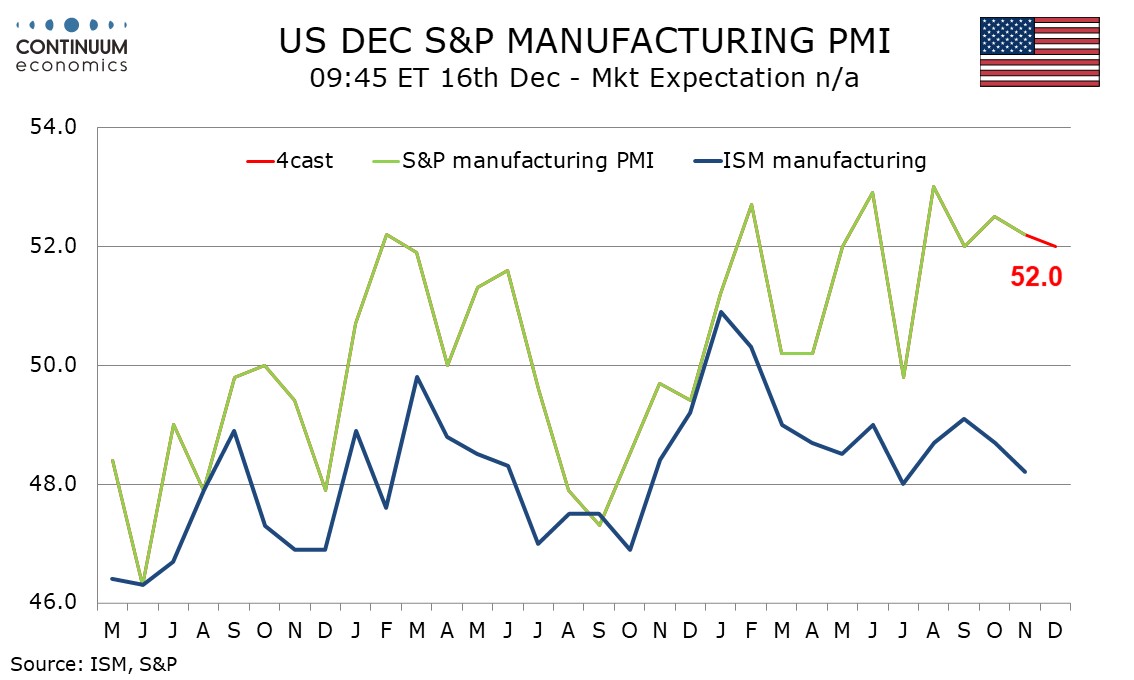

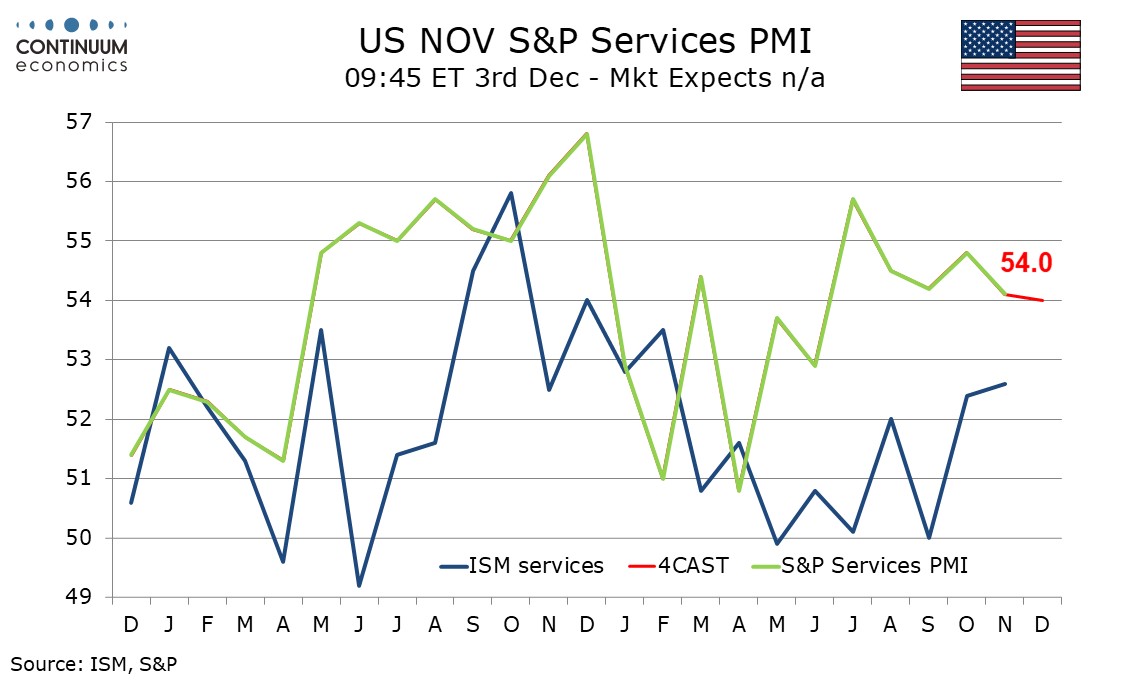

Preview: Due December 16 - U.S. December S and P PMIs - Only marginally lower, still healthy

We expect December’s S and P PMIs to both see very marginal slippage, manufacturing to 52.0 from 52.2 and services to 54.0 from 54.1. These will still leave the picture looking fairly healthy and there is little reason to expect a sharp fall in December, though we do see risks to the economy as leaning to the downside.

The manufacturing index would be seeing a second straight dip but would simply return to the September level. The index has been trending modestly above 50 through 2025 to date apart from a marginal dip below in July. The S and P manufacturing index has been outperforming the ISM’s which slipped in November, but with the latter remaining within its recent range it is not giving a strong negative signal for December’s S and P manufacturing index.

The S and P services PMI has also been outperforming its ISM counterpart, though the ISM services index did see some catch up in October and November. This argues against a significant slowing in the S and P services index which contrasted the ISM index by slipping in November. However we do see downside risks in consumer spending with Q3 spending having outpaced real disposable income.

.