Preview: Due January 13 - U.S. September and October New Home Sales - August overstated, but trend poised to improve

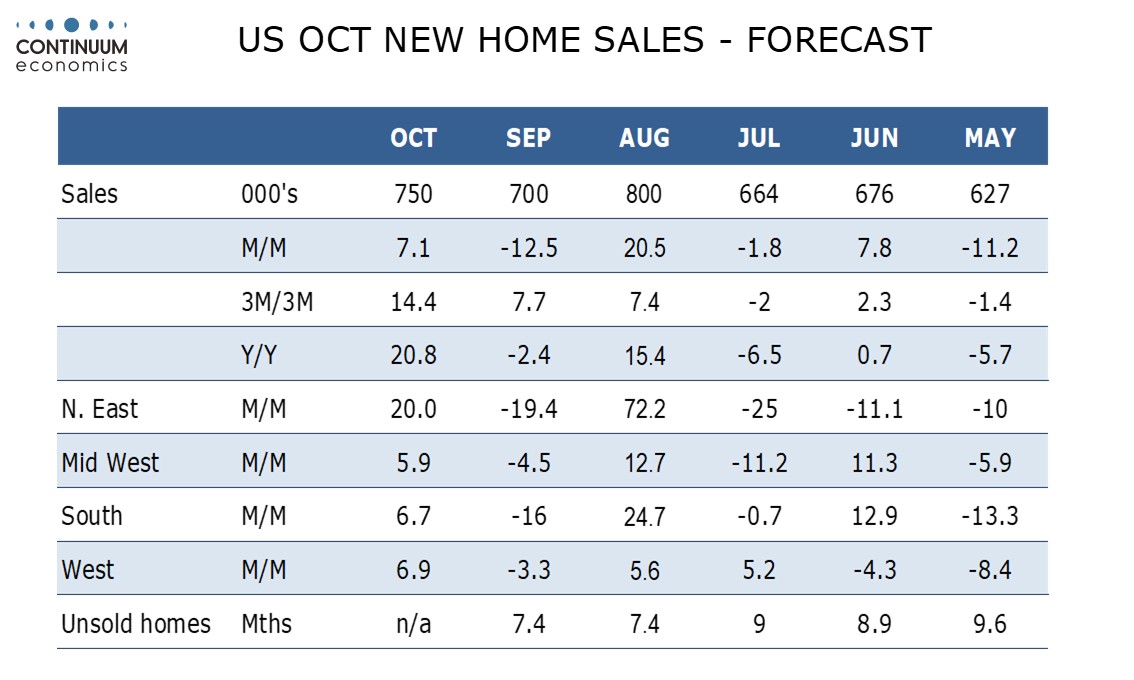

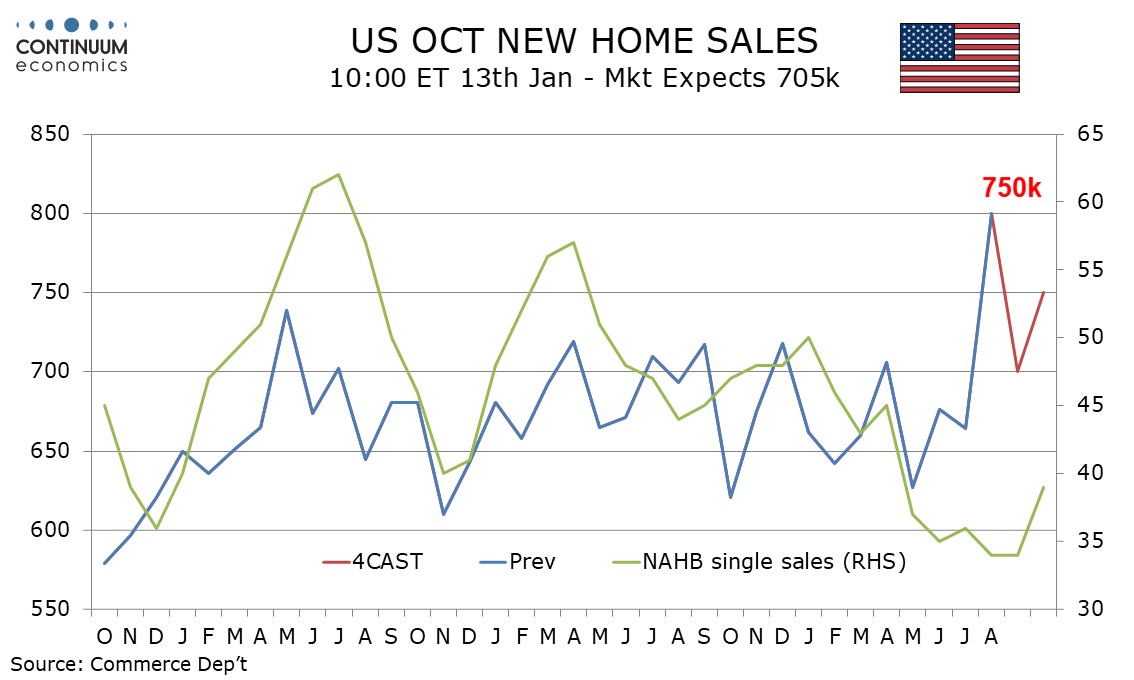

Delayed September and October new home sales data will be released on January 13. August data was surprisingly strong, up 20.5% to 800k, and despite signs of improvement in the housing sector since then, we expect September to be softer at 700k, before a bounce to 750k in October.

If August is unrevised September would then be down by 12.5% but risk for August’s revision is negative. We expect a 7.1% increase in October. August’s strength contrasted slippage in existing home sales but existing home sales have since seen three straight gains, while pending home sales and other housing sector surveys have also picked up as the Fed resumed easing. Before August’s bounce new home sales had been in a stable range between 600k and 750k. We expect a return to the range in September but October data to suggest that trend is now picking up.

Price data was also above trend in August with the median bouncing by 4.7% on the month and the average surging by 11.7%. We expect September to see corrections lower by 2.0% and 5.0% respectively with October price data unchanged on the month. This would see the median price down by 4.9% yr/yr in October after a 3.8% decline in September and a 1.9% increase in August. The average would be down 2.8% yr/yr in October after increases of 0.3% in September and 12.3% in August.