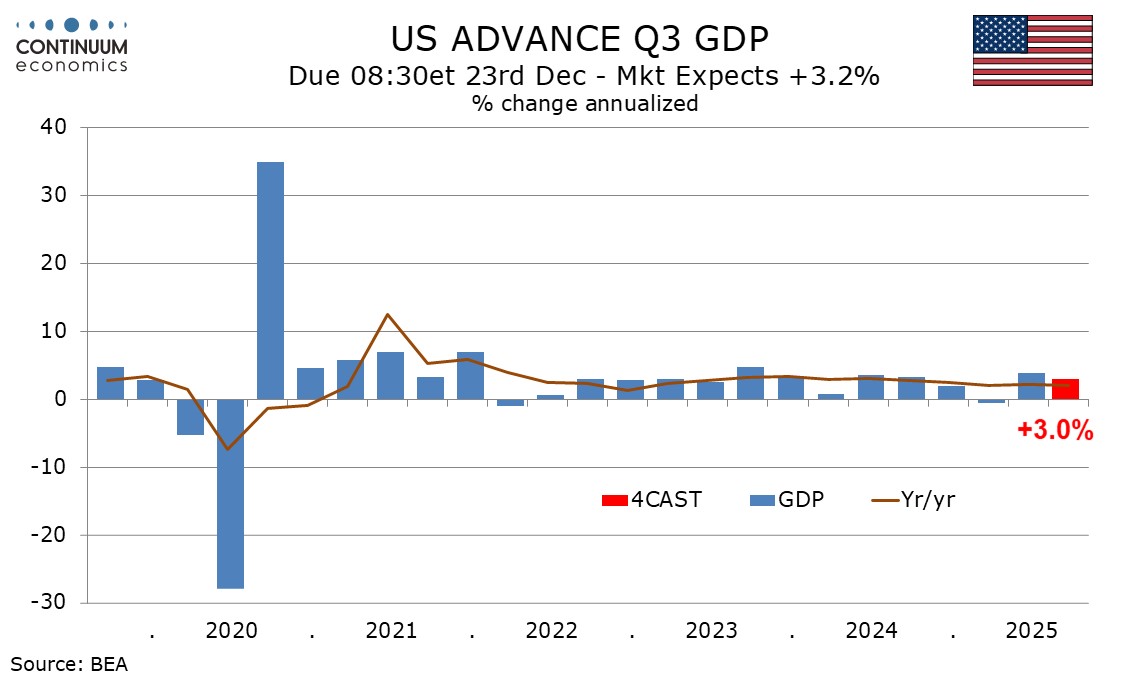

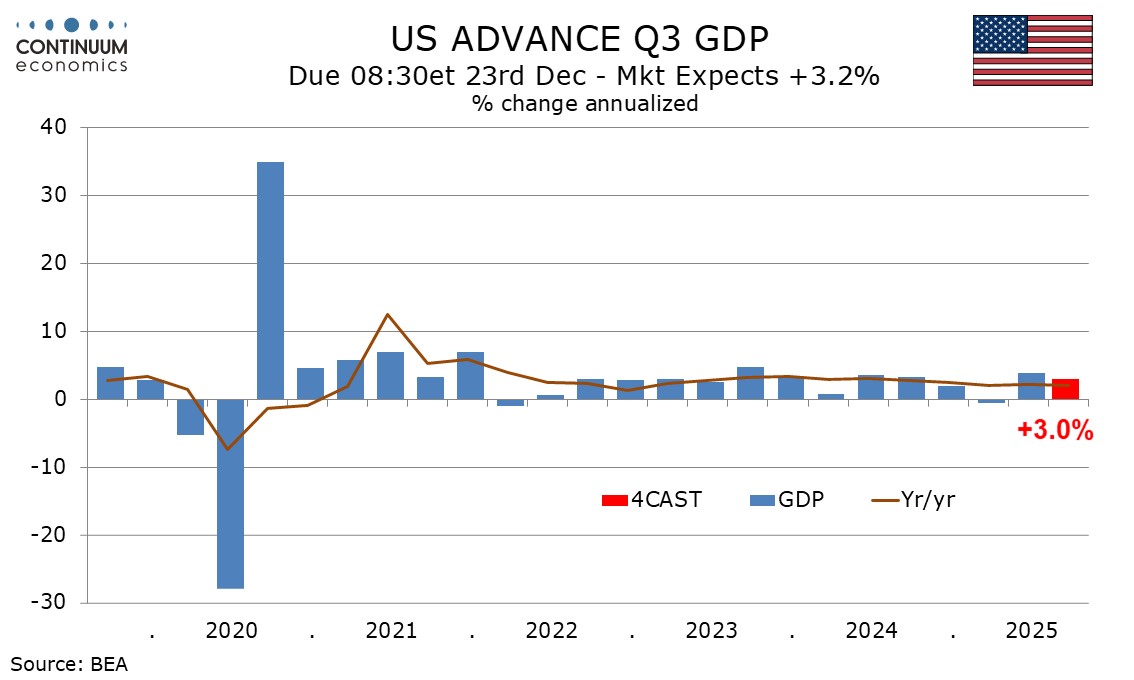

U.S. Q3 GDP: Better Than Expected, But

December 23, 2025 1:54 PM UTC

Q3 GDP came in better than expected due to a big net export contribution to growth. Gross domestic purchases at 2.7% were more in line with expectations, with mixed performance in key expenditure sectors. We see growth slowing in Q4, with net exports unlikely to repeat the Q3 outcome and consume

December 22, 2025

Preview: Due December 23 - U.S. October and November Industrial Production - Net marginally positive

December 22, 2025 3:08 PM UTC

The Fed will release October and November industrial production together, having received key input data from the non-farm payrolls. We expect a 0.1% decline in October to be followed by a 0.2% increase in November, with manufacturing up by 0.3% in November after a 0.1% decline in October.

Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

December 22, 2025 2:42 PM UTC

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

Russia’s Inflation is Expected to Continue to Soften in December

December 22, 2025 2:11 PM UTC

Bottom Line: After edging down to 6.6% in November, we expect Russian inflation to continue its decreasing pattern in December owing to lagged impacts of previous aggressive monetary tightening and relative resilience of RUB. December inflation figures will be announced on December 29, and we forese

December 19, 2025

Canada October retail sales - A weak month, but November seen stronger

December 19, 2025 1:49 PM UTC

Canadian retail sales with a 0.2% October decline are weaker than the unchanged estimate made with September’s report, and suggest a continued subdued consumer picture. However the preliminary estimate for November is quite strong, with a rise of 1.2% projected.

December 18, 2025

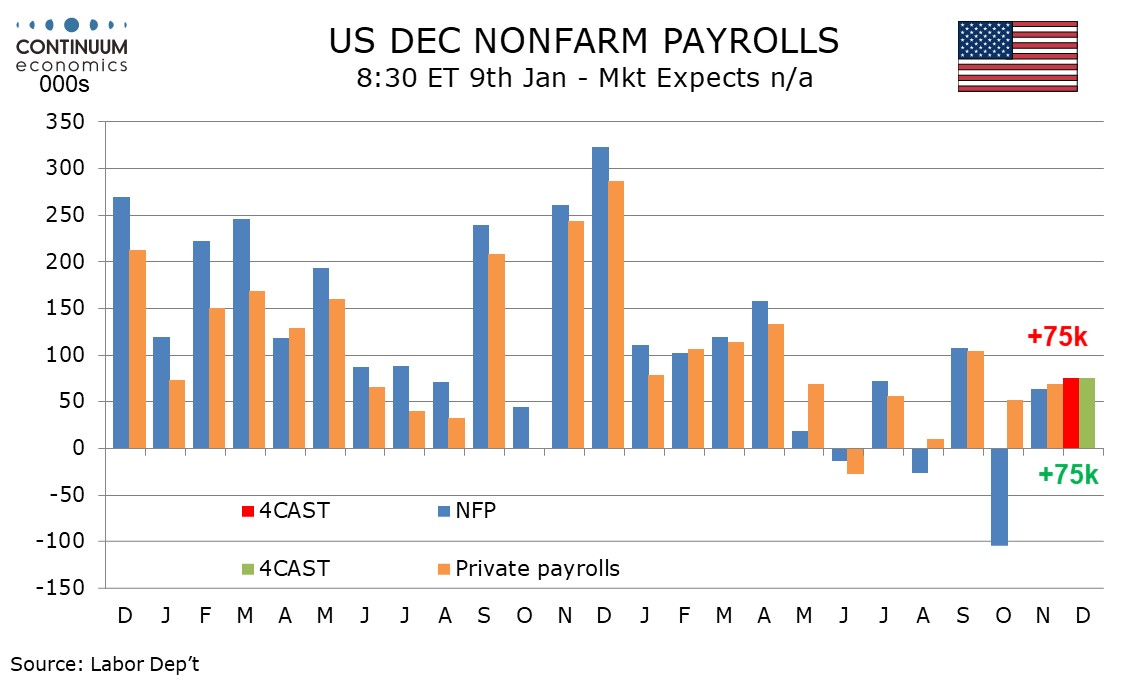

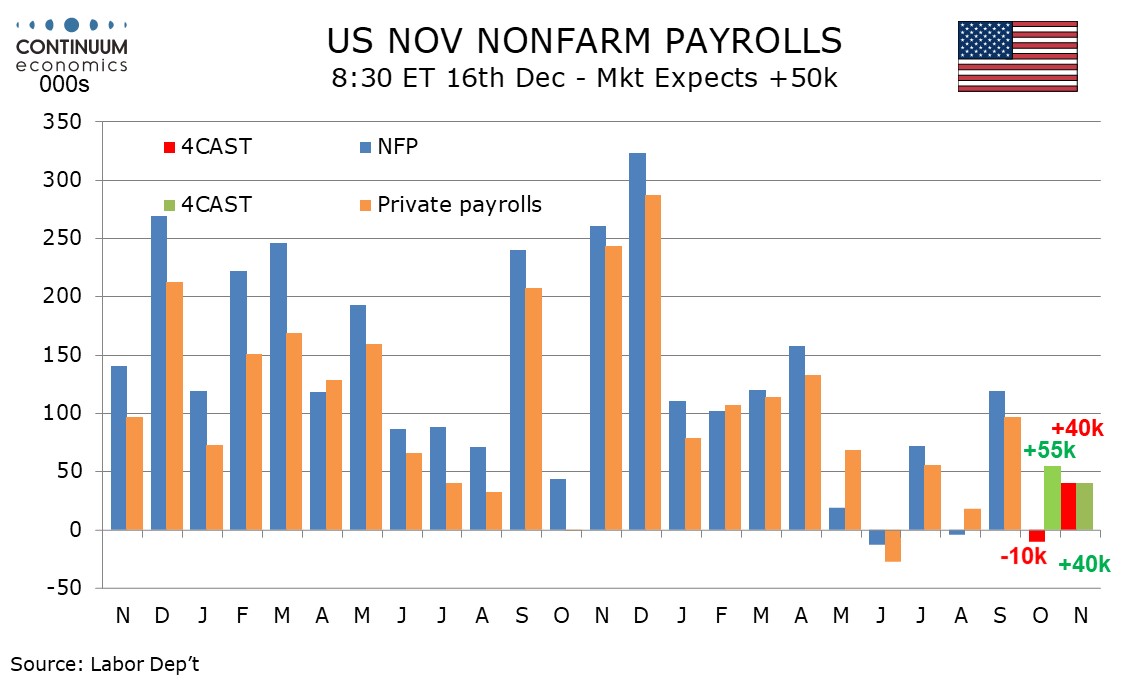

Preview: Due January 9 - U.S. December Employment (Non-Farm Payrolls) - Slightly firmer with unchanged unemployment

December 18, 2025 8:46 PM UTC

We expect December’s non-farm payroll to rise by 75k both overall and in the private sector, up from 64k and 69k respectively in November. We expect unemployment to be unchanged at 4.6% and a modest 0.3% increase in average hourly earnings.

Preview: Due January 9 - Canada December Employment - Recent strength unlikely to persist

December 18, 2025 6:32 PM UTC

We expect Canadian employment to increase by 10k in December, a number that is probably closer to trend than the three straight strong gains averaging close to 60k. We expect unemployment to correct higher to 6.7% from 6.5% in November, still below October’s 6.9% and the 7.1% highs of July and Aug

Preview: Due January 5 - U.S. December ISM Manufacturing - Stable slightly short of neutral

December 18, 2025 4:19 PM UTC

We expect December’s ISM manufacturing index to remain at November’s level of 48.2, which was down from 48.7 in October and the weakest since July. Trend is fairly stable slightly below neutral.

Preview: Due December 19 - U.S. November Existing Home Sales - Revival to continue

December 18, 2025 2:37 PM UTC

We expect November existing home sales to increase by 1.5% to 4.16m, which would be a third straight increase and the highest level since February, as the housing market gets support from lower mortgage rates as Fed easing resumes.

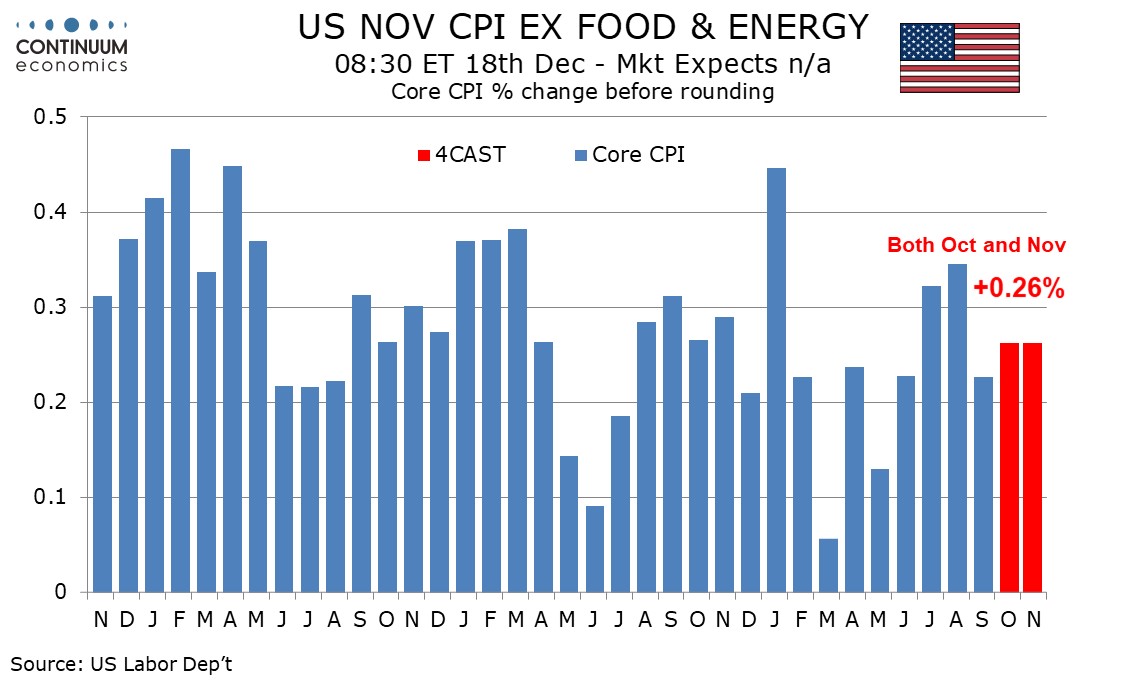

U.S. November CPI - Is the tariff impact fading?

December 18, 2025 2:10 PM UTC

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month ov

December 17, 2025

Preview: Due January 7 - U.S. December ISM Services - Headline and prices paid to slow

December 17, 2025 6:56 PM UTC

We expect December’s ISM services index to slip to 52.0 from November’s 9-month high of 52.6. A weaker December S and P services PMI suggests downside risk even if its level at 52.9 remained above November’s ISM services index.

Preview: Due December 23 - U.S. October and November Industrial Production - Net marginally positive

December 17, 2025 6:25 PM UTC

The Fed will release October and November industrial production together, having received key input data from the non-farm payrolls. We expect a 0.1% decline in October to be followed by a 0.2% increase in November, with manufacturing up by 0.3% in November after a 0.1% decline in October.

South Africa Inflation Moderately Softens to 3.5% y/y in November

December 17, 2025 5:08 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on December 17 that annual inflation softened moderately to 3.5% y/y in November from 3.6% the previous month, but food and restaurant prices remained worrisome. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 pe

Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

December 17, 2025 1:41 PM UTC

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October b

December 16, 2025

Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

December 16, 2025 4:25 PM UTC

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

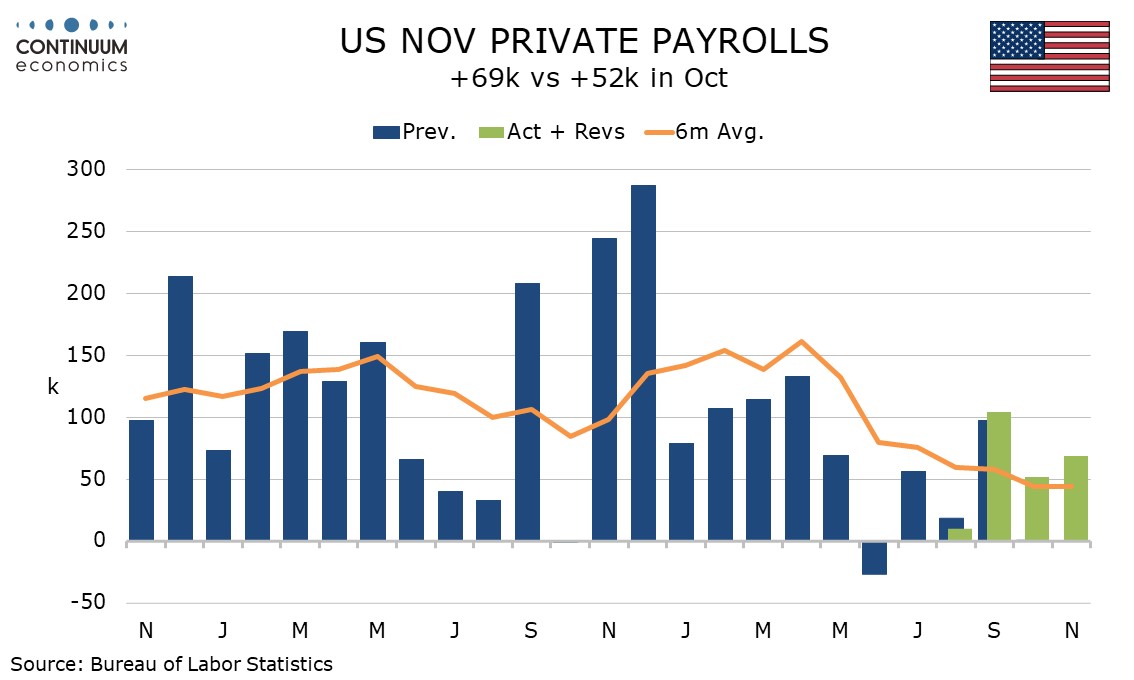

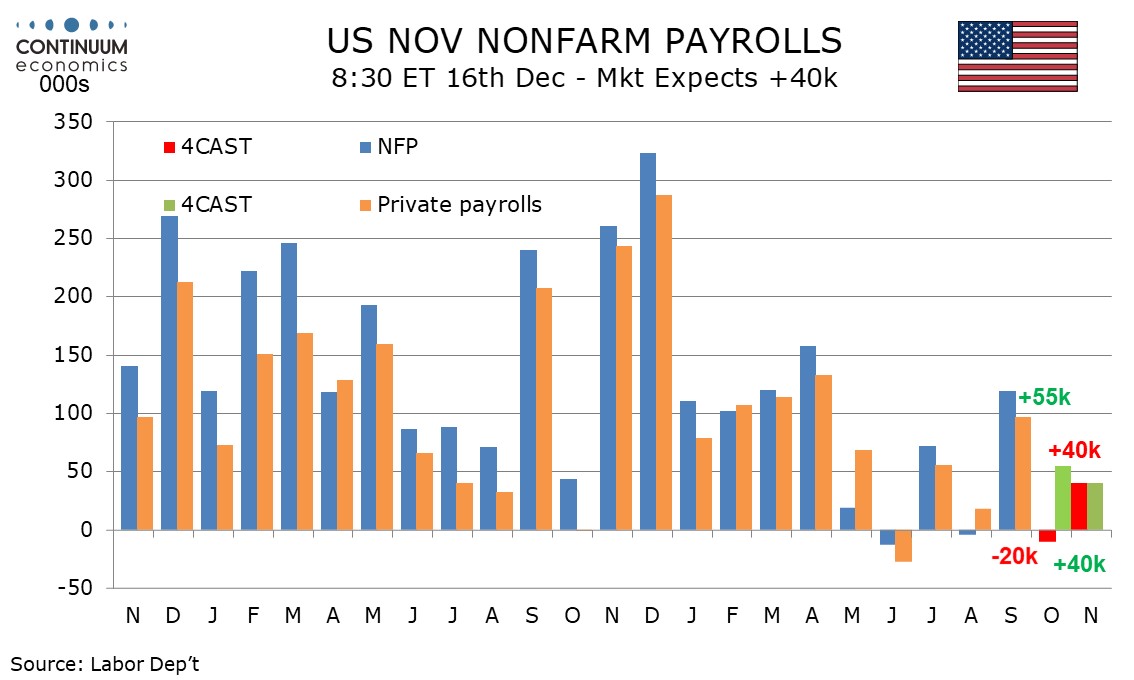

U.S. October and November Employment - Unemployment rising but economy maintains some momentum

December 16, 2025 2:22 PM UTC

November’s non-non-farm payroll at 64k does not fully erase a 105k decline in October but private payrolls at 69k in November and 52k in October maintain moderate growth, though unemployment at 4.6% in November is the highest since September 2021, and average hourly earnings growth is slowing. Oct

December 15, 2025

Preview: Due December 16 - U.S. December S and P PMIs - Only marginally lower, still healthy

December 15, 2025 3:51 PM UTC

We expect December’s S and P PMIs to both see very marginal slippage, manufacturing to 52.0 from 52.2 and services to 54.0 from 54.1. These will still leave the picture looking fairly healthy and there is little reason to expect a sharp fall in December, though we do see risks to the economy as le

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 15, 2025 3:25 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

U.S. December NAHB Homebuilders Index - Third straight rise

December 15, 2025 3:09 PM UTC

December’s NAHB homebuilders’ index of 39 from 38 has delivered a third straight rise though the latest two gains are marginal, by one point, after a strong five point bounce in October and the level is still quite soft.

U.S. December Empire State Manufacturing Survey - Correction from strong November

December 15, 2025 2:06 PM UTC

December’s Empire State manufacturing index at -3.9 versus 18.7 has corrected from a 12-month high, though remains within this year’s range and the series is volatile. November was well above trend both in 2024 and 2025.

Canada November CPI - Underlying trend has slowed

December 15, 2025 1:48 PM UTC

November Canadian CPI at 2.2% has held steady at October’s pace, and is slightly weaker than expected. The Bank of Canada’s core are are on balance weaker, with CPI-Median and CPI-Trim falling to 2.8% from 3.0%, though CPI-Common (less important to the BoC) edged up to 2.8% from 2.7%.

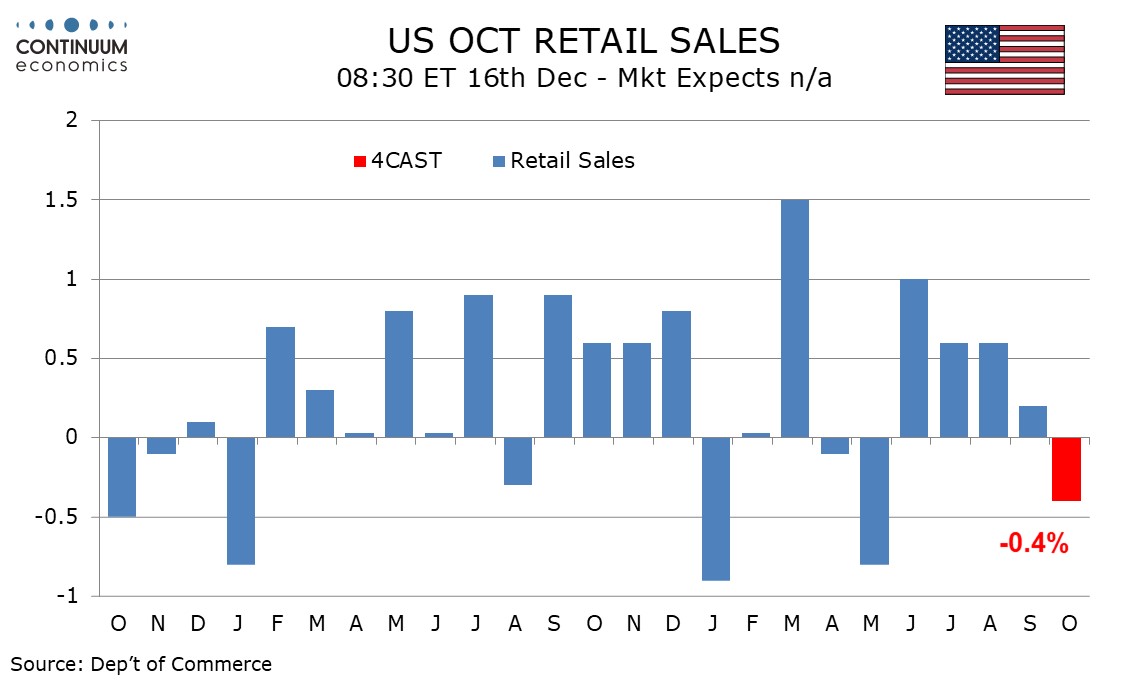

Preview: Due December 16 - U.S. October Retail Sales - Autos to lead a dip

December 15, 2025 1:16 PM UTC

We expect a 0.4% decline in October retail sales in September, with autos set to be the main negative after the expiry of a tax credit for electrical vehicle purchases. Elsewhere however we expect subdued data, with a 0.1% increase ex autos and a rise of 0.2% ex autos and gasoline.

December 12, 2025

Preview: Due December 15 - Canada November CPI - Slightly firmer but not on the key core rates

December 12, 2025 4:17 PM UTC

We expect November’s Canadian CPI to increase to 2.3% yr/yr from 2.2% in October, suggesting Q4 is likely to exceed a Bank of Canada forecast of 2.0% made in October. However, risk on the Bank of Canada’s core rates leans to the downside.

December 11, 2025

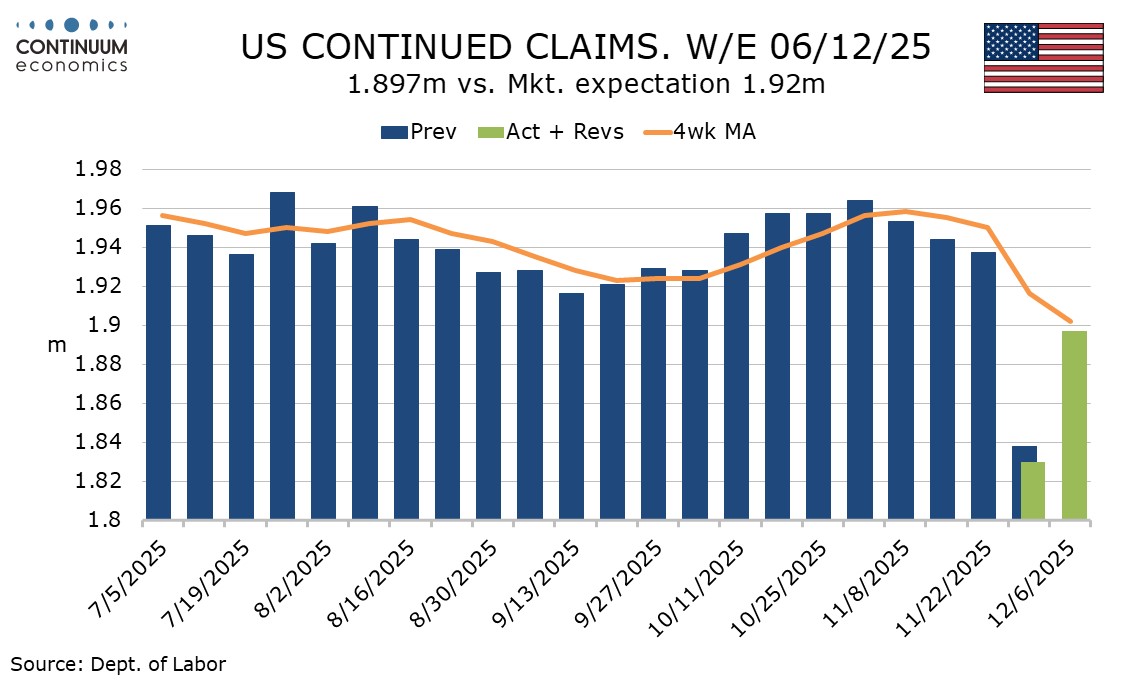

U.S. Initial Claims rebound from holiday drop, September trade deficit falls on surge in gold exports

December 11, 2025 2:14 PM UTC

After a sharply below trend outcome last week of 192k (revised from 191k) in a week that included the Thanksgiving holiday and may have seen seasonal adjustment problems, initial claims have rebounded above trend to 236k. The 2-week average is 214k, slightly below the 218k seen two weeks ago and the

Exceeding Expectations: Russia Inflation Eased Fast to 6.6% y/y in November

December 11, 2025 8:15 AM UTC

Bottom Line: Russian inflation continued its decreasing pattern in November and edged down to 6.6% owing to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB despite food and services prices continued to surge in November. We think the inflation will continue

December 10, 2025

Preview: Due December 11 - U.S. September Trade Balance - Canadian data suggests a wider deficit

December 10, 2025 1:48 PM UTC

We expect a September trade deficit of $70.5bn, up sharply from August’s $59.6bn but still below July’s $78.2bn. We expect exports to fall by 0.5% after a 0.1% August increase while imports rise by 2.8% after a 5.1% July decline. This could weigh on estimates for Q3 GDP, now due on December 23

December 09, 2025

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 9, 2025 5:01 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

U.S. September/October JOLTS report - Mostly a resilient message

December 9, 2025 3:25 PM UTC

The Labor Dep’t has released the JOLTS report on labor turnover for both September and October, with the September data being partial but the October release surveyed as originally planned. The picture is on the strong side of expectations and the pre-shutdown trend.

U.S. November NFIB survey shows significant acceleration in selling prices

December 9, 2025 1:11 PM UTC

The most notable feature of November’s NFIB survey of Small Business Optimism was a sharp rise in the proportion reporting higher selling prices, to 34% from 21%, reaching the highest level since March 2023. Why such as sharp bounce has some this month is difficult to explain but it could be that

December 08, 2025

Preview: Due December 16 - U.S. December S and P PMIs - Only marginally lower, still healthy

December 8, 2025 4:11 PM UTC

We expect December’s S and P PMIs to both see very marginal slippage, manufacturing to 52.0 from 52.2 and services to 54.0 from 54.1. These will still leave the picture looking fairly healthy and there is little reason to expect a sharp fall in December, though we do see risks to the economy as le

Preview: Due Decemebr 19 - U.S. November Existing Home Sales - Revival to continue

December 8, 2025 3:29 PM UTC

We expect November existing home sales to increase by 1.5% to 4.16m, which would be a third straight increase and the highest level since February, as the housing market gets support from lower mortgage rates as Fed easing resumes.

Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

December 8, 2025 2:00 PM UTC

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October b

December 05, 2025

Preview: Due December 16 - U.S. October Retail Sales - Autos to lead a dip

December 5, 2025 8:06 PM UTC

We expect a 0.4% decline in October retail sales in September, with autos set to be the main negative after the expiry of a tax credit for electrical vehicle purchases. Elsewhere however we expect subdued data, with a 0.1% increase ex autos and a rise of 0.2% ex autos and gasoline.

U.S. September Core PCE Prices consistent with CPI, December Michigan CSI sees inflation expectations fall

December 5, 2025 3:27 PM UTC

September PCE prices at 0.3% overall, 0.2% ex food and energy are in line with expectations with the respective gains before rounding at 0.269% and 0.198%. December’s Michigan CSI has seen inflation expectations easing, which will provide some comfort to the Fed.

Canada November Employment - Third straight strong rise, unemployment lowest since July 2024

December 5, 2025 2:00 PM UTC

Canada’s November employment report has surprised on the upside for a third straight month, rising by 53.6k, and this time with a sharp fall in unemployment to 6.5% from 6.9%. While the Bank of Canada is unlikely to be thinking about tightening yet, the data adds to hopes generated by a 2.6% annua