Preview: Due January 9 - Canada December Employment - Recent strength unlikely to persist

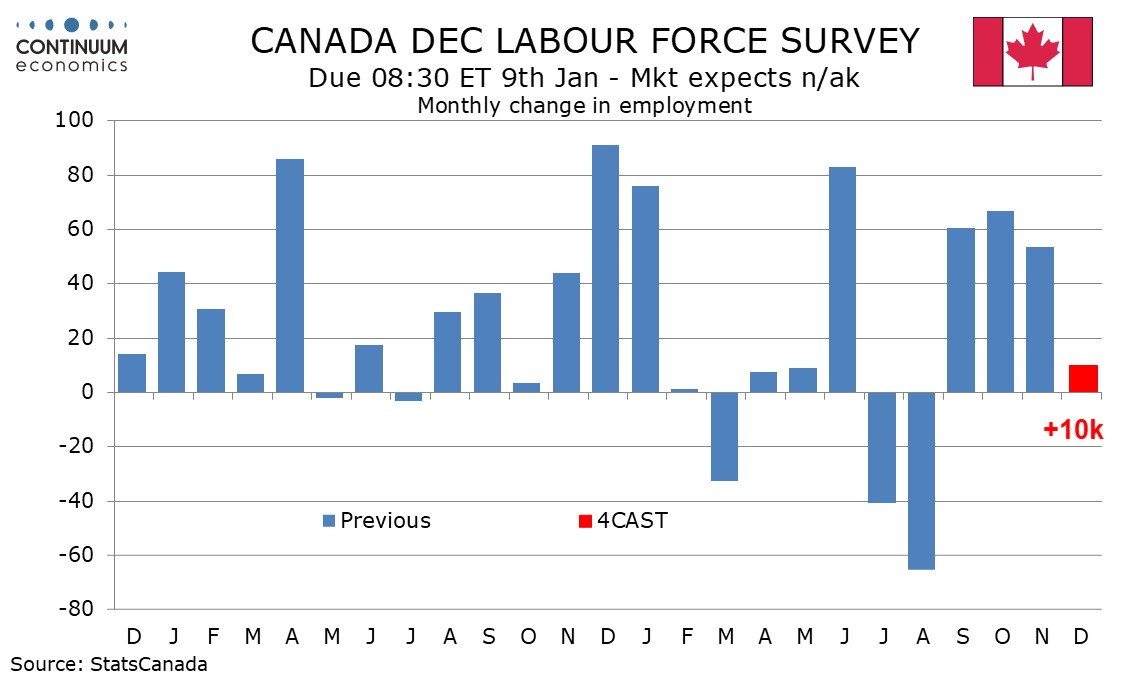

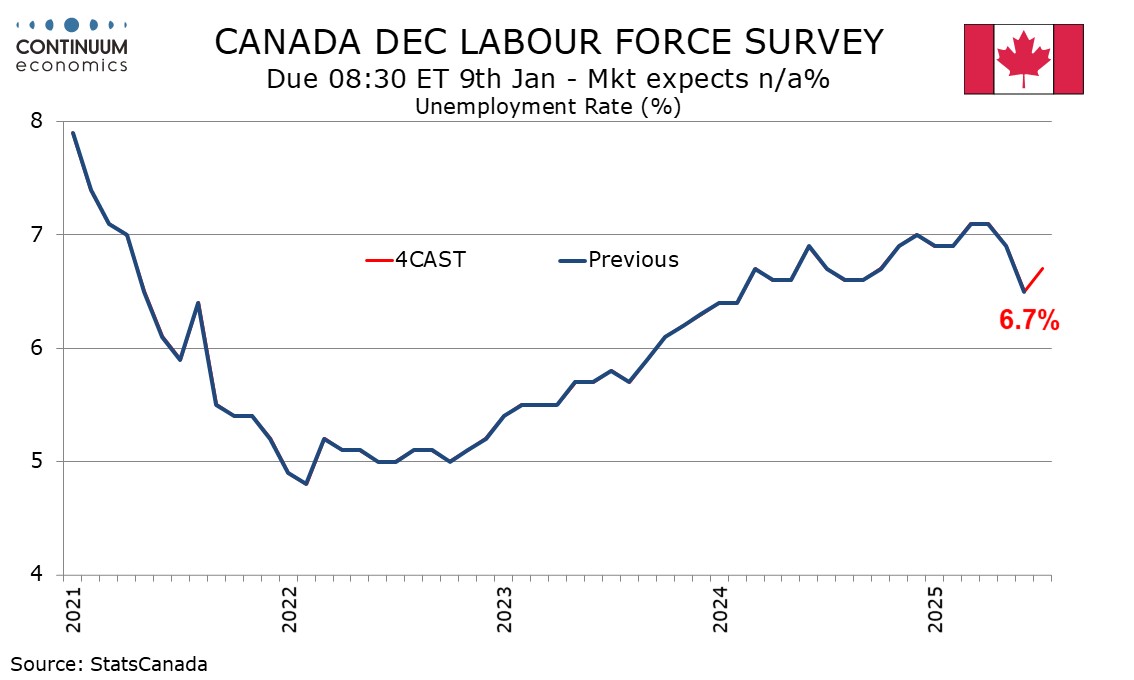

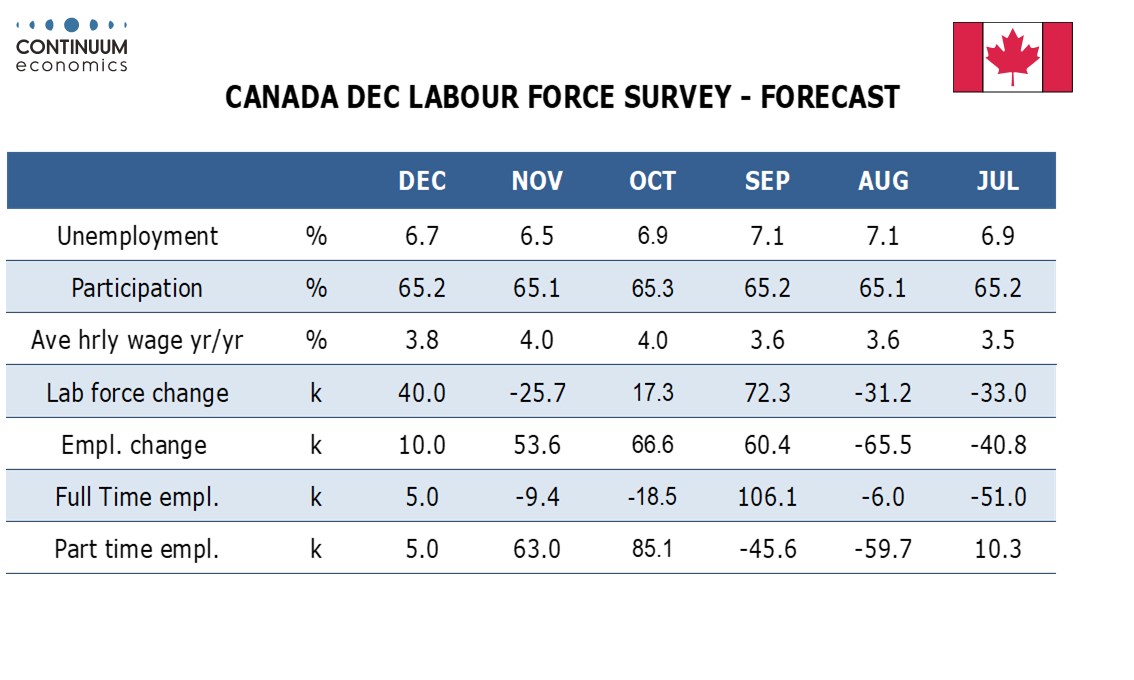

We expect Canadian employment to increase by 10k in December, a number that is probably closer to trend than the three straight strong gains averaging close to 60k. We expect unemployment to correct higher to 6.7% from 6.5% in November, still below October’s 6.9% and the 7.1% highs of July and August.

The three strong gains in employment followed steep declines in July and August, but the 6-month average is now 26.2k, up from -6.6k in August. The worst of the hit from tariffs appears to be over, but with Q4 GDP likely to be slower than Q3 the recent pace of job growth looks unlikely to be sustained. Monthly employment data based on employers’ payrolls, available only to October, rose by 21.2k in October after a 24.3k decline in September, with a 6-month average of only 8.3k.

We expect December’s employment gain to be evenly split between full time and part time work. Health care and social assistance, which at 45.5k in November explained most of that month’s 53.3k increase, is particularly vulnerable to a correction lower, though wholesale and retail may correct higher from a 34.1k November decline. A correction lower in employment is not to be ruled out but we believe underlying trend is modestly positive.

.